|

| Summary: Opportunities exist for operators to support third-party businesses in Customer Profiling, Marketing offers, ID & Authentication, Network QoS, and Billing, Payments & Collection. However, our in-depth research among senior execs in ‘upstream’ industries (e.g. retail, media, IT, etc.) and telcos shows that poor communication of the telecoms value proposition and slow implementation by operators is frustrating upstream customers and operators alike. Our new analysis identifies strategic customer segments for telcos building new ‘Telco 2.0’ business models, key obstacles to overcome, six real-world implementation strategy scenarios, and strategic recommendations for telcos. (March 2012, Executive Briefing Service, Transformation Stream.) |

|

- Below is an extract from this 29 page report, kindly commissioned and sponsored by Openet and independently produced by Telco 2.0. Openet developed the initial research concept and scope. The research, analysis and the writing of the report itself was carried out independently by STL Partners.

-

Members of the Telco 2.0 Executive Briefing service can download this report in full in PDF format here.

-

Alternatively, to download this report for free, join our Foundation 2.0 service (details here) by using the promotional code FOUNDATION2 in the box at the bottom of the sign-up page here. Once registered, you will be able to download the report here.

- We'll also be discussing our findings at the EMEA Executive Brainstorm in London (12-13 June, 2012).

- To access reports from the full Telco 2.0 Executive Briefing service, to submit whitepapers for review for inclusion in this service, or to find out more about our services please email or call +44 (0) 207 247 5003.

Preface

This research has been designed to explore how valuable new telecoms solutions could be for third-party companies (a key part of Telco 2.0), as well as to evaluate the barriers to effective implementation. Third-parties (upstream customers) and operators were interviewed to explore their thoughts in this key strategic area for the telecommunications industry.

Executive Summary

Headline Conclusions

- Opportunities exist for operators to support third-party businesses in Customer Profiling, Marketing offers, ID & Authentication, Network QoS, and Billing, Payments & Collection.

- Poor communication of the telecoms value proposition and slow implementation by operators is frustrating upstream customers and managers within operators themselves.

- There are four upstream customer segments. Two of these are particularly important for the operators to address when developing go-to-market approaches:

- Enthusiasts who need full-service Telco 2.0 solutions now;

- Non-believers who need to be educated on the value of telecoms enabling services and convinced of operators’ ability to implement.

- There are few material barriers to developing solutions except operators’ inability to implement effectively:

- Although lack of cross-operator solutions and regulatory impediments are considered significant in Europe and the US.

- There are four key reasons for the slow implementation by operators:

- Reason 1: Insufficient investment by operators in services and service enabler platforms.

- Reason 2: Financial metrics which do not encourage investment in new business models.

- Reason 3: Inability to pin down the optimal timing for investment in new business models.

- Reason 4: A prisoners’ dilemma over whether to collaborate or compete with other operators and with upstream customers when implementing solutions.

For the complete recommendations, detailed conclusions and full analysis, please download the report by following the instructions at the top of this page.

Introduction, Objectives and Methodology

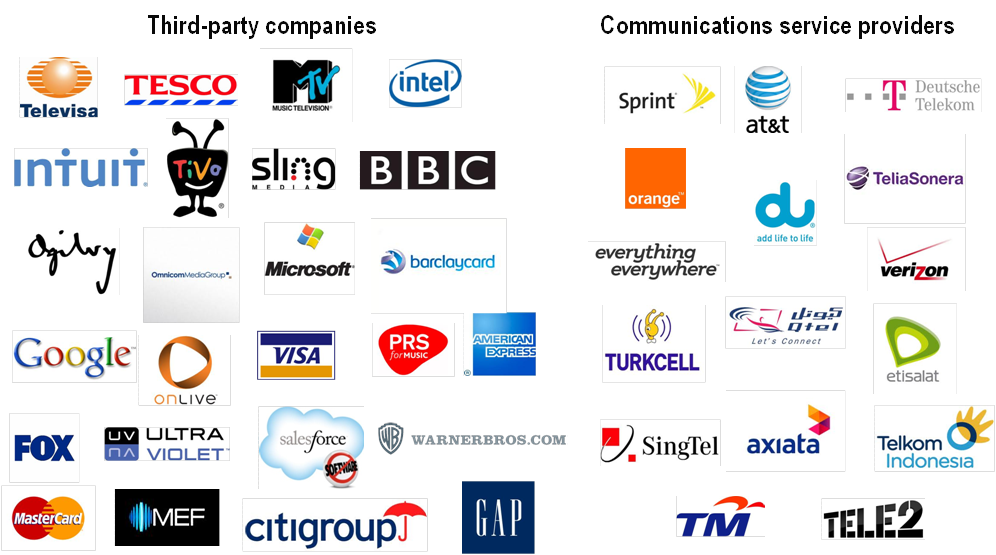

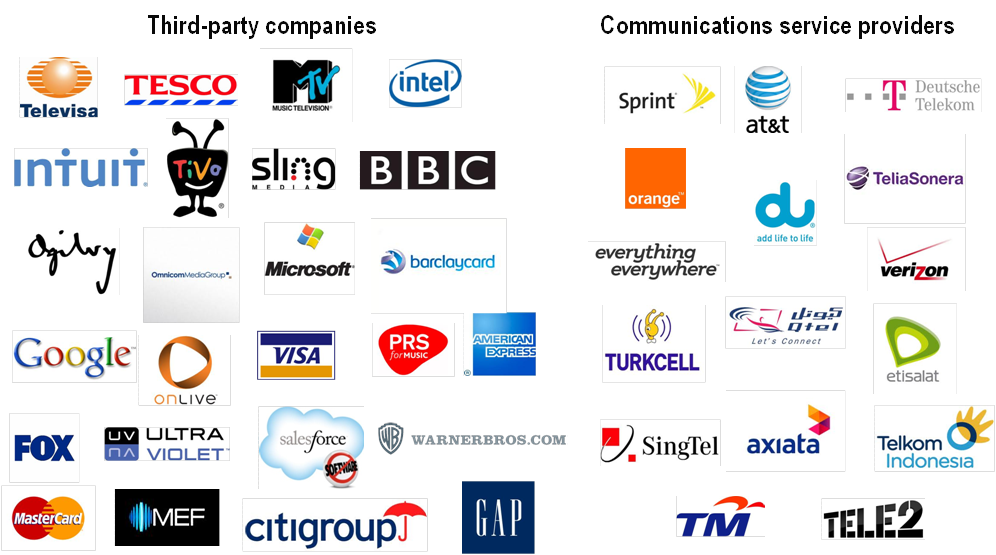

The research consisted of interviews with 26 major corporations that use telecoms networks to deliver services to consumers including players from advertising, media, financial services and retail (upstream customers or ‘third-party’ companies). Interviewees where senior managers who were responsible for the provision of services via digital channels and thus were familiar with the challenges and opportunities they faced in this developing market segment. Additionally, STL Partners interviewed senior managers from 16 major mobile and converged communications service providers (see Figure 1 below for more details on participants).

The objectives of the research were to determine:

- What Telco 2.0 (enabling) services would upstream customers like to see from communications service providers?

- What are the most common use cases and attractive commercial models for such services?

- What are the current barriers to realising the Telco 2.0 opportunity and what needs to be done to overcome these barriers?

Figure 1: Interviews conducted with players from telecoms and adjacent industries

Source: STL Partners

Interviews were 30-60 minutes in length and largely qualitative in nature. Some quantitative questions were asked so that the relative attractiveness of Telco 2.0 solution areas and the size of implementation barriers could be evaluated. The interviews were also designed to uncover differences in perspective between:

- Operators and upstream customers;

- Upstream customers from different industry groups – Advertising, Media, Financial services and IT;

- Operators from different geographic regions – Europe, North America, Middle East and North Africa (MENA) and Asia Pacific (APAC).

Interviews were conducted with senior decision-makers and influencers and, to ensure discussions were full and frank, the content of interviews has not been attributed to individual companies.

Report Contents

- Introduction

- Real potential value in Telco assets but implementation proving difficult

- Defining the opportunity areas

- Strong overall alignment across all eight areas between operators and upstream customers

- Averages hide variations in upstream customer responses

- Operators consistent about opportunities apart from Identity & Authentication solutions

- Telco ability to implement is seen by all as the key barrier...

- …although operators in Europe and US also see lack of cross-operator solutions and regulation as key barriers

- Four upstream customer segments require different solutions from operators

- Operator segment mix looks very different to upstream

- Why are operators finding implementing Telco 2.0 so hard?

- Reason1: Insufficient investment by operators in services and service enabler platforms

- Reason 2: Financial metrics which do not encourage investment in new business models

- Reason 3: Inability to pin down the optimal timing for investment in new business models

- Reason 4: A prisoners’ dilemma over whether to collaborate or compete with other operators and with upstream customers when implementing solutions

- Conclusions and recommendations

Report Figures

- Figure 1: Interviews conducted with players from telecoms and adjacent industries

- Figure 2: Broad alignment on opportunity areas from operators & upstream customers

- Figure 3: Upstream customers – variation even within industry sectors for specific Telco 2.0 solution areas

- Figure 4: Perceived lack of telco interest in developing new solutions for upstream customers

- Figure 5: Regional differences in operator opportunity sizing for Identity & Authentication solutions

- Figure 6: Telco operational and organisation limitations seen as the biggest barrier to success

- Figure 7: Regional differences in perception of key barriers to Telco 2.0 implementation

- Figure 8: Upstream customer segments

- Figure 9: Telco go-to-market approaches for upstream customer segments

- Figure 10: Telco segments – Telco 2.0 could be valuable but can it be realised?

- Figure 11: An historical lack of investment in services by operators threatens voice, messaging and newer Telco 2.0 solutions

- Figure 12: Current operator metrics discourage investment in new business models

- Figure 13: New business model investment timing dilemma

- Figure 14: The prisoners’ dilemma

- Figure 15: Six Telco 2.0 implementation strategies

- Figure 16: Value-creating and value-destroying approaches

- Figure 17: Geography determines the most important Telco 2.0 implementation strategies

To access this report:

- The 29 page Telco 2.0 Report can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service here.

- Additionally, to give an introduction to the principles of Telco 2.0 and digital business model innovation, we now offer for download a small selection of free Telco 2.0 Briefing reports (including this one) and a growing collection of what we think are the best 3rd party 'white papers'. To access these reports you will need to become a Foundation 2.0 member. To do this, use the promotional code FOUNDATION2 in the box provided on the sign-up page here. Your Foundation 2.0 member details will allow you to access the reports shown here only, and once registered, you will be able to download the report here.

- We'll also be discussing our findings at the EMEA Executive Brainstorm in London (12-13 June, 2012).

- To access reports from the full Telco 2.0 Executive Briefing service, or to submit whitepapers for review for inclusion in this service, please email or call +44 (0) 207 247 5003.

About Openet

Openet is a leading provider of Service Optimization Software (SOS) tailored to meet the evolving needs of communications service providers, or CSPs, including wireless, wireline and cable network operators. Openet’s integrated, high-performance software solutions provide real-time policy management, rating, charging and subscriber data management solutions to enable real-time, contextual network resource allocation and monetization decisions based on information about the end user and the service being used. CSPs use Openet’s SOS solutions to enhance quality of service, create a more personalized end user experience, develop new business models and dynamically control network resources. Openet’s SOS solutions are used by more than 80 customers in 28 countries. For more information, please visit www.openet.com.

Organisations interviewed for the report: Televisa, BBC, Intuit, Google, Tesco, MTV, Intel, TiVo, Sling, Ogilvy, Fox, Omnicom, Microsoft, Visa, Barclaycard, Ultraviolet, PRS, American Express, MasterCard, CitiGroup, On Live, Warner Bros, MEF, Gap, Salesforce, AT&T, Verizon, Sprint, Deutsche Telekom, Du, Teliasonera, Orange, Everything Everywhere, Turkcell, Qtel, Etisalat, Singtel, Axiata, Telekom Indonesia, TIM, Tele2.