| Summary: Google's shares have made little headway recently despite its dominance in search and advertising, and it faces increasing regulatory threats in this area. It either needs to find new sources of value growth or start paying out dividends, like Microsoft, Apple (or indeed, a telco). Overall, this is resulting in something of a strategic identity crisis. A review of Google's strategy and implications for Telcos. (March 2012, Executive Briefing Service, Dealing with Disruption Stream). |

|

Below is an extract from this 24 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service and the Telco 2.0 Dealing with Disruption Stream here. Non-members can subscribe here, buy a Single User license for this report online here for £595 (+VAT for UK buyers), or for multi-user licenses or other enquiries, please email / call +44 (0) 207 247 5003. We'll also be discussing our findings and more on Google at the Silicon Valley (27-28 March) and London (12-13 June) New Digital Economics Brainstorms.

To share this article easily, please click:Google appears to be suffering from a strategic identity crisis. It is the giant of search advertising but it also now owns a handset maker, fibre projects, an increasingly fragmented mobile operating system, a social network of questionable success, and a driverless car programme (among other things). It has a great reputation for innovation and creativity, but risks losing direction and value by trying to focus on too many strategies and initiatives.

We believe that Google needs to stop trying to copy what Apple and Facebook are doing, de-prioritise its ‘Hail Mary’ hunt for a strategy (e.g. driverless cars), and continue to build new solutions that serve better the customers who are already willing to pay – namely, advertisers.

It is our view that the companies who have created most value in the market have done so by solving a customer problem really well. Apple’s recent success derives from creating a simpler and more beautiful way (platform + products) for people to manage their digital lives. People pay because it’s appealing and it works.

Google initially solved how people could find relevant information online and then, critically, how to use this to help advertisers get more customers. They do this so well that Google’s $37bn revenues continue to grow at double digit pace, and there’s plenty of headroom in the market for now. While the TV strategy may not yet be paying off, it would seem sensible to keep working at it to try to keep extending the reach of Google’s platform.

While Android keeps Google in the mobile game to a degree, and has certainly helped to constrain certain rivals, we think Google should cast a hard eye over its other competing and distracting activities: Motorola, Payments, Google +, Driverless Cars etc. Its management team should look at the size of the opportunity, the strength of the competition, and their ability to execute in each.

Pruning the projects might also lose Google an adversary or two, and it might also afford some reward to shareholders too. After all, even Apple has recently decided to pay back some cash to investors.

This may be very difficult for Google’s current leadership. Larry Page seems to have the restless instincts of the stereotypical Valley venture capitalist, hunting the latest ideas, and constantly trying to create the next big beautiful thing. The trouble is that this is Google in 2012, not 1995, and it looks to us at least that a degree of ‘sticking to the knitting’ within Google’s huge, profitable and growing search advertising business may be a better bet than the highly speculative (and expensive) ‘Hail Mary’ strategy route.

This may sound surprising coming from us, the inveterate fans of innovation at Telco 2.0, so we’d like to point out some important differences between the situations that Google and the telcos are in:

In January this year, Google achieved a first – it missed the consensus forecast for its quarterly earnings. There is of course no magic in the consensus, which is an average of highly conventionalised guesses from a bunch of City analysts, but it is as good a moment as ever to review Google’s strategic position. If you bought Google stock at the beginning, you may not need to read this, as you’re probably very rich (the return since then is of the order of 400%). The entirety of this return, however, is accounted for by the 2004-2007 bull run. On a five-year basis, Google stock is ahead 30%, which sounds pretty impressive (a 6% annual return), but again, all the growth is accounted for by the last surge upwards over the summer of 2007. The peak was achieved on the 2nd of November, 2007.

As this chart shows, Google stock is still down about 9% from the peak, and perhaps more importantly, its path tracks Microsoft very closely indeed. Plus Microsoft investors get a dividend, whereas Google investors do not.

Larry Page is reported to have said that “Google is no longer a "search company." He says its model is now

“invent wild things that will help humanity, get them adopted by users, profit, and then use the corporate structure to keep inventing new things.”

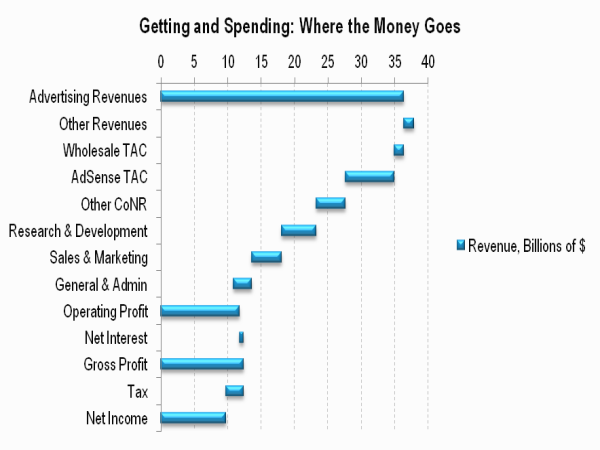

No longer a search company? Take a look at the revenues. Out of Google’s $37.9bn in revenues in 2011, $36bn came from advertising, aka the flip side of Google Search. Despite a whole string of mammoth product launches since 2007, Google’s business is essentially what it was in 2007 – a massive search-based advertising machine.

Our last Google coverage – Android: An Anti-Apple Virus ? and the Dealing with the Disruptors Strategy Report suggested that the search giant was suffering from a lack of direction, although some of this was accounted for by a deliberate policy of experimenting and shutting down failed initiatives.

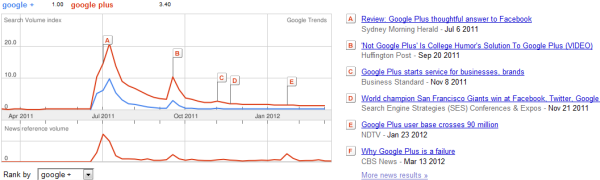

Since then, Google has launched Google +, closed Google Buzz, and closed Google Wave while releasing it into a second life as an open-source project. It has been involved in major litigation over patents and in regulatory inquiries. It has seen an enormous boom in Android shipments but not necessarily much revenue. It is about to become a major hardware manufacturer by acquiring Motorola. And it has embarked on extensive changes to the core search product and to company-wide UI design.

In this note, we will explore Google's activities since our last note, summarise key threats to the business and strategies to counter them, and consider if a bearish view of the company is appropriate.

We've found it convenient to organise Google’s business into several themed groups as follows:

Pyrrhic victory is defined as a victory so costly it is indistinguishable from defeat. Although there is nothing so bad at Google, it seems to have a knack of creating products that are hugely successful without necessarily generating cash. Android is exhibit A.

The obvious point here is surging, soaring growth – forecasts for Android shipments have repeatedly been made, beaten on the upside, adjusted upwards, and then beaten again. Android has hugely expanded the market for smartphones overall, caused seismic change in the vendor industry, and triggered an intellectual property war. It has found its way into an awe-inspiring variety of devices and device classes.

But questions are still hanging over how much actual money is involved. During the Q4 results call, a figure for “mobile” revenues of $2.5bn was quoted. This turns out to consist of advertising served to browsers that present a mobile device user-agent string. However, Google lawyer Susan Creighton is on record as saying that 66% of Google mobile web traffic originates from Apple iOS devices. It is hard to see how this can be accounted for as Android revenue.

Further, the much-trailed “fragmentation” began in 2011 with a vengeance. “Forkdroids”, devices using an operating system based on Android but extensively adapted (“forked” from the main development line), appeared in China and elsewhere. Amazon’s Kindle Fire tablet is an example closer to home.

And the intellectual property fights with Oracle, Apple, and others are a constant source of disruption and a potentially sizable leakage of revenue. In so far as Google’s motivation in acquiring Motorola Mobility was to get hold of its patent portfolio, this has already involved very large sums of money. Another counter-strategy is the partnership with Intel and Lenovo to produce x86-based Android devices, which cannot be cheap either and will probably mean even more fragmentation.

This is not the only example, though – think of Google Books, an extremely expensive product which caused a great deal of litigation, eventually got its way (although not all the issues are resolved), and is now an excellent free tool for searching in old books but no kind of profit centre. Further, Google’s patented automatic scanning has the unfortunate feature of pulling in marginalia, etc. from the original text that its rivals (such as Amazon Kindle) don’t.

Further, Google has recently been trying to monetise one of its classic products, the Google Maps API that essentially started the Web 2.0 phenomenon, with the result that several heavy users (notably Apple and Foursquare) have migrated to the free OpenStreetMap project and its OpenLayers API.

Like a telco, Google is dependent on one key source of revenue that cross-subsidises the rest of the company – search-based advertising.

[NB TAC = Traffic Acquisition Cost, CoNR = Cost of Net Revenues]

Having proven to be a category killer for search and advertising across the whole of the Internet, the twins (search and ads) are hugely critical for Google and also for millions of web sites, content creators, and applications developers. As a result, just like a telco, they are increasingly subject to regulation and political risk.

Google search rankings have always been subject to an arms race between the black art of search-engine optimisation and Google engineers’ efforts to ensure the integrity of their results, but the whole issue has taken a more serious twist with the arrival of a Federal Trade Commission inquiry into Google’s business practices. The potential problems were dramatised by the so-called “white lady from Google” incident at Google Kenya, where Google employees scraped a rival directory website’s customers and cold-called them, misrepresenting their competitors’ services, and further by the $500 million online pharmacy settlement. Similarly, the case of the Spanish camp site that wants to be disassociated from horrific photographs of a disaster demonstrates both that there is a demand for regulation and that sooner or later, a regulator or legislator will be tempted to supply it.

The decision to stream Google search quality meetings online should be seen in this light, as an effort to cover this political flank.

As well as the FTC, there is also substantial regulatory risk in the EU. The European Commission, in giving permission for the Motorola acquisition, also stated that it would consider further transactions involving Google and Motorola’s intellectual property on a case-by-case basis. To put it another way, after the Motorola deal, the Commission has set up a Google Alert for M&A activity involving Google.

Google is in the process of a far-reaching refresh of its user interfaces, graphic design, and core search product. The new look affects Search, GMail, and Google + so far, but is presumably going to roll out across the entire company. At the same time, they have begun to integrate Google + content into the search results.

This is, unsurprisingly, controversial and has attracted much criticism, so far only from the early adopter crowd. There is a need for real data to evaluate it. However, there are some reasons to think that Search is looking in the wrong place.

Since the major release codenamed Caffeine in 2008, Google Search engineers have been optimising the system for speed and for first-hit relevance, while also indexing rapidly-changing content faster by redesigning the process of “spidering” web sites to work in parallel. Since then, Google Instant has further concentrated on speed to the first result. In the Q4 results, it was suggested that mobile users are less valuable to Google than desktop ones. One reason for this may be that “obvious” search – Wikipedia in the first two hits – is well served by mobile apps. Some users find that Google’s “deep web” search has suffered.

Under “Google and your world”, recommendations drawn from Google + are being injected into search results. This is especially controversial for a mixture of privacy and user-experience reasons. Danny Sullivan’s SearchEngineLand, for example, argues that it harms relevance without adding enough private results to be of value. Further, doubt has been cast on Google’s numbers regarding the new policy of integrating Google accounts into G+ and G+ content into search.

Another, cogent criticism is that it introduces an element of personality that will render regulatory issues more troublesome. When Google’s results were visibly the output of an algorithm, it was easier for Google to claim that they were the work of impartial machines. If they are given agency and associated with individuals, it may be harder to deny that there is an element of editorial judgment and hence the possibility of bias involved.

Social search has been repeatedly mooted since the mid-2000s as the next-big-thing, but it seems hard to implement. Yahoo!, Facebook, and several others have tried and failed.

It is possible that Google may have a structural weakness in design as opposed to engineering (which is as excellent as ever). This may explain why a succession of design-focused initiatives have failed – Wave and Buzz have been shut down, Google TV hasn’t gained traction (there are less than one million active devices), and feedback on the developer APIs is poor.

Google’s tendency to launch new products is as intimidating as ever. However, there is a strong argument that its tireless creativity lacks focus, and the hit-rate is worrying low. Does Google really need two cut-down OSs for ultra-mobile devices? It has both Android, and ChromeOS, and if the first was intended for mobile phones and the second for netbooks, you can now buy a netbook-like (but rather more powerful) Asus PC that runs Android. Further, Google supports a third operating system for its own internal purposes – the highly customised version of Linux that powers the Google Platform – and could be said to support a fourth, as it pays the Mozilla Foundation substantial amounts of money under the terms of their distribution agreement and their Boot to Gecko project is essentially a mobile OS. IBM also supported four operating systems at its historic peak in the 1980s.

Also, does Google really need to operate an FTTH network, or own a smartphone vendor? The Larry Page quote we opened with tends to suggest that Google’s historical tendency to do experiments is at work, but both Google’s revenue raisers (Ads and YouTube, which from an economic point of view is part of the advertising business) date from the first three years as a public company. The only real hit Google has had for some time is Android, and as we have seen, it’s not clear that it makes serious money.

Google Wallet, for example, was launched with a blaze of publicity, but failed to attract support from either the financial or the telecoms industry, rather like its predecessor Google Checkout. It also failed to gain user adoption, but it has this in common with all NFC-based payments initiatives. Recently, a major security bug was discovered, and key staff have been leaving steadily, including the head of consumer payments. Another shutdown is probably on the cards.

Meanwhile, a whole range of minor applications have been shuttered.

Another heavily hyped project which does not seem to be gaining traction is the Chromebook, the hardware-as-a-service IT offering aimed at enterprises. This has been criticised on the basis that its $28/seat/month pricing is actually rather high. Over a typical 3 year depreciation cycle for IT equipment, it’s on a par with Apple laptops, and has the restriction that all the applications must work in a Web browser on netbook-class hardware. Google management has been promoting small contract wins in US school districts . Meanwhile, it is frequently observed that Google’s own PC fleet consists mostly of Apple hardware. If Google won’t use them itself, why should any other enterprise IT shop do so? The Google Search meeting linked above contains 2 Lenovo ThinkPads and 13 Apple MacBooks of various models and zero Chromebooks, while none other than Eric Schmidt used a Mac for his MWC 2012 keynote. Traditionally, Google insisted on “dogfooding” its products by using them internally.

The Google Fibre project in Kansas City, for its part, has been struggling with regulatory problems related to its access to city-owned civil infrastructure. Kansas City’s utility poles have reserved areas for different services, for example telecoms and electrical power. Google was given the concession to string the fibre in the more spacious electrical section – however, this requires high voltage electricians rather than telecoms installers to do the job and costs substantially more. Google has been trying to change the terms, and use the telecoms section, but (unsurprisingly) local cable and Bell operators are objecting. As with the muni-WLAN projects of the mid-2000s, the abortive attempt to market the Nexus One without the carriers, and Google Voice, Google has had to learn the hard way that telecoms is difficult.

And while all this has been going on, you might wonder where Google Enterprise 2.0 or Google Ads 2.0 are.

Google recently announced its “new ecosystem”, Google Play. This consists of what was historically known as the Android Market, plus Google Books, Google Music, and the web-based elements of Google Wallet (aka Google Checkout). All of these products are more or less challenged. Although the Android Market has been a success in distributing apps to the growing fleets of Android devices, it continues to contain an unusually high percentage of free apps, developer payouts tend to be lower than on its rivals, and it has had repeated problems with malware. Google Books has been an expensive hobby, involving substantial engineering work and litigation, and seems unlikely to be a profit centre. Google Music – as opposed to YouTube – is also no great success, and it is worth asking why both projects continue.

However, it will be the existing manager of Google Music who takes charge, with Android Market management moving out. It is worth noting that in fact there were two heads of the Android Market – Eric Chu for developer relations and David Conway for product management. This is not ideal in itself.

Further, an effort is being made to force app developers to use the ex-Google Checkout system for in-app billing. This obviously reflects an increased concern for monetisation, but it also suggests a degree of “arguing with the customers”.

To read the note in full, including the following additional analysis...

...and the following figures...

...Members of the Telco 2.0 Executive Briefing Subscription Service and the Telco 2.0 Dealing with Disruption Stream can download the full 24 page report in PDF format here. Non-Members, please subscribe here, buy a Single User license for this report online here for £595 (+VAT for UK buyers), or for multi-user licenses or other enquiries, please email / call +44 (0) 207 247 5003.

Organisations, geographies, people and products referenced: AdSense, AdWords, Amazon, Android, Apple, Asus, AT&T, Australia, BBVA, Bell Labs, Boot to Gecko, Caffeine, CES, China, Chromebook, ChromeOS, ContentID, David Conway, Eric Chu, Eric Schmidt, European Commission, Facebook, Federal Trade Commission, GMail, Google, Google +, Google Books, Google Buzz, Google Checkout, Google Maps, Google Music, Google Play, Google TV, Google Voice, Google Wave, GSM, IBM, Intel, Kenya, Keyhole Software, Kindle Fire, Larry Page, Lenovo, Linux, MacBooks, Microsoft, Motorola, Mozilla Foundation, Netflix, Nexus, Office 365, OneNet, OpenLayers API, OpenStreetMap, Oracle, Susan Creighton, ThinkPads, VMWare, Vodafone, Western Electric, Wikipedia, Yahoo!, Your World, YouTube, Zynga

Technologies and industry terms referenced: advertisers, API, content acquisition costs, driverless car, Fibre, Forkdroids, M&A, mobile apps, muni-WLAN, NFC, Search, smart TV, spectrum, UI, VoIP, Wallet