| Summary: an extract from our 284 page, 124 chart, strategy report that analyses the business models, markets, objectives, strategies and modus operandi of the major adjacent players, and their current and future impact on the telecoms industry. The report identifies the areas and options for competition and co-operation, and outlines potential strategies for interacting with each player. It also draws the combined activities of the digital empires - telcos, so called 'OTT players' and others - into the context of the new 'Great Game', the battle for power and value in the emerging digital economy. (Page updated Feburary 2012, report published November 2011. Dealing with Disruption) |  |

To share this article easily, please click:

This report is now availalable to members of our Telco 2.0 Research Dealing with Disruption stream. Below is an extract and list of contents from this 284page strategy Report that can be downloaded in full in PDF format by members of the Dealing with Disruption stream here.

For more on any of these services, please email / call +44 (0) 207 247 5003

"The most comprehensive report on the topic we've seen - a very valuable source of information on how we can deal with these players. The thing that makes it really different is that it has sound recommendations about what operators can actually do, not just treat them as a threat. The workshop was also a great way to help build this thinking into our plans."

SVP, Major European Operator

The report contains analysis of:

|

Pricing and Features |

|

|

This report analyses the strategies behind the success of Amazon, Apple, Facebook, Google and Skype, before going on to consider the key risks they face and how telcos and their partners should deal with these highly-disruptive Internet giants.

As the global economy increasingly goes digital, these five companies are using the Internet to create global brands with much broader followings than those of the traditional telecoms elite, such as Vodafone, AT&T and Nokia. However, the five have markedly different business models that offer important insights into how to create world-beating companies in the digital economy:

There is a clear and growing risk that consumers’ fixation on the products and services provided by the five leading disruptors could leave telcos providing commoditised connectivity and struggling to make a respectable return on their massive investment in network infrastructure and spectrum.

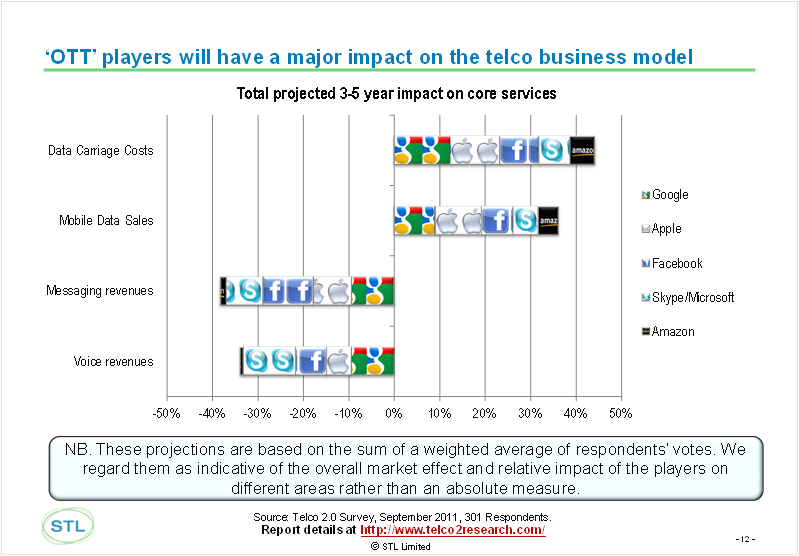

In developed countries, telcos’ longstanding cash-cows – mobile voice calls and SMS - are already being undermined by Internet-based alternatives offered by Skype, Google, Facebook and others. Competition from these services could see telcos lose as much as one third of their messaging and voice revenues within five years (see Figure 1) based on projections from our global survey, carried out in September 2011.

Source: Telco 2.0 online survey, September 2011, 301 respondents

Moreover, most individual telcos lack the scale and the software savvy to compete effectively in other key emerging mobile Internet segments, such as local search, location-based services, digital content, apps distribution/retailing and social-networking.

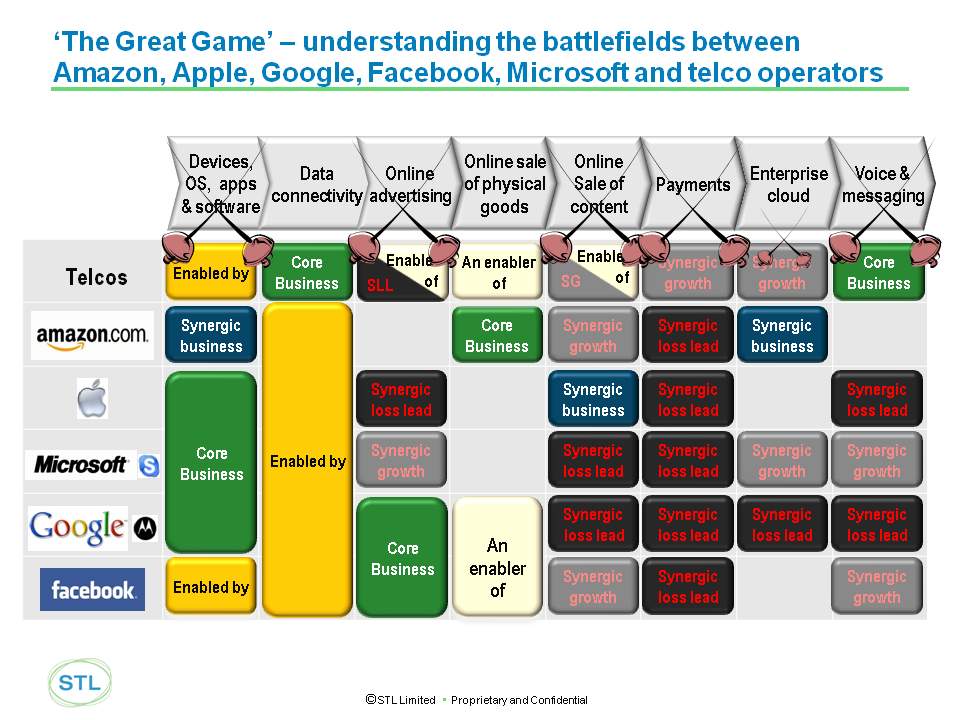

The challenge for telecoms and media companies is to figure out how to deal with the Internet giants in a strategic manner that both protects their core revenues and enables them to expand into new markets. Realistically, that means a complex, and sometimes nuanced, co-opetition strategy, which we characterise as the “Great Game”.

In Figure 3 below, we’ve mapped the players’ roles and objectives against the markets they operate in, giving an indication of the potential market revenue at stake, and telcos’ generic strategies.

Figure 3- The Great Game – Positions, Roles and Strategies

Our in-depth analysis, presented in this report, describes the 'Great Game' and the strategies that we recommend telcos and others can adopt in summary and in detail. [END OF FIRST EXTRACT]

...Members of the Telco 2.0 Dealing with Disruption Stream can download the full 284 page strategy report in PDF format here. Non-Members, please subscribe here. For other enquiries, please email / call +44 (0) 207 247 5003.

To find out more please email , call +44 (0) 207 247 5003.The rest of this page comprises an extract from the report's introduction, covering the 'new world order', investor views, the impact of disruptors on telcos, and how telcos are currently fighting back (including pricing, RCS and WAC), and further details of the report's contents.

The onward march of the Internet into daily life, aided and abetted by the phenomenal demand for smartphones since the launch of the first iPhone in 2007, has created a new world order in the telecoms, media and technology (TMT) industry.

Apple, Google and Facebook are making their way to the top of that order, pushing aside some of the world’s biggest telcos, equipment makers and media companies. This trio, together with Amazon and Skype (soon to be a unit of Microsoft), are fundamentally changing consumers’ behaviour and dismantling longstanding TMT value chains, while opening up new markets and building new ecosystems.

Supported by hundreds of thousands of software developers, Apple, Google and Facebook’s platforms are fuelling innovation in consumer and, increasingly, business services on both the fixed and mobile Internet. Amazon has set the benchmark for online retailing and cloud computing services, while Skype is reinventing telephony, using IP technology to provide compelling new functionality and features, as well as low-cost calls.

On their current trajectory, these five companies are set to suck much of the value out of the telecoms services market, substituting relatively expensive and traditional voice and messaging services with low-cost, feature-rich alternatives and leaving telcos simply providing data connectivity. At the same time, Apple, Amazon, Google and Facebook have become major conduits for software applications, games, music and other digital content, rewriting the rules of engagement for the media industry.

In a Telco2.0 online survey of industry executives conducted in September 2011, respondents said they expect Apple, Google, Facebook and Skype together to have a major impact on telcos’ voice and messaging revenues in the next three to five years . Although these declines will be partially compensated for by rising revenues from mobile data services, the respondents in the survey anticipate that telcos will see a major rise in data carriage costs (see Figure 1 - The potential combined impact of the disruptors on telcos’ core services).

In essence, we consider Amazon, Apple, Facebook, Google and Skype-Microsoft to be the most disruptive players in the TMT ecosystem right now and, to keep this report manageable, we have focused on these five giants. Still, we acknowledge that other companies, such as RIM, Twitter and Baidu, are also shaping consumers’ online behaviour and we will cover these players in more depth in future research.

The Internet is, of course, evolving rapidly and we fully expect new disruptors to emerge, taking advantage of the so-called Social, Local, Mobile (SoLoMo) forces, sweeping through the TMT landscape. At the same time, the big five will surely disrupt each other. Google is increasingly in head-to-head competition with Facebook, as well as Microsoft, in the online advertising market, while squaring up to Apple and Microsoft in the smartphone platform segment. In the digital entertainment space, Amazon and Google are trying to challenge Apple’s supremacy, while also attacking the cloud services market.

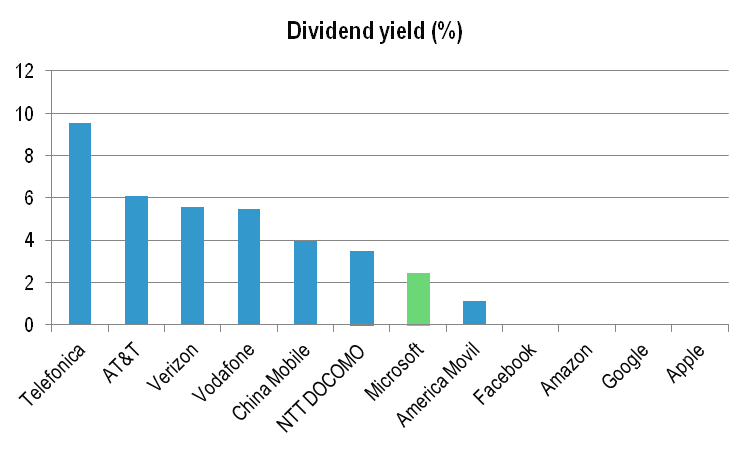

Unlike telcos, the disruptors are generally growing quickly and are under little, or no, pressure from shareholders to pay dividends. That means they can accumulate large war chests and reinvest their profits in new staff, R&D, more data centres and acquisitions without any major constraints. Investors’ confidence and trust enables the disruptors to spend money freely, keep innovating and outflank dividend-paying telcos, media companies and telecoms equipment suppliers.

By contrast, investors generally don’t expect telcos to reinvest all their profits in their businesses, as they don’t believe telcos can earn a sufficiently high return on capital. Figure 16 shows the dividend yields of the leading telcos (marked in blue). Of the disruptors, only Microsoft (marked in green) pays a dividend to shareholders.

Source: Google Finance 2/9/2011

The top telcos’ turnover and net income is comparable, or superior, to that of the leading disruptors, but this isn’t reflected in their respective market capitalisations. AT&T’s turnover is approximately four times that of Google and its net income twice as great, yet their market cap is similar. Even accounting for their different capital structures, investors clearly expect Google to grow much faster than AT&T and syphon off more of the value in the TMT sector.

More broadly, the disparity in the market value between the leading disruptors and the leading telcos’ market capitalisations suggest that investors expect Apple, Microsoft and Google’s revenues and profits to keep rising, while they believe telcos’ will be stable or go into decline. Figure 17 shows how the market capitalisation of the disruptors (marked in green) compares with that of the most valuable telcos (marked in blue) at the beginning of September 2011.

Figure 17: Investors value the disruptors highly

Source: Google Finance 2/9/2011 (Facebook valued at Facebook $66bn based on IPG sale in August 2011)

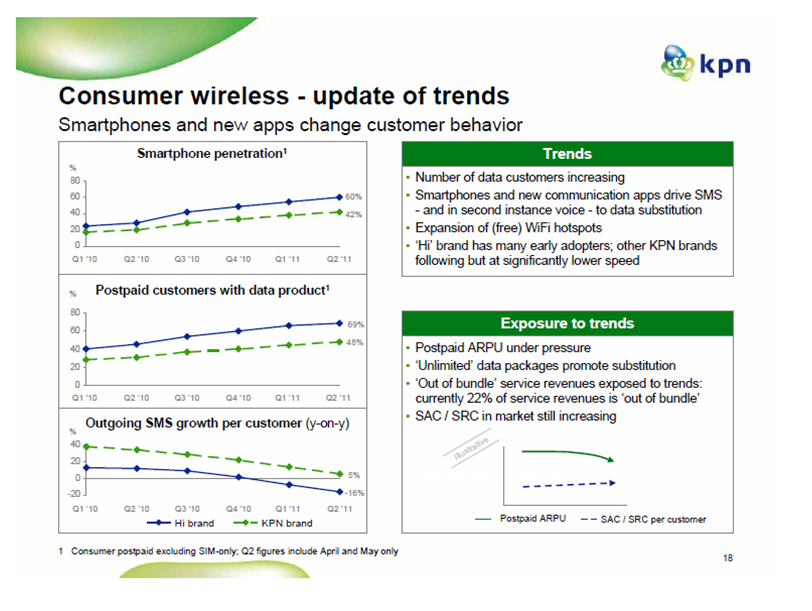

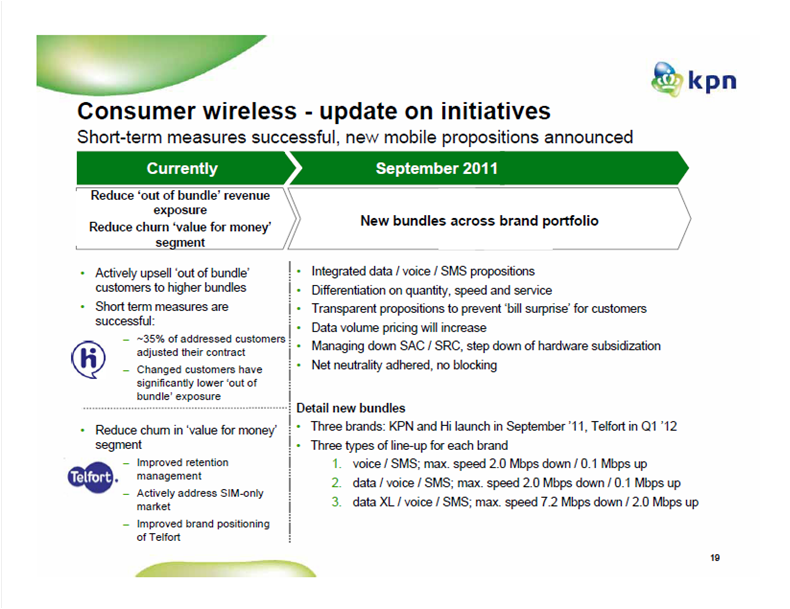

It has taken longer than many commentators expected, but Internet-based messaging and social networking services are finally eroding telcos’ SMS revenues in developed markets. KPN, for example, has admitted that smartphones, equipped with data communications apps (and Whatsapp in particular), are impacting its voice and SMS revenues in its consumer wireless business in its home market of The Netherlands (see Figure 18). Reporting its Q2 2011 results, KPN said that changing consumer behaviour cut its consumer wireless service revenues in Holland by 2% year-on-year.

Source: KPN Q2 results

In the second quarter, Vodafone also reported a fall in messaging revenue in Spain and southern Africa, while Orange saw its average revenue per user from data and SMS services fall in Poland.

Carefully-designed bundles are the most common tactic telcos are using to try and protect their voice and messaging business. Most postpaid monthly contracts now come with hundreds of SMS messages and voice minutes, along with a limited volume of data, bundled into the overall tariff package. This mix encourages consumers to keep using the telcos’ voice and SMS services, which they are paying for anyway, rather than having Skype or another VOIP service soak up their precious data allowance.

To further deter usage of VOIP services, KPN and some other telcos are also creating tiered data tariffs offering different throughput speeds. The lower-priced tariffs tend to have slow uplink speeds, making them unsuitable for VOIP (see Figure 19 below). If consumers want to use VOIP, they will need to purchase a higher-priced data tariff, earning the telco back the lost voice revenue.

Of course, such tactics can be undermined by competition – if one mobile operator in a market begins offering generous data-only tariffs, consumers may well gravitate towards that operator, forcing the others to adjust their tariff plans.

Moreover, bundling voice, SMS and data will generally only work for contract customers. Prepaid customers, who only want to pay for what they are use, are naturally charged for each minute of calls they make and each message they send. These customers, therefore, have a stronger financial incentive to find a free WiFi network and use that to send messages via Facebook or make calls via Skype.

To fend off the threat posed by Skype, Facebook, Google and Apple’s multimedia communications services, telcos are also trying to improve their own voice and messaging offerings. Overseen by mobile operator trade association the GSMA, the Rich Communications Suite is a set of standards and protocols designed to enable mobile phones to exchange presence information, instant messages, live video footage and files across any mobile network.

In an echo of social networks, the GSMA says RCS will enable consumers to create their own personal community and share content in real time using their mobile device.

From a technical perspective, RCS uses the Session Initiation Protocol (SIP) to manage presence information and relay real-time information to the consumer about which service features they can use with a specific contact. The actual RCS services are carried over an IP-Multimedia Subsystem (IMS), which telcos are using to support a shift to all-IP fixed and mobile networks.

Deutsche Telekom, Orange, Telecom Italia, Telefonica and Vodafone have publically committed to deploy RCS services, indicating that the concept has momentum in Europe, in particular. The GSMA says that interoperable RCS services will initially be launched by these operators in Spain, Germany, France and Italy in late 2011 and 2012. [NB We'll be discussing RCSe with some of the operators at our EMEA event in London in November 2011.]

In theory, at least, RCS will have some advantages over many of the communications services offered by the disruptors. Firstly, it will be interoperable across networks, so you’ll be able to reach people using different service providers. Secondly, the GSMA says RCS service features will be automatically available on mobile devices from late 2011 without the need to download and install software or create an account (by contrast, Apple’s iMessage service, for example, will only be installed on Apple devices).

But questions remain over whether RCS devices will arrive in commercial quantities fast enough, whether RCS services will be priced in an attractive way and will be packaged and marketed effectively. Moreover, it isn’t yet clear whether IMS will be able to handle the huge signalling load that would arise from widespread usage of RCS.

Internet messaging protocols, such as XMPP, require the data channel to remain active continuously. Tearing down and reconnecting generates lots of signalling traffic, but the alternative – maintaining a packet data session – will quickly drain the device’s battery.

By 2012, Facebook and Skype may be even more entrenched than they are today and their fans may see no need to use telcos’ RCS services.

Some of the largest mobile operators have tried, and mostly failed, to take on the disruptors at their own game. Vodafone 360, for example, was Vodafone’s much-promoted, but ultimately, unsuccessful €500 million attempt to insert itself between its customers and social networking and messaging services from the likes of Facebook, Windows Live, Google and Twitter.

As well as aggregating contacts and feeds from several social networks, Vodafone 360 also served as a gateway to the telco’s app and music store. But most Vodafone customers didn’t appear to see the need to have an aggregator sit between them and their Facebook feed. During 2011, the service was stripped back to be just the app and music store. In essence, Vodafone 360 didn’t add enough value to what the disruptors are already offering. We understand, from discussions with executives at Vodafone, that the service is now being mothballed.

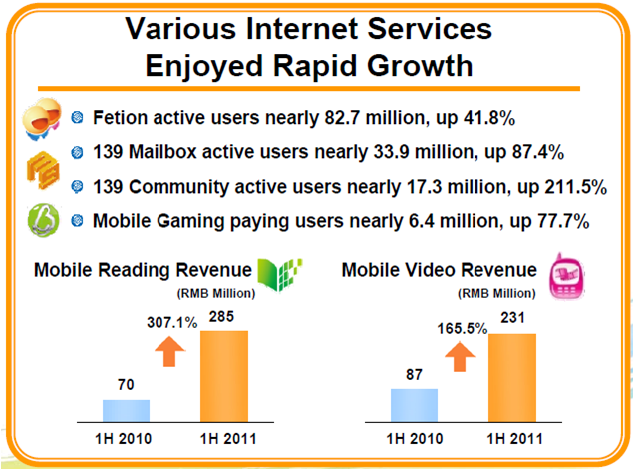

A small number of large telcos, mostly in emerging markets where smartphones are not yet commonplace, have successfully built up a portfolio of value-added consumer services that go far beyond voice and messaging. One of the best examples is China Mobile, which claims more than 82 million users for its Fetion instant messaging service, for example (see Figure 20 - China Mobile’s Internet Services).

Figure 20 - China Mobile’s Internet Services

Source: China Mobile’s Q2 2011 results

However, it remains to be seen whether China Mobile will be able to continue to attract so many customers for its (mostly paid-for) Internet services once smartphones with full web access go mass-market in China, making it easier for consumers to access third-parties’ services, such as the popular QQ social network.

Some telcos have tried to compete with the disruptors by buying innovative start-ups. A good example is Telefonica’s acquisition of VOIP provider Jajah for US$207 million in January 2010. Telefonica has since used Jajah’s systems and expertise to launch low-cost international calling services in competition with Skype and companies offering calling cards. Telefonica expects Jajah’s products to generate $280 million of revenue in 2011, primarily from low-cost international calls offered by its German and UK mobile businesses, according to a report in the FT.

Concerned about their growing dependence on the leading smartphone platforms, such as Android and Apple’s iOS, many of the world’s leading telcos have banded together to form the Wholesale Applications Community (WAC).

WAC’s goal is to create a platform developers can use to create apps that will run across different device operating systems, while tapping the capabilities of telcos’ networks and messaging and billing systems.

At the Mobile World Congress in February 2011, WAC said that China Mobile, MTS, Orange, Smart, Telefónica, Telenor, Verizon and Vodafone are “connected to the WAC platform”, while adding that Samsung and LG will ensure “that all devices produced by the two companies that are capable of supporting the WAC runtime will do so.”

It also announced the availability of the WAC 2.0 specification, which supports HTML5 web applications, while WAC 3.0, which is designed to enable developers to tap network assets, such as in-app billing and user authentication, is scheduled to be available in September 2011.

Ericsson, the leading supplier of mobile networks, is a particularly active supporter of WAC, which also counts leading Alcatel-Lucent, Huawei, LG Electronics, Qualcomm, Research in Motion, Samsung and ZTE, among its members.

In theory, at least, apps developers should also throw their weight behind WAC, which promises the so far unrealised dream of “write once, run anywhere.” But, in reality, games developers, in particular, will probably still want to build specific apps for specific platforms, to give their software a performance and functionality edge over rivals.

Still, the ultimate success or failure of WAC will likely depend on how enthusiastically Apple and Google, in particular, embrace HTML5 and actively support it in their respective smartphone platforms. We discuss this question further in the Apple and Google chapters of this report.

Telcos, and their close allies in the equipment market, are clearly alert to the threat posed by the major disruptors, but they have yet to develop a comprehensive game plan that will enable them to protect their voice and messaging revenue, while expanding into new markets.

Collective activities, such as RCS and WAC, are certainly necessary and worthwhile, but are not enough. Telcos, and companies across the broader TMT ecosystem, need to also adapt their individual strategies to the rise of Amazon, Apple, Facebook, Google and Skype-Microsoft. This report is designed to help them do that.

[END OF EXTRACT]

Organisations, people and products referenced in the report: 3G, 3UK, Accel Partners, Acer, Asus, AdMob, Adobe, AdSense, AdWords, Africa, Akamai, Alcatel-Lucent, Alibaba.com, Amazon, Amazon Prime, Amazon Web Services (AWS), Amazon Web Store, Ancestry.com, Android, Android Market, Angry Birds, Apple, Apple TV, Asia, Asymco, AT&T, Australia, Avaya, AWS, Baidu, Barnes and Noble, BBC, Beacon, Ben Horowitz, Billboard, Bing, BlackBerry, BlackBerry Messenger, Blu-ray, Bobsled, Brazil, BT, Buzz, Cameroon, Canada, Canalys, Caribbean, ChaCha, China, China Mobile, Chrome, Chromebooks, Cisco, Cloud Drive, CloudFormation, Cloudfront, CNet, Coca-Cola, Comcast, comScore, Converse Allstars, Côte d'Ivoire, Dalvik, David Drummond, David Kirkpatrick, Deezer, Dell, Department of Justice (DOJ), Deutsche Telekom, Digital Entertainment Content Ecosystem - DECE, Disney, EasyBits, eBay, EC2, EMI, Eric Schmidt, Ericsson, Europe, Facebook, Facebook Credits, FaceTime, Facetime, FarmVille, FB Zero, Fetion, Flickr, Foursquare, France, Freescale, Friendfeed, Galaxy, Genius, Germany, Gmail, Goldman Sachs, Google, Google Checkout, Google CheckOut, Google Earth, Google Groups, Google Maps, Google News, Google Talk, Google TV, Google Voice, Google Wallet, Google+, GrandCentral, Greylock Partners, GSMA, Guardian, HBO, Hewlett-Packard, HMV, Holland, Honeycomb, Hotmail, HTC, Huawei, Hulu, Hutchison, iAd, Ian Freed, IBM, iBooks, iBookstore, iChat, iCloud, IEEE, IFPI, iMessage, iMessenger, IMS MMTel, India, Intel, Internet Explorer, iOS, iPad, IPG, iPhone, iPods, Iron Man 2, Italy, ITU, iTunes, iTunes Match, J2ME, Jajah, James Hamilton, Janus Friis, Japan, Joel Podolny, KDDI Mobile, Kenya, Kindle, Kindle Fire, Kinect, Korea, KPN, LaLa, Latin America, Latitude, Lenovo, Level 3, LG, Linux, Lion, Logitech, LoveFilm, Lync, Mac, MacBook Air, MacOS, Mango, Marchex, Marissa Mayer, Mark Zuckerberg, Marketplace, MasterCard, Mexico, Microsoft, Microsoft-Nokia deal, Middle East, Mobile World Congress, MobileMe, Motorola, Mozilla, MP3Media, MSN, MTS, MXit, Myriad Group, MySpace, MySQL, NAT, Navteq, NBC Universal, Netflix, Netherlands, News Corp, Newsfeed, NewsStand, Niger, Niklas Zennström, Nokia, Nortel patent portfolio, North America, Norway, Notifications, NTT DOCOMO, Nuance, O2, OCA, Oceania, Ofcom, Office Live, Open Compute Alliance, OpenSocial, OpenStack, Orange, Orkut, Outlook, Ovi, PageRank, Pandora, Paul Allen, PayPal, PayPass, Peter Thiel, Philippines, Picasa, Pixar, Placebase, Poland, Poly9, PowerPoint, Python, Qik, QQ, Qualcomm, QuickTime, Quiz Planet, RCS, RDS, Reddit.com, Reminders, Research in Motion, Rhapsody, Ribbit, RIM, Route 53, Rovio, Russia, Safari, salesforce.com, Samsung, SAP, SEC, Senegal, Silicon Valley, SILK V3, Silver Lake, Simple Storage Service (S3), Siri, Sky Go, Skyhook, Skype, Skype Connect, SkypeIn, SkypeKit, SkypeOut, SkypePhone, SkyPlayer, Snow Leopard, Sony, Southern Africa, Spain, Spotify, Sprint, Stephan Hadinger, Steve Ballmer, Steve Jobs, Symbian, TechCrunch, Telefónica, Telenor, Teredo, Tesco, Texas Instruments, T-Mobile, Tony Jacobs, Toshiba, Toyota, Tropo, Turner Broadcasting, Twentieth Century Fox, Twilight Saga, Twilio, Twitter, Uganda, UK, UltraViolet, US, Verizon, Verizon Wireless, Viacom, Vic Gundotra, Victoria's Secret, Virgin, Virgin Media, Visa, Visual Studio, Vodafone, Vodafone 360, WAC, Wall Street Journal, Wal-Mart, Washington Post, Wave, WebEx, Werner Vogels, WhatsApp, Wholesale Applications Community (WAC), Widevine, Windows Mobile, Windows Phone, Windows Phone 7, Windows Server 2008, WindowShop, Worldwide Developer Conference (WWDC), Xbox, X-Series, Yahoo!, Yandex, YouTube, ZTE, Zynga.

Technologies and industry terms referenced: Activation, Advertising, API, App Store, apps, Authentication and Payments, Availability Zone, Border Gateway Protocol, business model, Call Detail Records (CDR), carrier billing, CDMA, CDN,click-through rates, Cloud Services, CloudFail, Comes with Data, Compatibility Definition Document (CDD), connectivity, content, ContentID, co-opetition strategy, CPM, customer data, dark fibre, data centre, dialler, digital content, digital economy, digital entertainment, digital media, digital money, disruption, DNS, dogfooding, DRM, DVDs, CRM, e-book, ecosystem, Elastic Block Service (EBS), Exchange Server, femtocells, films, fixed broadband, games, GPS, GSM, happy pipe, HD voice, HTML5, HTTP/S, Hybrid Cloud, IM, infrastructure, Infrastructure as a Service (IaaS), innovation, IP, IP networks, IP-Multimedia Subsystem (IMS), IPTV, IPv4, IPv6, kaizen, latency, local search, location-based services, long-tail, LTE, MMS, mobile broadband, mobile Internet, mobile money transfer, Motorola Mobility, movie streaming, MP3, music, Net Neutrality, network effects, NFC, OAuth 2.0, online payment, P2P, PBX, PCs, personal data, Places, Platform as a Service (PaaS), power supply units (PSUs), Presence, privacy, Project Spartan, PSTN, R&D, regulators, RESTful (Representational State Transfer), Rich Communications Suite (RCS), Session Initiation Protocol (SIP), signalling, SIM, SIM-based identification, SIP, Smart, smartphones, SMS, Social graph, social network, Software as a Service (SaaS), software engineering skills, strategy, SS7, supernode, tablets, tariff plans, telecom, tipping point, TMT, transformation, two-sided, URI, video, video telephony, Virtual Private Cloud, Voice & Messaging, Voice recognition, VOIP, VOIP over mobile networks, VPC, VPN, wallets, Wideband audio, WiFi, WLAN, WLAN, hotspot, credit, service, WP7, XMPP.