| Summary: In this extract from our forthcoming report ‘Cloud 2.0: Telco Strategies in the Cloud’ we outline the key components of Telstra, Singtel and China Mobile’s cloud strategies, and how they compare to the major ‘Big Technology’ players (such as Microsoft, VMWare, IBM, HP, etc.) and ‘Web Giants’ such as Google and Amazon. (November 2012, Executive Briefing Service, Cloud & Enterprise ICT Stream.) |

|

Below is an extract from this 14 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service and the Cloud and Enterprise ICT Stream here. Non-members can subscribe here or other enquiries, please email / call +44 (0) 207 247 5003.

We'll also be discussing our findings at the New Digital Economics Brainstorms in Singapore (3-5 December, 2012).

To share this article easily, please click:

This is an edited extract of Cloud 2.0: Telco Strategies in the Cloud, a new Telco 2.0 Strategy Report to be published next week. The report examines the evolution of cloud services; the current opportunities for vendors and Telcos in the Cloud market, plus a penetrating analysis on the positioning Telcos need to adopt in order to take advantage of the global $200Bn Cloud services market opportunity.

The report shows how CSP’s can create sustainable differentiated positions in Enterprise Cloud. It contains a concise and comprehensive analysis of key vendor and telco strategies, market forecasts (including our own for both the market and telcos), and key technologies.

Led by Robert Brace (formerly Global Head of Cloud Services for Vodafone), it leverages the knowledge and experience of Telco 2.0 analyst team, senior global brainstorm participants, and targeted industry research and interviews. Robert will also be presenting at Digital Asia, 4-5 Dec, Singapore 2012.

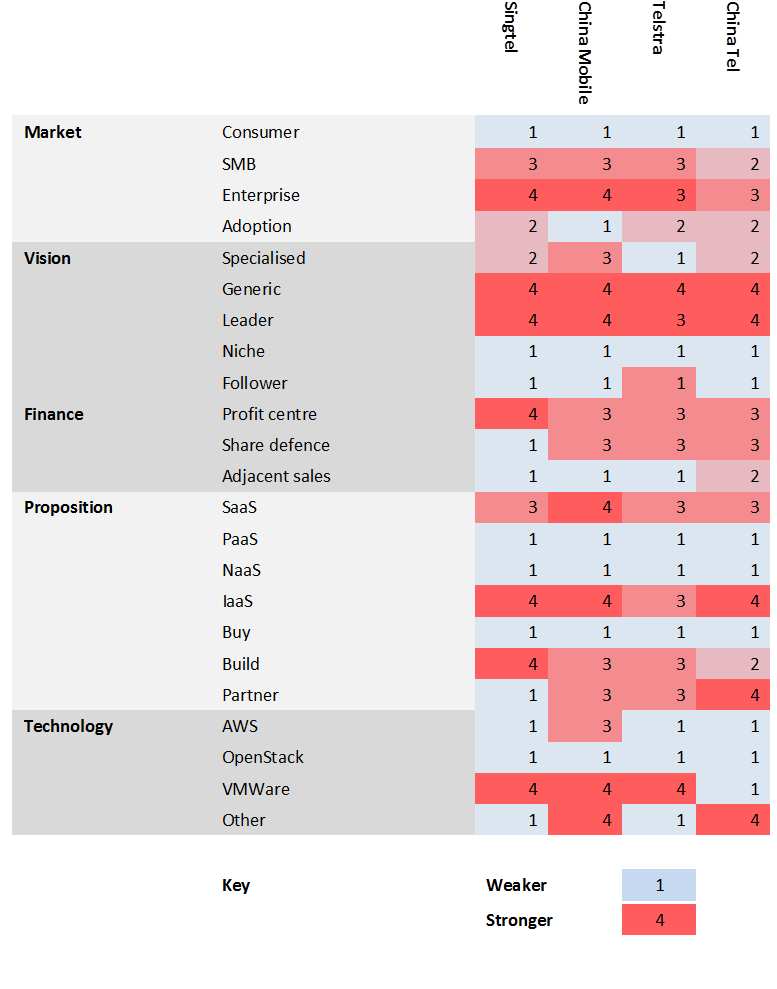

In the full report, we reviewed both telcos and technology companies using a list of 30 criteria organised in six groups (Market, Vision, Finance, Proposition, Value Network, and Technology). We aimed to cover their objectives, strategy, market areas addressed, target customers, proposition strategy, routes to market, operational approach, buy / build partner approach, and technology choices.

We based our analysis on a combination of desk research, expert interviews, and output from our Executive Brainstorms.

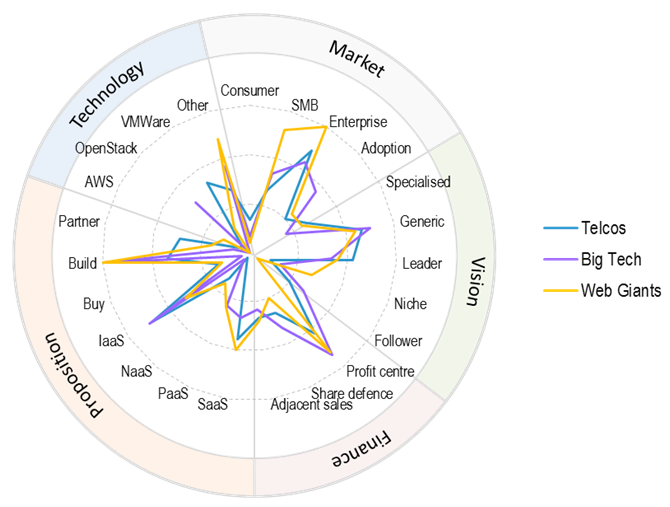

Among the leading cloud technology companies we identify two groups, which we characterise as “Big Tech” and the “Web Giants”. The first of these are the traditional enterprise IT vendors, while the second are the players originating in the consumer web 2.0 space (hence the name).

In the report and our analyses below, we use averages for each of these groups to give a key comparator for telco strategies. The full strategy report contains individual analyses for each of these companies and the following telcos: AT&T, Orange, Telefonica, Deutsche Telekom, Vodafone, Verizon, China Telecom, SFR, Belgacom, Elisa, Telenor, Telstra, BT, Cable and Wireless.

The 'heatmap' table below shows the summary results of a 4-box scoring against our key criteria for the four APAC telcos enterprise cloud product intentions (i.e. what they intend to do in the market), where 1 (light blue) is weakest, 4 (bright red) stronger.

In the full report are similar tables and comparisons for capabilities and used these results to compare telco to vendor strategies and telco to telco strategies where they compete in the same markets.

In this briefing we summarise results for Telstra, Singtel, China Mobile, and China Telecom.

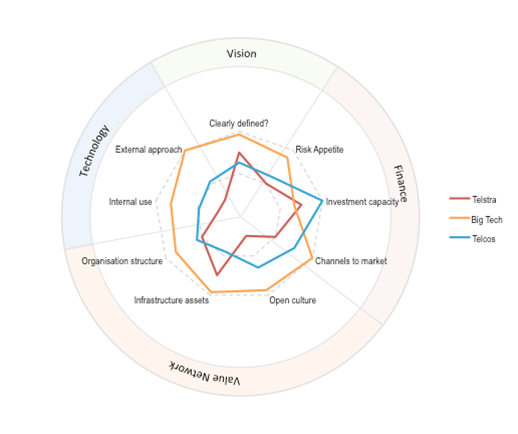

Operating in the somewhat special circumstances of Australia, Telstra is pursuing both an SMB SaaS strategy (typical of mobile operators) and an enterprise IaaS strategy (see Figure 2). Under the first, it resells a suite of business applications centred on Microsoft Office 365, for which it has exclusivity in Australia.

Under the second, it is trying to develop a cloud computing business out of its managed hosting business. VMWare is the main technology provider, with some Microsoft Hyper-V. Unlike many telcos, Telstra benefits from the fact that the major IaaS players are only just beginning to develop data centres in Australia, and therefore cloud applications hosted with Amazon etc. are subject to a considerable latency penalty.

Figure 2: Telstra: A local leader

Source: STL Partners / Telco 2.0

However, data sovereignty concerns in Australia will force other cloud providers to develop at least some presence if they wish to address a variety of important markets (finance, government, and perhaps even mining), and this will eventually bring greater competition.

So far, Telstra has a web portal for the reseller SaaS products, and relies on a mixture of its direct sales force and a partnership with Accenture as a channel for IaaS.

Figure 3: Telstra benefits from geography

Source: STL Partners / Telco 2.0

To read the note in full, including the following analysis...

...and the following figures...

This research report is a part of the ‘Cloud 2.0’ programme. The report was independently commissioned, written, edited and produced by STL Partners.

The Cloud 2.0 programme is a new initiative that brings together STL Partners’ research and senior thought-leaders and decision makers in the fast evolving Cloud ecosystem to develop new propositions and new partnerships. We’d like to thank the sponsors of the programme listed below for their support. To find out more or to join the Cloud 2.0 programme, please email or call +44 (0) 207 247 5003.

Stratus Partners:

![]()