Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

|

Summary: Regardless of business strategy, the development of 'Smart Pipes' - more intelligent networks - will be a key driver of shareholder returns from operators. Smarter networks will also benefit network users – upstream service providers and end users, and operators, and their vendors and partners, will need to compete to be the smartest. What are they, why are they needed, and what are the key strategies employed to develop them? (February 2012, Foundation 2.0, Future of the Networks Stream). |

|

It is over fourteen years since David Isenberg wrote his seminal paper The Rise of the Stupid Network in which he outlined the view that telephony networks would increasingly become dumb pipes as intelligent endpoints came to control how and where data was transported. Many of his predictions have come to fruition. Cheaper computing technology has resulted in powerful ‘smartphones’ in the hands of millions of people and new powerful internet players are using data centres to distribute applications and services ‘over the top’ to users over fixed and mobile networks.

The hypothesis behind this piece of research is that endpoints cannot completely control the network. STL Partners believes that the network itself needs to retain intelligence so it can interpret the information it is transporting between the endpoints. Mobile network operators, quite rightly, will not be able to control how the network is used but must retain the ability within the network to facilitate a better experience for the endpoints. The hypothesis being tested in this research is that ‘smart pipes’ are needed to:

Overall, smarter networks will benefit network users – upstream service providers and end users – as well as the mobile network operators and their vendors and partners. Operators will also be competing to be smarter than their peers as, by differentiating here, they gain cost, revenue and performance advantages that will ultimately transform in to higher shareholder returns.

This report has kindly been sponsored by Tellabs and is freely available. Tellabs developed the initial concepts, and provided STL Partners with the primary input and scope for the report. Research, analysis and the writing of the report itself was carried out independently by STL Partners. The views and conclusions contained herein are those of STL Partners.

Tellabs innovations advance the mobile Internet and help our customers succeed. That’s why 43 of the top 50 global communications service providers choose our mobile, optical, business and services solutions. We help them get ahead by adding revenue, reducing expenses and optimizing networks.

Tellabs (Nasdaq: TLAB) is part of the NASDAQ Global Select Market, Ocean Tomo 300® Patent Index, the S&P 500 and several corporate responsibility indexes including the Maplecroft Climate Innovation Index, FTSE4Good and eight FTSE KLD indexes. http://www.tellabs.com

Mobile network operators are now valued as utility companies in US and Europe (less so APAC). Investors are not expecting future growth to be higher than GDP and so are demanding money to be returned in the form of high dividends.

In his seminal book, Michael Porter identified three generic strategies for companies – ‘Cost leadership’, ‘Differentiation’ and ‘Focus’. Two of these are viable in the mobile telecommunications industry – Cost leadership, or Happy Pipe in STL Partners parlance, and Differentiation, or Full-service Telco 2.0. No network operators have found a Focus strategy to work as limiting the customer base to a segment of the market has not yielded sufficient returns on the high capital investment of building a network. Even MVNOs that have pursued this strategy, such as Helio which targeted Korean nationals in the US, have struggled.

Underpinning the two business strategies are related ‘smart pipe’ approaches – smart network and smart services:

|

Porter Strategy |

Telco 2.0 strategy |

Nature of smartness |

Characteristics |

|

Cost leadership |

Happy Pipe |

Smart network |

Cost efficiency – minimal network, IT and commercial costs. Simple utility offering. |

|

Differentiation |

Full-service Telco 2.0 |

Smart services |

Technical and commercial flexibility: improve customer experience by integrating network capabilities with own and third-party services and charging either end user or service provider (or both). |

Source: STL Partners

It is important to note that, currently at least, having a smart network is a precursor of smart services. It would be impossible for an operator to implement a Full-service Telco 2.0 strategy without having significant network intelligence. Full-service Telco 2.0 is, therefore, an addition to a Happy Pipe strategy.

In a survey conducted for this report, it was clear that operators are pursuing ‘smart’ strategies, whether at the network level or extending beyond this into smart services, for three reasons:

Assuming that most mobile operators currently have limited smartness in either network or services, our analysis suggests significant upside in financial performance from successfully implementing either a Happy Pipe or Full-service Telco 2.0 strategy. Most mobile operators generate Cash Returns on Invested Capital of between 5 and 7%. For the purposes of our analysis, we have a assumed a baseline of 5.8%. The lower capital and operator costs of a Happy Pipe strategy could increase this to 7.4% and the successful implementation of a Full-service Telco 2.0 strategy would increase this to a handsome 13.3%:

|

Telco 2.0 strategy |

Nature of smartness |

Cash Returns on Invested Capital |

|

As-is – Telco 1.0 |

Low – relatively dumb |

5.8% |

|

Happy Pipe |

Smart network |

7.4% |

|

Full-service Telco 2.0 |

Smart services |

13.3% |

Source: STL Partners

STL Partners has identified six opportunity areas for mobile operators to exploit with a Full-service Telco 2.0 strategy. Summarised here, these are outlined in detail in the report:

|

Opportunity Type |

Approach |

Typical Services |

|

Core Services |

Improving revenues and customer loyalty by better design, analytics, and smart use of data in existing services. |

Access, Voice and Messaging, Broadband, Standard Wholesale, Generic Enterprise ICT Services (inc. SaaS) |

|

Vertical industry solutions (SI) |

Delivery of ICT projects and support to vertical enterprise sectors. |

Systems Integration (SI), Vertical CEBP solutions, Vertical ICT, Vertical M2M solutions, and Private Cloud. |

|

Infrastructure services |

Optimising cost and revenue structures by buying and selling core telco ICT asset capacity. |

Bitstream ADSL, Unbundled Local Loop, MVNOs, Wholesale Wireless, Network Sharing, Cloud - IaaS. |

|

Embedded communications |

Enabling wider use of voice, messaging, and data by facilitating access to them and embedding them in new products. |

Comes with data, Sender pays delivery, Horizontal M2M Platforms, Voice, Messaging and Data APIs for 3rd Parties. |

|

Third-pary business enablers |

Enabling new telco assets (e.g. Customer data) to be leveraged in support of 3rd party business processes. |

Telco enabled Identity and Authorisation, Advertising and Marketing, Payments. APIs to non-core services and assets. |

|

Own-brand OTT services |

Building value through Telco-owned online properties and ‘Over-the-Top’ services. |

Online Media, Enterprise Web Services, Own Brand VOIP services. |

As operators globally experience a slow-down in revenue growth, they are pursuing ways of maintaining margins by reducing costs. Unsurprisingly therefore, most operators in North America, Europe and Asia-Pacific appear to be pursuing a Happy Pipe/smart network strategy. Squeezing capital and operating costs and improving network performance is being sought through such approaches as:

Vodafone Asia-Pacific is a good example of an operator pursuing these activities aggressively and as an end in itself rather than as a basis for a Telco 2.0 strategy. Yota in Russia and Lightsquared in the US are similarly content with being Happy Pipers.

In general, Asia-Pacific has the most disparate set of markets and operators. Markets vary radically in terms of maturity, structure and regulation and operators seem to polarise into extreme Happy Pipers (Vodafone APAC, China Mobile, Bharti) and Full-Service Telco 2.0 players (NTT Docomo, SK Telecom, SingTel, Globe).

In Telefonica, Europe is the home of the operator with the most complete Telco 2.0 vision globally. Telefonica has built and acquired a number of ‘smart services’ which appear to be gaining traction including O2 Priority Moments, Jajah, Tuenti and Terra. Recent structural changes at the company, in which Telefonica Digital was created to focus on opportunities in the digital economy, further indicate the company’s focus on Telco 2.0 and smart services. Europe too appears to be the most collaborative market. Vodafone, Telefonica, Orange, Telecom Italia and T-Mobile are all working together on a number of Telco 2.0 projects and, in so doing, seek to generate enough scale to attract upstream developers and downstream end-users.

The sheer scale of the two leading mobile operators in the US, AT&T and Verizon, which have over 100 million subscribers each, means that they are taking a different approach to Telco 2.0. They are collaborating on one or two opportunities, notably with ISIS, a near-field communications payments solution for mobile, which is a joint offer from AT&T, Verizon and T-Mobile. However, in the main, there is a high degree of what one interviewee described as ‘Big Bell dogma’ – the view that their company is big enough and powerful enough to take on the OTT players and ‘control’ the experiences of end users in the digital economy. The US market is more consolidated than Europe (giving the big players more power) but, even so, it seems unlikely that either AT&T or Verizon can keep customers using only their services – the lamented wall garden approach.

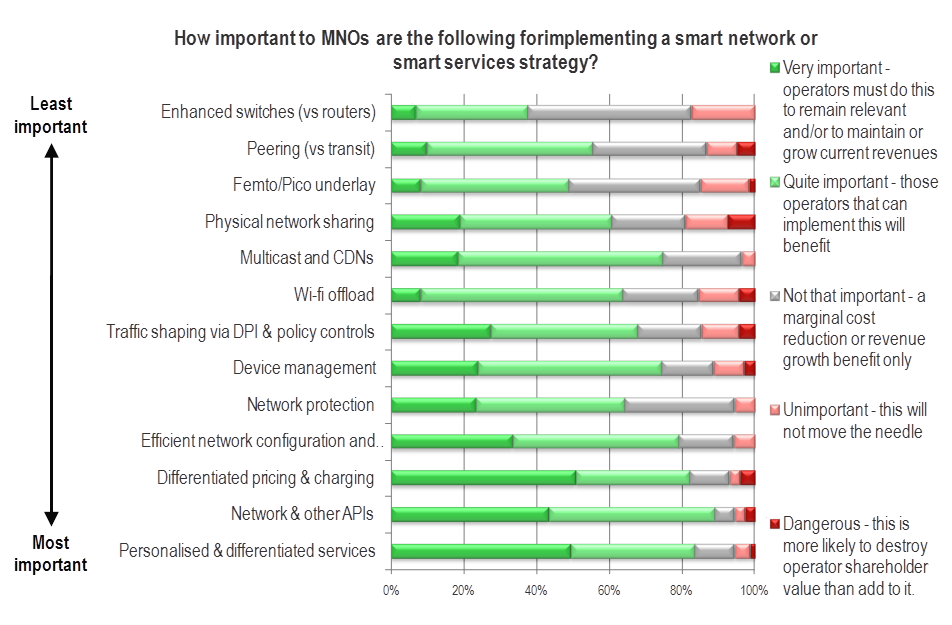

STL Partners explored both how important and how difficult it is to implement the changes required to deliver a Happy Pipe strategy (outlined in the bullets above) and those needed for Full-service Telco 2.0 strategy, via industry interviews with operators and a quantitative survey. The key findings of this analysis were:

NOTE: Overall ranking was based on a weighted scoring policy of Very important +4, Quite important +3, Not that important +2, Unimportant +1, Dangerous -4.

Overall, most respondents to the survey and people we spoke with felt that operators had more chance in delivering a Happy Pipe strategy and that only a few Tier 1 operators would be successful with a Full-Service Telco 2.0 strategy. For both strategies, they were surprisingly sceptical about operators’ ability to implement the necessary changes. Five reasons were cited as major barriers to success and were particularly big when considering a Full-Service Telco 2.0 strategy:

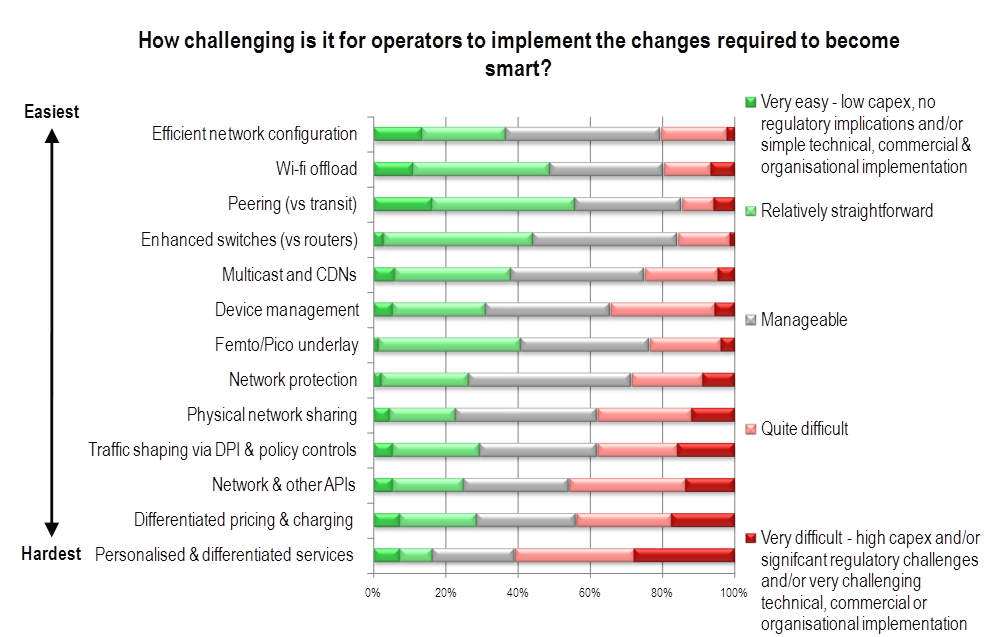

Looking at the specific activities required to build smartness, it was clear that those required for a Full-service Telco 2.0/smart services strategy are considered the hardest to implement (see chart below):

NOTE: Overall ranking was based on a weighted scoring policy of Very easy +5, Relatively straightforward +4, Manageable +3, Quite difficult +2, Very difficult -2.

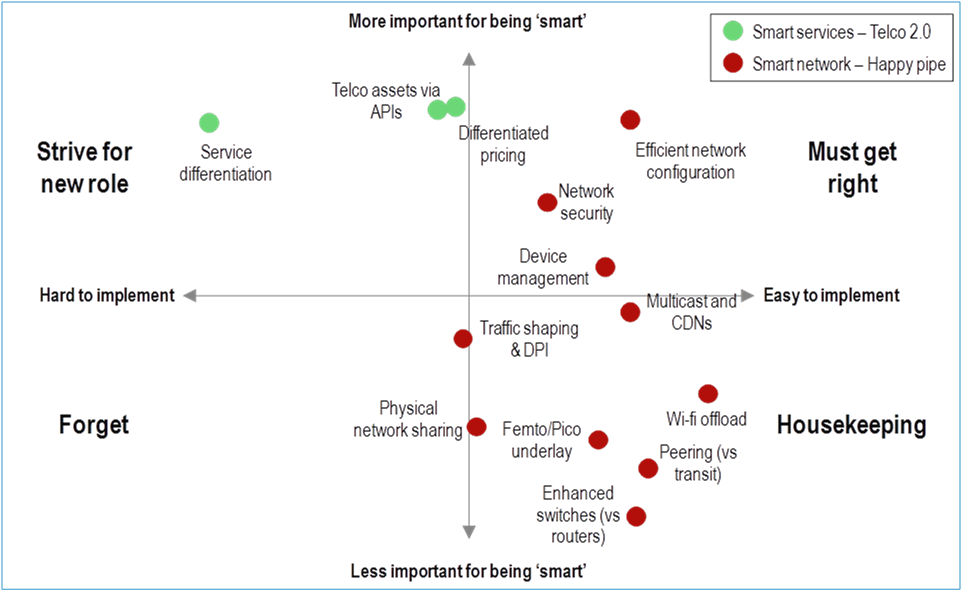

By comparing the relative importance of specific activities against how easy they are to implement, we were able to classify them into four categories:

|

Category |

Importance for delivering smart strategy |

Relative ease of implementation |

|

Must get right |

High |

Easy |

|

Strive for new role |

High |

Difficult |

|

Housekeeping |

Low |

Easy |

|

Forget |

Low |

Difficult |

Unfortunately, as the chart above shows, no activities fall clearly into the ‘Forget’ categories but there are some clear priorities:

Although deemed more marginal in our survey, we would include as equally important:

There is second cluster of smart network activities which appear to be equally easy (or difficult) to implement but are deemed by respondents to be lower value and therefore fall into a lower ‘Housekeeping’ category:

Overall, it appears that mobile network operators need to continue to invest resources in developing smart networks but that a clear prioritisation of efforts is needed given the multitude of ‘moving parts’ required to develop a smart network that will deliver a successful Happy Pipe strategy.

A successful Full-Service Telco 2.0 strategy is likely to be extremely profitable for a mobile network operator and would result in a substantial increase in share price. But delivering this remains a major challenge and investors are sceptical. Collaboration, experimentation and investment are important facets of a Telco 2.0 implementation strategy as they drive scale, learning and innovation respectively. Given the demands of investors for dividend yields, investment is only likely to be available if an operator becomes more efficient, so implementing a Happy Pipe strategy which reduces capital and operating costs is critical.

Organisations, geographies, people and products indexed in the report: AccuWeather, Akamai, Amazon, Amazon Kindle, Amerigo, Android, APAC, Apple, Arun Sarin, Asia, Asia-Pacific, AT&T, AT&T Wireless, Australia, BellSouth, Bharti Airtel, BlackBerry, BlueVia, BT, BT Global Services, BT Ribbit, Cable and Wireless, China, China Mobile, Cisco Systems, Cyworld, David Isenberg, Deutsche Telekom, Easyown, Equant, Europe, Facebook, GCash, Globe, Google, GoTone, GSMA, Helio, Huawei, Hutch-Essar, India, Indonesia, iPhone, ISIS, iTunes, Jajah, Japan, JD Power, Joe Lueckenhoff, Kenya, Kindle, Korea, KT, Lebara, Level 3, Lightsquared, Matthew Key, Megafon, Michael Porter, mPesa, MTS, M-Zone, New Zealand, North America, NTT, NTT Docomo, O2, O2 Priority Moments, Openreach, Optus, Orange, Philippines, PowerOn, Rostelecom, Russia, Safaricom, SBC, Singapore, SingTel, SK Telecom, Skype, Smart, South America, Sprint, TDC, TDC Play, Telecom Italia, Telefonica, Telefonica Digital, Telenor, Telenor Objects, Telkomsel, Tellabs, Terra, T-Mobile, T-Mobile USA, T-Systems, Tuenti, US, Verizon, VHA, Vimpelcom, Vittorio Colao, Vodafone, Vodafone 360, Wang Jianzhou, Wayra, Wholesale Applications Consortium (WAC), Yota.

Technologies and industry terms indexed in the report: 2G, 3G, 4G, Access, Advertising and Marketing, APIs, asynchronous, authentication, B2B VAS Platform, backhaul, Best effort, billing-on-behalf, Bitstream ADSL, Broadband, broadband data access, Cash Returns on Invested Capital (CROIC), CDNs, charging, cloud, Comes with data, Core services, Cost Leadership, Culture, customer care, Data APIs, deep-packet inspection (DPI), device management, differentiated pricing, Differentiation, DSL, EBITDA, Embedded Communications, enablers, enhanced switches, enterprise apps, Enterprise ICT Services, Enterprise Web Services, Ethernet, Femto, FTTC, FTTH, Full-service Telco 2.0, Happy Pipe, HSPA+, identity, IMS, Infrastructure as a Service (IaaS), Infrastructure services, IP NGN, IPTV, IPv6, KPIs, laptops, lobbying, location, LTE, M2M, mobile, MVNO, Near-Field Communications (NFC), Net Neutrality, network protection, network sharing, Next Generation, Online Media, OTT players, Own Brand VOIP services, Own-brand OTT, payments, PC, Peering, Personalised and differentiated services, Platforms, policy controls, presence, Private Cloud, provisioning, quality of service (QoS), RBOCs, Rich Communications Suite (RCS), RNC, routers, SaaS, Self-Organising Network standards, Sender pays delivery, smart network, smart pipes, smart services, smartphones, SMS, SS7, Standard Wholesale, structural separation, Systems Integration (SI), tablets, telephony, Third-party business enablers, Traffic shaping, TV, two-sided, ultra-low latency, Unbundled Local Loop, upstream, user experience, VDSL, Vertical CEBP, Vertical ICT, Vertical industry solutions, Voice and Messaging, voice telephony, Wholesale Wireless Networks, Wi-Fi, Wi-Fi offload, WLAN, yield.