This 148-page PowerPoint style PDF report (and accompanying Excel data pack) examines the transformation efforts of Vodafone Group as it both embraces a Happy Piper philosophy through organic and inorganic network investment and experiments in digital services more generally. Vodafone's mixed fortunes and competitive positioning across its developed and emerging markets is assessed, which is supplemented by a broader discussion of these markets' characteristics and prospects.

The report examines Vodafone's service offerings by describing and evaluating its activities across all services areas, from core (e.g. 4G LTE, IPTV) to near-core (e.g. M2M, cloud) and digital (e.g. M-Pesa, Vouchercloud). Partnerships with other industries are evaluated in the Value Network section as well as collaborations with other CSPs such as Weve and its M2M partnership strategy.

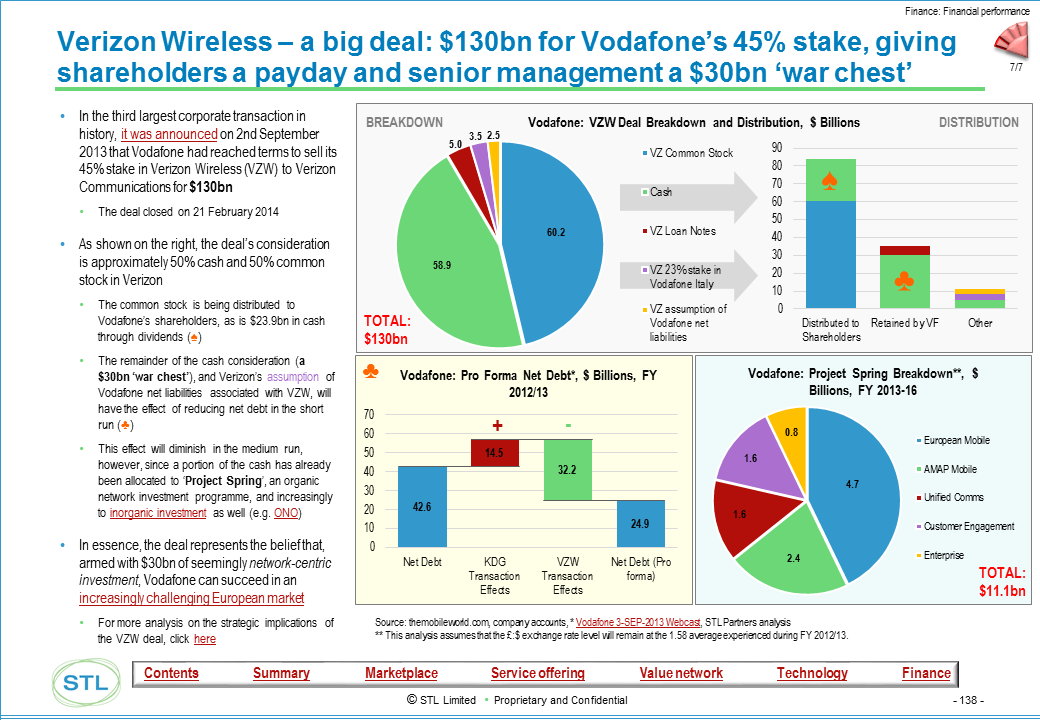

The report highlights Vodafone's experience and efforts relative to its peers in technology transformation. This is followed by a deep-dive into its financial results, including how these have been affected by the Verizon Wireless deal.

Key strengths, shortcomings – including its heavy exposure to the struggling European marketplace and lack of a clearly articulated vision in digital services – and strategic priorities are outlined.

Who is it for?

The Telco 2.0 Transformation Index is the world’s first benchmark of Communications Service Providers provides benchmarking and deep analysis, the index reports are designed for:

Telcos and CSP operators (including those covered, those operating in the same markets and telcos operating in other markets)

For vendors either partnering with or wishing to partner with these telcos

Investors seeking to understand where to place their bets with CSPs

Key Benefits

Determine the key drivers of telecoms industry transformation

Clarify Vodafone's performance in specific areas of transformation

Understand Vodafone's relative strengths and weaknesses

Learn from Vodafone's transformation activities

Prioritise transformation projects at your organisation

Determine how your solutions can support Vodafone

Improve your value propositions for Vodafone

|

|

Background: Defining Telco 2.0

Telco 2.0 Transformation Index Overview

Executive summary

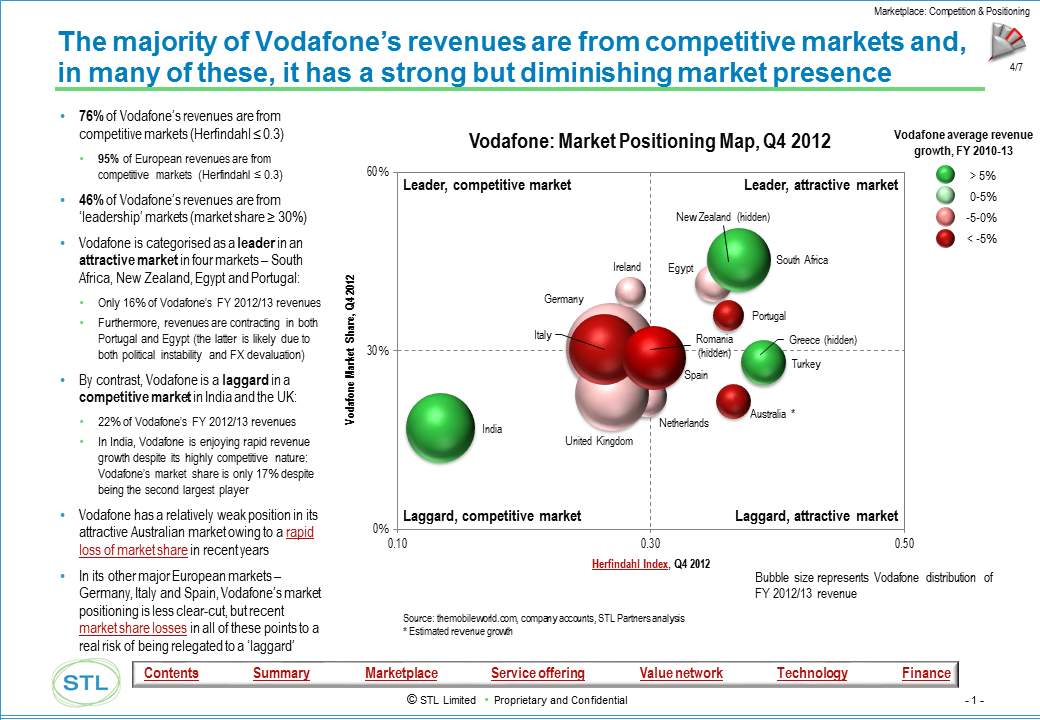

Figure 1: Example output - Vodafone's market positioning

Summary findings

Market economics and digital maturity

Telecoms market regulation by country

Telecoms market structure and growth by country

Market share position by country/segment

Share gain/loss analysis by country/segment

Strategic positioning by country/segment

Operating company portfolio analysis

Competitor analysis by market/segment

Customer base analysis (pre-pay and post-pay) vs competitors

Customer churn rates vs competitors

Brand strength vs competitors

Customer engagement vs competitors

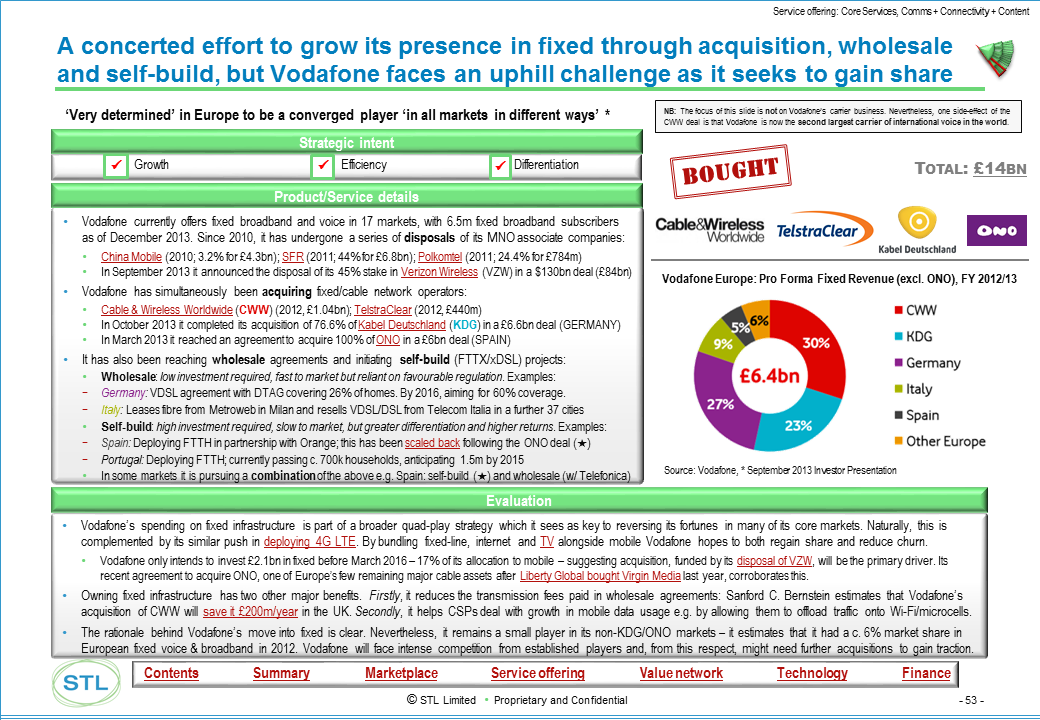

Figure 2: Example output - Vodafone's growing presence in fixed

Summary findings

6 service offering categories defined:

Core services

Vertical industry solutions

Infrastructure services

Embedded communications (including M2M)

Third-Party business enablers (including identity, marketing, advertising, payments)

OTT services

Telco 2.0 services strategies defined – ‘Happy Piper’ and ‘Service Provider’

Vodafone’s Telco 2.0 services strategy

Summary performance by service offering category

Evaluation of specific services within each service category

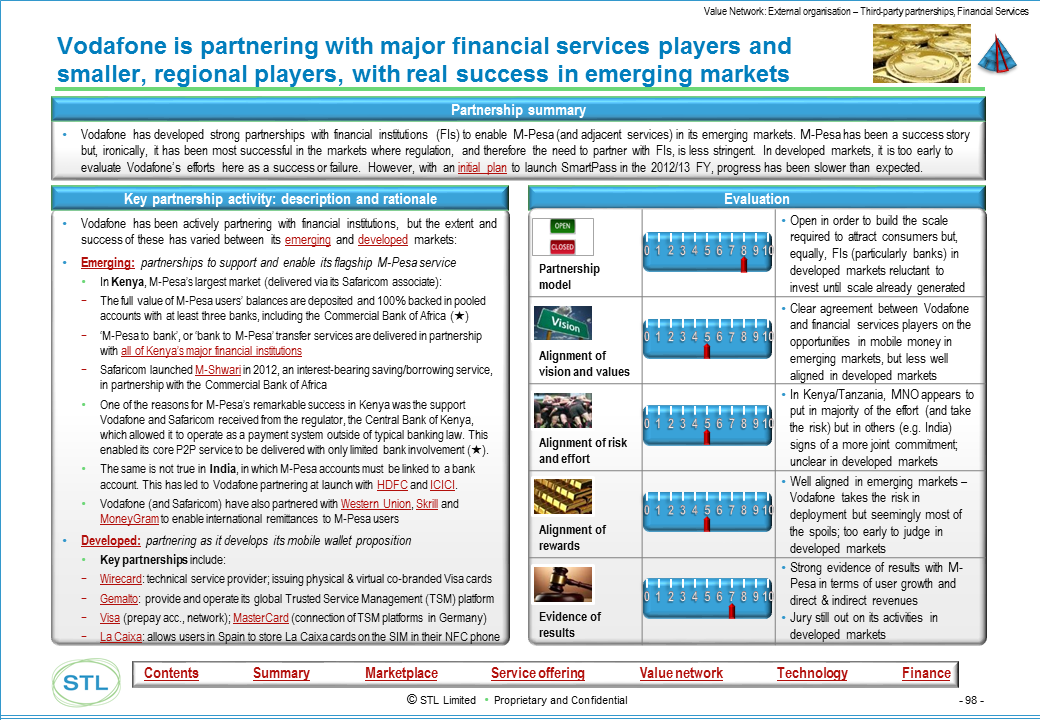

Figure 3: Example output - Vodafone's partnerships in financial services

|

Best-Practice examples |

|||||||

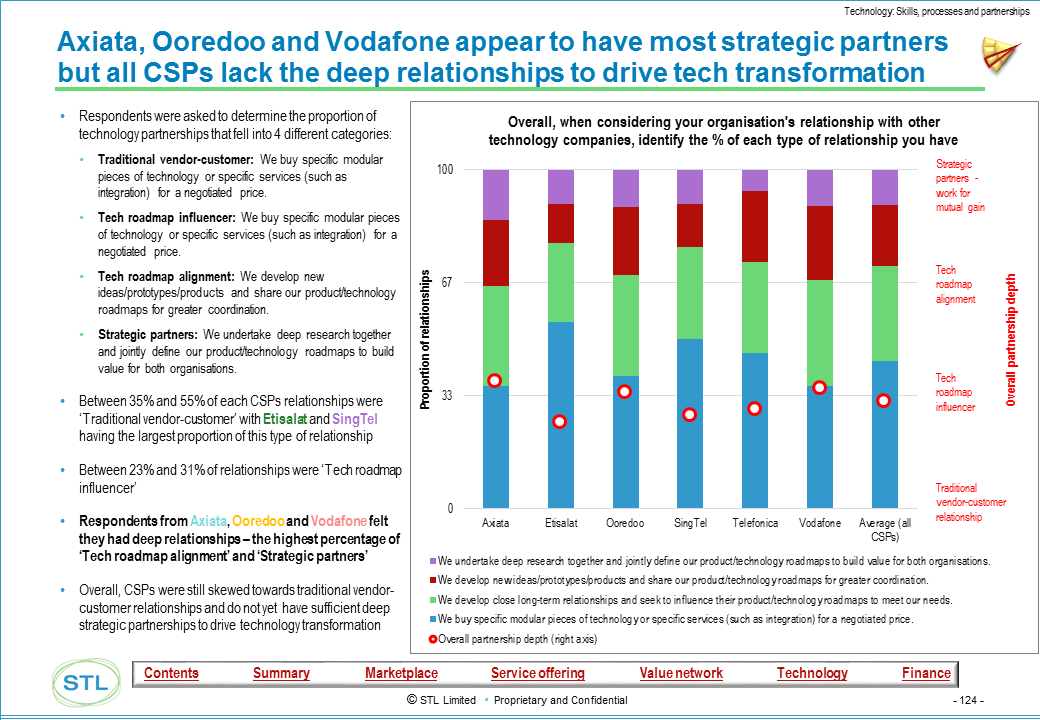

Figure 4: Example output - Vodafone's technology partnership model

Summary findings

Technology objectives and priorities

Commercial and technology alignment

Technology skills, processes, and partnerships

Technology execution: speed and ability to meet objectives

Technology positioning vs other CSPs

Figure 5: Example output - Verizon Wireless deal's financial implications

Summary findings

Financial performance: profitability, return on investment, debt position, capital intensity

Finance and Telco 2.0 strategy alignment: use of Telco 2.0 metrics

Revenue Model: ability to protect Telco 1.0 revenues and grow Telco 2.0 revenues

Cost Model: Capital investment and operating cost levels including revenue per employee

Format and pricing

|

|

|

|

|

Contact us for pricing on +44 (0)207 247 5003 or

Return to the Telco 2.0 Transformation Index home page, or see more on the Benchmarking report, Telefonica, Vodafone, AT&T, Verizon, Singtel and Ooredoo deep-dive reports.

ADSL, broadband, Cable & Wireless Worldwide, cloud computing, customer churn, digital services, enterprise services, FTTH, GDSP, Global Data Services Platform, IaaS, IPTV, Kabel Deutschland, LTE, M2M, managed hosting, messaging, mHealth, mobile advertising, mobile payments, mobile wallet, M-Pesa, new business models, NFC, One Net, ONO, OTT, Pay TV, post-pay, pre-pay, private cloud, Project Spring, SaaS, Safaricom, SmartPass, SMBs, Telco 2.0, TelstraClear, Verizon Wireless, Vodacom, Vodafone Red, Vodafone Ventures, Vodafone xone, voice, VoIP, Vouchercloud, Weve.