Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

This is an extract from a report by Arete Research, a Telco 2.0TM partner specalising in investment analysis. The views in this article are not intended to constitute investment advice from Telco 2.0TM or STL Partners. We are reprinting Arete's analysis to give our customers some additional insight into how some investors see the Telecoms market.

This is an extract from a report by Arete Research, a Telco 2.0TM partner specalising in investment analysis. The views in this article are not intended to constitute investment advice from Telco 2.0TM or STL Partners. We are reprinting Arete's analysis to give our customers some additional insight into how some investors see the Telecoms market.

|

This report can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service and Future Networks Stream using the links below. Please use the links or email [email protected] or call +44 (0) 207 247 5003 to find out more. |

Everyone in the technology industry loves "next gen" products: they solve all the problems of the previous iteration! In LTE: Late, Tempting, and Elusive in June '09, we [Arete Research] forecast delays and said LTE would require intensive R&D and bring minimal near-term sales. Two years later, its impact is limited, mostly driven by market-specific reasons. Now we see operators adopting LTE by moving to single RAN (radio access network) platforms, giving them a choice of how to use spectrum, and sparking de facto concentration of vendor market shares.

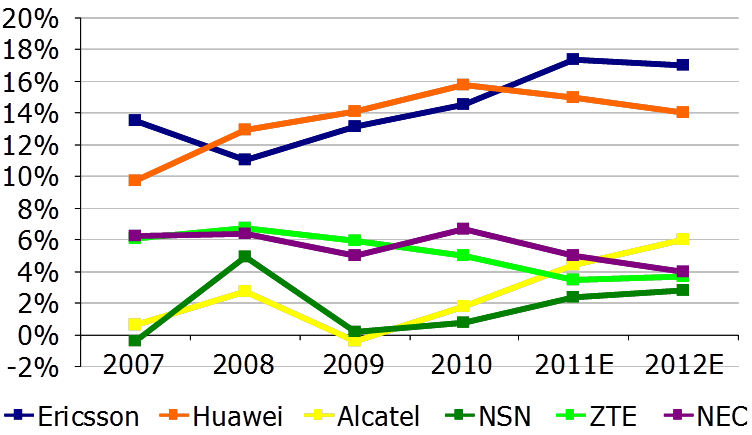

The "single RAN" (including LTE) is another example of deflation in wireless infrastructure; peak shipments of HSPA may be five years off, but now come with LTE. Collapsing networks onto single platforms (so-called "network modernisation") prepares operators to re-farm spectrum, even if short-term spend goes up. The vendor market is consolidating around Ericsson and Huawei (both financially stable), with ZTE and Samsung as new entrants, and ALU, NSN and NEC struggling to make profits (see Fig. 1) while "pioneering" new concepts. All vendors see LTE as their chance to gain share, a dangerous phase. LTE also threatens to add costs in '12 as networks need optimisation. A recent LTE Asia conference reinforced our three previous meanings for this nascent technology:

Still Late. In '09 we said "Late is Great," with no business case for aggressive deployment. Most operators are in "commercial trials", awaiting firmer spectrum allocations, if not also devices. LTE rollouts have been admirably measured in all but a few markets, and where accelerated, mostly done for market-specific reasons.

Less Tempting? Operators are re-setting pricing and ending unlimited plans. LTE's better spectral efficiency requires much higher device penetration. Operators are gradually deploying LTE as part of a evolution to single RAN networks (allowing re-farming), but few talk of "enabling new business models" beyond 3G technology.

Elusive Economics. As a new air interface, LTE needs work in spectrum, standards and handsets. Device makers are cagey about ramping LTE volumes at mid-range price points. Vendors are still testing new concepts to lower costs in dense urban areas. Network economics (of any G) are driven by single RAN rollouts, often by low-cost vendors.

Transformation Hardly Happens. For all the US 4G hype, LTE is continuing a decade-old "revolution" in mobile data (DoCoMo launched 3G in '01), boosted by smartphones since '07. LTE or not, operators struggle to add value beyond connectivity. Investors should reward operators that reach the lowest long-term cash costs, even with upfront capex.

No Help to Vendor Margins. Despite 175 "commitments" to launch LTE, single RANs will be no bonanza, inviting fresh attempts to "buy" share. In a market we see growing ~5-10% in '12. Ericsson and Huawei are the only vendors now generating returns above their capital costs: LTE will not make this better, while vendors like NSN and ALU must fend off aggressive new entrants like ZTE pricing low to win swaps deals.

...and the following charts and tables...

...Members of the Telco 2.0TM Executive Briefing Subscription Service and Future Networks Stream can download the full 7 page report in PDF format here. Non-Members, please see here for how to subscribe. Please email [email protected] or call +44 (0) 207 247 5003 for further details.