Please email or call +44 (0) 207 247 5003 to contact Telco 2.0 or STL Partners.

To share this article easily, please click:STL Partners’ New Digital Economics Executive Brainstorm & Developer Forum EMEA took place from 11-13 May in London. The event brought together 250 execs from across the telecoms, media and technology sectors to take part in 6 co-located interactive events: the Telco 2.0, Digital Entertainment 2.0, Mobile Apps 2.0, M2M 2.0 and Personal Data 2.0 Executive Brainstorms, and an evening AppCircus developer forum.

Building on output from the last Telco 2.0 events and new analysis from the Telco 2.0 Initiative – including the new strategy report ‘The Roadmap to New Telco 2.0 Business Models’ - the Telco 2.0 Executive Brainstorm explored latest thinking and practice in growing the value of telecoms in the evolving digital economy.

This document gives an overview of the strategic messages from the opening Telco 2.0 session, looking at strategic opportunities for new growth.

Most telco execs now recognise the strategic ‘battle for relevance’ they face in the new digital economy, brought about by the rapid rise of hero tech brands such as Apple, Google and Facebook, changing consumer expectations, and the increasing convergence of the offerings of IT and communications companies in the enterprise sector.

The Microsoft / Skype announcement just prior to the brainstorm brought this into even sharper relief, with many agreeing that Microsoft had got a good deal, especially if the execution is good. One delegate commented that ‘$8.5Bn seems like a good deal for what could be half of the future communications industry’.

This growing recognition of the new battle, coupled with a slight improvement in shareholder views of growth prospects brought about by the growth in mobile data, is starting to unlock another wave of innovation in core telecoms and adjacent markets. At the brainstorm, we had collected many case studies of business model innovation from around the world. These created a sense of motivation about what was possible for the participants.

A major theme from the Roadmap to New Telco 2.0 Business Models report and the Brainstorm was that different combinations of Telco 2.0 strategies should be employed by Telcos of different types (based on their size, nature, markets, etc.). The Brainstorm further highlighted how strongly the differing financial and market positions of telcos will also influence their appetite and ability to change. Indeed, pressures on the cost base may ultimately prove as effective stimuli to innovation as slowing or declining revenues.

‘Leave the fat kid alone’ was the somewhat politically incorrect paraphrasing of the current sentiment towards telcos in investor circles coined by Richard Kramer of Arete Research - meaning that investors had started to find greater respect for many telcos after several years of delivering strong dividends in a weakened economy. Additionally, irrational valuations of technology stocks, and investor confidence in mobile data growth and enjoyment of ongoing cash streams might mean that there is now perhaps the faintest chink of opportunity for more confident telcos to talk about pursuing more innovative strategies, although Richard also said that telcos in general currently have a poor reputation in terms of delivering valuable innovation.

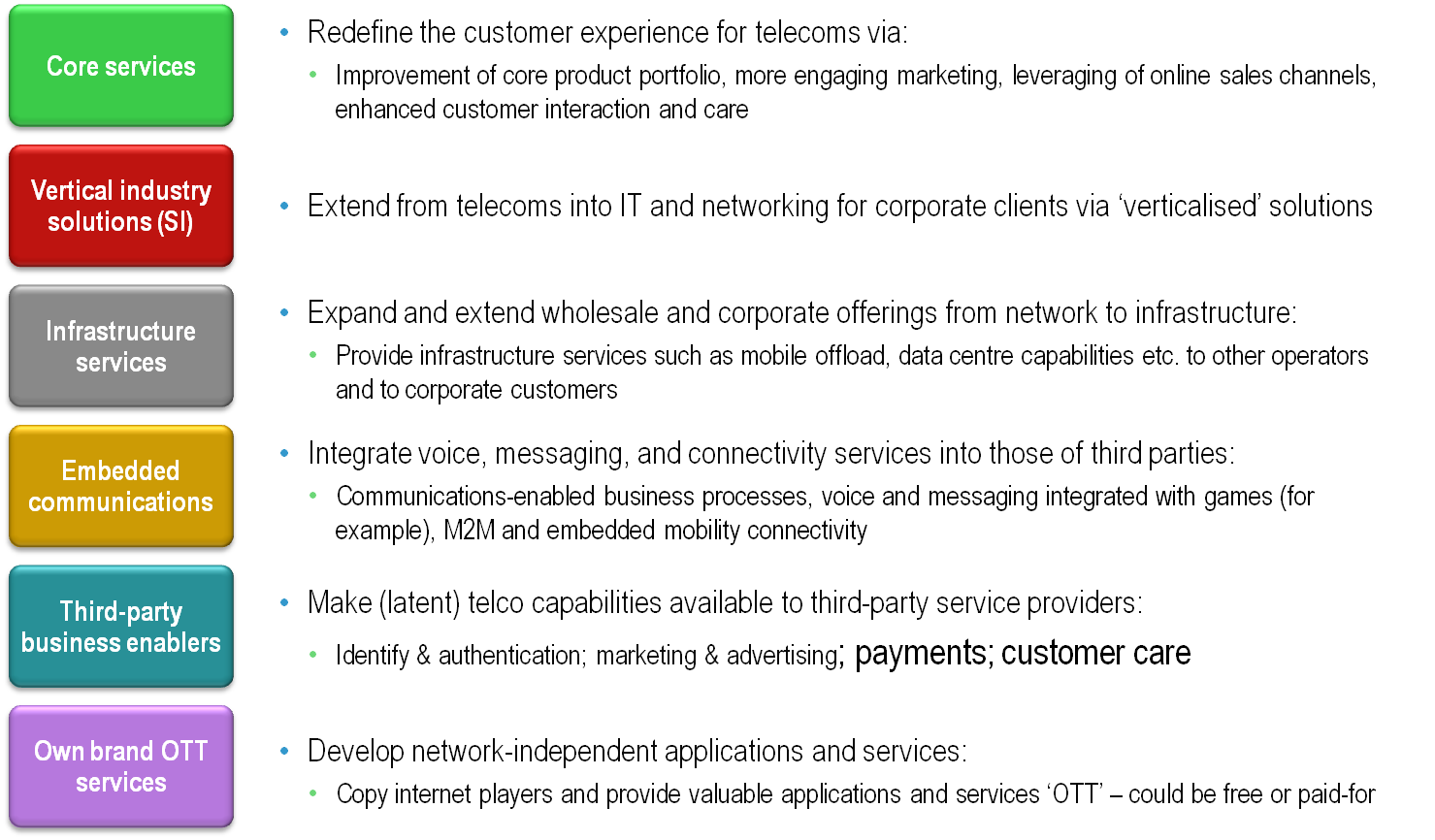

Chris Barraclough, Telco 2.0's Chief Strategist then presented a summary of the six Telco 2.0 Opportunity Types detailed in the Roadmap report.

Figure 1 – The Six Telco 2.0 Opportunity Types

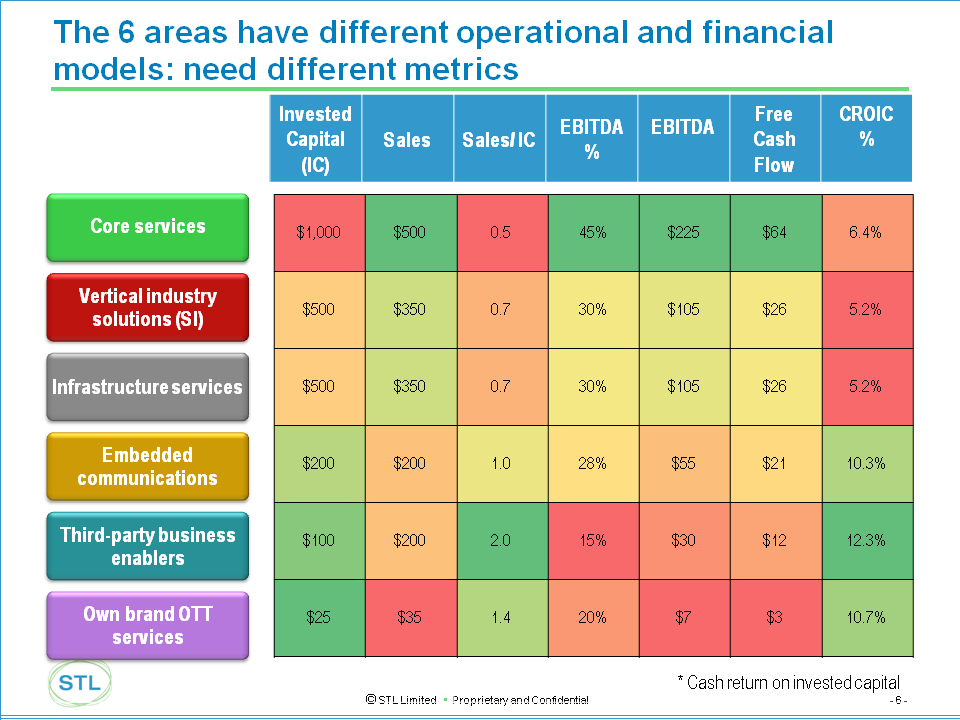

Chris argued that Cash Returned On Invested Capital (CROIC) should be a key metric for innovation in new business models rather than EBITDA (which was rapidly becoming a less relevant measure for the industry), and that the areas of Embedded Communications, 3rd Party enablers, and Own-Brand ‘OTT’ services (described in Figure 1 above) would perform well against these metrics as illustrated in Figure 2.

Figure 2 – Different Business Models Need Different Metrics

Source: STL Partners Presentation13th Telco 2.0 Executive Brainstorm, London, May 2011

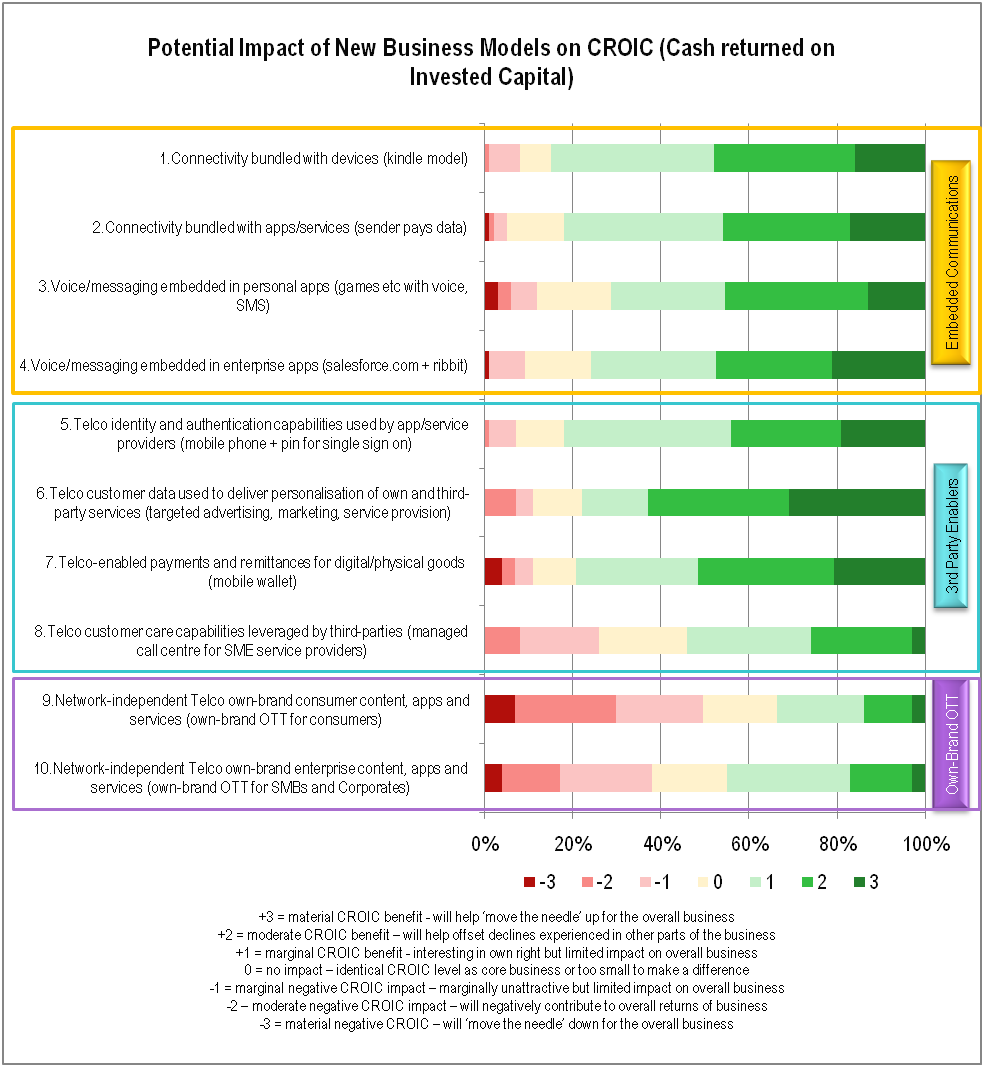

In a detailed vote delegates were asked to rate the impact of 10 different potential strategies against the new business model areas - Embedded communications, Third-party business enablers, and Own brand OTT services.

In Figure 3 below, we’ve shaded positive sentiment in green, and negative in red to show how delegates were much more positive about the impact of Third-party business enablers and Embedded communications, but had more reservations about Own brand OTT services. We see this general trend as a reasonable reflection of the greater implementation risks of such businesses that are further from the core communication business.

Figure 3 – Impact of New Business Models on CROIC

Source: Delegate Vote, 13th Telco 2.0 Executive Brainstorm, London, May 2011

Our further take-outs from these results are that it’s logical that using customer data more effectively is the most appealing initial strategy, and that the general distribution of views above is consistent with the ‘one strategy does not fit all’ Roadmap report analysis summarised above (NB the report identifies strategies against 5 categories of operator).

The Wholesale Applications Community (WAC) is an important cross-industry initiative to facilitate app development and commercialisation across multiple operators’ appstores. It’s a great example of the type of development that the industry needs to deliver to facilitate new business models. It is also a classic example of the challenges of ‘telco speed’ innovation – one speaker amusingly pointed out that in contrast to the once popular ‘internet speed’ idea (i.e. fast), ‘telcos are known for their speed – and it’s slow’.

Despite the seemingly best intentions of 28 of the world’s top telcos, and sensible prioritisation of the billing API, it seems to be taking too long to achieve commercial engagement and alignment in the context of a fast moving market. Why? It's inherently difficult to build consensus, and no doubt there's also some internal telco cultural inertia, caused by the friction and politics - the anti-change ‘white blood-cells’ that slow and kill initiatives that aren’t internally generated or sufficiently prioritised.

Yet we all know how quickly things can be done when initiatives become a CEO’s ‘JFDI’ directive (standing for ‘Just Do It’, only even more quickly). The challenge now is both for the CEOs to make it a ‘JFDI’, and for all the rest of the people involved to understand that the competitive game has changed – the competition is no longer just the other operators – and new types of action are urgently required.

The next steps for the Telco 2.0 Initiative will be to update our detailed forecasts in these opportunity areas, and to collect further examples and case studies showing the strategies in action.

Additionally over the next few weeks we will summarise of some of the great innovations we saw, and give more detailed analysis of the sessions on: Mobile Broadband Economics, Cloud Services, Personal Data and Transformation, Digital Entertainment 2.0, Mobile Apps 2.0, M2M 2.0, Connected TV, Augmented Reality, and lessons from Apple and Google.