Summary: This Telco 2.0 Strategy Report plots the transformational path that telcos need to follow to achieve the $375Bn p.a. 'Telco 2.0' opportunities. It describes the six growth opportunity areas for the Telecoms industry, identifies new categories of operators, benchmarks the primary strategies needed by each to evolve and thrive in the new industry environment, and highlights leading examples of telco business model innovation. It has 284 pages, including a 13 page Executive Summary and a detailed index to ensure that busy people can get what they need from it. (April 2011, Telco 2.0 Transformation Stream)

This report is now availalable to members of our Telco 2.0 Transforamtion Stream. Below is an introductory extract and list of contents from this 284 page strategy Report that can be downloaded in full in PDF format by members of the Telco 2.0 Transformation stream here.

For more on any of these services, please email / call +44 (0) 207 247 5003

Contains |

Pricing and Features |

|

|

To order, please email or call +44 (0) 207 247 5003. Some of the findings of the report will be also presented at the EMEA Executive Brainstorm, 11-13 May, London.

Over the last three years, the Telco 2.0 Initiative has identified new business model growth opportunities for telcos of $375Bn p.a. in mature markets alone (see the ‘$125Bn Telco 2.0 ‘Two-Sided’ Market Opportunity’ and ‘New Mobile, Fixed and Wholesale Broadband Business Models’ Strategy Reports). In that time, most of the major operators have started to integrate elements of Telco 2.0 thinking into their strategic plans and some have begun to communicate these to investors.

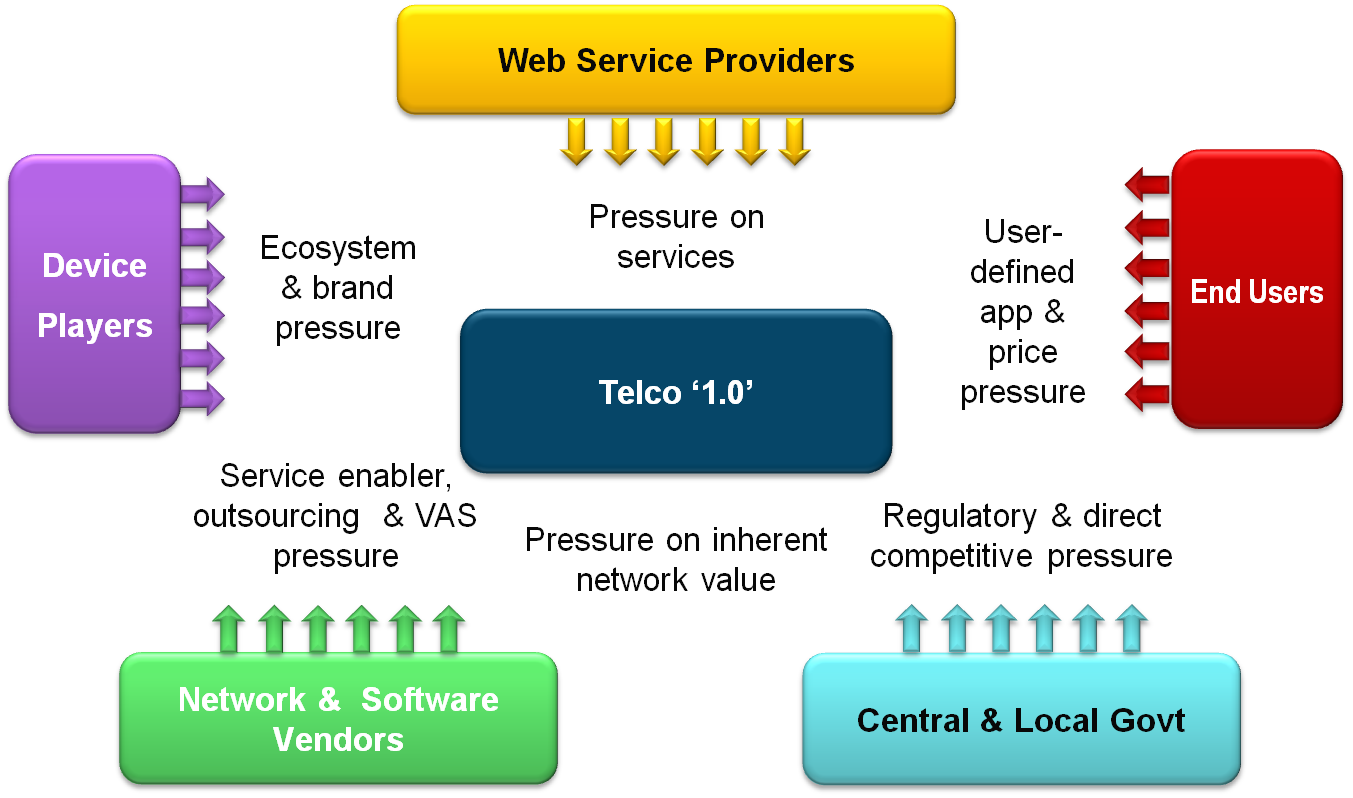

But, as they struggle with the harsh realities of the seismic shift from being predominantly voice-centric to data-centric businesses, telcos now find themselves:

Pressures on the Telecoms Business Model

Source: The Roadmap to New Telco 2.0 Business Models

As a result, far from yet realising the innovative growth potential we identified, many telcos around the world seem challenged to make the bold moves needed to make their business models sustainable, leaving them facing retrenchment and potentially ultimately utility status, while other players in the digital economy prosper.

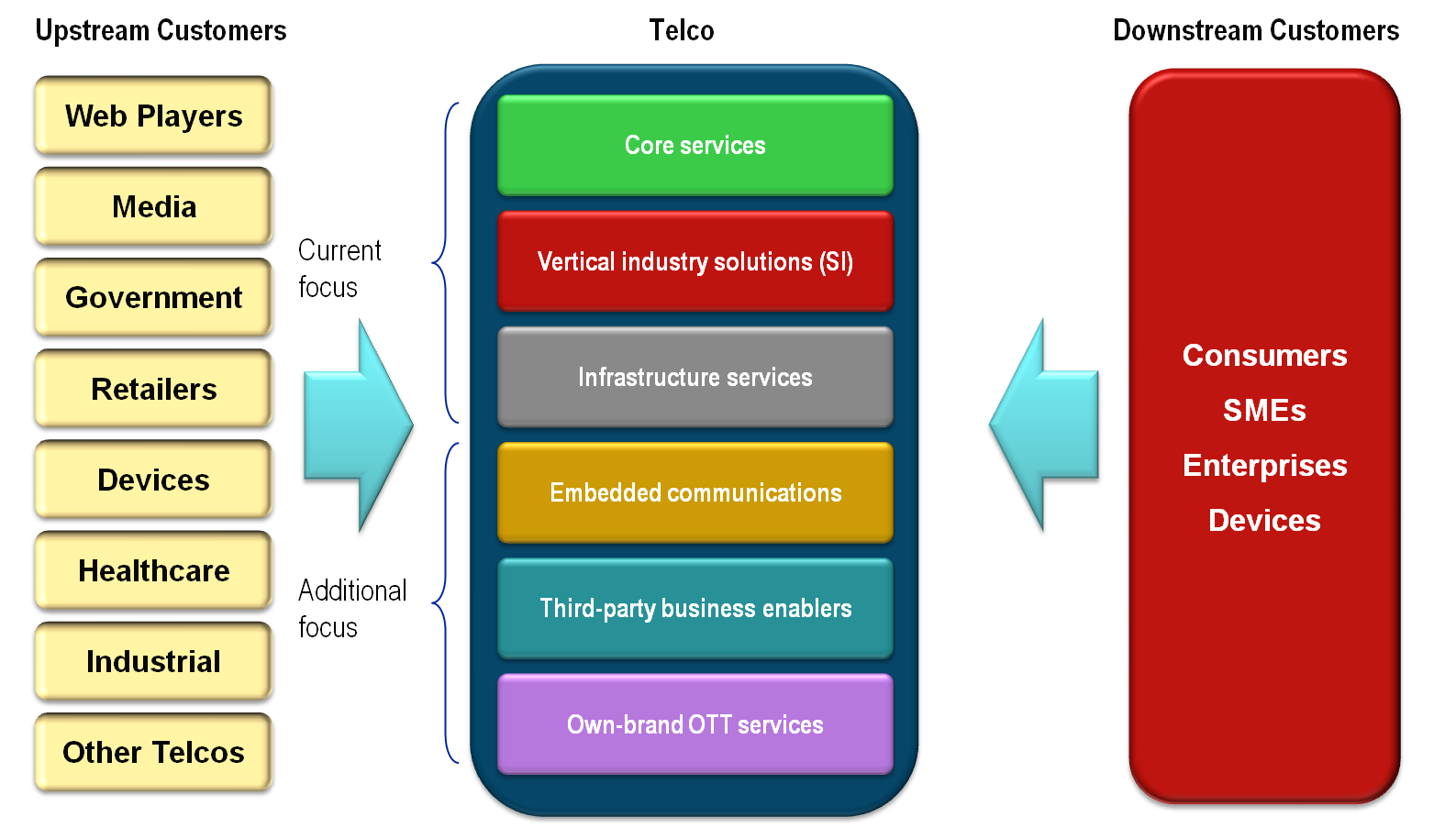

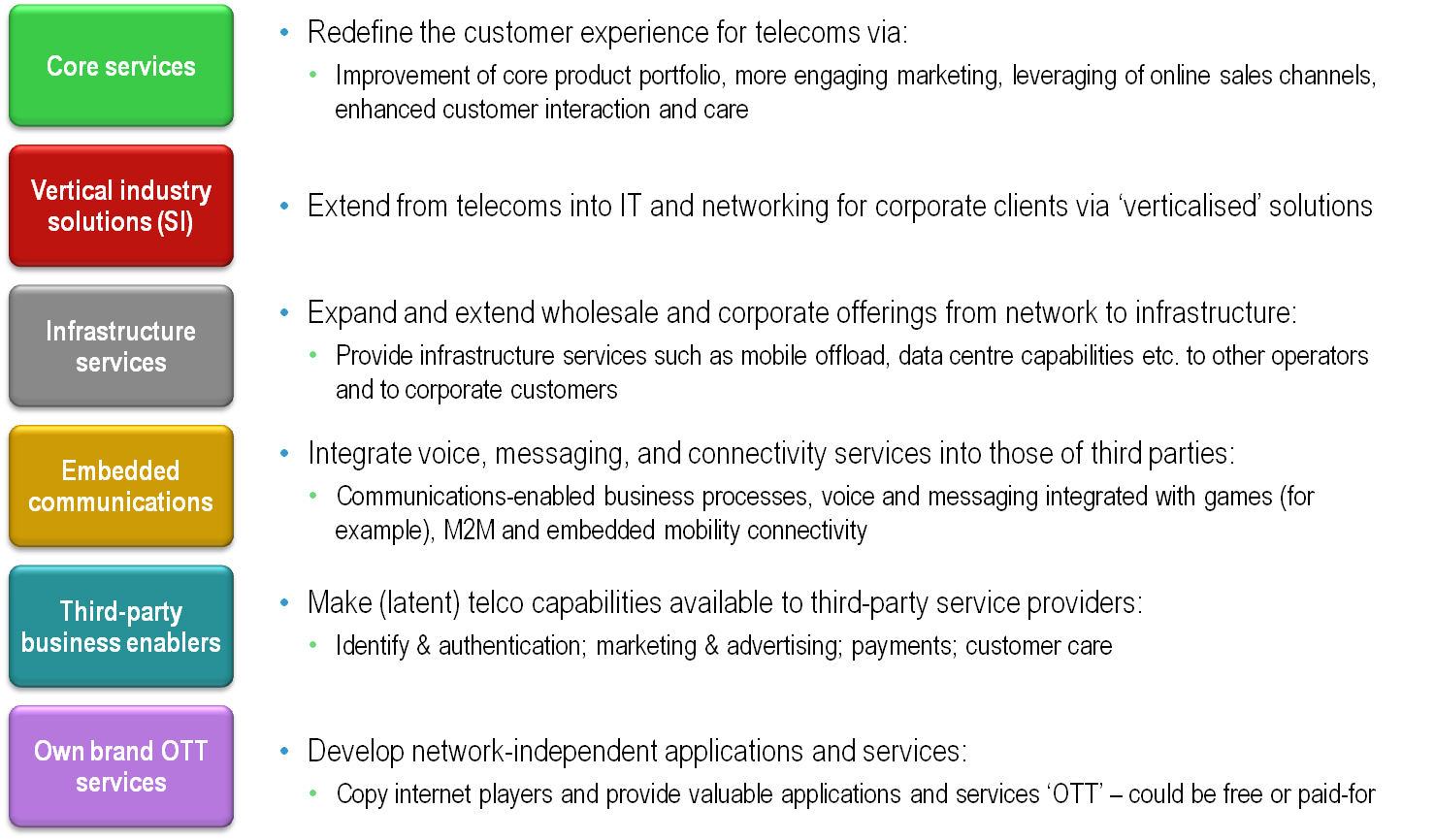

In our new 284 page strategy report - ‘The Roadmap to Telco 2.0 Business Models’ – we describe the transformational path the telecoms industry needs to take to carve out a more valuable role in the evolving ‘digital economy’. Based on the output from 5 intensive senior executive ‘brainstorms’ attended by over 1000 industry leaders, detailed analysis of the needs of ‘upstream’ industries and ‘downstream’ end users markets, and with the input from members and partners of the Telco 2.0 Initiative from across the world, the report specifically describes:

The report is for strategy decision makers and influences across the TMT (Telecoms, Media and Technology) sector. In particular, CxOs, Strategists, Technologists, Marketers, Product Managers, and Legal and Regulatory leaders in telecoms operators, vendors, consultants, and analyst companies. It will also be valuable to those managing or considering medium to long-term investment in the telecoms and adjacent industries, and to regulators and legislators.

It provides fresh, creative ideas to:

Grow revenues beyond current projections by:Stay relevant with customers through:

Evolve business models by:

For Telcos:

For Vendors and Partners:

For Investors and Regulators:

We have published an extract from the three sections on 'Principles of Innovation and Services Delivery' in 'Ten Innovation Principles for Success in a Disrupted (Telco) Market'.

This report is now availalable to members of our Telco 2.0 Transforamtion Stream. Below is an introductory extract and list of contents from this 284 page strategy Report that can be downloaded in full in PDF format by members of the Telco 2.0 Transformation stream here.

For more on any of these services, please email / call +44 (0) 207 247 5003

To pre-order, please email or call +44 (0) 207 247 5003.

Telcos and telco brands referenced: 3UK, A1, AAPT, AboveNet, Aero2, Airtel, Akamai, Alpheus, America Movil, Arbinet, AT&T, Axtel, Belgacom, Bell Canada, Bell Mobility, Betavine, Bharti, BICS, BlueGrass Cellular, Bouygues, BT, Cable & Wireless, Centurylink, China Mobile, China Unicom, Clear, Clearwire, Cogent, Colt, Comcast, Comfone, Cricket Wireless, Cyta, Deutsche Telekom, Edgecast, eMobile, Etisalat, Everything Everywhere, Fastweb, FiOS, France Telecom, GiffGaff, Global Crossing, Globtel, Hiberia Atlantica, Hutchison, iBasis, IDC Global, Iliad, iMode, Intelsat, Interoute, iPass, Jersey Telecom, KDDI, KPN, KT, Lebara, Level 3, LightSquared, Litmus, MACH, Mobiltel, M-Pesa, MTN, Neutral Tandem, NTT Docomo, O2, Optus, Orange, P1, PCCW, PLDT, Portugal Telecom, Qwest, Reggefiber, Reliance, Ribbit, Rogers, Ros Telecom, Safaricom, SFR, SIMYO, Singtel, SK Telecom, Skipti, Smile, Softbank, Spread Networks, Sprint, Sunrise, Swisscom, Syniverse, TDC, Tele2, Telecom Italia, Telecom New Zealand, Telefonica, Telenor, Teliasonera, Telstra, Telus, Tinet, T-Mobile, Turkcell, Vanco, Velcom, Verizon, Virgilio, Virgin Media, Vodafone, Vyvx, WIND, XO Communications, Yipes, Yoigo, Yota, YTL, Zain, Zoompass.

Technology companies and brands referenced: Acision, Acme Packet, Adobe, Alcatel-Lucent, Amazon, Amdocs, Android, Apple, Arquiva, Avaya, Baidu, Blackberry, Brocade, Comverse, Convergys, CoSentry, eBay, Ericsson, Expedia, Facebook, Foundry Networks, Google, HP, HTC, Huawei, IBM, IfByPhone, INQ, Intel, Intrado, iPad, iPad2, iPhone, Ipanema, iTunes, Kindle, Jajah, Juniper, LG, LinkedIn, Linksys, mBlox, Microsoft, Motorola, Neustar, Nextel, Nokia, Nokia Siemens Networks, NSN, Oracle, Ovi, Pace, Paypal, RIM, salesforce.com, Samsung, SAP, Sicap, Siemens, Skype, Sonus, Sony, Sony Ericsson, Symbian, Tata, Technicolor, Tekelec, Telio, TI Labs, Truphone, Twitter, Voicesage, Vonage, Windows, Yahoo, YouTube, ZTE.

Media and entertainment companies and brands referenced: BBC, Channel 4, Channel 5, Consolidated Media, Foxtel, ITV, LastFM, Marchex, Netflix, News Corp, Pandora, Rhapsody, Sky, Spotify, Tesco, Time Warner, Vivendi, Walmart, YouView, Zynga.

Industry terms referenced: API, app, appstore, authorisation, B2B VAS, business model, CEBP, cloud, digital, dumb pipe, happy pipe, IaaS, identity, innovation, IPR, location, Managed Services, MVNO, NEPs, NGA, NGN, ODMs, PaaS, platform, QoE, QoS, retail, spectrum, strategy, transformation, two-sided, wholesale.

Products and technologies referenced: 2G, 3G, 4G, ACD, ADSL, API,Asterisk, Cable, Carrier Ethernet, CDMA, CDN, DNS, DOCSIS, dongles, ENUM, femtocells, fibre, Flash, FTTH, GSM, HSPA, HSPA+, HTML5, IMS, Internet, iOS, IP, IPTV, IPTV, IPv4, IPv6, LiMo, Linux, LTE, M2M, MiFi, mobile, MPLS, Netbook, NFC, online, PDF, PSTN, PVR, RCS, SDH, SIM, Smartphone, SONET, SS7, Tablet, TDM, TiVo, TV, VOIP, VPN, WiFi, WiMax.

Industry bodies referenced: 3GPP, ATIS, CAMEL, FASB, FCC, Femto Forum, FMCA, GSA, GSMA, IASB, IEEE, JIL, MEF, MPAA, NGMN, Ofcom, OMA, OneAPI, PRS, TMF, TNO, W3C, WAC, WiMax Forum.