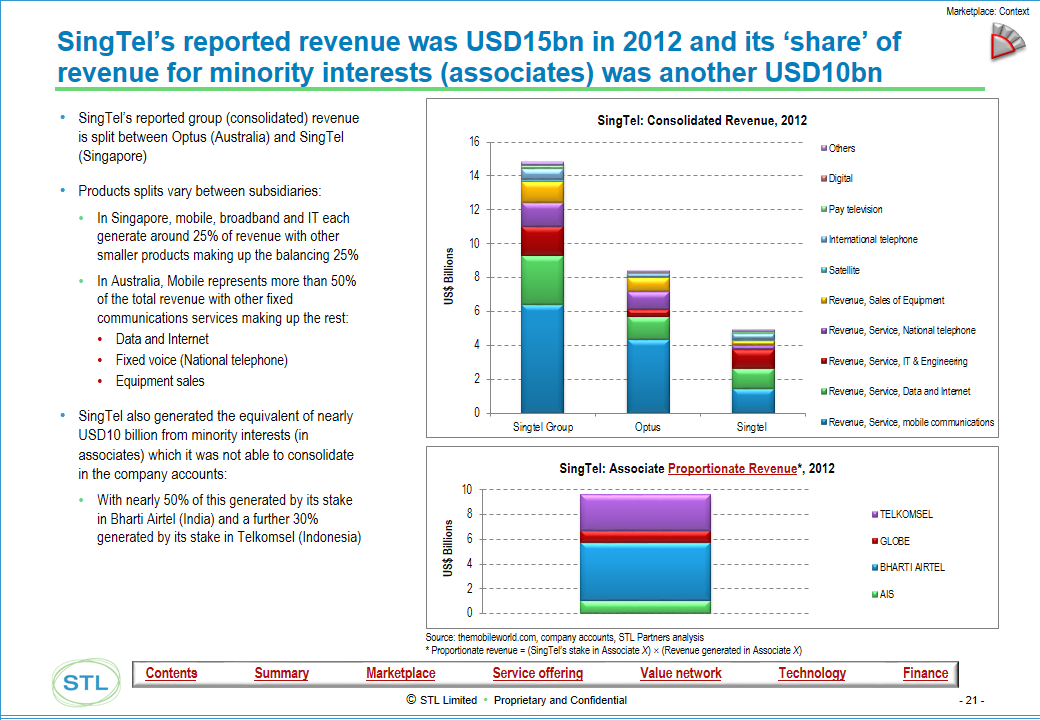

This 154-page PowerPoint style PDF report (and accompanying Excel data pack) examines the transformation efforts of the SingTel Group in moving to be a Telco 2.0 Service Provider. The report also examines SingTel’s positioning and growth prospect in its two subsidiaries (Singapore and Australia) and four main associates markets (Thailand, India, Philippines and Indonesia).

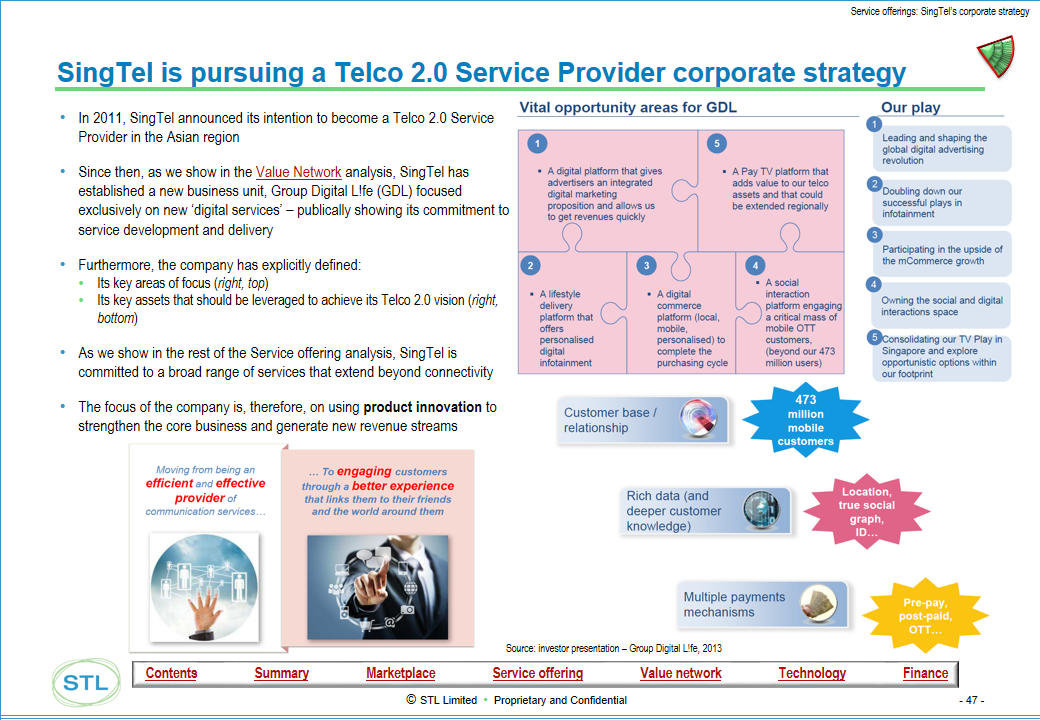

In 2012, SingTel fundamentally changed its management organisation to reflect its Digital aspiration - moving from a geographic-based organisation to a customer segment oriented one with the creation of SingTel’s Enterprise, Consumer and Digital L!fe business units. The report examinse how Singtel's new organisation has identified and is now leveraging its key assets: reach, customer insights, local knowledge and billing mechanisms to become a major Digital player in the Asian region.

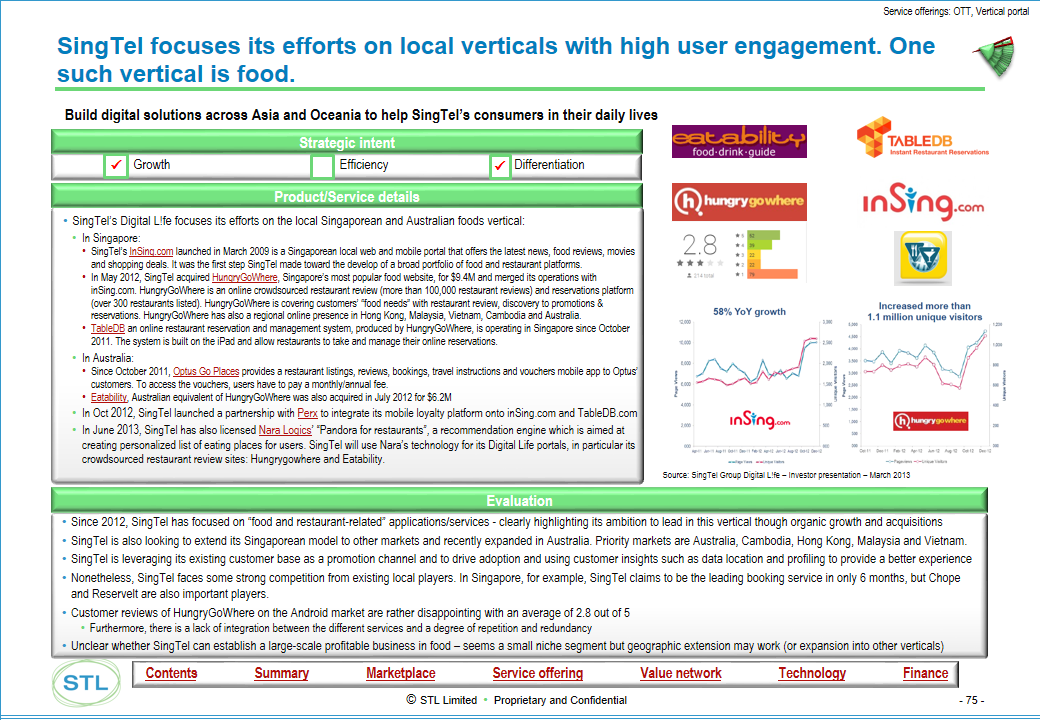

The report shows that industry partnerships are scarce and SingTel seems to prefer organic build (Mobile Wallet, AMPed2.0, myBusiness) and acquisitions (Amobee, HungryGoWhere, Eatability) to build pan-Asian Digital solutions. SingTel has also recently deployed 4G network in its subsidiaries markets, nonetheless this analysis highlights a challenging technology transformation.

The Telco 2.0 Transformation Index is the world’s first benchmark of Communications Service Providers provides benchmarking and deep analysis, the index reports are designed for:

Format and pricing

|

|

Contact us for pricing on +44 (0)207 247 5003 or [email protected]

Figure 1: Example output - SingTel - Marketplace section

Figure 2: Example output - SingTel - Service Offerings section

Summary findings

6 service offering categories defined:

Core services

Vertical industry solutions

Infrastructure services

Embedded communications (including M2M)

Third-Party business enablers (including identity, marketing, advertising, payments)

OTT services

Telco 2.0 services strategies defined – ‘Happy Piper’ and ‘Service Provider’

SingTel’s Telco 2.0 services strategy

Summary performance by service offering category

Evaluation of specific services within each service category

Figure 3: Example output - SingTel - Value Network section

|

Execution:

|

|||||||

Figure 4: Example output - SingTel - Technology section

Summary findings

Technology objectives and priorities

Commercial and technology alignment

Technology skills, processes, and partnerships

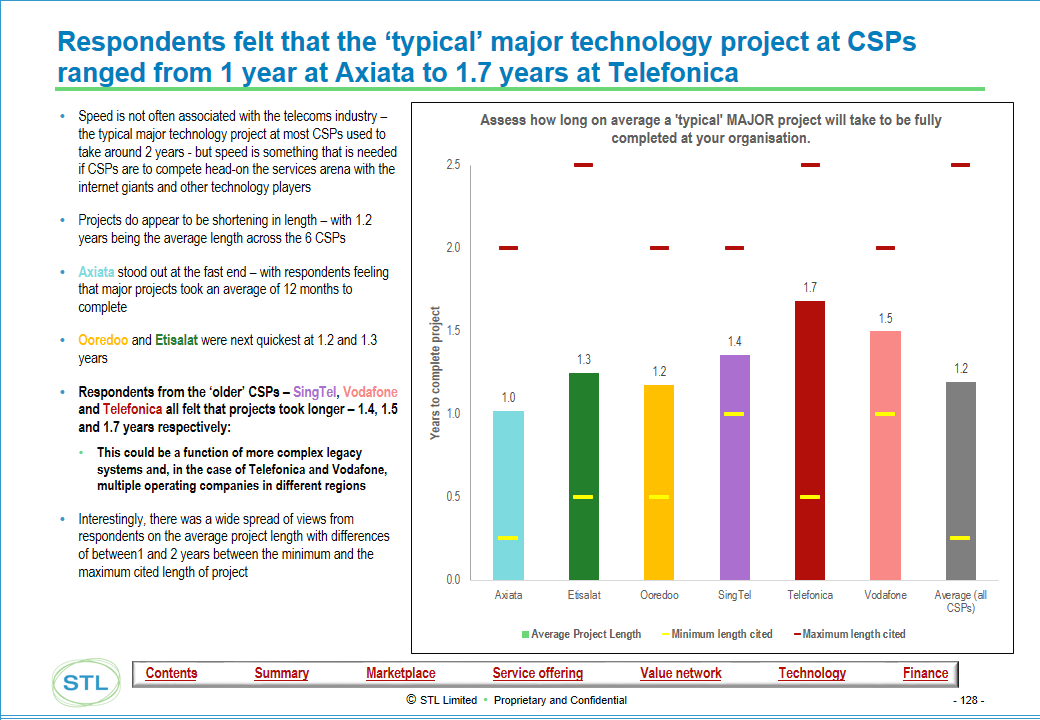

Technology execution: speed and ability to meet objectives

Technology positioning vs other CSPs

Figure 5: Example output - SingTel - Finance section

Summary findings

Financial performance: profitability, return on investment, debt position, capital intensity

Finance and Telco 2.0 strategy alignment: use of Telco 2.0 metrics

Revenue Model: ability to protect Telco 1.0 revenues and grow Telco 2.0 revenues

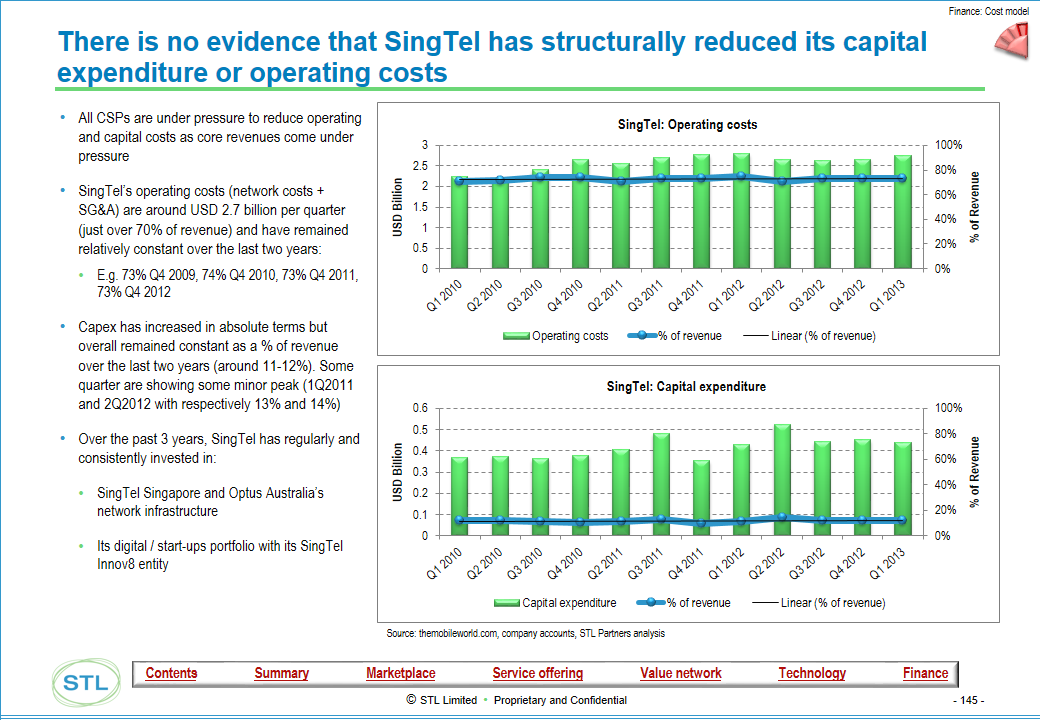

Cost Model: Capital investment and operating cost levels including revenue per employee

|

|

Contact us for pricing on +44 (0)207 247 5003 or

Return to the Telco 2.0 Transformation Index home page, or see more on the Benchmarking Report, Telefonica, Vodafone, AT&T, Verizon, Singtel and Ooredoo deep-dive reports.

ADSL, Amobee, AMPed2.0, Bridge Alliance, broadband, CDN, cloud computing, customer churn, CrewLink , crewXchange@singtel, DataRoam, digital advertising, digital commerce, digital services, Eatability, eHealth, enterprise services, FTTH, GCash, Google Play, GPON, GREE , HungryGoWhere, IAAS, identity, Infocomm Development Authority, InSing.com, IPTV, loyalty, LTE, M2M, managed hosting, managed services, messaging, MioTV, mobile advertising, Mobile Gaming, mobile payments, myBusiness, National Computer Systems, new business models, news reader, OC-48, Optus TV, OTT, payments, Pixable pictures, PoC, post-pay, pre-pay, remittances, Roaming, SAAS, Shopify, SingTel Innov8, SIP trunking, SMBs, SMS, strategic services, TableDB, Telco 2.0, The Mobile Gamer, VDSL, Visa, VMWare, voice, VoiceLink, VoIP