Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

|

Summary: The latest results for Telefonica are grim, showing a 12% y-o-y revenue decline, following Orange and Deutsche Telekom’s 4% drops. This signals unequivocally that transformation is now a necessity not a luxury for European operators – and the rest of the world is not far behind. Longer term recovery is possible but not a certainty – what are the key steps? (May 2014, Foundation 2.0, Executive Briefing Service, Telco 2.0 Transformation Stream.) |

|

To share this article easily, please click:

Telefonica’s efforts to transition to a new Telco 2.0 business model are well-regarded at STL Partners. The company, together with SingTel, topped our recent Telco 2.0 Transformation Index which explored six major Communication Service Providers (AT&T, Verizon, Telefonica, SingTel, Vodafone and Ooredoo) in depth to determine their relative strengths and weaknesses and provide specific recommendations for them, their partners and the industry overall.

But Telefonica’s Q1 2014 results were even worse than recent ones from two other European players, Deutsche Telekom and Orange, which both posted revenue declines of 4%. Telefonica’s Group revenue came in at €12.2 billion which was down 12% on Q1 2013. Part of this was a result of the disposal of the Czech subsidiary and weaker currencies in Latin America, in which around 50% of revenue is generated. Nevertheless, the negative trend for Telefonica and other European players is clear.

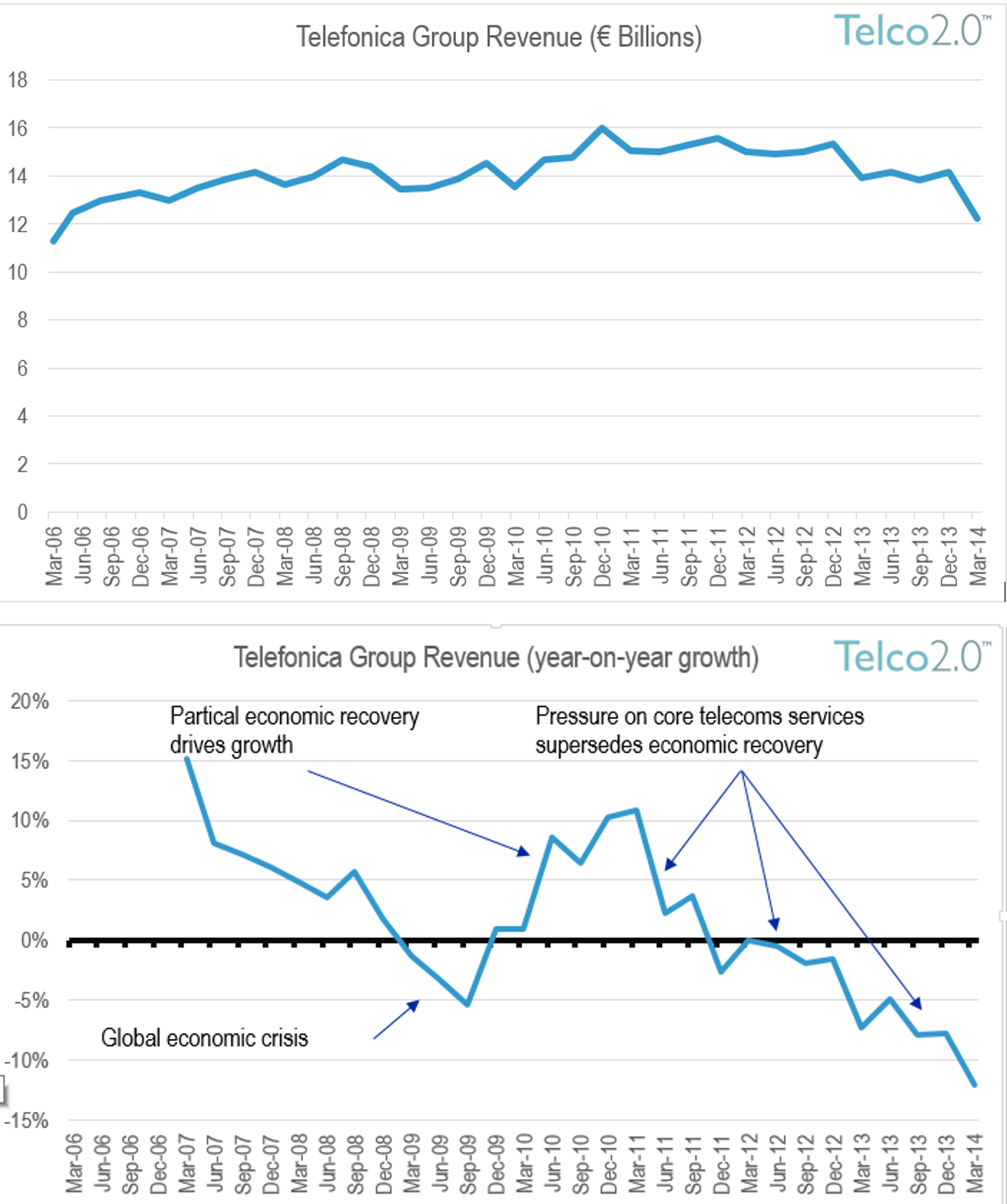

As the first chart in Figure 1 shows, Telefonica’s revenues have followed a gentle parabola over the last eight years. They rose from 2006 to 2010, reaching a peak in Q4 of that year, before declining steadily to leave the company in Q1 2014 back where it started in Q1 2006.

The second chart, however, adds more insight. It shows the year-on-year percentage growth or decline in revenue for each quarter. It is clear that between 2006 and 2008 revenue growth was already slowing down and, following the 2008 economic crisis in which Spain (which generates around quarter of Telefonica’s revenue) was hit particularly hard, the company’s revenue declined in 2009. The economic recovery that followed enabled Telefonica to report growth again in 2010 and 2011 before the underlying structural challenges of the telecoms industry – the decline of voice and messaging – kicked in, resulting in revenue decline since 2012.

Source: Telefonica, STL Partners analysis

The biggest concern for Telefonica and something that STL Partners believes will be replicated in other CSPs over the next few years is the accelerating nature of the decline since the peak. It seems clear that Telco 1.0 revenues are not going to decline in a steady fashion but, once they reach a tipping point, to tumble away quickly as:

The results of the European CSPs confirms STL Partners belief that the outlook for the global industry in the next few years is negative overall. It is clear that telecoms industry maturity is at different stages globally:

Asia: mixed, some markets growing, others in decline

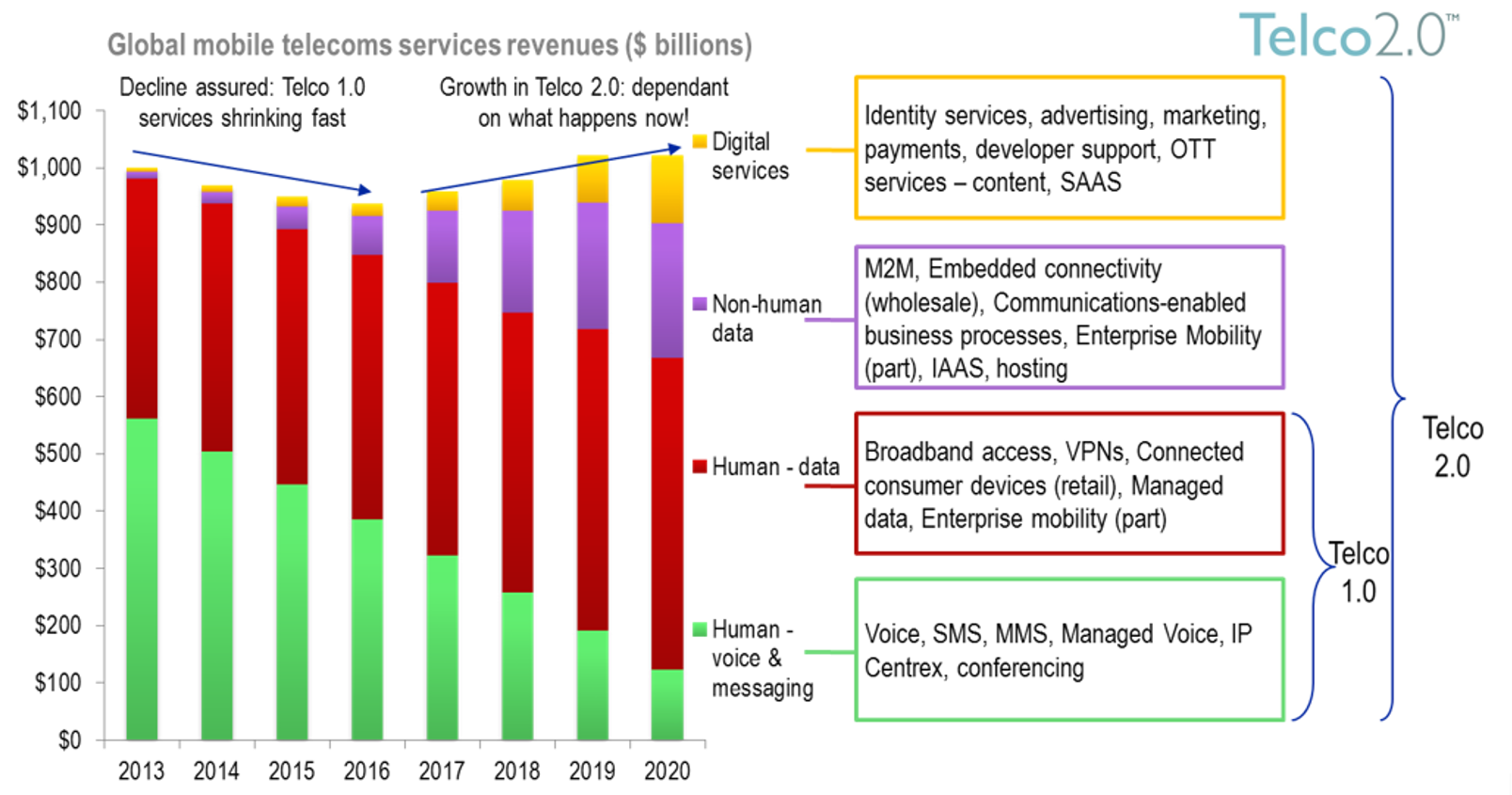

Given these different mixes, STL Partners reaffirms its forecast of 2012 that overall the industry will contract by up to 10% between 2013 and 2017 as core Telco 1.0 service revenue decline accelerates once more and more countries get beyond the peak. This is illustrated for the mobile industry in Figure 2, below.

Source: STL Partners

If the downturn to 2016 is a virtual certainty, the shape of the recovery beyond this, which STL Partners (tentatively) forecasts, is not. The industry’s fortunes could be much better or worse than the forecast owing to the importance of transformation activities which all players (CSPs, Network Equipment Providers, IT players, etc.) need to make now.

The growth of what we have termed Human Data (personal data for consumers and business customers, including some aspects of Enterprise Mobility), Non-Human Data (connection of devices and applications – Internet of Things, Machine2Machine, Infrastructure as a Service, and some Enterprise Mobility) and Digital Services (end-user and B2B2X enabling applications and services) requires CSPs and their partners to develop new skills, assets, partnerships, customer relationships and operating and financial models – a new business model.

As IBM found in moving from being hardware manufacturer to a services player during the 1990’s, transforming the business model is hard. IBM was very close to bankruptcy in the early 90’s before disrupting itself and re-emerging as a dominant force again in recent years. CSPs and NEPs, in particular, are now seeking to do the same and must act decisively from 2013-2016 if they are to enjoy a rebirth rather than continued and sustained decline.

What to do?

STL Partners specialises in strategic insight on how to slow the declines of disruption, understand the key digital players, and create new growth and innovative services. We’d be delighted to discuss access to our research or potential consulting projects – please contact us at

We’ll also be exploring the options for telcos, their partners, and other digital players dealing with disruption, transformation and innovation at the OnFuture EMEA 2014 Executive Brainstorm in London, June 11-12, Digital Arabia 2014, 10-12 November, and Digital Asia 2014, Bali, 2-4 December. Items on the agenda include:

To download this report in full for free, you first need to become a member of our Foundation 2.0 service. To do this, you need to create a personal user-id and password by entering the promotional code FOUNDATION2 in the box at the bottom of the sign-up page here. Your user-id will allow you to log-in and download the report using the button and links on the rest of this page.

Logged-in members of the premium Telco 2.0 Executive Briefing service and the Telco 2.0 Transformation Stream can also download this report in full here, in addition to the full database of our Executive Briefings

Technologies and industry terms referenced include: Telefonica, Orange, Deutsche Telekom, Ooredoo, Verizon, Vodafone, Telco 2.0 Transformation Index, Service Providers, Revenue, Voice and Messaging, Communications, CSPs, Big Data, Human Data, Personal data, Enterprise Mobility, Non Human Data, Digital Services, Business Model, telecom, strategy, strategies.