Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

|

Summary: AT&T’s residential fixed operation is underperforming as faster cable connections take over. It would probably like to trim its footprint or get out, and invest in fibre and its content business model. Is that really an option, and what are the lessons for other telcos? (December 2014, Executive Briefing Service) |

|

Below is an introductory extract and list of contents from this 20 page Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing Service here.

For more on any of these services, please email / call +44 (0) 207 247 5003

In version 1.0 of the Telco 2.0 Transformation Index, we identified a number of key strategic issues at AT&T that would mark it in the years to come. Specifically, we noted that the US wireless segment, AT&T Mobility, had been very strong, powered by iPhone data plans, that by contrast the consumer wireline segment, Home Solutions, had been rather weak, and that the enterprise segment, Business Solutions, faced a massive “crossing the chasm” challenge as its highly valuable customers began a technology transition that exposed them to new competitors, such as cloud computing providers, cable operators, and dark-fibre owners.

Source: Telco 2.0 Transformation Index

We noted that the wireless segment, though strong, was behind its great rival Verizon Wireless for 4G coverage and capacity, and that the future of the consumer wireline segment was dependent on a big strategic bet on IPTV content, delivered over VDSL (aka “fibre to the cabinet”).

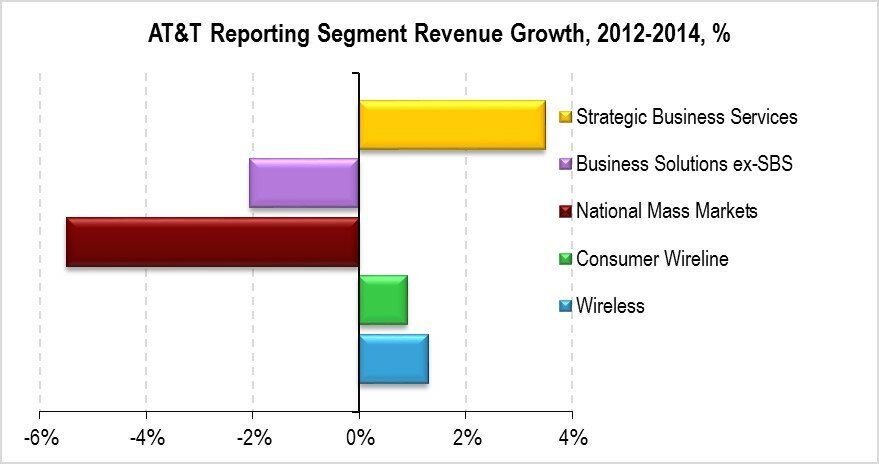

In Business Solutions, newer products like cloud, M2M services, Voice 2.0, and various value-added networking services, grouped in “Strategic Business Services”, had to scale up and take over from traditional ones like wholesale circuit voice and Centrex, IP transit, classic managed hosting, and T-carriers, before too many customers went missing. The following chart shows the growth rates in each of the reporting segments over the last two years.

Source: Telco 2.0 Transformation Index

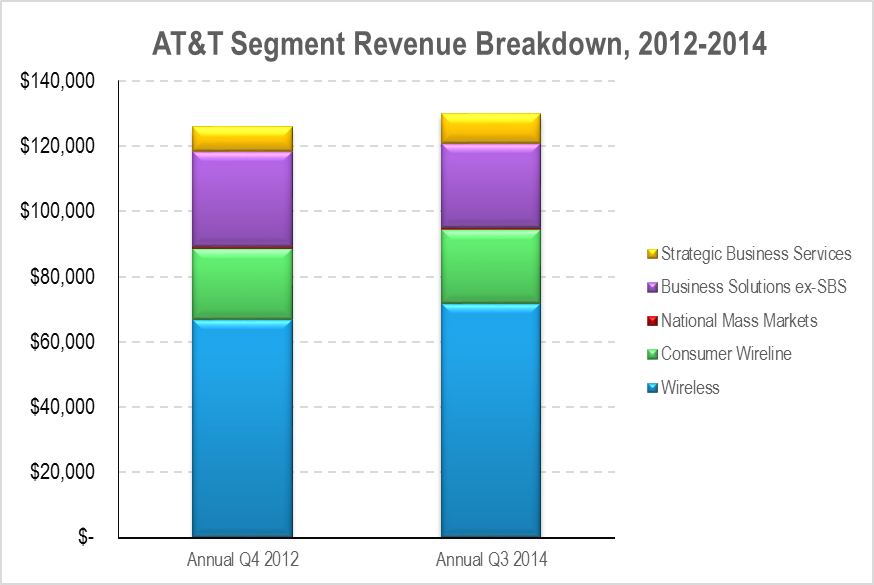

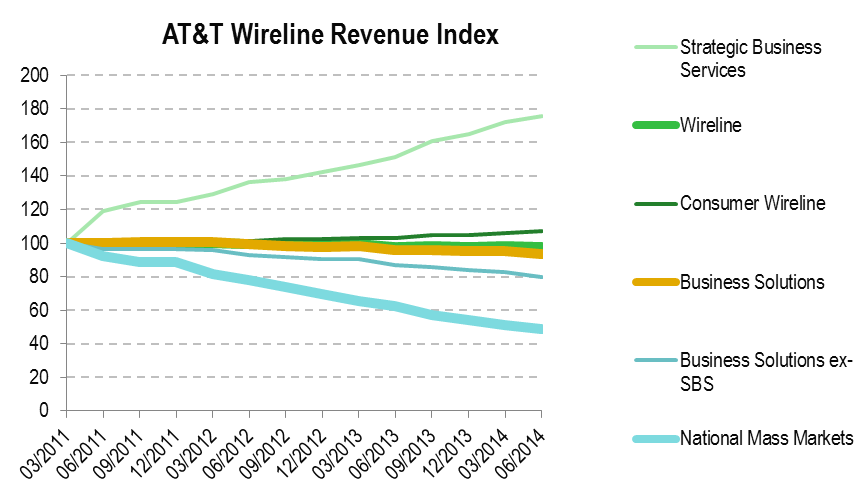

Out of the three major segments, wireless, consumer wireline, and business solutions, we can see that wireless is performing acceptably (although growth has slowed down), business solutions is in the grip of its transition, and wireline is just about growing. Because wireless is such a big segment (see Figure 1), it contributes a disproportionate amount to the company’s top line growth. Figure 2 shows revenue in the wireline segment as an index with Q2 2011 set to 100.

Source: Telco 2.0 Transformation Index

Back in 2012, we summed up the consumer wireline strategy as being all about VDSL and TV. The combination, plus voice, makes up the product line known as U-Verse, which we covered in the Telco 2.0 Transformation Index. We were distinctly sceptical, essentially because we believe that broadband is now the key product in the triple-play and the one that sells the other elements. With cable operators routinely offering 100Mbps, and upgrades all the way to gigabit speeds in the pipeline, we found it hard to believe that a DSL network with “up to” 45Mbps maximum would keep up.

To access the rest of this 20 page Report in full, including...

Figure 1: AT&T revenues by reporting segment, 2012 and 2014

Figure 2: Revenue growth by reporting segment, 2-year CAGR

Figure 3: Wireline overall is barely growing…

Figure 4: It’s been a struggle for all fixed operators to retain customers – except high-speed cablecos Comcast and Charter

Figure 5: AT&T is 5th for ARPU, by a distance

Figure 6: AT&T’s consumer wireline ARPU is growing, but it is only just enough to avoid falling further behind

Figure 7: U-Verse content sales may have peaked

Figure 8: For the most important speed band, the cable option is a better deal

Figure 9: Revenue – only cablecos left alive…

Figure 10: Broadband “drives” bundles…

Figure 11: …or do bundles drive broadband?

...Members of the Telco 2.0 Executive Briefing Subscription Service can download the full 20 page report in PDF format here. Non-Members, please subscribe here. For other enquiries, please email / call +44 (0) 207 247 5003.

Technologies and industry terms referenced include: Telco 2.0, fixed, broadband, copper, ftth, at&t, regulation, strategy, verizon, Comcast, BT