| Summary: So Facebook is buying the mobile IM app WhatsApp for $19bn including $4bn in cash, and WhatsApp is launching a voice service. Why, and what are the consequences and lessons for telcos and others? (March 2014, Executive Briefing Service, Dealing with Disruption Stream.) |

|

Below is an extract from this 20 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service and the Dealing with Disruption stream here. Non-members can find out about the service and how to subscribe here. We'll also be discussing disruptive strategies further at our upcoming Executive Brainstorms in EMEA, the Americas, the Middle East and Asia. For other enquiries, please email / call +44 (0) 207 247 5003.

To share this article easily, please click:

In 2010, we predicted in our analysis Facebook: Moving into Telco Space? that Facebook would inevitably decide to move further into the communications space in order to sustain and grow its valuation. In 2011 we published a major strategy report “Dealing with the 'Disruptors': Google, Apple, Facebook, Microsoft/Skype and Amazon”, which charted the complex and inter-related battles and relationships between the main internet giants of the western world. It showed how they’re disrupting numerous fields, including communications, commerce, marketing – and not least each other.

In 2014 we’re launching an extension of this research into an ongoing stream of analysis on the key players to help strategists and senior decision makers navigate these complex waters. As a precursor, Facebook’s acquisition of WhatsApp shows further aspects of, and lessons from this ongoing disruption.

Facebook has already had to re-engineer its business model since the traumatic (and predicted) flop of the IPO. Users flocked away to mobile, and Facebook had to redesign its primary user experience in order to cope. At the same time, the advertisers who are Facebook’s real customers lost interest in the brand-building display pages that were its key advertising product.

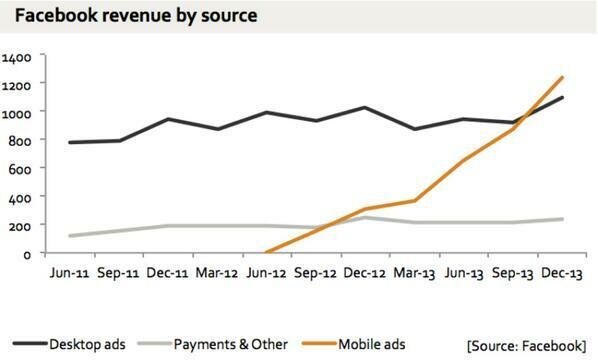

Facebook chased the audience, developing new advertising products to fit into the context of a mobile user experience. It worked: post-IPO Facebook has succeeded in getting revenue from its mobile advertising, so much so that it made $523m in net profits on revenue of $2.6bn in Q4. But it’s worth remembering that this represents Facebook concentrating on one very specific niche business: mobile apps discovery.

In the last quarter, 53 per cent[1] of Facebook’s revenue, over $1bn, came from mobile ads. Mobile app downloads are becoming a very important segment of this. As Mark Zuckerberg said in the Q4 earnings call:

we’re finding that people also really want to buy a lot of app install ads, and that’s grown incredibly quickly and is one of the best parts of the ad work that we did over the last year

Sheryl Sandberg reiterated it later:

We are very excited about the mobile app space in general. If you look at our mobile app installation ads, we’ve really done a great job working with developers to help users discover and download their apps.

This is because app developers can expect to pay as little as $2 in advertising costs[2] for each install.

This is a significant change in the model. In Figure 1, the chart below, note especially that the mobile ads line of business starts immediately after the IPO in June, 2012, when ads in the News Feed were introduced, and accelerates further in early 2013, when mobile app ads were introduced.

This implies that revenue equivalent to roughly a quarter of app sales[1] through Apple’s iTunes App Store is going to Facebook just for ads, and much of it is advertising for apps. How long will Apple, whose app store it is, or Google, fundamentally an advertising business, put up with that before they launch something that competes?

The problem is summed up quite simply here:

“This exposes the strategic fallacy behind Facebook, which was the idea that there was going to be a monopoly on the social graph, and that Facebook was going to own it,” said Keith Rabois, a partner at venture capital firm Khosla Ventures. “That’s not true, and I don’t believe Facebook will constantly be able to buy its way out of this structural challenge.”

This pattern has been visible for a while. Rather than big multi-functional platforms, suddenly it seemed that leaner, focused, task-specific apps were in demand, notably Instagram, Snapchat, ask.fm, and Vine. It should come as no surprise that Unix-based iOS and Linux-based Android both seem to encourage app developers to do “one thing well” in the classic tradition of the core Unix/Linux utilities, with the unifying platform being the OS itself. So Facebook chased its audience again, buying Instagram.

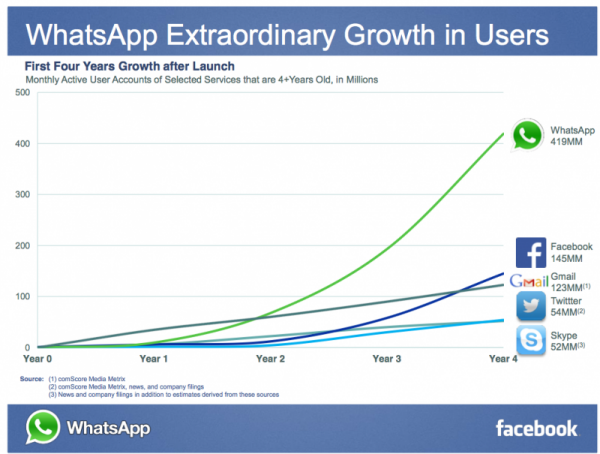

Meanwhile, users sought out a new generation of mobile instant-messaging apps, which saw astonishingly fast growth and shocked the carrier industry with the hit to their SMS revenues. And Facebook has chased the audience again, with the WhatsApp acquisition.

WhatsApp’s user-base acceleration has been outstanding, as shown in Figure 2.

Source: Facebook

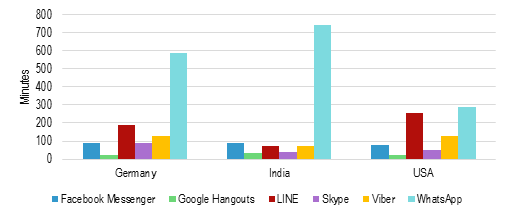

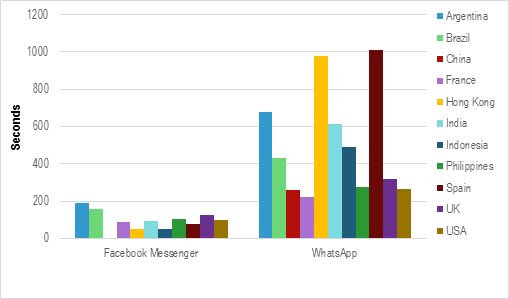

Its usage stats are equally impressive (Figure 3), as are the comparisons between WhatsApp’s and Facebook’s user engagement (Figure 4)

Source Mobidia May 2013

Source: Mobidia Q4 2012

WhatsApp is nothing if not a lean, focused, task-specific app that does one thing well. Its USP could be summarised as “instant messaging done right”. Its business model is simplicity itself, asking users for a dollar a year, rather than seeking advertisers or volume-billing. The simplicity, as with most simplicity, is founded on engineering excellence - WhatsApp holds the record for the most concurrent TCP sockets, 2 million, on a FreeBSD Unix server. It’s because they spent the time and money developing their highly customised fork of the open-source ejabberd XMPP server that they kept costs down to the level where their business model made sense. (There is much more information on WhatsApp technology in this High Scalability post.)

Across Europe, WhatsApp and the proliferation of other IM apps has dragged SMS pricing down until it has become a bundled, unlimited service. Vodafone, for example, bundles unlimited messaging with 1GB of data at its €29 price point.

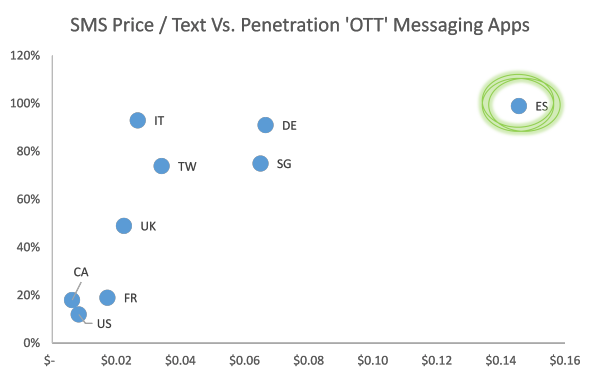

While its appeal is not all about price, WhatsApp and other Over The Top (OTT) messaging apps capitalise on high priced markets, with much higher adoption in the markets with higher priced that we analysed in our recent Future Value of Voice and Messaging report (see Figure 5 below).

Source: Onavo, Ofcom, CMT, BNETZA, TIA, KCC, Telco accounts, STL Partners

But, as we point out in the report, price is only part of the story. Price drove the acquisition of customers, but quality retained them. WhatsApp offers a searchable, conversation-based chat history and a one-tap voice messaging function; it remains shocking to this day that it took Apple to show SMS messages as threaded conversations like e-mail.

To read the note in full, including the following additional analysis...

...and the following figures...

...Members of the Telco 2.0 Executive Briefing Subscription Service and the Dealing with Disruption stream can download the full 20 page report in PDF format and the Telco 2.0 Disruption stream here. Non-Members, please subscribe here. For other enquiries, please email / call +44 (0) 207 247 5003.

Technologies and industry terms referenced include: Facebook, WhatsApp, telco, Vodafone, Telefonica, AT&T, VOIP, voice, messaging, apps, disruption.