Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

|

Summary: Our new global research among enterprises and telcos shows that many telcos are ideally positioned, but underprepared, to exploit the fast emerging and evolving $50bn Enterprise Mobility opportunity. How can telcos address this gap? (May 2014, Foundation 2.0, Executive Briefing Service, Cloud & Enterprise ICT Stream.) |

|

To download this report in full for free, you first need to become a member of our Foundation 2.0 service. To do this, you need to create a personal user-id and password by entering the promotional code FOUNDATION2 in the box at the bottom of the sign-up page here. Your user-id will allow you to log-in and download the report using the button and links on the rest of this page.

Logged-in members of the premium Telco 2.0 Executive Briefing service and the Cloud and Enterprise ICT stream can also download this report in full here, in addition to the full database of our Executive Briefings.

To find out more about our services please email or call +44 (0) 207 247 5003.

To share this article easily, please click:

STL Partners believe that mobility – the use of mobile data, new devices, new applications and communications services - is one of the most disruptive forces in today’s enterprise market. We think that a business philosophy to embrace mobility as a strategic asset and opportunity, rather than simply a technical challenge, will be a critical success factor for all businesses moving forward. Telcos can be a key enabler and business partner in this transformation, but to do so they will need to significantly change their approaches to working with enterprise customers.Key findings

Our new global research, independently produced by STL Partners and kindly sponsored by SAP, shows that many telcos are both ideally positioned but underprepared to exploit this fast emerging and evolving opportunity. We found that among the 101 global enterprise and 44 telco executives we surveyed:

Mobility works - 80% of enterprise execs thought their mobile app based initiatives had met or exceeded expectations

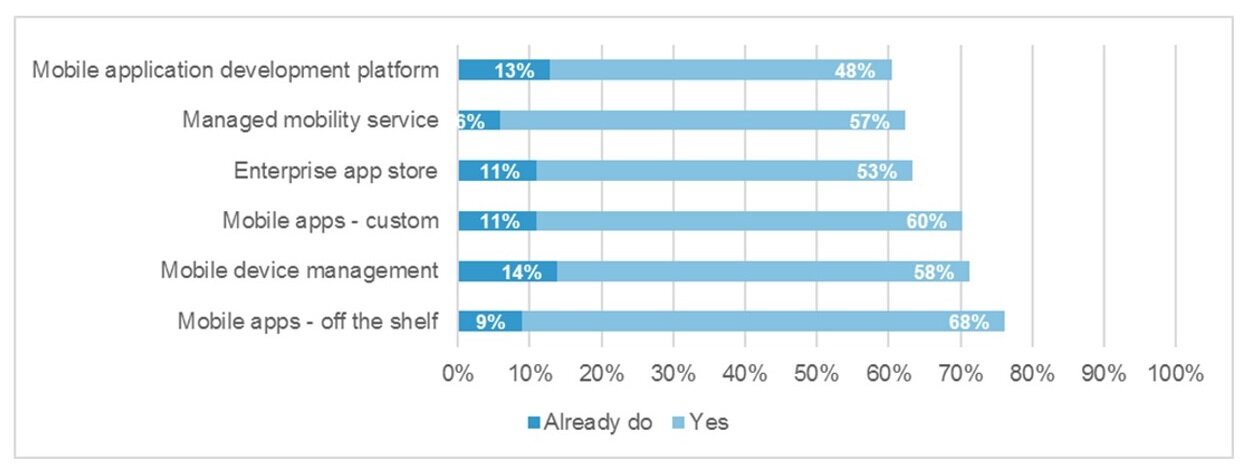

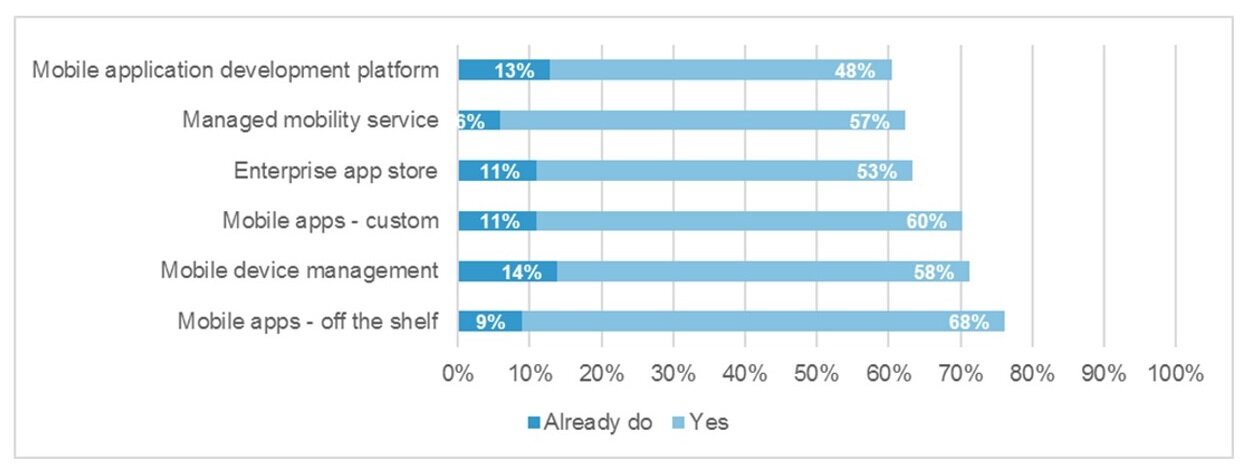

There’s big latent demand for telcos - 5 times as many enterprises (i.e. over half the total) would buy services and solutions from telcos than currently do

But telcos need to address credible capability issues such as security, product portfolio, app development, and process and industry expertise

And most telcos are underprepared – only 16% have a defined market offer or strategy, and internal adoption of mobility lags many other industries, with only 45% of telcos we surveyed offering internal apps compared to 61% in the enterprise sample.

Four major trends in demand are transforming the Enterprise Information and Communication Technology (ICT) market today:

In pursuit of greater agility, new sources of revenue, improved efficiency, and closer customer relationships, enterprises are exploring opportunities to mobilise strategic aspects of their business.

Enterprises are increasingly exploiting big-data, cloud, and mobile strategies to innovate and transform.

To focus on their core businesses, they are outsourcing IT infrastructure and technology services.

As employees increasingly use new digital technologies and services, enterprises have started to reduce spend on traditional telecoms services.

In response, telcos are looking to identify alternative ways to grow revenues from enterprise customers. This includes tools for the development, deployment, and management of enterprise apps, and managed infrastructure and technology services that offer flexibility and economies of scale.

In December 2013, STL Partners conducted a sizing study of the Enterprise Mobility market and identified a global opportunity of $50 billion (see Telco 2.0™ Executive Briefing: “The $50Bn Enterprise Mobility Opportunity: four steps for telcos to take today”). This precipitated further exploration into:

Enterprises’ opportunities and priorities for mobile solutions

Their drivers and expectations vis-à-vis Enterprise Mobility, and their attitudes towards telcos as a prospective partner

The practical and perceptual inhibitors causing telcos to arrive comparatively late to the Enterprise Mobility party

How telcos can achieve the greatest value for their customers – and themselves – by developing or assimilating the Enterprise Mobility capabilities they lack today

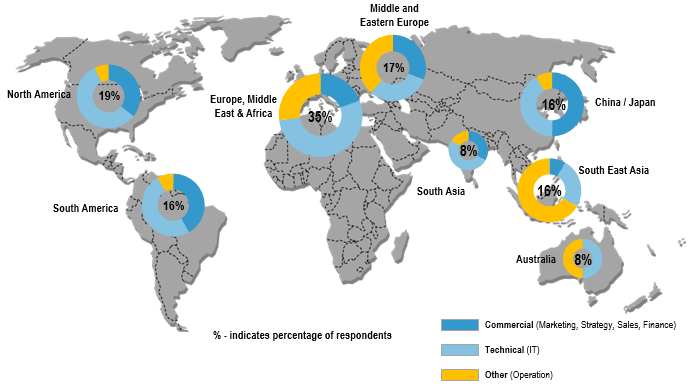

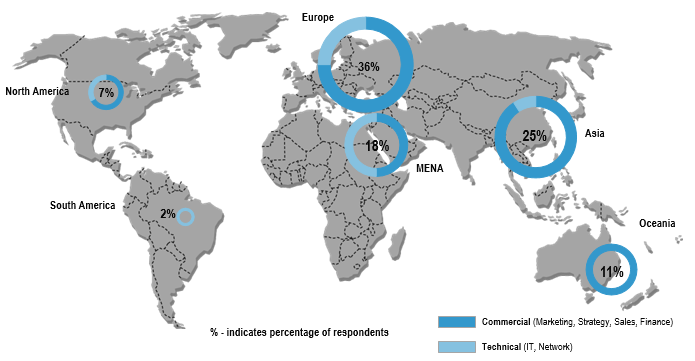

In the first quarter of 2014, STL Partners carried out a combined research programme consisting of:

a survey of 101 enterprises worldwide (organisations with 250+ employees)

a quantitative study of 44 telcos

in-depth qualitative interviews with strategists and proposition owners representing 11 telcos

All the interviews were conducted on a confidential basis. Information and insights shared by the interviewees have therefore been anonymised. Names and titles have also been withheld.

The findings – which suggest telcos are even further adrift of a robust Enterprise Mobility proposition than initially thought – are detailed in this report, together with recommendations on steps telcos can take to accelerate their go-to-market strategy and make up for the early momentum they have lost.

As demand for access to information on the go via mobile platforms is increasing, Enterprise Mobility is one of the hottest topics in IT. Mobile apps are fast becoming a business imperative to support better ways of working and business transformation. Enterprises must react quickly to harness the potential of mobile apps, while satisfying themselves that security, governance, and compliance across data, applications, and devices are fit for purpose.

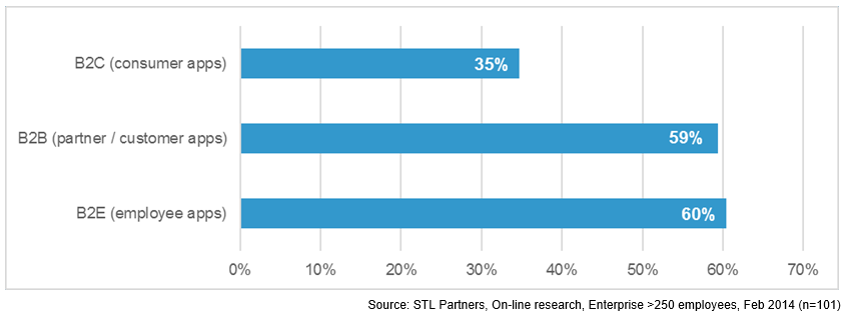

Our study revealed that most enterprises have already mobilised at least some of their organisation’s processes and interactions, generally starting from the inside out by prioritising internal initiatives over customer-facing ones.

Though we observed variations in adoption by sector and country that may indicate relevant differences (see Appendix – Industry and Regional Splits, page 48), the commonality of fundamental demand across regions and sectors is more significant.

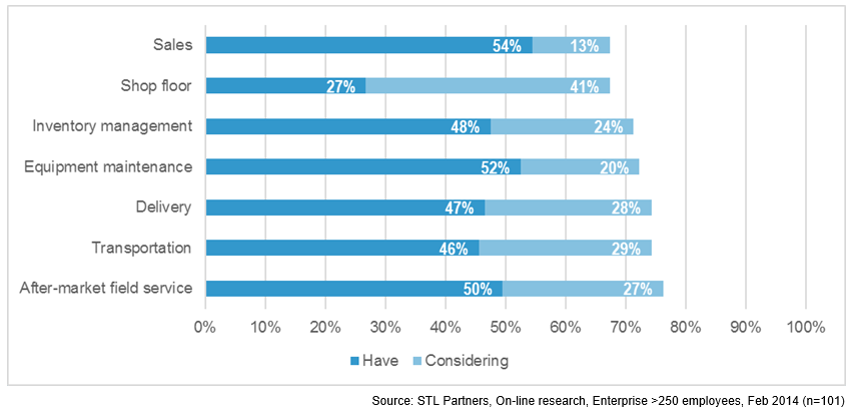

Findings: field sales has always been a natural candidate area for mobilisation, borne out by the fact that more than half of enterprises in the study already had some form of sales app. While the Shop Floor currently has experienced the lowest adoption of enterprise apps, it is also one of the areas of greatest potential for mobilisation, with 41% of enterprises contemplating mobilising their production facilities, concourse, or retail environment. The highest levels of mobilisation or intent to mobilise were seen in Aftermarket Field Service, Transportation & Delivery, and Equipment Maintenance.

Opportunity: administrative apps are now a relatively mature, horizontal process market. Some telcos have had success selling these and it is an important area in which to have a compelling offering. However, such apps have lower price points and margins, whereas other sales and operational apps offer the potential for higher growth and greater business impact. Moreover, there is also potential for a new generation of intelligent sales apps to change sales performance in a more fundamental fashion.

Key Question: how can telcos best develop the agility and depth of ICT skills to sell and support both horizontal process apps and deeper vertical / operational needs?

Options: telcos have broad options to develop this internally, partner, or choose not to support these segments and their needs. See Four key enterprise mobility competencies for telcos, page 42.

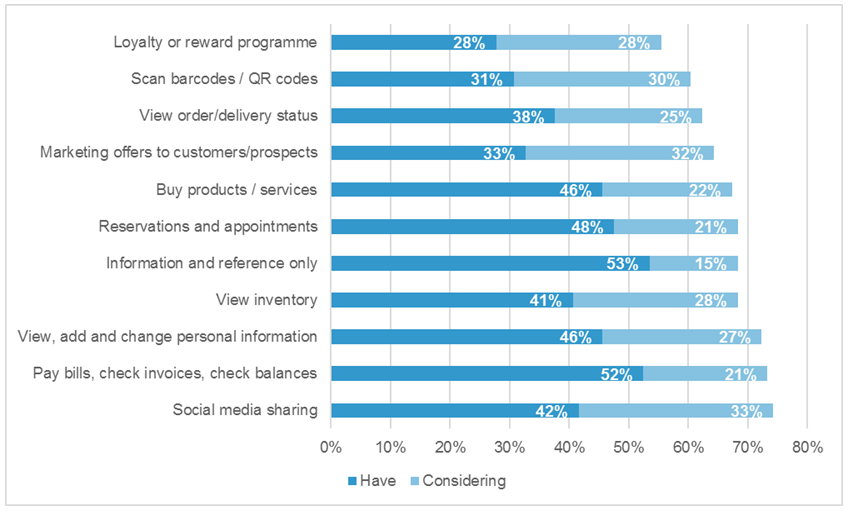

Findings: the customer-facing processes that had most typically been already mobilised were identified as Information & Reference (53%) and Paying Bills/Checking Balances (52%). The areas of greatest untapped interest in mobilisation were Social Media Sharing (33%), Marketing Offers (32%), and Scanning Barcodes/QR Codes (31%).

Opportunity: as an increasing volume of purchases are researched or made via mobile devices, traditional mobile marketing and shopping experiences in developed economies are likely to continue to evolve significantly.

Key Question: how can telcos develop and support the next generation of customer-facing mobile apps?

Options: again, telcos have broad options to develop this internally, partner, or choose not to support these segments and their needs. See Four key enterprise mobility competencies for telcos, page 42.

...and the following report figures...

To download this report in full for free, you first need to become a member of our Foundation 2.0 service. To do this, you need to create a personal user-id and password by entering the promotional code FOUNDATION2 in the box at the bottom of the sign-up page here. Your user-id will allow you to log-in and download the report using the button and links on the rest of this page.

Logged-in members of the premium Telco 2.0 Executive Briefing service and the Cloud and Enterprise ICT Stream can also download this report in full here, in addition to the full database of our Executive Briefings.

Technologies and industry terms referenced include: Mobile enterprise, mobile security, mobility, enterprise mobility, enterprise mobility management, mobile enterprise application platform, MEAP, mobile device management, MDM, mobile application platform, mobile platform, enterprise apps, enterprise app store, mobile development platform, app developer, mobile proposition, employee apps, corporate apps, mobilization, B2E apps, mobile business processes, Telco2.0, SAP, Telecom, Strategy, Innovation, Digital.