|

Summary: The valuation of digital businesses is vital because it drives key strategy and investment decisions, yet highly contentious, as there are many different possible approaches. In the first of two reports on this topic, we appraise the main external valuation methods, and their suitability for use or otherwise with new telecoms business models. (February 2015, Telco 2.0 Transformation Stream) |

|

Below is an extract from this 23 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Transformation Stream here.

For more on any of these services, please email / call +44 (0) 207 247 5003.

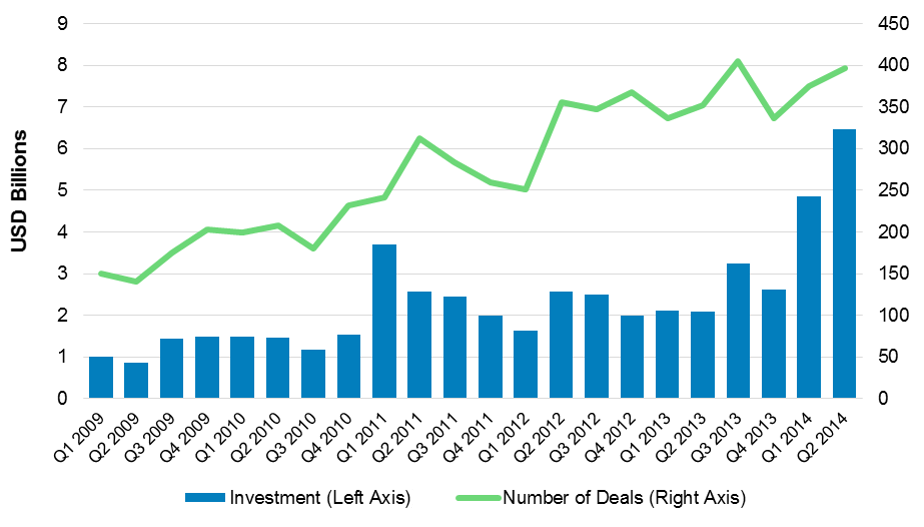

Venture capital investment across the mobile, digital and broader technology sectors is soaring. Although it stumbled during the 2008/9 financial crisis, the ecosystem has since recovered with 2013 and 2014 proving to be record-breaking years. Looking at Silicon Valley, for example, 2013 saw deals and funding more than double compared to 2009, and 2014 had already surpassed 2013 by the half-year mark:

Source: CB Insights Venture Capital Database

As Figure 1 shows, growth in funding has outstripped growth in the number of deals: consequently, the average deal size has more than doubled since 2009. In part, this has been driven by a small number of large deals attracting very high valuations, with some of the highest valuations seen by Uber ($41bn), SpaceX ($12bn), Dropbox ($10bn), Snapchat ($10-20bn) and Airbnb ($13bn). Similarly high valuations have been seen in Silicon Valley tech exits, with Facebook’s $19bn acquisition of WhatsApp and Google’s $3.2bn acquisition of Nest two high-profile examples. These billion-dollar valuations are leading many to claim that a dotcom-esque bubble is forming: what can possibly justify such valuations?

In some cases, these concerns are driven by a lack of publicly available information on financial performance: for example, Uber’s leaked dashboard showed its financials to be considerably stronger than analysts’ expectations at the time. In other cases, they appear to be driven by a lack of understanding of the true rationale behind the deal. See, for example, the Connected Home: Telcos vs Google (Nest, Apple, Samsung, +…) and Facebook + WhatsApp + Voice: So What? Executive Briefings.

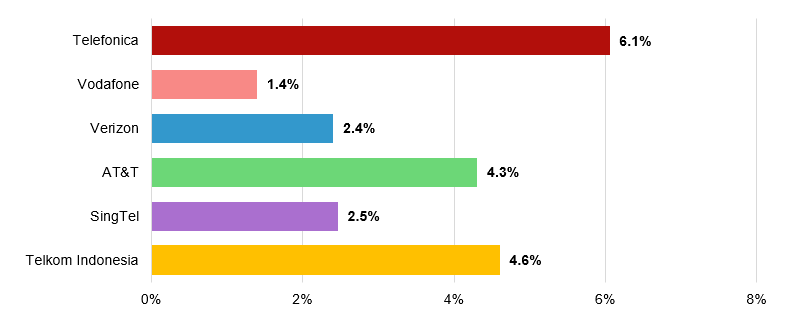

Against this uncertain backdrop, telecoms operators are expanding into such new mobile and digital services as a means to fill the ‘hunger gap’ left by falling revenues from core services. They are doing so through a mixture of organic and inorganic investment, in different verticals and with varying levels of ambition and success:

Source: Telco 2.0 Transformation Index

* Disclaimer: Scope of what is included/excluded varies slightly by operator and depends upon the ability to source reliable data

Note: Vodafone data from 2012/13 financial year

However, this is a comparatively new area for telcos and many are now asking what is the real ‘value’ of their individual digital initiatives. For example, to what extent are Telefonica’s digital activities leading to a material uplift in enterprise value?

This question is further complicated by the potential for a new service to generate ‘synergy value’ for the acquirer or parent company: just as Google’s $3.2bn+ valuation of Nest was in part driven by the synergy Nest’s sensor data provides to Google’s core advertising business, digital services have also been shown to provide synergy benefits to telcos’ core communications businesses. For example, MTN Mobile Money in Uganda is estimated to have seen up to 48% of its gross profit contribution generated by synergies, such as core churn reduction and airtime distribution savings, as opposed to standard transaction commissions.

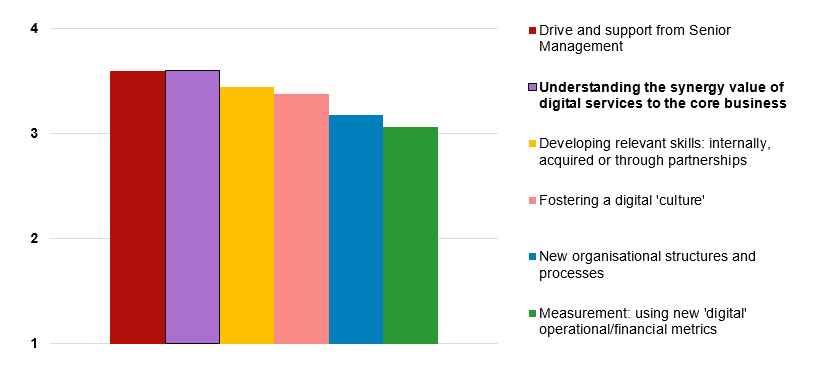

Ultimately, without understanding the value of their digital businesses and how this changes over time (capital gain), telcos cannot effectively govern their digital activities. Prioritisation, budget allocation and knowing when to close initiatives (‘fast failure’) within digital is challenging without a clear idea of the return on investment different verticals and initiatives are generating. Understanding valuation was therefore identified as the joint most important success factor for delivering digital services in STL Partners' recent survey of telco executives:

Source: Digital Transformation and Ambition Survey Results, 2014, n=55

Crucially, however, survey respondents also identified developing this understanding as more than two years away from being resolved. In order to accelerate this process, there are three key questions which need to be addressed:

This Executive Briefing (Part 1) focuses on question 1; questions 2 and 3 will be addressed by future research (Part 2).

To access the rest of this 23 page Telco 2.0 Report in full, including...

...and the following report figures...

...Members of the Telco 2.0 Transformation Stream can download the full 23 page report in PDF format here. Non Members, please subscribe here. For other enquiries, please email / call +44 (0) 207 247 5003.

Technologies and industry terms referenced include: AT&T Digital Life, benchmark, causation, churn, correlation, DCF, discounted cash flow, Facebook, fast failure, Google, governance, investment, MTN Mobile Money, proxy model, Skype, Spotify, synergies, synergy value, Telesom ZAAD, Uber, valuation, VC, venture capital, Vodafone One Net.