|

Summary: Since Google acquired Nest for $3.2bn, Apple and Samsung have also entered the complex battle for the connected home. We analyse in-depth why Google wanted Nest, the players’ goals and strategies, and what should telcos and others do to stay in the game? (August 2014, Executive Briefing Service, Dealing with Disruption Stream.) |

|

Below is an extract from this 31 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service and Dealing with Disruption here. For more on any of these services, please email / call +44 (0) 207 247 5003

On January 13th 2014, Google announced its acquisition of Nest Labs for $3.2bn in cash consideration. Nest Labs, or ‘Nest’ for short, is a home automation company founded in 2010 and based in California which manufactures ‘smart’ thermostats and smoke/carbon monoxide detectors. Prior to this announcement, Google already had an approximately 12% equity stake in Nest following its Series B funding round in 2011.

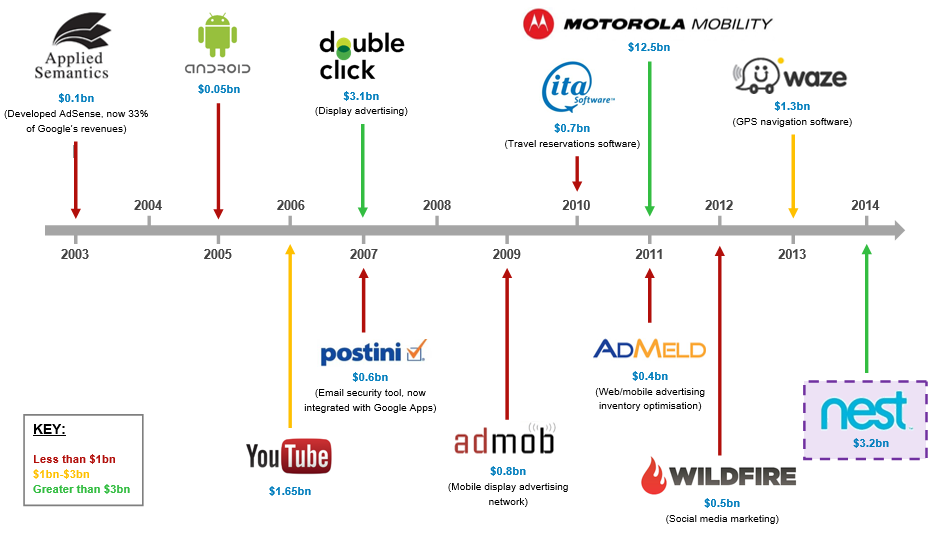

Google is known as a prolific investor and acquirer of companies: during 2012 and 2013 it spent $17bn on acquisitions alone, which was more than Apple, Microsoft, Facebook and Yahoo combined (at $13bn) . Google has even been known to average one acquisition per week for extended periods of time. Nest, however, was not just any acquisition. For one, whilst the details of the acquisition were being ironed out Nest was separately in the process of raising a new round of investment which implicitly valued it at c. $2bn. Google, therefore, appears to have paid a premium of over 50%.

This analysis can be extended by examining the transaction under three different, but complementary, lights.

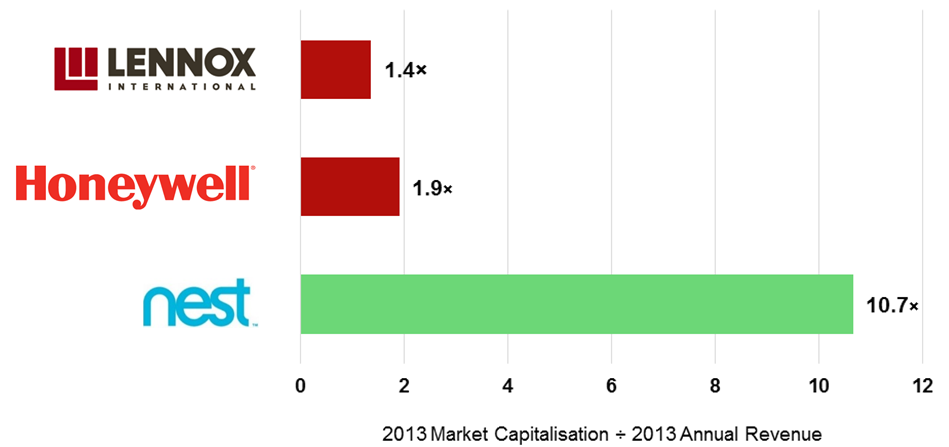

At the time of the acquisition, estimates placed Nest as selling 100k of its flagship product (the ‘Nest Thermostat’) per month . With each thermostat retailing at c. $250 each, this put its revenue at approximately $300m per annum. Now, looking at the ratio of Nest’s market capitalisation to revenue compared to two of its established competitors (Lennox and Honeywell) tells an interesting story:

Source: Company accounts, Morgan Stanley

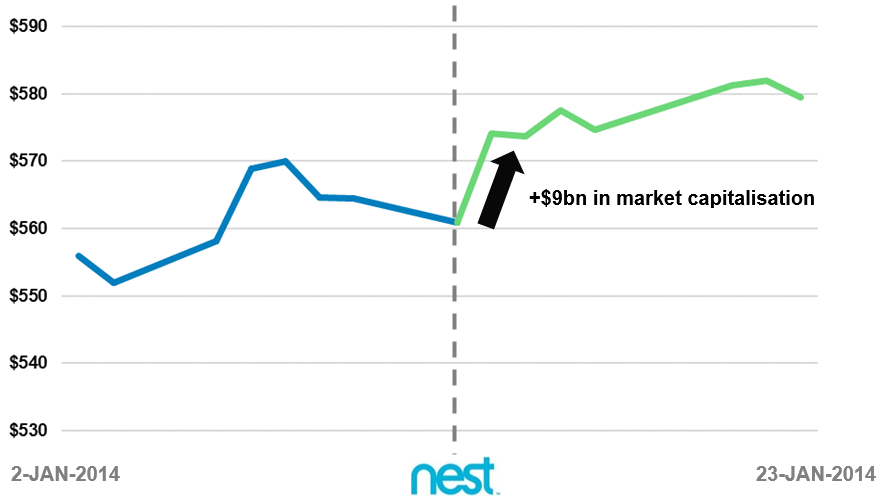

Prior to the deal’s announcement, Google’s share price was oscillating around the $560 mark. Following the acquisition, Google’s share price began averaging closer to $580. On the day of the announcement itself, Google’s share price increased from $561 to $574 which, crucially, reflected a $9bn increase in market capitalisation . In other words, the value placed on Google by the capital markets increased by nearly 300% of the deal’s value. This is shown in Figure 2 below:

Source: Google Finance

This implies that the capital markets either see Google as being well positioned to add unique value to Nest, Nest as being able to strongly complement Google’s existing activities, or both.

At $3.2bn, the acquisition of Nest represents Google’s second largest acquisition of all time. The largest was its purchase of Motorola Mobility in 2011 for $12.5bn, but Google has since reached a deal to sell the majority of its assets (excluding its patent portfolio) to Lenovo for $2.9bn. In other words, Nest is soon to become Google’s largest active, inorganic investment. Google’s ten largest acquisitions, as well as some smaller but important ones, are shown in Figure 3 below:

Source: Various

Beyond its size, the Nest acquisition also continues Google’s recent trend of acquiring companies seemingly less directly related to its core business. For example, it has been investing in artificial intelligence (DeepMind Technologies), robotics (Boston Dynamics, Industrial Perception, Redwood Robotics) and satellite imagery (Skybox Imaging).

George Geis, a professor at UCLA, claims that Google develops a series of metrics at an early stage which it later uses to judge whether or not the acquisition has been successful. He further claims that, according to these metrics, Google on average rates two-thirds of its acquisitions as successful. This positive track record, combined with the sheer size of the Nest deal, suggests that the obvious question here is also an important one:

Finally, there is a question to be asked around the implications of this deal for Telcos and their partners. Many Telcos are now active in this space, but they are not alone: internet players (e.g. Google and Apple), big technology companies (e.g. Samsung), utilities (e.g. British Gas) and security companies (e.g. ADT) are all increasing their involvement too. With different strategies being adopted by different players, the following question follows naturally:

To access the rest of this 31 page Telco 2.0 Report in full, including...

...and the following report figures...

...Members of the Telco 2.0 Executive Briefing Subscription Service and Dealing with Disruption Stream can download the full 31 page report in PDF format here. Non-Members, please subscribe here. For other enquiries, please email / call +44 (0) 207 247 5003.

Technologies and industry terms referenced include: advertising, analytics, android, APIs, Apple, B2B2x, big data, business model, connected home, Dropcam, e-Health, energy demand response, energy management, Google, home automation, Internet of Things, interoperability, machine learning, Nest, platform, Samsung, thermostat, utilities, Zigbee, telecom, strategy, strategies, Telco 2.0, innovation, mobile, wireless.