|

Summary: T-Mobile USA’s ‘uncarrier’ strategy has delivered significant net additions, but is it a good strategy - and is the disruption promised by Softbank CEO Masayoshi Son already underway? We compare it to Free Mobile’s disruptive approach in France, and the results of its competitors’ responses. (June 2014, Executive Briefing Service.) |

|

Below is an extract from this 20 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service here. We'll also be exploring the implications at Digital Asia (2-4 December, Bali). For more on any of these services, please email / call +44 (0) 207 247 5003.

Ever since the original Softbank bid for Sprint-Nextel, the industry has been awaiting a wave of price disruption in the United States, the world’s biggest and richest mobile market, and one which is still very much dominated by the dynamic duo, Verizon Wireless and AT&T Mobility.

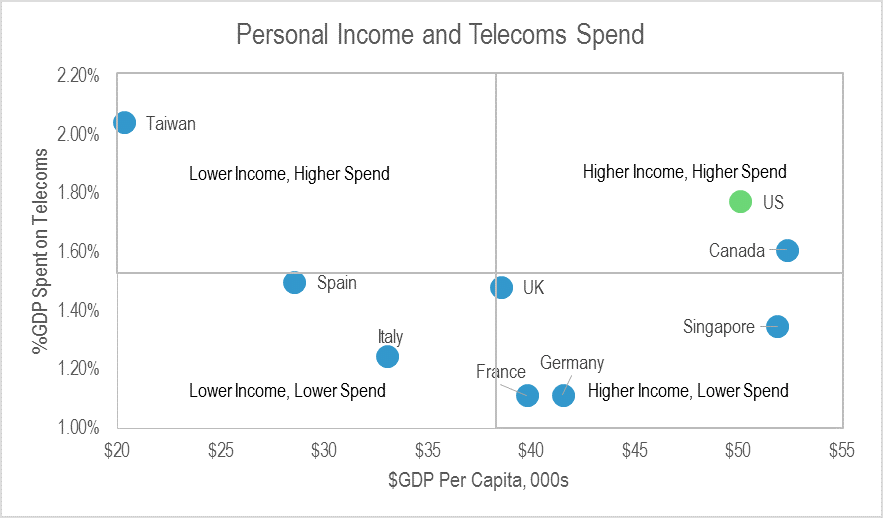

Source: Onavo, Ofcom, CMT, BNETZA, TIA, KCC, Telco accounts, STL Partners

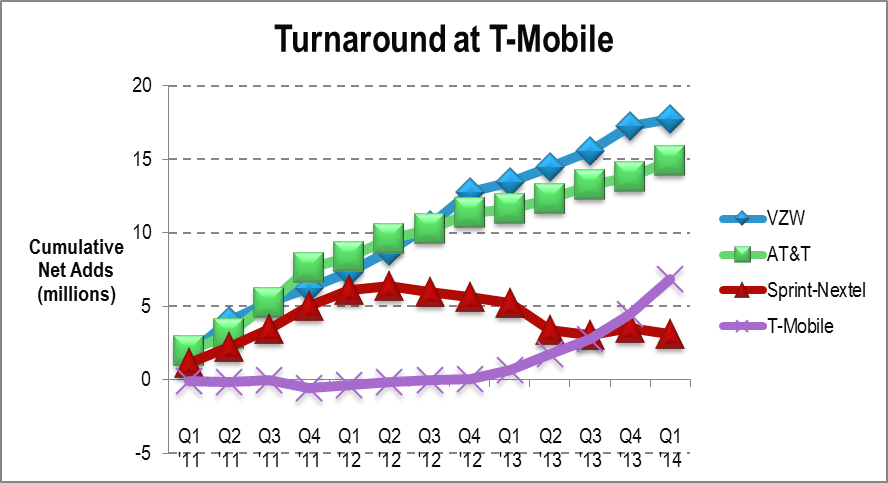

However, the Sprint-Softbank deal saga delayed any aggressive move by Sprint for some time, and in the meantime T-Mobile USA stole a march, implemented its own very similar ‘uncarrier’ proposition strategy, and achieved a dramatic turnaround of their customer numbers.

As Figure 2 shows, the duopoly marches on, with Verizon in the lead, although the gap with AT&T has closed a little lately. Sprint, meanwhile, looks moribund, while T-Mobile has closed half the gap with the duopolists in an astonishingly short period of time.

Now, a Sprint-T-Mobile merger is seriously on the cards. Again, Softbank CEO Masayoshi Son is on record as promising to launch a price war. But to what extent is a Free Mobile-like disruption event already happening? And what strategies are carriers adopting?

For more STL analysis of the US cellular market, read the original Sprint-Softbank EB , the Telco 2.0 Transformation Index sections on Verizon and AT&T , and our Self-Disruption: How Sprint Blew It EB . Additional coverage of the fixed domain can be found in the Triple-Play in the USA: Infrastructure Pays Off EB and the Telco 2.0 Index sections mentioned above

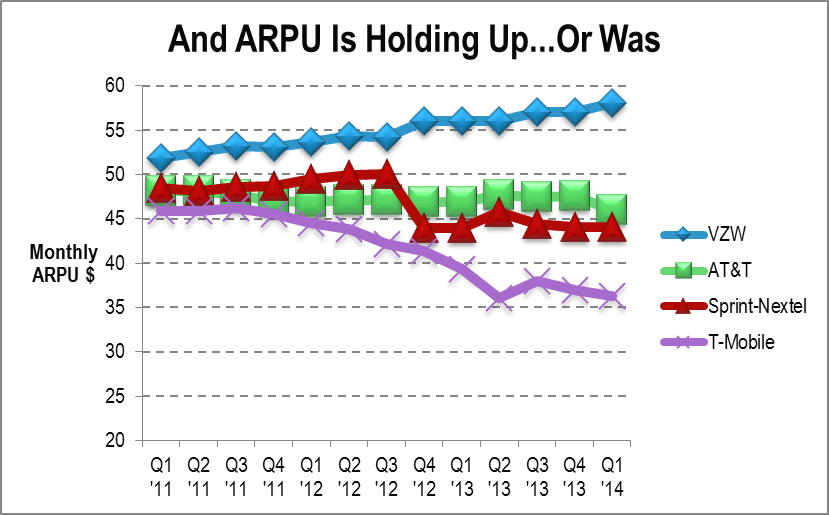

In our previous analysis Self-Disruption: How Sprint Blew It, we used the following chart, Figure 3, under the title “…And ARPU is Holding Up”. Updating it with the latest data, it becomes clear that ARPU – and in this case pricing – is no longer holding up so well. Rather than across-the-board deflation, though, we are instead seeing increasingly diverse strategies.

Source: STL Partners

AT&T’s ARPU is being very gradually eroded (it’s come down by $5 since Q1 2011), while Sprint’s plunged sharply with the shutdown of Nextel (see report referenced above for more detail). Since then, AT&T and Sprint have been close to parity, a situation AT&T management surely can’t be satisfied with. T-Mobile USA has slashed prices so much that the “uncarrier” has given up $10 of monthly ARPU since the beginning of 2012. And Verizon Wireless has added almost as much monthly ARPU in the same timeframe.

Each carrier has adopted a different approach in this period:

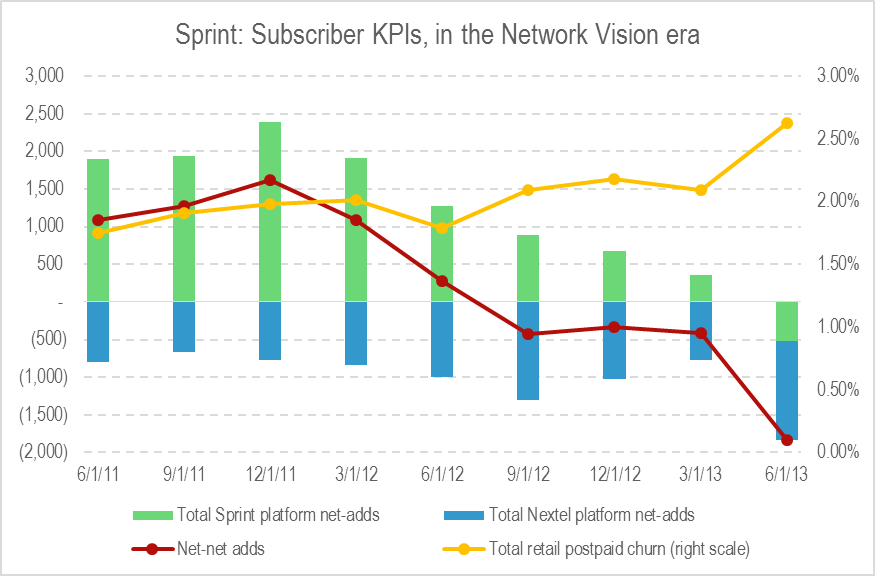

Source: STL Partners, Sprint filings

To access the rest of this 20 page Telco 2.0 Report in full, including...

...Members of the Telco 2.0 Executive Briefing Subscription Service can download the full 21 page report in PDF format here. Non-Members, please subscribe here. For other enquiries, please email / call +44 (0) 207 247 5003.

Technologies and industry terms referenced include: pricing, strategy, disruption, competition, cellular, t-mobile, sprint, free.fr, telecom, strategy, strategies, wireless, mobile, disruption.