Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

|

Summary: A high-level analysis of the M2M market, including the strategies of Vodafone, AT&T and Telefonica, and the impact that the Internet of Things and new entrants such as Google and others will have with new business models. What are the implications for operators, and where is it all leading? (March 2015, Executive Briefing Service) |

|

Below is an extract from this 24 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing Service here. STL Partners has partnered with More With Mobile in the production of this report.

For more on any of these services, please email / call +44 (0) 207 247 5003.

The ‘Internet of Things’ first appeared as a marketing term in 1999 when it was applied to improved supply-chain strategies, leveraging the then hot-topics of RFID and the Internet.

Industrial engineers planned to use miniaturised, RFID tags to track many different types of asset, especially relatively low cost ones. However, their dependency on accessible RFID readers constrained their zonal range. This also constrained many such applications to the enterprise sector and within a well-defined geographic footprint.

Modern versions of RFID labelling have expanded the addressable market through barcode and digital watermarking approaches, for example, while mobile has largely removed the zonal constraint. In fact, mobile’s economies of scale have ushered in a relatively low-cost technology building block in the form of radio modules with local processing capability. These modules allow machines and sensors to be monitored and remotely managed over mobile networks. This is essentially the M2M market today.

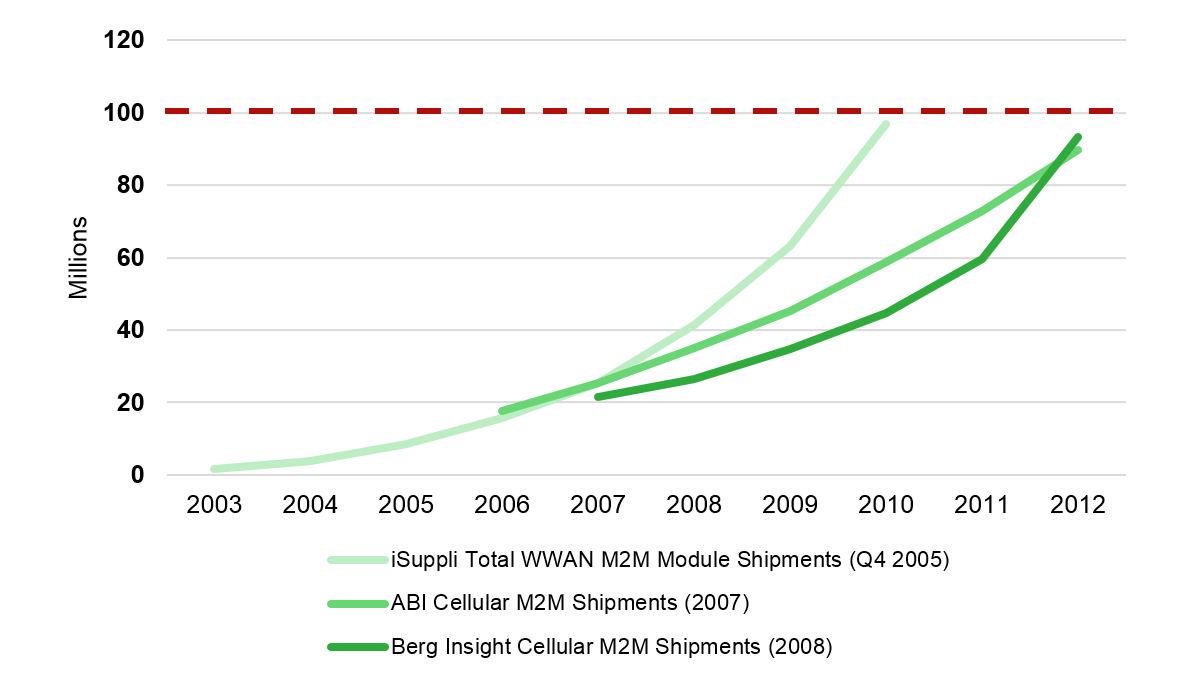

M2M remained a specialist, enterprise sector application for a long time. It relied on niche, systems integration and hardware development companies, often delivering one-off or small-scale deployments. For many years, growth in the M2M market did not meet expectations for faster adoption, and this is visible in analyst forecasts which repeatedly time-shifted the adoption forecast curve. Figure 1 below, for example, illustrates successive M2M forecasts for the 2005-08 period (before M2M began to take off) as analysts tried to forecast when M2M module shipment volumes would breach the 100m units/year hurdle:

Source: STL Partners, More With Mobile

Although the potential of remote connectivity was recognised, it did not become a high-volume market until the GSMA brought about an alignment of interests, across mobile operators, chip- and module-vendors, and enterprise users by targeting mobile applications in adjacent markets.

The GSMA’s original Embedded Mobile market development campaign made the case that connecting devices and sensors to (Internet) applications would drive significant new use cases and sources of value. However, in order to supply economically viable connected devices, the cost of embedding connectivity had to drop. This meant:

The late 2000's proved to be a turning point for M2M, with the market now achieving scale (c. 189m connections globally as of January 2014) and growing at an impressive rate (c. 40% per annum).

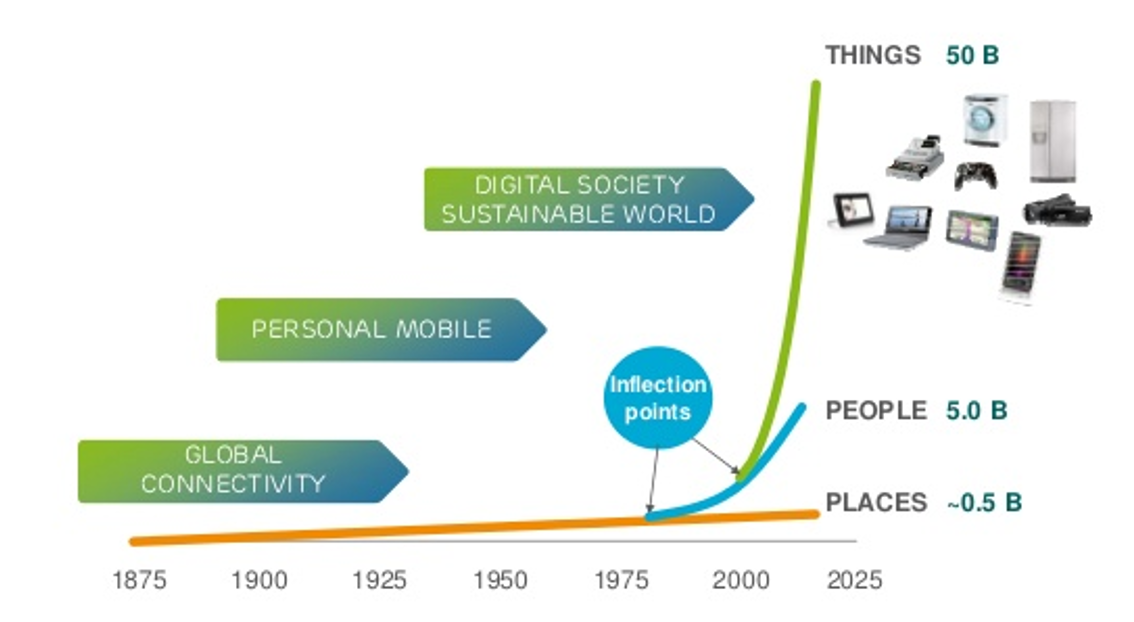

Over the past 5 years, companies such as Cisco, Ericsson and Huawei have begun promoting radically different market visions to those of ‘traditional M2M’. These include the ‘Internet of Everything’ (that’s Cisco), a ‘Networked Society’ with 50 billion cellular devices (that’s Ericsson), and a ‘Cellular IoT’ with 100 billion devices (that’s Huawei).

Source: Ericsson

Ericsson’s calculation builds on the idea that there will be 3 billion “middle class consumers”, each with 10 M2M devices, plus personal smartphones, industrial, and enterprise devices. In promoting such visions, the different market evangelists have shifted market terminology away from M2M and towards the Internet of Things (‘IoT’).

The transition towards IoT has also had consequences beyond terminology. Whereas M2M applications were previously associated with internal-to-business, operational improvements, IoT offers far more external market prospects. In other words, connected devices allow a company to interact with its customers beyond its strict operational boundaries. In addition, standalone products can now deliver one or more connected services: for example, a connected bus can report on its mechanical status, for maintenance purposes, as well as its location to deliver a higher quality, transit service.

Another consequence of the rise of IoT relates to the way that projects are evaluated. In the past, M2M applications tended to be justified on RoI criteria. Nowadays, there is a broader, commercial recognition that IoT opens up new avenues of innovation, efficiency gains and alternative sources of revenue: it was this recognition, for example, that drove Google’s $3.2 billion valuation of Nest (see the Connected Home EB).

In contrast to RFID, the M2M market required companies in different parts of the value chain to share a common vision of a lower cost, higher volume future across many different industry verticals. The mobile industry’s success in scaling the M2M market now needs to adjust for an IoT world. Before examining what these changes imply, let us first review the M2M market today, how M2M service providers have adapted their business models and where this positions them for future IoT opportunities.

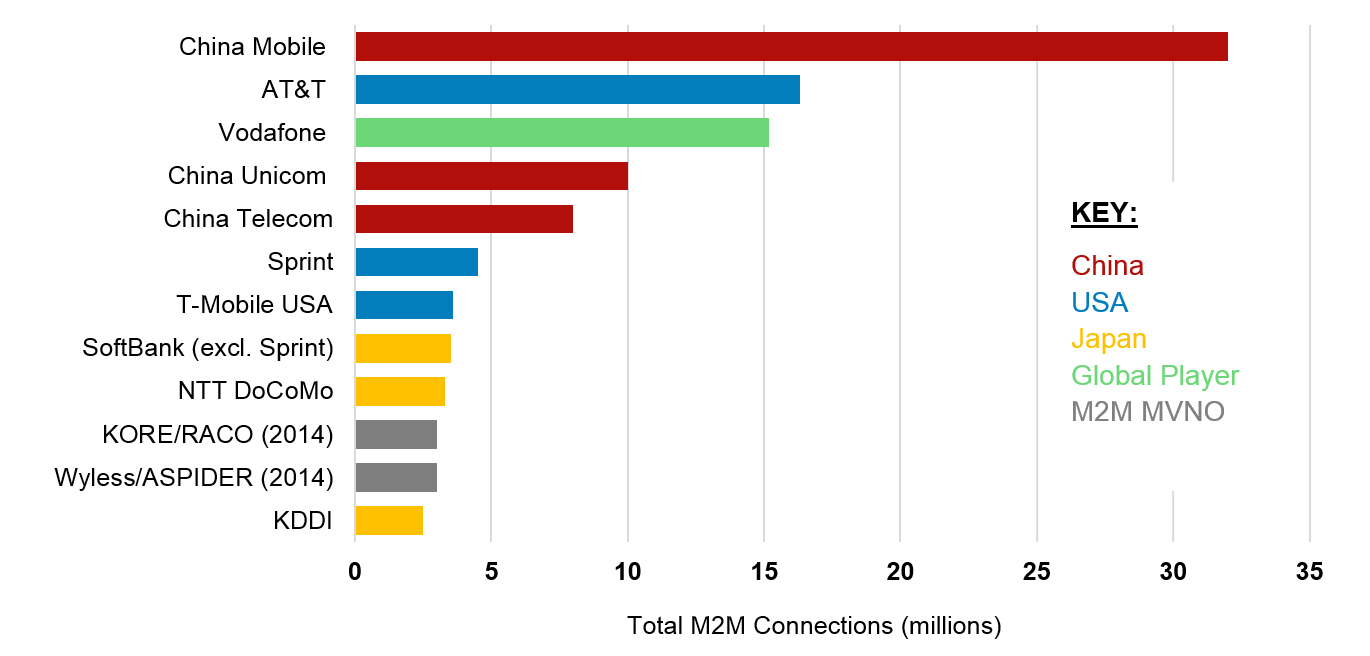

The M2M market has now evolved into a high volume and highly competitive business, with leading telecoms operators and other service providers (so-called ‘M2M MVNOs’ e.g. KORE, Wyless) providing millions of cellular (and fixed) M2M connections across numerous verticals and applications.

Specifically, 428 MNOs were offering M2M services across 187 countries by January 2014 – 40% of mobile network operators – and providing 189 million cellular connections. The GSMA estimates the number of global connections to be growing by about 40% per annum. Figure 3 below shows that as of Q4 2013 China Mobile was the largest player by connections (32 million), with AT&T second largest but only half the size.

Source: Various, including GSMA and company accounts, STL Partners, More With Mobile

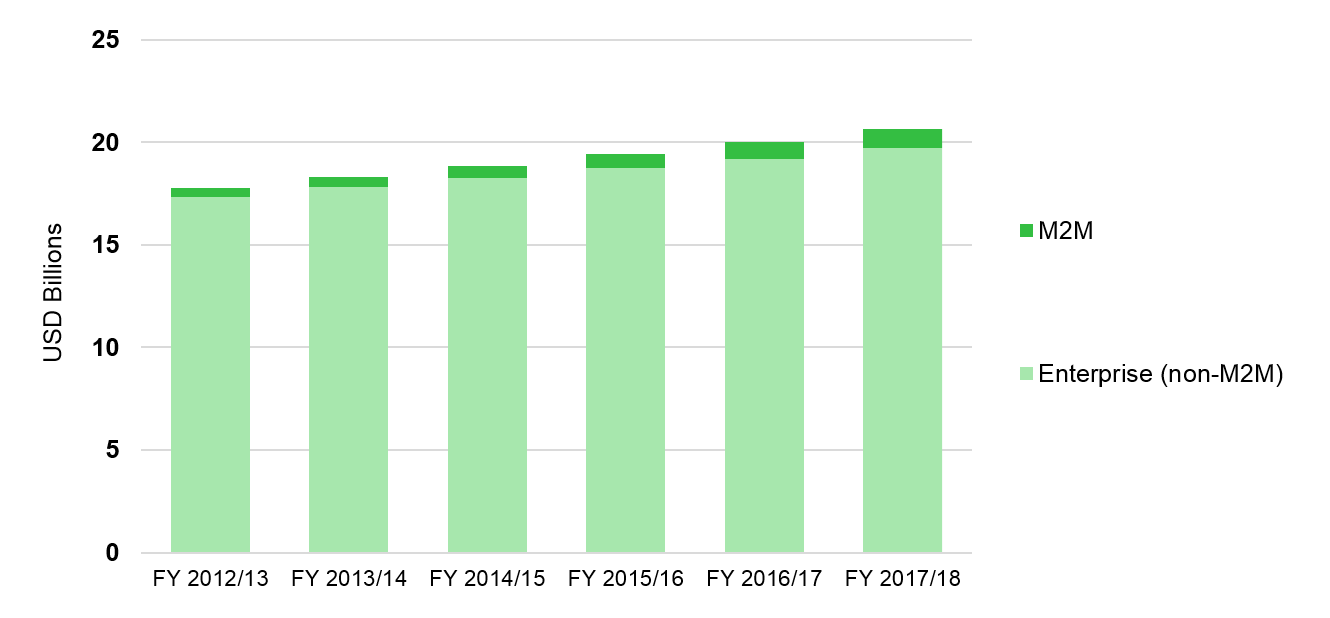

Unsurprisingly, these millions of connections have also translated into material revenues for service providers. Although MNOs typically do not report M2M revenues (and many do not even report connections), Verizon reported $586m in ‘M2M and telematics’ revenues for 2014, growing 47% year-on-year, during its most recent earnings call. Moreover, analysis from the Telco 2.0 Transformation Index also estimates that Vodafone Group generated $420m in revenues from M2M during its 2013/14 March-March financial year.

However, these numbers need to be put in context: whilst $500m growing 40% YoY is encouraging, this still represents only a small percentage of these telcos’ revenues – c. 0.5% in the case of Vodafone, for example.

Source: Company accounts, STL Partners, More With Mobile

Figure 4 uses data provided by Vodafone during 2013 on the breakdown of its enterprise line of business and grows these at the rates which Vodafone forecasts the market (within its footprint) to grow over the next five years – 20% YoY revenue growth for M2M, for example. Whilst only indicative, Figure 4 demonstrates that telcos need to sustain high levels of growth over the medium- to long-term and offer complementary, value added services if M2M is to have a significant impact on their headline revenues.

To do this, telcos essentially have three ways to refine or change their business model:

To provide further context, the following section examines where M2M has focused to date (geographically and by vertical). This is followed by an analysis of specific telco activities in 1, 2 and 3.

To access the rest of this 24 page Telco 2.0 Report in full, including...

...and the following report figures...

...Members of the Telco 2.0 Executive Briefing Service can download the full 24 page report in PDF format here. Non Members, please subscribe here. For other enquiries, please email / call +44 (0) 207 247 5003.

Technologies and industry terms referenced include: application enablement platform, AT&T Digital Life, Axeda, B2B2x, China Mobile, connected device, connected device platform, digital services, Ericsson, Google, Internet of Things, IoT, Jasper, Kore, M2M, M2M MVNO, machine-to-machine communication, Nest, organising model, PTC, Qualcomm, RFID, Samsung, short-range networking, Singtel, Sprint, Sprint Velocity, Telefonica, Telefonica Digital, Verizon, Vodafone, Vodafone Group Enterprise, Wyless, ZigBee.