|

Summary: STL Partners' industry transformation analysis, including a recent global survey of telco executives, suggests operators' digital ambitions are rising fast but, given 9 substantial implementation challenges, too little is currently being done to engender successful industry-wide business model transformation. We also look at the lessons from NTT DoCoMo, one of the operators that has made the most overall progress towards a 'digital' model. (February 2015, Executive Briefing Service, Telco 2.0 Transformation Stream.) |

|

Below is an extract from this 42 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service and Telco 2.0 Transformation Stream here.

For more on any of these services, please email / call +44 (0) 207 247 5003.

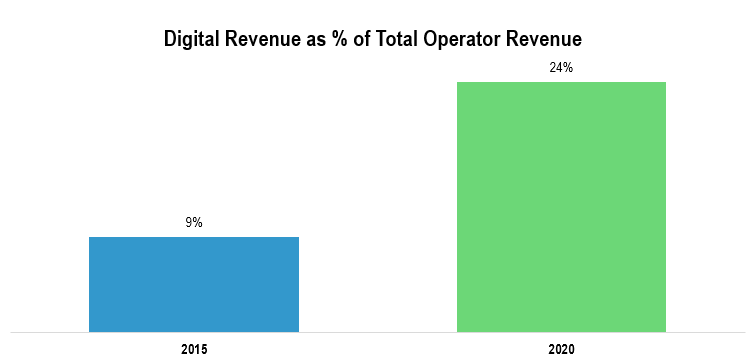

Despite recent evidence in Europe of material revenue decline from telecoms operators, the executives that STL Partners canvassed in its recent global survey were relatively optimistic about the opportunities for revenue growth from new business models. On average, executives felt that revenue from new digital business models should reach 9% of total revenue in 2015 and this should rise to 24% by 2020 (see Figure 1).

In the case of 2015, 9% is way beyond what will be achieved by most players and probably represents respondents’ theoretical target that their organisation should have achieved by the end of this year if management had invested more effort in building new revenue sources earlier: it is where their organisation should be in an ideal world. One of the few operators in the world that is at this level of digital revenues is NTT DoCoMo. We explore its digital activities later in this report.

24% of telecoms revenue coming from new business models in 2020 is also ambitious but STL Partners considers this a realistic target and one which would probably result in the overall telecoms market being no bigger than it was in 2013 – see the forecast on page 15.

A key question for the industry is whether the 2020 target can be achieved by growing material new business model revenues in tandem with limited voice, messaging and connectivity decline or whether it could result from an implosion of these Telco 1.0 revenues. In other words, modest new business model revenue could be 24% of a very much smaller overall telecoms market if voice, messaging and connectivity revenues suffer a precipitous decline.

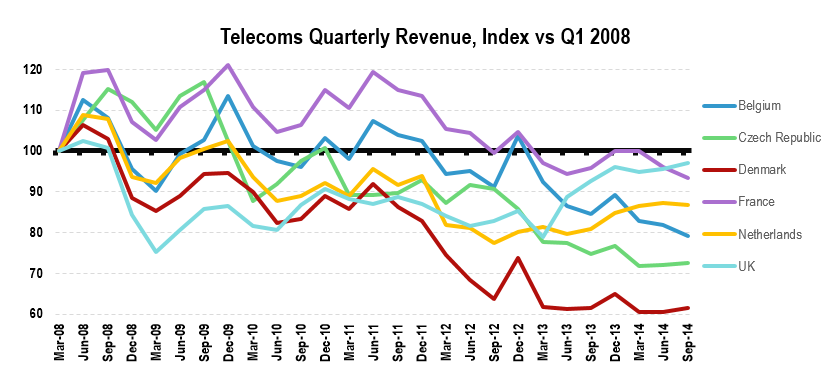

Figure 2 charts the quarterly revenue for six European markets and illustrates a range of trajectories for telecoms revenues. At one extreme is Denmark where telecoms revenue in Q3 2014 was nearly 40% lower than Q1 2008. At the other extreme are the UK and French markets where the figure is 3% and 7% lower respectively. Clearly, if most telecoms markets follow the Danish route then the opportunity for modest digital revenues to become important to operators grows substantially. Interestingly, in most of the six markets, 2013 and 2014 has seen revenues stabilising (at least among operators that publish accounts which split out those markets over the time period) and in some cases, such as the UK and Netherlands, growth has been achieved from the lows of 2012.

STL Partners’ global forecast lies somewhere between the two extremes outlined in Figure 2: we believe that core telecoms revenues will decline by around 25% between 2013 and 2020. If this is indeed the case then for digital revenues to represent 24% of telecoms revenue, they will need to be very material – around $250 billion for mobile telecoms alone!

Source: STL Partners/Telco 2.0 Operator Survey, November 2014, n=55

Source: Telecoms company accounts, STL Partners analysis

Note: Revenue is for operators reporting quarterly figures for each market. As a result, not all market revenue is captured.

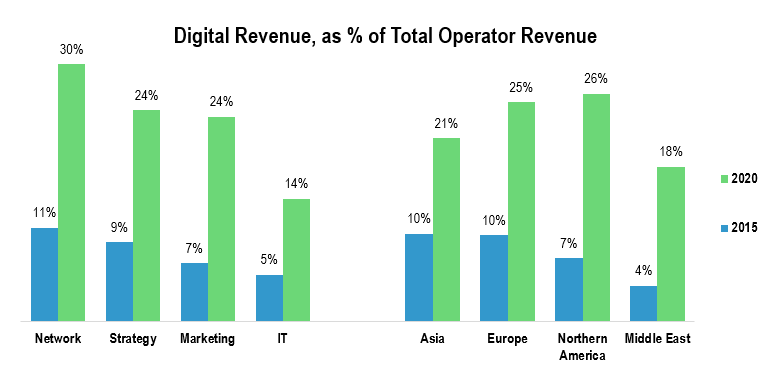

Where there were 10 or more respondents in a functional or geographic group, we examined the responses for that group. As Figure 3 shows, there were wide differences in ambition for digital services by functional area with respondents from Network being far more bullish than those in IT: the former suggesting 30% of 2020 revenue should come from digital services compared with only 14% from IT.

There was a consistency among functional groups in their ambitions for digital services: those that were more bullish for 2015 remained more so for 2020. This contrasted with the regional split in which North American respondents believed the ‘correct’ proportion of revenue from digital services in 2015 is 7% (compared with 10% for Europe and Asia) rising to a formidable 26% in 2020. This suggests that North American executives remain confident that their organisations can compete effectively in consumer and enterprise digital markets despite the US, in particular, being the home market of many formidable digital players: Google, Facebook, Amazon, Microsoft, Salesforce, Twitter, and so forth.

To put the North American perspective in perspective: if STL Partners’ global forecast for core telecoms services holds true in the US then a $120bn revenue telecoms company, such as Verizon, will lose around $30 billion in core service revenues by 2020. In this scenario, for Verizon to end up the same size as it is now in 2020, it will have to replace this $30 billion with new digital business revenues (which would equate roughly to the 26% proposed by North American respondents). In our deep-dive analysis of Verizon for the Telco 2.0 Transformation Index, STL Partners estimated that Verizon generated around $2.9 billion in Telco 2.0 digital business model revenues (around 2.4% of total revenue) in 2013. For that $2.9 billion to grow to $30 billion by 2020 requires compound annual growth of a whopping 40% per year: a tall order indeed and one that is almost certainly unrealistic.

Unsurprisingly, the Middle Eastern respondents whose companies are enjoying continued growth in core telecoms services and, in many countries advantageous regulatory environments, were least bullish about digital services in the near and longer term. The danger for this region is complacency: operators are in a similar position to those in Europe in 2007. European operators failed to prepare early enough for core service decline – most digital activities were not kicked off until 2012 by which time aggregate revenue from voice, messaging and connectivity was either flat or in decline in most markets.

Source: STL Partners/Telco 2.0 Operator Survey, November 2014, n=55

To access the rest of this 42 page Telco 2.0 Report in full, including...

...and the following report figures...

...Members of the Telco 2.0 Executive Briefing Subscription Service and Telco 2.0 Transformation Stream can download the full 42 page report in PDF format here. Non-Members, please subscribe here. For other enquiries, please email / call +44 (0) 207 247 5003.

Technologies and industry terms referenced include: business model, culture, digital services, disruption, innovation, metrics, NTT DoCoMo, Smart Life, synergy value, transformation, Telco 2.0, Verizon.