Summary: senior industry executives in Palo Alto at the 12th Telco 2.0 Executive Brainstorm agreed that half of the telco growth available in the next 3 years would come from the new business model opportunities identified in the ‘Roadmap to new Telco 2.0 Business Models’ report. The other half would come from improvements to the current business model. Headline findings in brief. (April 2011, Executive Briefing Service)

NB We'll be discussing all of the issues outlined here and more in the 13th Executive Brainstorm in London, 11-13 May 2011. Please see here for more details, email , or call +44 (0) 207 247 5003.

To share this article easily, please click:STL Partners’ New Digital Economics Executive Brainstorm & Developer Forum AMERICAS took place from 5-7 April in Silicon Valley, California. It was attended by just under 200 senior industry executives and focused on new growth opportunities at the intersection of Communications, Media and Entertainment.

The Brainstorm brought together 4 events in 1 venue, co-locating the Telco 2.0, Digital Entertainment 2.0, Mobile Apps 2.0 and Personal Data 2.0 summits, and built on the output of previous brainstorms, new market research and analysis from us and our partners, and used our unique 'Mindshare' interactive approach.

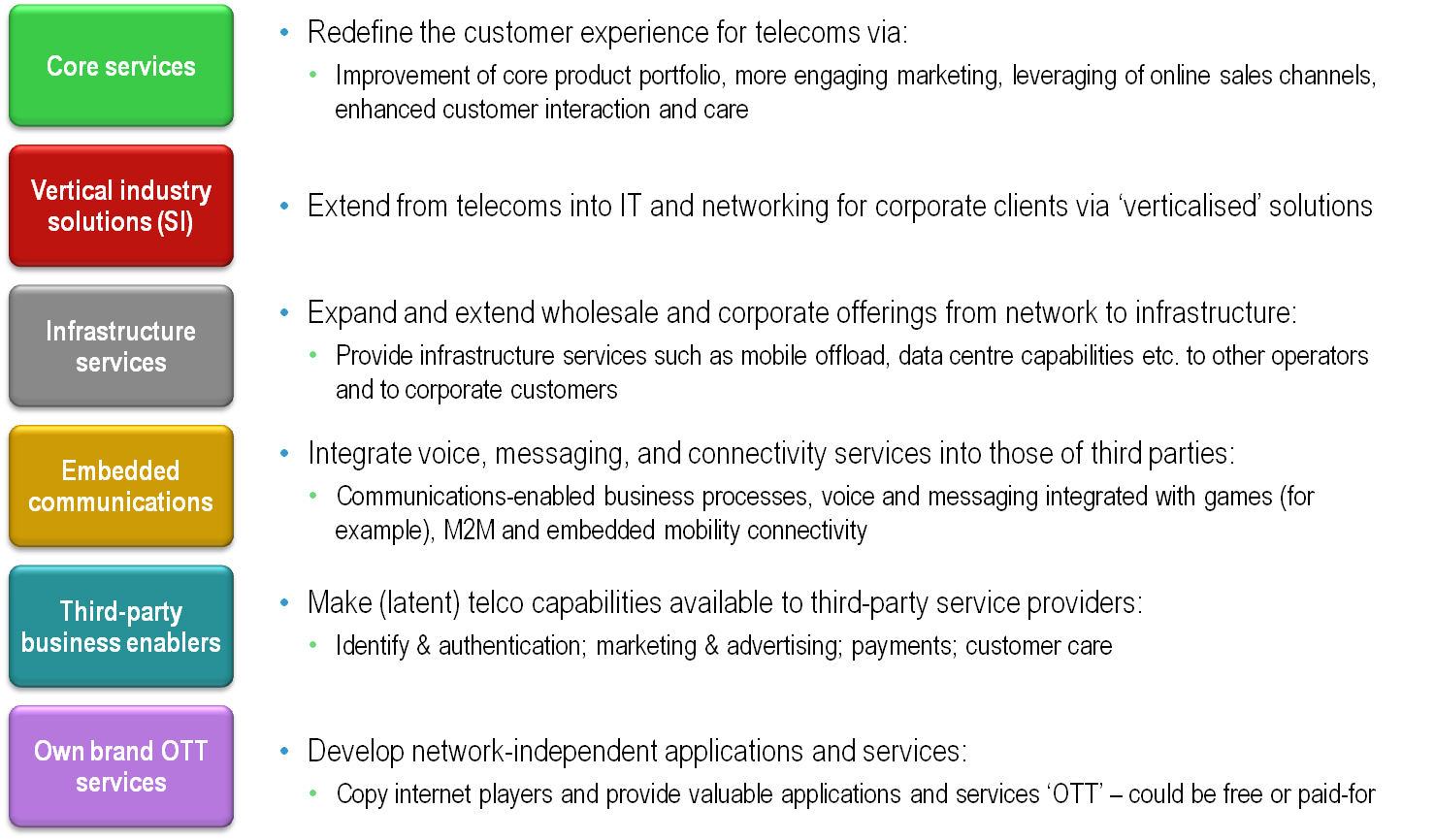

As one of the stimulus presentations in the session on finding new growth, Chris Barraclough, Telco 2.0's Chief Strategist, presented the six opportunity categories identified in the new strategy report 'The Roadmap to New Telco 2.0 Business Models'.

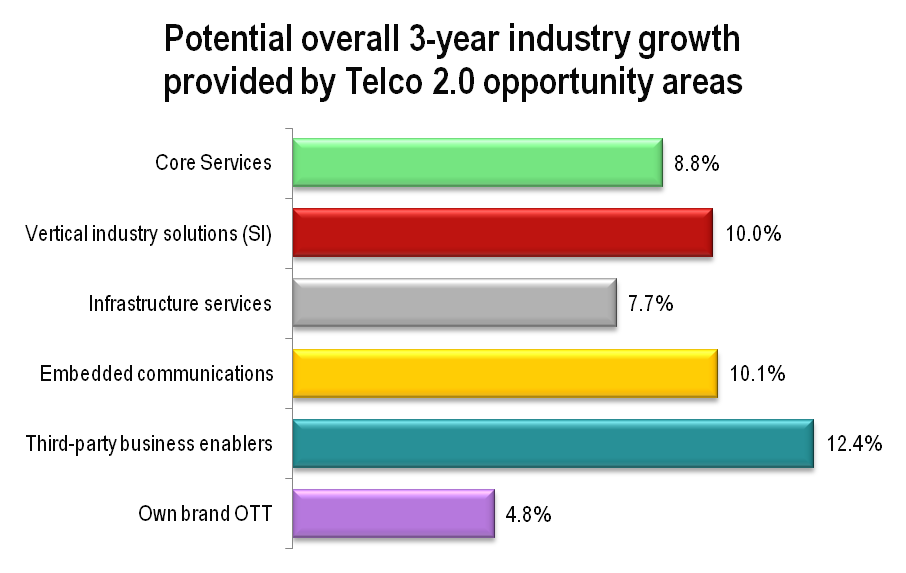

The participants then debated the issues and challenges, and were then asked to vote on the scale of the opportunity within the next three years.

Hence it would seem that there was support for the view that new business model opportunities could indeed generate roughly half of potential growth, which is encouraging.

However, it is important to note that these opportunities are not all necessarily additive – i.e. one can’t necessarily add all opportunities together and say the opportunity is for 53% growth overall. In our previous forecasts we've been somewhat more conservative - see e.g. the $125Bn Two-Sided Telco Market Opportunity report, and have generally said that new business models could account for up to 30% of revenues in 10 years time.

Moreover, 'Third-party business enablers' will be tough to do well. There will be lots of competition from new players (Google, Facebook, Apple), from other industries (banks etc.), and to capitalise on the opportunity requires new skills and relationships – latent assets, new revenue model, new distribution channels etc. It also has regulatory implications – e.g. privacy. That is not to say that telcos can't succeed in this area - we describe which telcos could be successful at this and what they need to do in the Roadmap report.

Despite their limitations as an absolute measure, we think these new results are a useful indicator of the relative attractiveness of the types of opportunity. While the 'wisdom of crowds' is not always that profound, the six opportunty types were supported by the participants at the brainstorm and, given the experience and seniority of the audience, we see this as evidence of significant industry support in the key strategy making arena.

There is a significant further reason to be positive about the new opportunities, as we believe that the three new business model opportunities will require less capex to implement than the existing opportunities. This will mean a better potential return on invested capital (ROIC) - a key measure when looking at investment in growth initiatives, and one which we believe will take on increasing importance for telco CxOs when looking at future strategies in order to achieve a successful balance between feeding quarterly EBITDA performance and ensuring that their businesses have a future other than as a commodity stock.

We'll be writing and publishing more in-depth analysis on all of the following areas over the next few weeks, building on output from both the Americas and the upcoming EMEA brainstorms. Here's a brief round-up.

We''ll be discussing and developing these themes further at the 13th EMEA Executive Brainstorm in London, 11-13 May 2011 (please see here, email , or call +44 (0) 207 247 5003). We'll also be developing and publishing further analysis based on the discussions and output from these brainstorms.