Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

|

Summary: We outline our ‘proxy model’ for valuing Digital Services Businesses, based on current best practice, which has significant advantages over traditional approaches. This report, our second of two on valuation, gives a worked example of a telco’s digital business in Asia that is already worth $1bn, and includes an analysis of approaches being taken by some leading telcos today. (April 2015, Executive Briefing Service, Telco 2.0 Transformation Stream.) |

|

Below is an extract from this 22 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing Service and Telco 2.0 Transformation Stream here.

For more on any of these services, please email / call +44 (0) 207 247 5003.

When Hewlett Packard’s then-CEO (Carly Fiorina) defended HP’s infamous acquisition of Compaq in 2002, she offered a number of arguments as to why the deal made sense. Firstly, the combined entity would now be able to meet the demands of customers for “solutions on a truly global basis.” Secondly, she claimed that the firm would be able to offer products “from top to bottom, from low-end to high-end.” Lastly, but perhaps most importantly, the merger would generate “synergies that are compelling.”

‘Synergy’ is a straightforward concept: the interaction of two or more entities to produce a combined effect greater than the sum of their parts. Synergistic phenomena are ubiquitous in the natural world, ranging from physics (e.g. the building blocks of atoms), to genetics (e.g. the cooperative interactions among genes in genomes) and the synergies produced by socially-organised groups (e.g. the division of labour).

In the business world, ‘synergy’ refers to the value that is generated by combining two organisations to create a new, more valuable entity. Synergies here can be ‘operational’, such as the combination of functional strengths, or ‘financial’, such as tax benefits or diversification. Traditionally, however, investors have been deeply sceptical of synergies, in terms of both their existence and the ability of M&A activity to deliver them. This was the case with the HP-Compaq merger: the day the merger was announced HP’s stock closed at $18.87, down sharply from $23.21 the previous day.

Recently, ‘synergy’ has also become an increasingly familiar term within the telecommunications industry, owing to activities in two distinct areas. These are now discussed in turn.

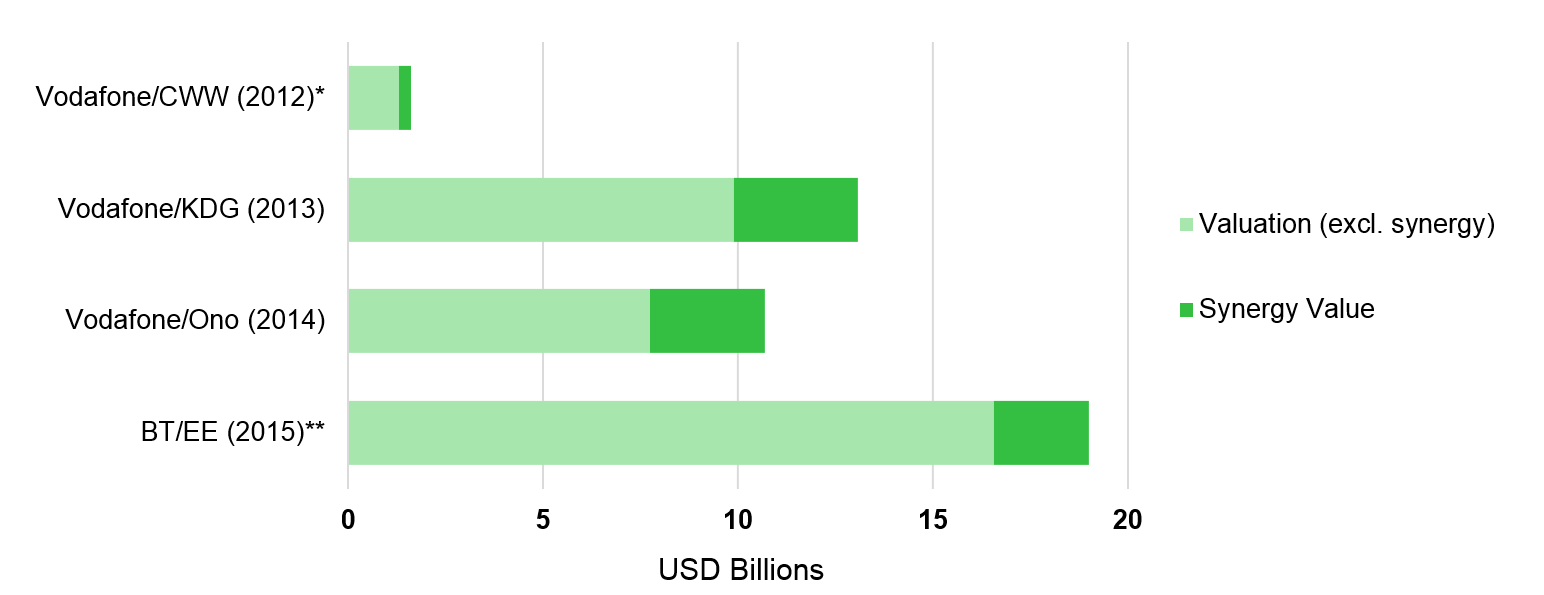

Fixed-mobile convergence (FMC) is a hot topic, and numerous substantial M&A transactions have occurred in this space in recent years (especially in Europe). Figure 1 charts some of these transactions, including publicly available synergy estimates (reflecting cost savings, revenue benefits, or both), below:

Source: Vodafone, Analysys Mason, STL Partners

* Synergy run-rate by 2016; ** Revenue synergies only

With synergies estimated to account for over 10% of each of these transactions’ valuations, and in the case of Vodafone/KDG nearly 30%, they are clearly perceived as an important driver of value. However, there are two key qualifications to be made here:

These qualifications mirror those raised in the ‘Valuing Digital: A Contentious Yet Vital Business’ Executive Briefing, which discusses the challenges telecoms operators are facing when seeking to generate formal valuations of their digital businesses.

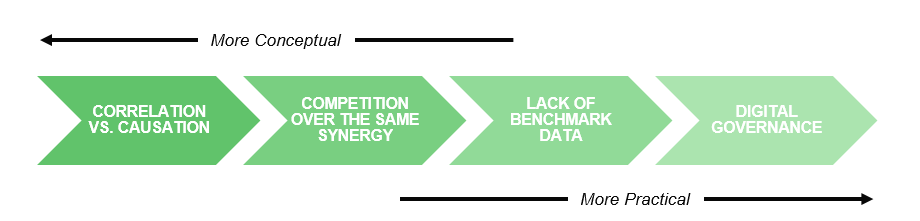

As telecoms operators’ ambitions in digital services continue to grow, they are increasingly asking what the value of their specific digital initiatives are. Without understanding the value of their digital businesses, telcos cannot effectively govern their individual digital activities: prioritisation, budget allocation and knowing when to close initiatives (‘fast failure’) within digital is challenging without a clear idea of the return on investment different verticals and initiatives are generating. However, telcos face significant challenges across three areas when attempting to value their businesses:

Source: STL Partners

Therefore, telcos (but also the broader technology ecosystem in general) need a new set of tools to answer questions in two key areas. For example:

These questions are addressed in the remainder of this report - to access the rest of this 22 page Telco 2.0 Report in full, including...

...and the following report figures...

...Members of the Telco 2.0 Executive Briefing Service and Telco 2.0 Transformation Stream can download the full 22 page report in PDF format here. Non Members, please subscribe here. For other enquiries, please email / call +44 (0) 207 247 5003.

Technologies and industry terms referenced include: B2B2x, causation, clinical trial, correlation, DCF, discounted cash flow, Facebook, fixed-mobile convergence, FMC, M-Pesa, MelOn, MTN Mobile Money, net synergy, proxy model, SK Telecom, SME SaaS, strategy, synergy value, telecoms, transformation, valuation, venture capital.