Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

|

Summary: 5G. SDN/NFV. Gigabit cable. WiFi. IoT. Spectrum policy. Vendor consolidation. Despite carefully-constructed business cases for future network investment, the goal-posts are always moving, and even the best-laid plans face possible disruptions – positive or negative. To kick off our ‘Future of the Network’ research stream, we outlined the key questions determining the business case for future investments in the network. This is Part 2, which covers critical network-technology disruptions, the impact of government and regulation, and the shifting vendor landscape. (May 2015, Future of the Network Stream) |

|

Below is an extract from this 40 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Future of the Network Stream here.

For more on any of these services, please email / call +44 (0) 207 247 5003.

We recently published a report, Key Questions for The Future of the Network, Part 1: The Business Case, exploring the drivers for network investment. In this follow-up report, we expand the coverage into two separate areas through which we explore 5 key questions:

Disruptive network technologies

External changes

In the extract below, we outline the context for the first area – disruptive network technologies – and explore the rationales and processes associated with virtualisation (Question 1).

This section covers three huge questions which should be at the top of any CTO’s mind in a CSP – and those of many other executives as well. These are strategically-important technology shifts that have the potential to “change the game” in the longer term. While two of them are “wireless” in nature, they also impact fixed/fibre/cable domains, both through integration and potential substitution. These will also have knock-on effects in financial terms - directly in terms of capex/opex costs, or indirectly in terms of services enabled and revenues.

This is not intended as a round-up of every important trend across the technology spectrum. Clearly, there are many other evolutions occurring in device design, IoT, software-engineering, optical networking and semiconductor development. These will all intersect in some ways with telcos, but there are so many “logical hops” away from the process of actually building and running networks, that they don’t really fit into this document easily. (Although they do appear in contexts such as drivers of desirable 5G network capabilities).

Instead, the focus once again is on unanswered questions that link innovation with “disruption” of how networks are conceived and deployed. As described below, network-virtualisation has huge and diverse impacts across the CSP universe. 5G will likely have a large gap versus today’s 4G architecture, too. This is very different to changes which are mostly incremental.

The mobile and software focus of this section is deliberate. Fixed-network technologies – fast-evolving though they are – generally do not today cause “disruption” in a technical sense. As the name suggests, the current newest cable-industry standard, DOCSIS3.1, is an evolution of 3.0, not a revolution. There is no 4.0 on the drawing-boards, yet. But the relative ease of upgrade to “gigabit cable” may unleash more market-related disruptions, as telcos feel the need to play catch-up with their rivals’ swiftly-escalating headline speeds.

Fibre technologies also tend to be comparatively incremental, rather than driving (or enabling) massive organisational and competitive shifts. In fixed networks there are other important drivers – competition, network unbundling, 4K television, OTT-style video and so on – as well as important roles for virtualisation, which covers both mobile and fixed domains. For markets with high use of residential “OTT video” services such as Netflix – especially in 4K variants – the push to gigabit-range speeds may be faster than expected. This will also have knock-on impacts on the continued improvement of WiFi, defending against ever-faster cellular WiFi networks. Indeed, faster gigabit cable and FTTH networks will be necessary to provide backhaul for 4.5G and 5G cellular networks, both for normal cell-towers and the expected rapid growth of small-cells.

The questions covered in more depth here examine:

All of these intersect, and have inter-dependencies. For instance, 5G networks are likely to embrace SDN/NFV as a core component, and also perhaps form an “umbrella” over other low-power wireless networks.

A fourth “critical” question would have been to consider security technology and processes. Clearly, the future network is going to face continued challenges from hackers and maybe even cyber-warfare, against which we will need to prepare. However, that is in many ways a broader set of questions that actually reflect on all the others – virtualisation will bring its own security dilemmas, as (no doubt) will 5G. WiFi already does. It is certainly a critical area that bears consideration at a strategic level within CSPs, although it is not addressed here as a specific “question”. It is also a huge and complex area that deserves separate study.

As well as being prepared to exploit truly disruptive innovations, the industry also needs to get better at spotting non-disruptive ones that are doomed to failure, and abandoning them before they incur too much cost or distraction. The telecoms sector has a long way to go before it embraces the start-up mentality of “failing fast” – there are too many hypothetical “standards” gathering dust on a metaphorical shelf, and never being deployed despite a huge amount of work. Sometimes they get shoe-horned into new architectures, as a way to breathe life into them – but that often just encumbers shiny new technologies with the failures of the past.

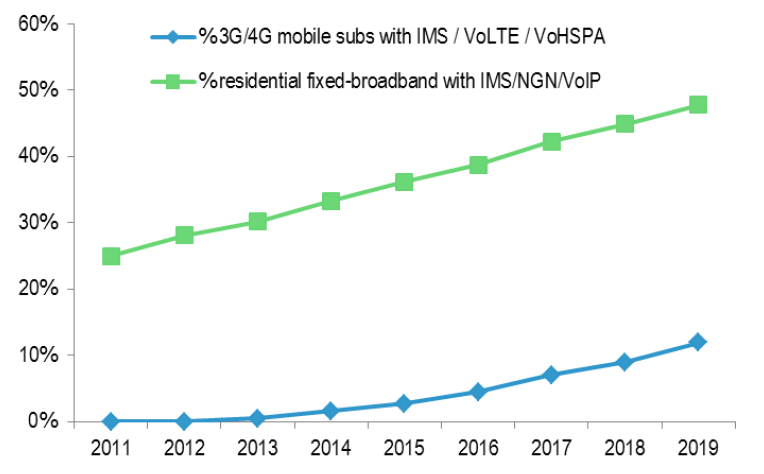

For example, over the past 10+ years, the telecom industry has been pitching IMS (IP Multimedia Subsystem) as the future platform for interoperating services. It is finally gaining some adoption, but essentially only as a way to implement VoIP versions of the phone system – and even then, with huge increases in complexity and often higher costs. It is not “disruptive” except insofar as sucking huge amounts of resources and management attention, away from other possible sources of genuine innovation. Few developers care about it, and the “technology politics” behind it have helped contribute to the industry’s problems, not the solutions. While there is growth in the deployment of IMS (e.g. as a basis for VoLTE – voice on LTE, or fixed-line VoIP) it is primarily an extra cost, rather than a source of new revenue or competitive advantage. It might help telcos reduce costs by retiring old equipment or reclaiming spectrum for re-use, but that seems to be the limit of its utility and opportunity.

Source: Disruptive Analysis

A common theme in recent years has been for individual point solutions for technical standards to seem elegant “in isolation”, but actually fail to take account of the wider market context. Real-world “offload” of mobile data traffic to WiFi and femtocells has been minimal, because of various practical and commercial constraints – many of which have been predictable. Self-optimising networks (where radio components configured, provisioned and diagnosed themselves automatically) suffered from apathy by vendors – as well as fears from operator staff that they might make themselves redundant. A whole slew of attempts at integrating WiFi with cellular have also had minimal impact, because they ignored the existence of private WiFi and user behaviour. Some of these are now making a return, engineered into more holistic solutions like HetNets and SDN. Telcos execs need to ensure that their representatives on standards bodies, or industry fora, are able to make pragmatic decisions with multiple contributory inputs, rather than always pursue “engineering purity”.

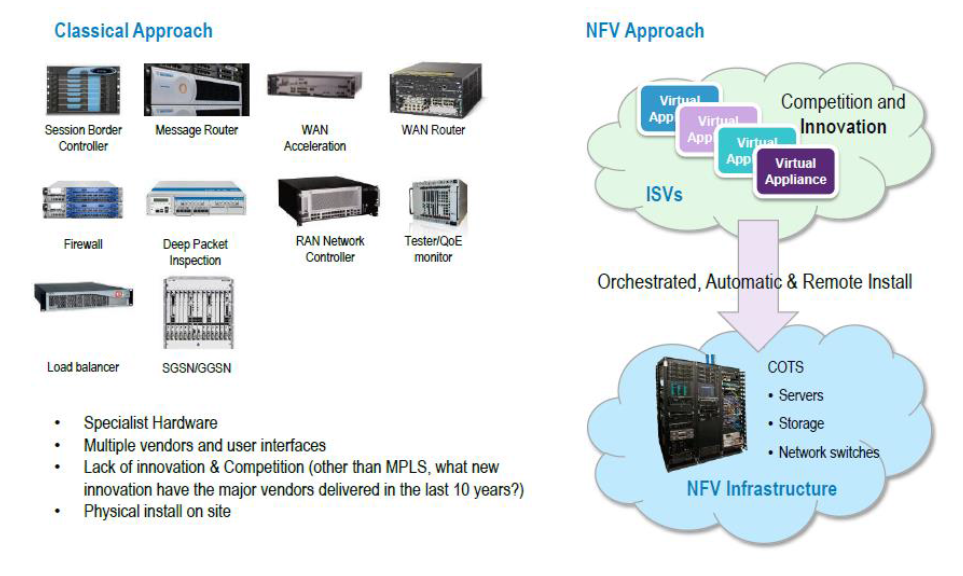

Spurred by rapid advances in standardised computing products and cloud platforms, the idea of virtualisation is now almost ubiquitous across the telecom sector. Yet the specialised nature of network equipment means that “switching to the cloud” is a lot more complicated than is the case for enterprise IT. But change is happening - the industry is now slowly moving from inflexible, non-scalable network elements or technology sub-systems, to ones which are programmable, running on commercial hardware, and which can “spin up” or down in terms of capacity. We are still comparatively early in this new cycle, but the trend now appears to be inexorable. It is being driven both by what is becoming possible – and also the threats posed by other denizens of the “cloud universe” migrating towards the telecoms industry and threatening to replace aspects unilaterally.

Two acronyms cover the main developments:

Source: ETSI & STL Partners

And while a lot of focus has been placed on operators’ own data-centres and “data-plane” boxes like routers and assorted traffic-processing “middle-boxes” even, that is not the whole story. Virtualisation also extends to the other elements of telco kit: “control-plane” elements used to oversee the network and internal signalling, billing and OSS systems, and even bits of the access and radio network. Tying them all together – and managing the new virtual components – brings new challenges in “orchestration”.

But this begs a number of critical subsidiary questions:

To access the rest of this 40 page Telco 2.0 Report in full, including...

...and the following report figures...

...Members of the Future of the Network Stream can download the full 40 page report in PDF format here. Non Members, please subscribe here. For other enquiries, please email / call +44 (0) 207 247 5003.

Technologies and industry terms referenced include: 4G, 5G, business model, FTTX, gigabit cable, HetNet, internet governance, IoT, mobile, network, NFV, regulation, SDN, SigFox, spectrum, Telco 2.0, vCPE, vendor consolidation, virtualisation, WiFi, ZigBee.