Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

Summary: There's less than 3 years for telcos to take advantage of key strategic ‘control points’ in their battle for sustainable growth in the communications and e-commerce markets, concluded delegates at the Telco 2.0 EMEA Brainstorm in November. How should they think differently about their value and where do they need to (re)focus their attention? Full report from the Brainstorm..

40 page PDF format report, summary and except below.

Alternatively, please email or call +44 (0) 207 247 5003 for further details. There's also more on adjacent player strategies at our AMERICAS, EMEA and APAC Executive Brainstorms and Best Practice Live! virtual events.

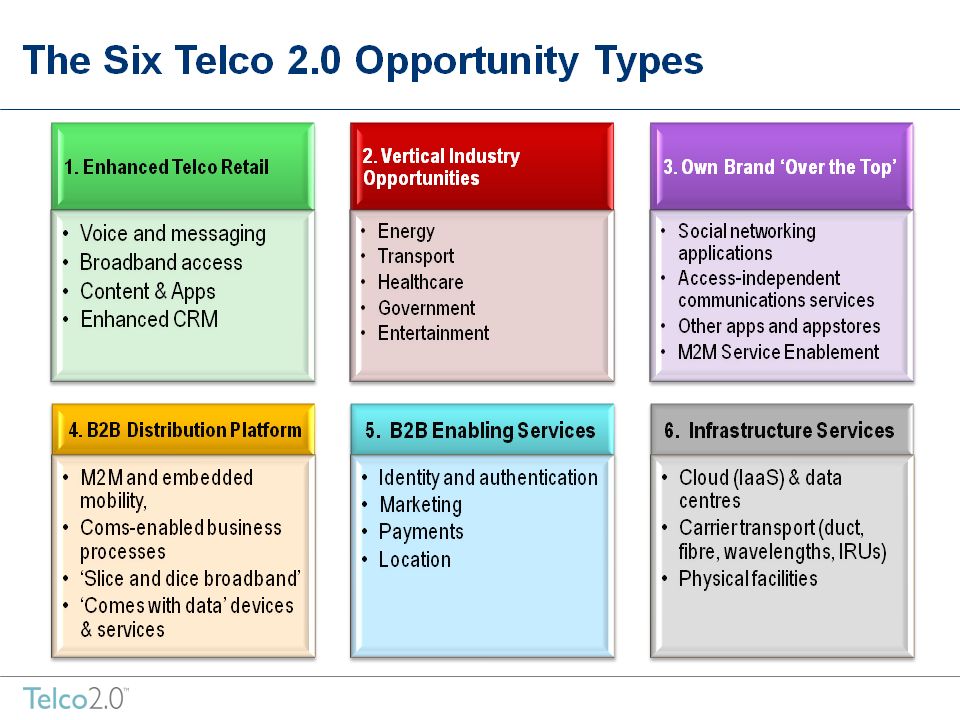

A new framework for thinking about growth opportunities in the communications sector and the value that telcos can add to other industries in the wider ‘digital economy’ was presented by analysts from the Telco 2.0 Initiative and debated by senior strategy execs from the Telecoms, Media and Technology sectors at the 11th Telco 2.0 Executive Brainstorm, EMEA, on 9-10 November 2010, incorporating Digital Entertainment 2.0. The six key telecoms growth opportunity areas are:

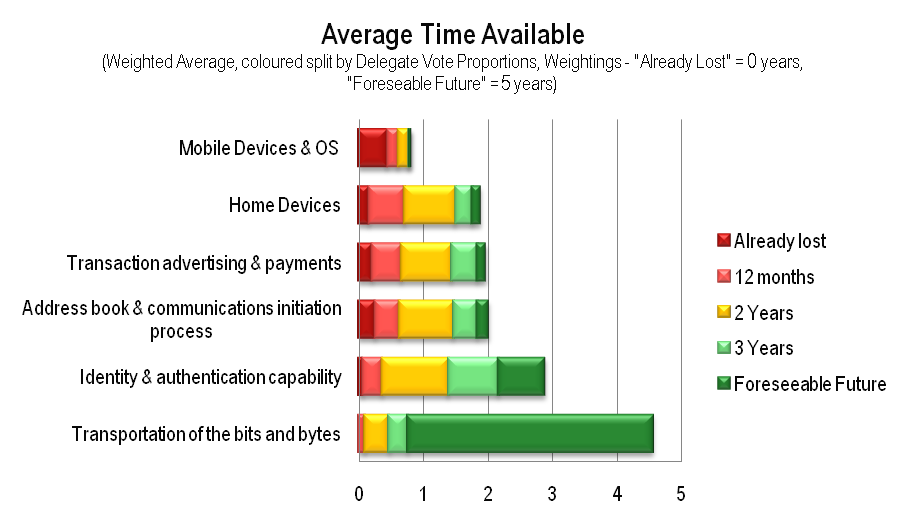

Delegates concluded that two in particular, B2B Enabling Services and B2B Distribution Platforms, are being particularly underinvested in compared to their potential future value. The big concern was that time is running out for the slow-moving telco industry to take advantage of some key strategic ‘control points’ in the communications and e-commerce value chains, beyond pure data transportation. In a vote participants rated the time remaining for telcos to retain or build a strong position versus internet players and other competitors as follows (see Fig 1 below):

In contrast, other players are not waiting. Telco 2.0’s analysis of Facebook’s ambitions in communications added to the sense of urgency required by telcos.

Part of Telco 2.0’s argument discussed at the brainstorm is that, in parallel with ensuring telcos don’t lose strategic control points, there are certain core areas of business in which telcos need to make specific improvements in order to position them effectively to take advantage of new growth opportunities. Two important areas are:

Broadband access, for which it is important for telcos to establish more sophisticated business models, particularly those in which new ‘upstream’ (3rd party) customer revenues are generated;

Being a better digital retailer (part of ‘Enhanced Telco Retail’), in order to maximise loyalty, trust and relevance, not just for the clear business benefits that this provides, but also because many of the new ‘two-sided’ market opportunities require a scale and quality of customer base that this will enable. Participants clearly recognised the value of this, but also saw that much more needs to be done here.

The Brainstorm examined a number of emerging growth areas in depth, each a subset of one of the Six ‘Telco 2.0’ Opportunity Areas.

The rest of this report provides detailed analysis of all the brainstorming from the event. STL Partners, the analyst firm behind the Telco 2.0 and Digital Entertainment 2.0 Initiatives, will continue to research these and other related new business model opportunities and provide a forum for high quality debate at our online and physical events in 2011:

The following is an excerpt from the body of the report

Viable opportunities and strategies to innovate and develop new sources of value exist, yet there are also doubts about the telecom’s industry to exploit them in time. At the Brainstorm, Chris Barraclough, MD & Chief Strategist, Telco 2.0, presented 10 of the 17 ‘Principles for Success in a Disrupted Markets’ and outlined the six new Telco 2.0 Opportunity Areas described in the forthcoming ‘Roadmap to New Telco 2.0 Business Models’ Strategy Report (see diagram above).

Overall, despite their concerns on the urgency of action, delegates considered that all of the outlined opportunities had merit, and that some key areas are currently relatively underinvested in compared to their perceived potential. While Enhanced Retail and Infrastructure Services (i.e. enhanced wholesale) were understandably rated most highly, B2B Enabling Services and Distribution Platform showed the biggest gap between potential and investment.

Figure 1 – B2B Enabling Services and Distribution Platform Need Investment

Source: Delegate Vote, 11th Telco 2.0 EMEA Brainstorm

Source: Delegate Vote, 11th Telco 2.0 EMEA Brainstorm

Figure 2 – Other than “being a pipe”, Telcos have the most time and Opportunity to address Identity & Authentication Capabilities

[Q. What is your opinion of the amount of time that telecoms operators have to either retain OR build a strong position (versus internet or other players) in each of these ‘ecosystem control points'?]

Delegates broadly viewed telcos opportunities to hold the control points in the ecosystem in three groups: “the pipe”, which whether “dumb” or “happy” will be the domain of telcos for the foreseeable future; mobile devices and OS which they have already lost; and a middle-range comprising home devices, advertising and payments, address book, and identity and authentication. Of these, telcos are perceived to be in a significantly better position on identity and authentication.

A similar chart to Figure 3 drawn up 5 to 10 years ago would have shown “Location Services” as an equal or better prospect than “Identity & Authentication”. Yet location today no longer registers as an opportunity because of the success of other players finding alternative ways to provide this information. In their eventual efforts to enable location, Telcos were late to the market, disjointed in that they did not offer common solutions across the industry, and overpriced.

It is intriguing to look at two other examples that may reflect this trait.

First, in the case of mobile Apps, operators have now created the Wholesale Applications Community (WAC), which is, at least, a common approach to the market, but which will struggle to establish operator control in this area if the delegate vote and evident strength of the Apple and Android ecosystems is anything to go by However, Telco 2.0 believes that WAC may succeed in enabling a second tier of appstores or segmented “app malls”.

Secondly, Vodafone presented its closed, vertically integrated M2M strategy at the event, which as smart and well-conceived as it is in many ways, still lacks the level of openness that customers will ultimately want from M2M applications.

In the area of Personal Information, Identity, and Authentication, operators do have a chance to do something, and there were suggestions from Vodafone in EMEA, and AT&T in the US, that telcos may act. But will it be enough, and sufficiently aligned and open to create a new role for the industry?

To read the report in full, covering in addition to the above...

......Members of the Telco 2.0TM Executive Briefing Subscription Service and the Dealing with Disruption Stream can read the Executive Summary and download the full 40 page report in PDF format here. Non-Members, please see here for how to subscribe. Please email or call +44 (0) 207 247 5003 for further details.

This report includes a summary analysis of all the brainstorming and voting from the 11th Telco 2.0 Executive Brainstorm (EMEA), held in London on 9-10 November 2010 with over 150 execs from the Telecoms, Media and Technology sector, and incorporating the 3rd Digital Entertainment 2.0 Executive Brainstorm. It was organised and facilitated by analyst firm STL Partners – founders of the Telco 2.0 and Digital Entertainment 2.0 Initiatives - using their interactive ‘Mindshare’ format.

The aim of the event was to review and debate new business model concepts and current best practice related to the upcoming Telco 2.0 strategy report, ‘From Theory to Practice: the Roadmap to ‘two-sided’ Telecoms Business Models’. This analysis centres around a new framework for thinking about growth opportunities in the communications sector and the value that telcos can add to other industries in the ‘digital economy’. The Executive Brainstorm looked at:

This report is ordered by event session, and includes an analysis overview, a short summary of the objectives of the relevant session and a list of the stimulus speakers. The brainstormed comments, ideas and questions and the votes have been included verbatim, and organised under a colour-coding to make them more digestible.

Many thanks to everyone who contributed to the brainstorm, the output of which will inform our ongoing research programme for the Telco 2.0 (on this site) and Digital Entertainment 2.0 (www.digitalentertainment2.com) initiatives, along with two new programmes for 2011: Mobile Apps 2.0 and Personal Data 2.0.

In particular we would like to thank the event sponsors without whom the event would not have been possible: Platinum - Ericsson; Gold – Aepona, Aito, Aricent, Blyk, IBM, Intel, Nokia Siemens Networks, Oracle and Ubiqisys; and Bronze – Huawei, Juniper, Martin Dawes Systems, Metaswitch and Wipro. And to our collaborators: Analysys Mason, Arete Research and the World Economic Forum.

The next Telco 2.0/Digital Entertainment 2.0 EMEA Brainstorm will be held on the 17-18 May in London. In the meantime, there is a FREE global ‘virtual event’, online on 2-3 February 2011 and the 12th Telco 2.0/Digital Entertainment 2.0 AMERICAS Executive Brainstorm on 5-6 April 2011 in San Francisco (more here).

The ‘Roadmap to New Telco 2.0 Telecoms Business Models’ report will be published in early 2011.