Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

|

Summary: What is disruption, when is it a good idea, and what do you do when it happens to you? We illustrate five principles of disruptive strategy based on our analysis of the telecoms and adjacent markets over the past eight years. The analysis covers both principles of creating and defending against disruption. (November 2014, Executive Briefing Service, Dealing with Disruption Stream) |

|

Below is an introductory extract and list of contents from this 16 page Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing Service and Dealing with Disruption stream here.

We'll also be exploring the implications at Digital Asia (2-4 December, Bali). For more on any of these services, please email / call +44 (0) 207 247 5003

Disruption has become a popular theme, and there are some excellent studies and theories, notably the work of Clayton Christensen on disruptive innovation.

This briefing is intended to add some of our observations, ideas and analysis from looking at disruptive forces in play in the telecoms market and the adjacent areas of commerce and content that have had and will have significant consequences for telecoms.

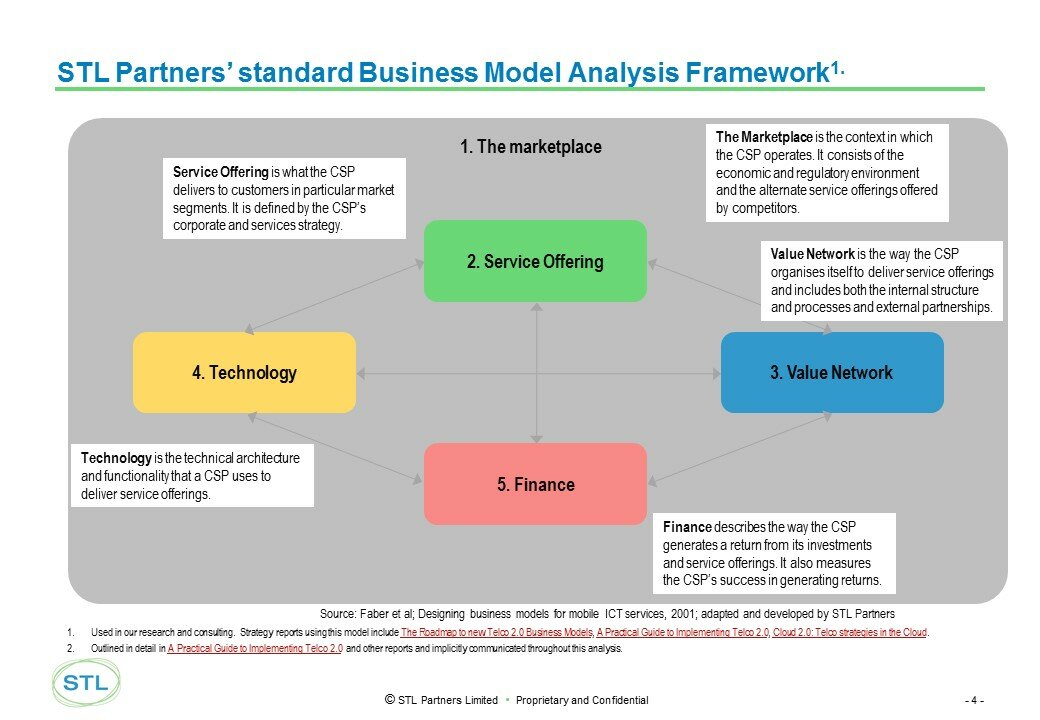

Our analysis centres on the concept of a business model: a relatively simple structure that can be used to describe and analyse a business and its strategy holistically. The structure we typically use is shown below in Figure 1, and comprises 5 key domains: The Marketplace; Service Offering; Value Network; Finance; and Technology.

Source: STL Partners

This structure is well suited to analysis of disruption, because disruptive competition is generally a case of conflict between companies with different business models, rather than competition between similarly configured businesses.

A disruptive competitor, such as Facebook for telecoms operators, may be in a completely different core business (advertising and marketing services) seeking to further that business model by disrupting an existing telecoms service (voice and messaging communications). Or it may be a broadly similar player, such as Free in France whose primary business is recognisably telecoms, using a radically different operational model to gain share from direct competitors.

We will look at some of these examples in more depth in this report, and also call on analysis of Google, Apple, Facebook and Amazon to illustrate principles

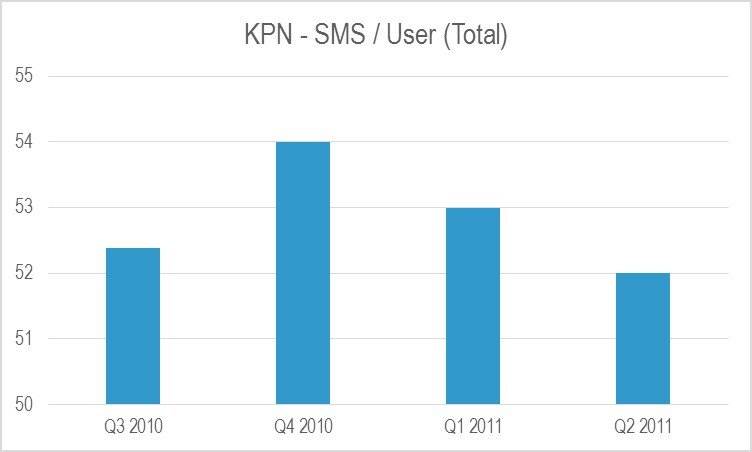

KPN, a mobile operator in the Netherlands, started to report a gradual reduction in SMS / user statistics in early 2011, after a long period of near continuous growth.

Source: STL Partners, Mobile World Database

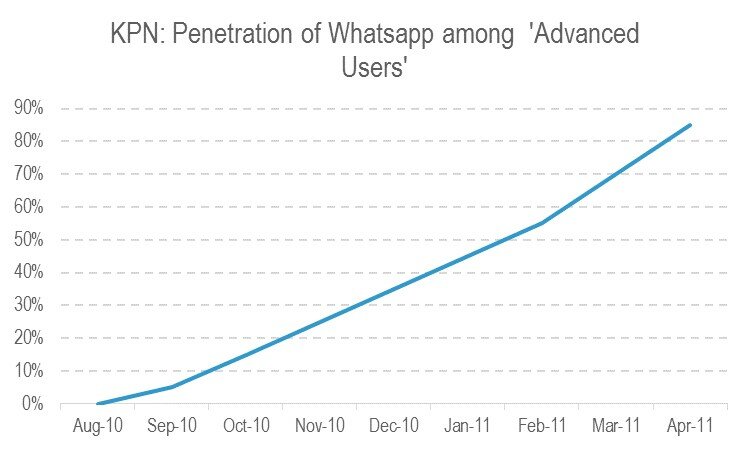

KPN linked this change to the rapid rise of the use of WhatsApp, a so-called over-the-top (OTT) messaging application it had noticed among ‘advanced users’ - a set of younger Android customers, as shown in Figure 3.

Source: KPN Corporate Briefing, May 2011

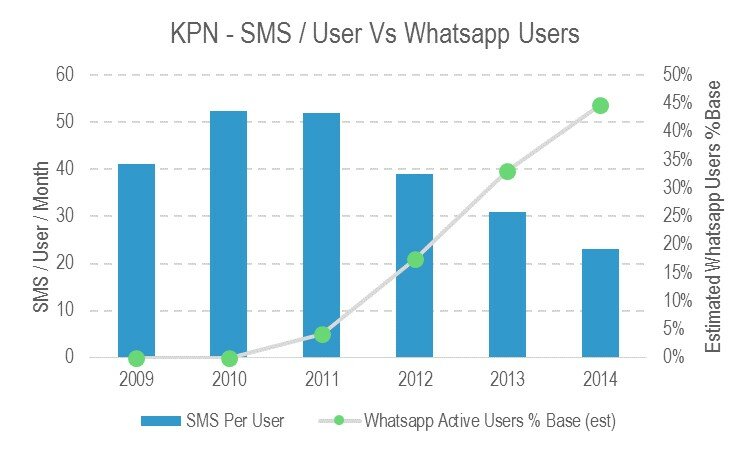

There was some debate at the time about the causality of the link, but the longer term picture of use and app penetration certainly supports the connection between the rise of WhatsApp take-up among KPN’s broader base (as opposed to ‘advanced users’ in Figure 3) and the rapid decline of SMS volumes as Figure 4 shows.

Source: STL Partners estimates, Mobile World, Telecomspaper, Statista, Comscore, KPN.

KPN’s position was particularly suited to a disruptive attack by WhatsApp (and other messaging apps) in the Netherlands because:

KPN responded by increasing the number of SMSs in bundles and attempting to ‘sell up’ users to packages with bigger bundles. It has also embarked on more recent programmes of cost reduction and simplification. But as far as SMS was concerned, the ‘horse had bolted the stable’ and the decline continues as consumers gravitate away from a service perceived as losing relevance and value.

We will look in more depth at disruptive pricing and product design strategies in the section on ‘Free is not enough, nor is it the real issue’ later in this report. This case study also presents another challenge for strategists: why did the company not act sooner and more effectively?

One might be forgiven for thinking that the impact of WhatsApp on KPN was all a big surprise. And perhaps to some it was. But there were plenty of people that expected significant erosion of core revenues from such disruption. In a survey we conducted in 2011, the average forecast among 300 senior global telecoms execs was that OTT services would lead to a 38% decline in SMS over the next 3-5 years, and earlier surveys had shown similar pessimism.

Having said that, it is also true that there was some shock in the market at the time over KPN’s results, and subsequent findings in other markets in Latin America and elsewhere. It is only recently that it has become more of an accepted ‘norm’ in the industry that its core revenues are subject to attack and decline.

Perhaps the best narrative explanation is one of ‘corporate denial’, akin to the human process of grief. Before we reach acceptance of a loss, individuals (and consequently teams and organisations by this theory) go through various stages of emotional response before reaching ‘acceptance’ – a series of stages sometimes characterised as ‘denial, anger, negotiation and acceptance’. This takes time, and is generally considered healthy for people’s emotional health, if not necessarily organisations’ commercial wellbeing.

So what can be done about this? It’s hard to change nature, but it is possible to recognise circumstances and prepare forward plans differently. In the digital era, leaders, strategists, marketers, and product managers need to recognise that profit pools are increasingly transient, and if you are skilful or lucky enough to have one in your portfolio, it is critical to anticipate that someone is probably working on how to disrupt it, and to gather and act quickly on intelligence on realistic threats. There are also steps that can be taken to improve defensive positions against disruption, and we look at some of these in this report. It isn’t always possible because sometimes the start point is not ideal – but then again, part of the art is to avoid that position.

To access the rest of this 33 page Cloud Report in full, including...

...Members of the Telco 2.0 Executive Briefing Subscription Service and Dealing with Disruption Stream can download the full 16 page report in PDF format here. Non-Members, please subscribe here. For other enquiries, please email / call +44 (0) 207 247 5003.

Technologies and industry terms referenced include: Disruption, Google, Apple, Facebook, Amazon, Skype, Whatsapp, KPN, telco, telecoms, strategy, growth, principles, Free.fr, AT&T, Verizon, SFR, business model, SMS, IM, social networking, voice, flywheel, OTT.