Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

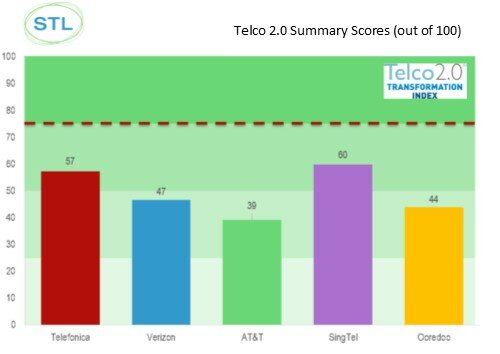

The Telco 2.0 Transformation Index provides a comprehensive business model transformation benchmark of leading global communication service providers - the first benchmark of future telecoms business models from The Telco 2.0 Initiative. The index shows that changes are underway at AT&T, Ooredoo, SingTel, Telefonica and Verizon but no player is yet doing enough to ensure a successful transition to a sustainable new ‘Telco 2.0’ business model.

Results from the Telco 2.0 Transformation Index show that SingTel and Telefonica lead the way in transforming themselves from engineering-led infrastructure businesses to innovation-led platform and production players.

A key driver of this has been in the bold efforts they have made to change their organisation structure and processes to support new services and customers via independent ‘digital’ business units. The US giants – AT&T and Verizon – and the Middle Eastern CSP, Ooredoo, also covered in the first tranche of analysis, are at an earlier stage of the transformation journey.

STL Partners believes that all CSPs should be aiming to score 75% or more on the Telco 2.0 Transformation Index to give themselves a good chance of enjoying successful growth in the future. However, even SingTel (scoring 60%) and Telefonica (scoring 57%) deemed to be leaders in this space are still progressing too slowly.

The Index consists of detailed analysis of individual communication service providers (CSPs) across 5 ‘domains’ – Marketplace, Servicing Offerings, Value Network (internal organisation and external partnerships), Technology and Finance. Quantitative and qualitative analysis has been conducted over 7 months by STL Partners’ analysts to determine the strengths and weaknesses of each CSP in each domain. Objective scores for each CSP in each domain are then calculated so valid comparisons can be made independent of geographic region and company strategy.

According to Chris Barraclough, Telco 2.0’s Chief Strategist, “Our analysis suggests there is a potential uplift to share prices of 45+% for CSPs that can transform from being pure ‘infrastructure players’ to platform and production innovation companies. However, such a transformation is challenging. It is not simply about CSPs launching and handful of ‘digital services’. Transformation needs to be company-wide covering both ‘hard’ factors, such as organisation structures and business metrics, but also ‘soft’ ones, including business processes, partnerships and culture. The Telco 2.0 Transformation Index covers all this in depth and provides strategic guidance on the process of change in the telecoms industry.”

“The leaders – SingTel and Telefonica – are working hard to get their organisations in shape for the new digital world. However, to date, changes at CSPs have not yet yielded material additional value in the form of great new services and new customer relationships. It is clear that more needs to be done by all CSPs if the industry is going to avoid substantial value destruction over the next 5 years.”

Website Link: telco2research.com/categories/telco_2_transformation_index

Contact: Hayley Brace. +44 (0) 207 247 5003. Email:

Telco 2.0 Index Summary Scores

Figure 1 - Telco 2.0 Transformation Index Summary Scores

The Index draws on dozens of data sources, including surveys and interviews, to examine the strategic positioning and goals of specific CSPs. It uses The Telco 2.0 Intiative’s tried and tested business model analysis methodologies and frameworks to calibrate how effectively CSPs are transforming themselves from a Telco 1.0 to a Telco 2.0 business model:

At a time when full service telcos face a sharp decline in core revenues and uncertainty about new sources of growth in the ‘digital economy’, the Telco 2.0 Transformation Index is a new service that helps senior telco executives:

Established in 2006, the Telco 2.0 Initiative helps drive the transformation of the telecoms industry, looking in particular at new business models and service innovation. It is highly influential on the strategies of the leading players in the market.

The Initiative publishes ongoing research into new business model strategies, and runs regular high level 'executive brainstorms' in 4 continents (Europe, APAC, Middle East, Silicon Valley). These bring senior execs in the telco industry together with their peers in other sectors (banking, advertising, media, retail, etc.) to explore new opportunities for collaborative growth.

Research: telco2research.com

Executive Brainstorms: www.newdigitaleconomics.com/events

The Telco 2.0 Initiative was set up by analyst and consulting firm STL Partners, a specialist research and consulting firm.

“Our focus is on driving transformation through business model innovation in the Telecoms, Media and Technology sector – i.e. how companies make money and grow in turbulent times.”

“Most of the telcos and technology companies around the world subscribe to our research, participate in our brainstorms, and use our consulting services, due to its unique focus and methodologies. We also work closely with the World Economic Forum in the area of ‘personal data’ and have a seat on their global ICT agenda council.” Simon Torrance, CEO, STL Partners / Telco 2.0.

Hayley Brace – Marketing Director +44 (0) 207 247 5003. Email:

Andrew Collinson, COO & Research Director

Telco 2.0 / STL Partners.

4G LTE, ADSL, BlueVia, broadband, carrier Ethernet, CDN, cloud computing, customer churn, digital advertising, digital commerce, digital services, eHealth, enterprise services, FiOS, FTTH, GPON, IAAS, identity, IP conferencing, IPTV, ISIS, LTE, M2M, managed hosting, managed services, messaging, mobile advertising, mobile payments, new business models, OC-48, OTT, payments, PoC, post-pay, pre-pay, Redbox Instant, SAAS, SIP trunking, SMBs, SMS, SONET, strategic services, Telco 2.0, TV Everywhere, U-verse, VDSL, voice, VoIP, WEVE.