Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

|

What are the possible impacts on telecoms of further economic troubles in the Eurozone? Will it be recessionary business as usual or something much nastier? And how will it impact ‘Telco 2.0’ Strategies? (December 2011, Executive Briefing Service) |

|

Below is an extract from the 17 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service here. Non-members can subscribe here or for other enquiries, please email / call +44 (0) 207 247 5003.

To share this article easily, please click:In October 2008 we started a series of eight articles on the Credit Crunch, starting with Credit crunch - silver lining for telcos? and progressing to Credit Crunch 8: Show us your Labs in March 2009. Sadly, we’re now back looking into the cloudy economic crystal ball. What lies ahead?

Recent weeks and months have witnessed near-panic in financial markets, with the woes of the Eurozone top of the list of pain points. Escalating fears about defaults on sovereign debt in Greece, Portugal and Ireland has been followed by “contagion” elsewhere – Italy, Spain, Belgium and even France are in the frame as well.

This in turn is driving knock-on effects in the wider economy, with recession looming once more for much of Europe. Germany is seen as being in the driving seat, but has taken a hard stance on the role of the European Central Bank, and Angela Merkel is wary of overburdening her hardworking, tax-paying electorate.

Elsewhere, the US is still suffering under a huge debt burden but seems to be slowly struggling back to its economic feet. The global macro-economy, however, still looks fragile, with even China showing a couple of signs of shakiness in recent weeks. This is without the de-stabilising effects of the situations with Syria or Iran.

Given the depths of the world’s economic worries, it almost seems churlish and selfish to start thinking about the effect on a specific industrial sector like telecoms. But assuming that “the worst” doesn’t happen, and that the pain is manageable but severe, and the economic and legislative remedies are robust, what might happen? What are the most likely outcomes, and what else might be lurking hidden on the sidelines?

One possible scenario is that we’ll once more see a ‘traditional’ cyclical economic downturn response, where the telecoms industry hunkers down, goes into “recession mode”, and waits for everything to blow over. The sector has proven pretty resilient in the past – consumers won’t give up their phones and Internet access, although they might shop around a bit more, and hang onto older devices a while more before upgrading.

In that situation we’ll see some sluggishness in revenue growth, some reduced profit forecasts, and maybe some consolidation. To take the most recent example, the telecoms industry we see in 2011 doesn’t look much different to that before the 2008-10 recession. If anything, with the engines of smartphone adoption and mobile broadband growth, it’s powered through the economic gloom almost (but not quite) without flinching.

But maybe this time is different. Not only is the current crisis being precipitated by the debt situation rather than a normal “cycle”, but some of the other factors are different too. There are major government austerity projects, potential changes in the structure of the European Union, uncertainty about currencies, write-downs of assets and an inability for even governments to raise finance.

The spectre of financial “contagion” is looming worryingly again, and there’s a real possibility that private individuals might be pressured to breaking point and beyond, where telecom services once again become luxuries compared to the basic necessities of existence. Rather than a “normal” recession, where GDP slips perhaps 1-5% and economies can build/borrow their way out, if GDP slips 5-10% or even more, assorted negative-feedback loops can occur, as highlighted by the current debt problems and harsh Brussels-imposed austerity measures. Growth would seem very hard to come by, even in those countries currently perceived as “safer” such as the UK.

The Irish economic crash has been ongoing for a while during 2011, and signs from operators like Eircom have not been encouraging . Performance of Greek operators like OTE is also sharply down, and this is not encouraging either.

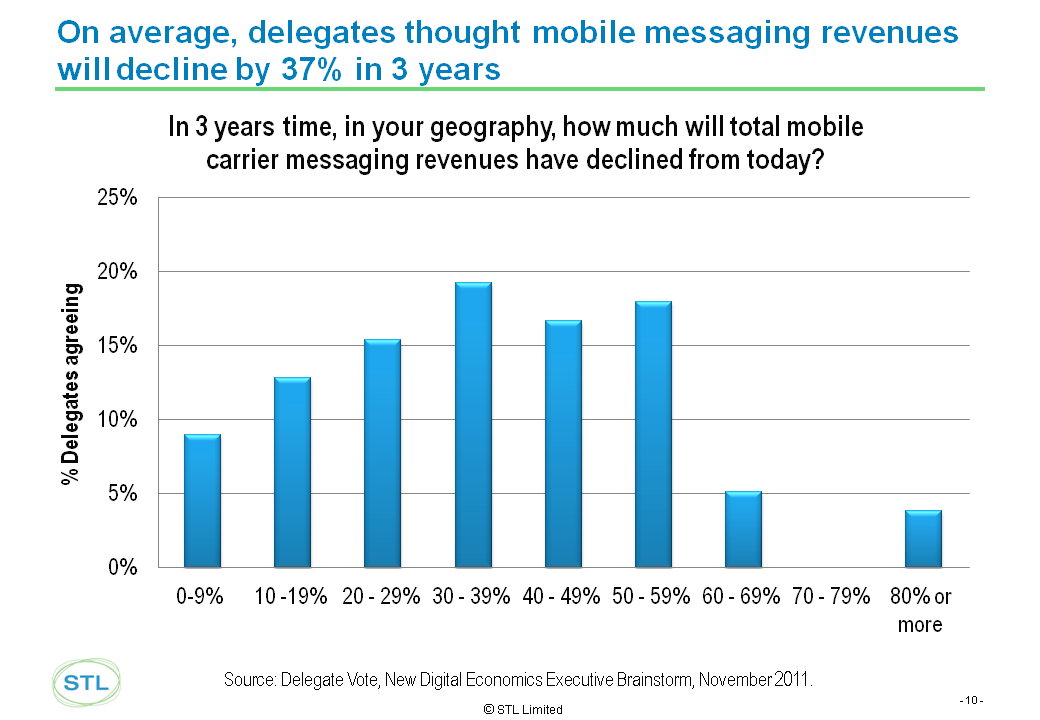

And then add to that some other worries. Even without the current economic situation, telcos are increasingly on shaky ground. Our recent surveys at events have shown an expectation that normal “bread and butter” revenue streams like telephony and messaging are under huge threat from so-called OTT providers. For example, a survey conducted at our EMEA Brainstorm in November 2011 showed an expectation of 30-40% revenue falls in messaging over the next three years, for example, without any explicit reference to the economy, just ongoing market developments. These findings are summarised in the Briefing ‘Your Text is on Fire: OTT's to burn 40% SMS revenue by 2015’.

Figure 1 – The predicted impact of ‘OTT’ players on messaging revenues

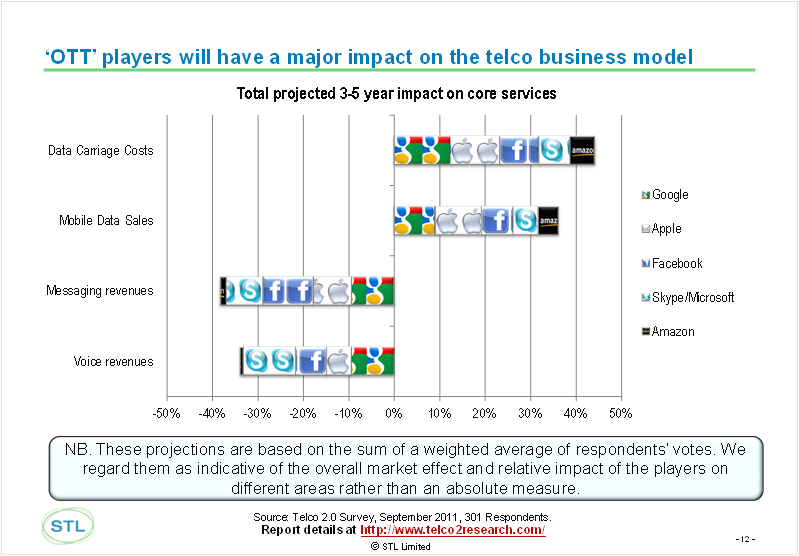

These findings are also consistent with views expressed in an online survey of over 300 executives in October 2011, as part of our research for the strategy report ‘Dealing with the 'Disruptors': Google, Apple, Facebook, Microsoft/Skype and Amazon’.

Figure 2 – The impact of ‘OTT’ players on the telco business model

The juxtaposition of lower consumer spending-power, plus improving capabilities of various competing services, together with smartphones as almost universal enablers, is not a happy one. The current downturn might hit operators harder than we might hope – people are going to be more incentivised to seek out cheaper options, and may also be more prepared to make price/quality trade-offs that seem unthinkable to telco traditionalists designing networks for 5-9’s reliability.

Many telcos have significant amounts of debt, often used to finance spectrum purchases, network deployments and acquisitions. With 4G and fibre rollouts expected, any dry-up in funding has significant ramifications. Historically underwritten by high and dependable cashflow levels, the same potential risks exist for telcos that are being observed in other parts of the economy (and at national level) – over-leverage, and difficulty in “rolling over” maturing debt.

Greek operator OTE and Irish telco Eircom are thought by Moody’s to be worst exposed, especially given the state of their domestic economies. The “big 5” of Telefonica, Vodafone, Deutsche Telekom, Telecom Italia and France Telecom are thought to be less at risk, as they have cashflow, cash reserves, and available credit lines .

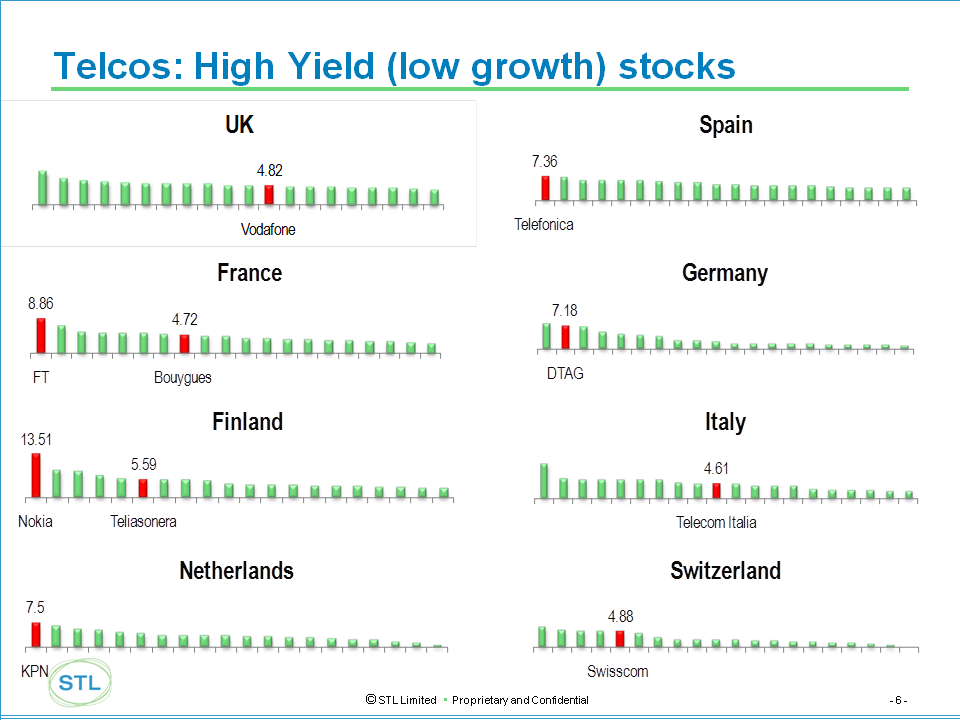

Indeed, many telcos are at the top of the stock yield ratings (see Figure 3 – Telco stock yields are high in European markets), showing that investors want to see a return on their money, or want telcos to ‘give it back before they blow it on something stupid’ to paraphrase Richard Kramer, of Telco 2.0 partners Arete Financial research. In addition, many telco shares yield more that the interest paid on their debt bonds which implies that buying telcos’ shares is riskier than buying their debt, and can mean that investors expect either the dividend or the share price to drop in the short term.

Problems are highlighted by some major groups’ expansion into regions now worst-affected by the crisis. For example, T-Mobile has sizeable exposure to the Greek market through its 40% stake in OTE – previously the group’s largest business outside the US and Germany. (OTE has a wider footprint in SE Europe than just Greece – it also operates in Bulgaria, Romania and Albania). Its Greek revenue and customer base has dropped precipitously over the last year. Worse, OTE will need to refinance a large slab of debt over the coming couple of years, which will likely mean it will have to divest assets, probably at prices lower than it would ideally want. Deutsche Telekom AG has already said it will act as a lender of last resort if OTE can’t raise finance on constrained capital markets.

In November 2011, UK joint-venture EverythingEverywhere raised £875m in financing, primarily to pay off other debts it owes to its shareholder parents, France Telecom and Deutsche Telekom.

We see this as a special case, and don’t expect to see much further restructuring of this type, since most telco debt is structured to be tax-efficient and the benefits of any debt restructuring are unlikely to outweigh the tax-efficiency benefits.

However, it is also worth noting that EE will probably have to raise quite a lot more capital if it is to participate fully in 2012’s 800/2600MHz UK spectrum auctions and 4G buildout. This will be the case for the majority of companies wishing to build out LTE in the short term.

One of the major unknowns at the moment is the fate of the Euro. There is a possibility that there will be some form of restructuring – maybe some countries leaving the Eurozone, or perhaps a two-tier Euro1 and Euro2 system. The Bank of England has undertaken scenario-planning for potential “disorderly” events in the Eurozone. The opinions here are both shrill and conflicting – there are numerous believers in “the project” who feel that the currency should be saved at all costs, and many others who believe equally vehemently that it was a bad idea all along and now needs to be radically altered. Some suggest Greece may be forced out while others think that Germany is too powerful and is itself the cause of the problem.

The net result is that the Euro is looking weaker, and certainly at the time of writing (late November 2011) is falling against currencies like the dollar. Bond markets have shown a flight from Eurozone government paper to perceived “safer havens” like the UK, Switzerland, Sweden and beyond.

Most obviously, any major changes will be reflected in their results when reported in local currencies and consolidated. The exact structures (and any hedging) will be highly company-specific. On the vendor side, there are also going to be inevitable fluctuations in import/export attractiveness that are hard to predict or analyse across-the-board, as supply chains are heavily globalised. International services like roaming are also going to be exposed.

What is more certain is that historically, declining currencies have been a large contributing factor to rising inflation.

In a scenario where revenues are under threat both from general economic conditions and competitive pressures, it is unlikely that telcos would be able to raise their prices to fully cover inflation. The outcome is shrinking margins which ultimately lead to lower telco valuations.

For instance, Orange in the UK have just announced a 4.3% price rise for contract (postpay) customers within their current plans, prompting negative customer reaction. This is despite current UK Retail Price Index (RPI) inflation of greater than 5%. None of the other UK operators have so far followed.

Perhaps the biggest difference between this economic downturn and the last is the widespread arrival of the “austerity programme” in most countries across Europe. Typically, this is rooted in a desire by governments to cut spending, in order to reduce deficits and convince bond-holders that they might, one day, get their money back. In some cases (e.g. Greece and Italy) the austerity measures are being imposed and monitored by Brussels as a condition of a bail-out, together with the appointment of new governments and prime ministers. Further “political convergence” is expected.

In reality, austerity tends to mean:

There are a few big risks here:

Early signs are not promising. Greek, Irish, Romanian and Hungarian telecoms markets have suffered already. Plus Telefonica has suffered from the Spanish government’s changed tax policy on “goodwill deductions” for previous foreign acquisitions.

One slightly perverse outcome is that some large incumbent operators are now seen as less-risky investments than their countries’ own sovereign bonds. Portugal Telecom, for example, is thought to be well-financed for the next 2-3 years, even if it suffers from pressure from its weak domestic economy .

One interesting area is the potential for telecoms regulatory changes that might be put in place by the new breed of “technocrats” running some of Europe’s governments. This is only likely to emerge over the next 6-12 months, but some possibilities include:

There is in any event an ongoing trend for telcos to aim to significantly reduce costs, and operators will continue to look for even better deals. However, cash and debt pressures may both slow refresh time tables and further increase cost pressure on vendors.

Possible upsides we can imagine include:

To read the note in full, including the following additional analysis...

...and the following charts...