|

Summary: Free’s shock bid for T-Mobile USA will stretch its finances and management capacity to the limit. Can Free’s package of tactics, technology, and procedures work in the US context? (August 2014, Executiive Briefing Service, Future of the Networks Stream). |

|

Below is an extract from this 18 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service and Future of the Networks Stream here.

We'll also be exploring the implications at Digital Asia (2-4 December, Bali), and are initiating coverage of a new research programme on Dealing with Disruption, and we'd really appreciate your input here. For more on any of these services, please email / call +44 (0) 207 247 5003

The future of the US market and its 3rd and 4th operators has been a long-running saga. The market, the world’s richest, remains dominated by the duopoly of AT&T and Verizon Wireless. It was long expected that Softbank’s acquisition of Sprint heralded disruption, but in the event, T-Mobile was simply quicker to the punch.

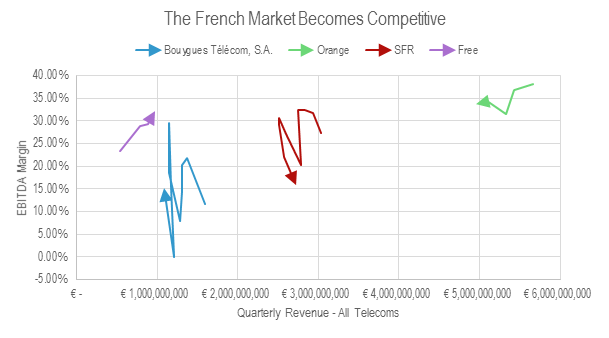

Since the launch of T-Mobile’s “uncarrier” price-war strategy, we have identified signs of a “Free Mobile-like” disruption event, for example, substantial net-adds for the disruptor, falling ARPUs, a shakeout of MVNOs and minor operators, and increased industry-wide subscriber growth. However, other key indicators like a rapid move towards profitability by the disruptor are not yet in evidence, and rather than industry-wide deflation, we observe divergence, with Verizon Wireless increasing its ARPU, revenues, and margins, while AT&T’s are flat, Sprint’s flat to falling, and T-Mobile’s plunging.

This data is summarised in Figure 1.

Source: STL Partners, company filings

Source: STL Partners, company filings

T-Mobile: the state of play in Q2 2014

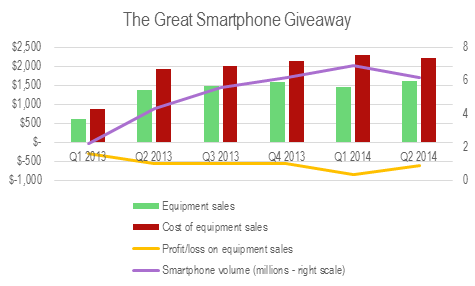

When reading Figure 1, you should note that T-Mobile’s Q2 2014 accounts contain a negative expense item of $747m, reflecting a spectrum swap with Verizon Wireless, which flatters their margin. Without it, the operating margin would be 2.99%, about a third of Sprint’s. Poor as this is, it is at least positive territory, after a Q1 in which T-Mobile lost money. It is not quite true to say that T-Mobile only made it to profitability thanks to the one-off spectrum deal; excluding it, the carrier would have made $215m in operating income in Q2, a $243m swing from the $28m net loss in Q1. This is explained by a $223m narrowing of T-Mobile’s losses on device sales, as shown in Figure 2, and may explain why the earnings release makes no mention of profits instead of adjusted EBITDA despite it being a positive quarter.

Source: STL Partners, company filings

T-Mobile management likes to cite its ABPU (Average Billings per User) metric in preference to ARPU, which includes the hire-purchase charges on device sales under its quick-upgrade plans. However, as Figure 3 shows, this is less exciting than it sounds. The T-Mobile management story is that as service prices, and hence ARPU, fall in order to bring in net-adds, payments for device sales “decoupled” from service plans will rise and take up the slack. They are, so far, only just doing so. Given that T-Mobile is losing money on device pricing, this is no surprise.

To access the rest of this 18 page Telco 2.0 Report in full, including...

...and the following report figures...

...Members of the Telco 2.0 Executive Briefing Subscription Service and Future Networks Stream can download the full 18 page report in PDF format here. Non-Members, please subscribe here. For other enquiries, please email / call +44 (0) 207 247 5003.

Technologies and industry terms referenced include: acquisitions, cable company, consolidation, disruption, EBITDA multiple, fibre, fixed-mobile, Free.fr, Iliad, LBO, leverage, leveraged buy-out, small cells, spectrum, T-Mobile USA, telecom, strategy, strategies, Telco 2.0, innovation, mobile, wireless.