|

| Digital Commerce 2.0: A summary of the findings of the Digital Commerce 2.0 Executive Brainstorm, 6 June 2013, held in the Wyndham Grand Hotel, London, part of the New Digital Economics EMEA event. With more and more people using their smartphones to shop, the Brainstorm explored how to use mobile technologies and capabilities to optimise and enable each element of the wheel of commerce. The sessions explored the evolution of mobile payments, the need to rethink mobile advertising/marketing and the potentially pivotal role of personal data. |

|

Part of the New Digital Economics Executive Brainstorm series, the Digital Commerce 2.0 event took place at the Wyndham Grand Hotel, in London on June 6th. With more and more people using their smartphones to shop, the Brainstorm explored how to use mobile technologies and capabilities to optimise and enable each element of the wheel of commerce – STL Partners’ depiction of the inter-related steps involved in bringing together buyers and sellers to complete a transaction. The Brainstorm’s sessions explored the evolution of mobile payments, the need to rethink mobile advertising/marketing and the potentially pivotal role of personal data.

Using a widely-acclaimed interactive format called ‘Mindshare’, the event enabled specially-invited senior executives from across the communications, media, banking and technology sectors to discuss opportunities, challenges, and practical experiences from the future of e-commerce.

This note summarises some of the high-level findings and includes the verbatim output of the brainstorm.

Further research on Digital Commerce can be found at telco2research.com. STL plans to publish a new strategy report on mobile commerce in September.

More information: Andrew Collinson, Research Director, STL Partners (www.stlpartners.com)

Email: . Phone: +44 (0) 207 247 5003.

DOWNLOAD REPORT

With thanks to our Sponsors:

Table of Contents:

- Introduction

- Executive Summary

- How to win in SoLoMo (social, local, mobile commerce)

- Stimulus presentations – Retail 2.0

- Stimulus presentations – Payments 2.0

- Innovation showcase

- Brainstorm

- Key takeaways

- Advertising & Marketing: Making Mobile Work

- Stimulus presentations – mobile marketing 2.0

- Brainstorming

- Key takeaways

- Session 3: Big Data - Exploiting the New Oil for the New Economy

- Stimulus presentations

- Key takeaways

- About STL Partners

Table of Figures:

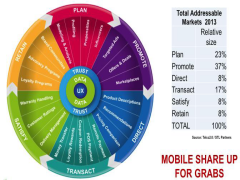

- Figure 1: The relative size of the elements in the wheel of commerce

- Figure 2: The strategy of the proposed anayou mobile commerce venture in MENA

- Figure 3: Deutsche Telekom’s local commerce proposition

- Figure 4: Using locations to find target customers

- Figure 5: Interest in different kinds of mobile offers

- Figure 6: Are mobile offers approaching an inflexion point?

- Figure 7: How the fundamental Amazon flywheel increases working capital

- Figure 8: How the Amazon Payments flywheel has evolved

- Figure 9: The different strands of Visa Europe’s mobile strategy

- Figure 10: Asking consumers to register holds back usage of carrier billing

- Figure 11: The carrier billing uplift in one digital store in Hungary

- Figure 12: Google Wallet tipped to be the number one digital wallet in 2017

- Figure 13: The proportion of mobile transactions to be enabled by NFC in 2017

- Figure 14: Who is best placed to win in facilitating local commerce?

- Figure 15: What scale of transformation is needed in the advertising industry?

- Figure 15: Examples of what major brands are looking for from mobile marketing

- Figure 17: Ordering products featured in a video: The next big thing?

- Figure 18: Using responsive design to optimise a web site for different devices

- Figure 19: Airline miles, a big business, could be a model for telcos

- Figure 20: Mobile currency can be used to reward the mass market

- Figure 21: Mobile’s share of the global advertising market in 2017

- Figure 22: About one third of mobile advertising will be real-time location-based

- Figure 23: Top six strategic opportunities for telcos

- Figure 24: Trust is breaking down between big data stakeholders

- Figure 25: WEF principles for personal data

- Figure 26: Five telco opportunity areas for personal data

- Figure 27: When will most enterprises take the following steps?