Telco 2.0™ Research

The Future Of Telecoms And How To Get There

The Future Of Telecoms And How To Get There

Summary: We examine four examples of the growing trend of wholesale-oriented LTE operations, their key challenges and opportunities, and recommend that incumbent operators should be more aggressive in wholesale.

We'll be exploring LTE and Wholesale networks further at the 13th Telco 2.0 Executive Brainstorm in London, 11th-13th May 2011 - for more or to join us please see here.

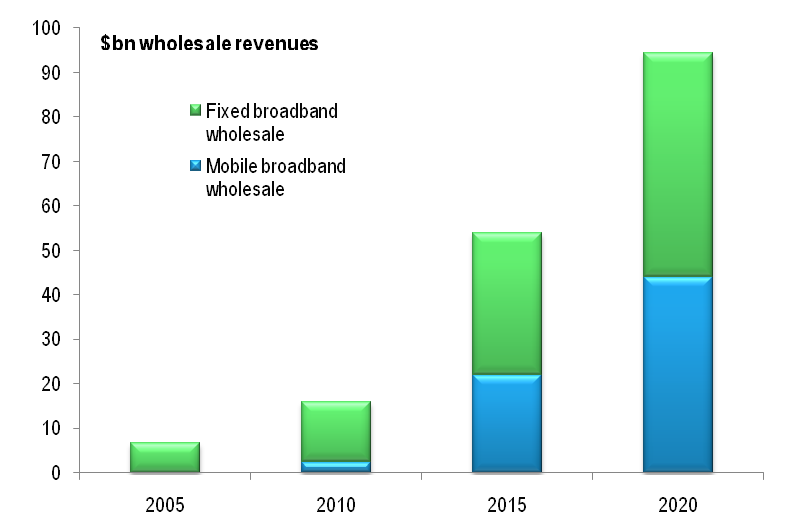

To share this article easily, please click:In our major strategy report on new fixed and mobile broadband business models, published in March 2010 and looking at near and far-term market evolution and strategies, one of the key findings was that wholesale propositions for broadband would expand in various directions - including "sliced and diced" provision to upstream customers such as device vendors (think "the Kindle model"), or potentially specific application and service providers.

Source: Telco 2.0 New Mobile, Fixed and Wholesale Broadband Business Models Report

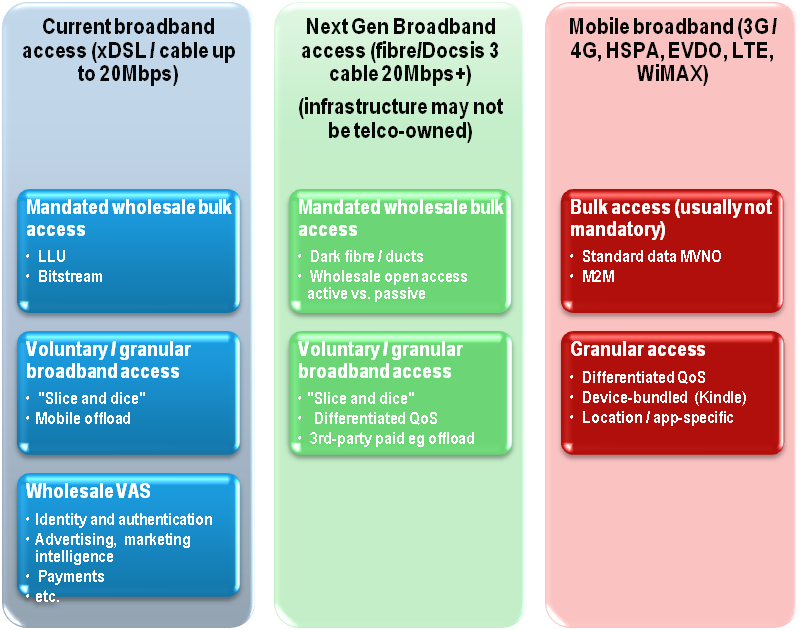

The report also covered one of the more prosaic areas of two-sided telecom business models: what we termed "bulk wholesale" - essentially an evolution from today's MVNO deals in mobile, or access-line rental in fixed markets. Various retailers, utilities and other brands already resell and repackage ("distribute") telecoms capacity and services provided by "host" operators, although these are usually just an add-on to a normal, vertically-integrated MNO's business.

Report Extract - Figure 47: Broadband wholesale segmentation

Source: Telco 2.0 New Mobile, Fixed and Wholesale Broadband Business Models Report

Our report foresaw a continued evolution of this model towards wholesale-only or wholesale-centric wireless providers, which support a broad range of retail partners (MVNOs seemed too weak a term), perhaps with differing regional coverage needs or tailored QoS/performance parameters. This will go well beyond the historic MVNO model.

Our benchmarks at the time of publication were mostly in the WiMAX space - Clearwire in the US, and UQ Communications in Japan. Both were heavily wholesale-oriented, and had ownership structures comprising a mix of incumbent operators (Sprint and KDDI respectively) plus other stakeholders from cable, utility or private equity backgrounds.

What has emerged over the past 15 months has gone significantly beyond that model, and has underscored our views of both mobile data wholesale, and also the concept of "under the floor players" discussed in detail in our new 2011 strategy report, ‘The Roadmap for New Telco 2.0 Business Models'.

Specifically, there are now at least four examples of wholesale-oriented LTE providers rolling out networks, in diverse parts of the globe:

There are significant differences between them, but it is the similarities that are most striking. We can also draw a conclusion that four is a sufficiently large number, launched sufficiently quickly, to suggest this is not just a handful of isolated examples - we fully expect more companies to follow this path, in other parts of the world.

Developing propositions for un-served or under-served customers is a disruptive business model innovation principle discussed in both 10 'Innovation Principles' for success in a disrupted marketplace and the ‘Roadmap' report.

A clear theme emerging is that these companies are primarily new entrants (although Yota has shareholders from an incumbent-operator background) targeting new customers often including the existing telcos. Indeed, most mobile markets are now sufficiently saturated that greenfield operators will face insurmountable challenges - as well as huge market entry costs - if they target traditional Telco 1.0 retail consumers.

The fact that such companies are emerging now is also a reflection that LTE's much-vaunted "flatter" (i.e. simpler and in some ways cheaper) architecture makes the wholesale business case more effective. It is worth noting that Yota and Aero2 also have retail operations as well as wholesale, at least on their non-LTE networks.

Another similarity is that these operators are generally using "sub-prime", or at least slightly non-mainstream spectrum and technology choices. While this means that upfront costs are lower than incumbent operators, it may bring other challenges, for example with coverage or device support.

LightSquared, for example, is using an unusual spectrum band usually reserved for satellites, and therefore may struggle to get support from chipset and RF component providers, and by extension suffer from poor handset range. Although Qualcomm is supporting the L-band for some devices for the operator, it still needs to sell those components into the handset vendors, which are already faced with a bewildering set of choices of frequency ranges. For the foreseeable future, it seems unlikely that any device will support more than four or five LTE bands from a choice of over 20.

Given that most of LightSquared's potential customers will have their own, different, LTE spectrum, and will also wish to support roaming elsewhere in the world (probably at 800MHz or 2.5GHz), they will have to make some tough decisions. Will supporting another US-specific band reduce their devices' appeal to international travellers? Will the most attractive future devices necessarily support the LightSquared frequencies and be able to roam onto those parts of the network - and if not, how will operators position premium devices that have more limited coverage than other products? Will LightSquared-supporting phones be more expensive and slower to reach the market? Unless LightSquared holds the realistic promise of 10's of millions of device sales, handset vendors are likely to be lukewarm in their support of L-Band, given their constraints on R&D, and the opportunity costs of using engineers for that work, rather than something else that could drive greater incremental sales.

A similar set of concerns apply to the other wholesalers. Aero2 is using LTE at 1800MHz, which is looking increasingly like a niche choice. It is also, like MVS, working with the TDD (Time Division Duplexing) variant of LTE at 2.5GHz, which is less mature than the more common FDD (Frequency Division Duplexing) approach. Although for LTE, TDD/FDD dual-mode devices are on the horizon, it is less clear how long it will take them to reach maturity in terms of price, performance, battery life and so on. Yota's 3.5GHz spectrum is really not optimal for full mobility, as it will struggle with range and indoor penetration - and is also unsupported in most handheld devices and their chipsets. Its contested 2.5GHz allocation should be better, if it gets regulatory approval.

An open question is how this LTE wholesale model fits with telephony. It is unclear whether these wholesalers remain just data "happy pipe" providers, and if so, how that squares with the ultimate aim of many in the telecoms industry to use LTE for voice and other services as well. It is not obvious that they will want to deploy their own core network and application infrastructure, in the way in which a traditional host network for MVNOs runs most of the voice and messaging equipment. Equally, it remains unclear exactly how a retail provider extends its own services over the top of a wholesale partner's network - especially if they require guaranteed QoS for telephony or other demanding apps.

It is also worth noting that many incumbent operators are also looking to reduce their costs of building and running LTE networks, through a variety of deals to share or outsource radio-network assets. Tele2 and Telenor are running a jointly-owned LTE network in Sweden, for example. Such shared networks may end up also becoming platforms for wholesale provision, although if they are (for example) owned by the #2 and #4 operators in a country, it is not obvious they could easily cut deals with #1 or #3 to fill in coverage gaps or offer extra capacity.

Overall, we are watching the LTE wholesale trend closely. Perhaps the first crop of providers will give lessons on what works, and what doesn't - but overall we expect to see others emerging over time. Some will come to market as new spectrum gets auctioned and innovators and investors see the potential for shared wholesale LTE networks - but don't wish to deal with the cost, complexity and competitive dynamics of building their own greenfield retail operation.

We also expect - and indeed recommend - incumbent operators to be much more aggressive with their wholesale operations than has been the case in the past. Compared to the fixed world, most mobile operators have had a lukewarm attitude towards wholesale (ie hosting MVNOs) because of the fear of cannibalisation, but in Telco 2.0's view they are missing the potential richness of mobile broadband data wholesale. LTE's architecture is perhaps better-suited to such endeavours than 3G networks, but we do not yet see the drive, energy and philosophical acceptance of wholesale data among most operators today.

There should also be a possibility for existing MNOs to bundle LTE wholesale with other products and services - perhaps cloud-based applications, or even offering parts of their OSS/BSS stack on a managed-service basis to other operators. Wholesale data should also be optimal for various "slice and dice" strategies - bundled with hardware products, enmeshed into M2M offerings, partitioned for government private networks and so forth.

Lastly, there is another possibility for wholesale market entry - if substitutive pressures and declining margins for 2G/3G voice and SMS become catastrophic in coming years, we may see some cellular operators exit the market or restructure. Under such circumstances, it is not impossible we might see separation into NetCo and ServCo arms, with spin-offs and sales becoming feasible.

Overall, LTE wholesale is likely to be one of the pivot-points for two-sided models in mobile data. The questionmark is whether it can be exploited by existing telcos as the sellers of capacity (i.e. wholesaling on their own networks), or as buyers of the new-entrant "under the floor" players' networks. Yota and LightSquared suggest the latter model may win out - none of the incumbent operators running LTE have been as aggressive about wholesale so far.