|

Summary: In the next 10 years, many industries face the 'Great Compression' in which, in addition to the pressures of ongoing global economic uncertainty, there is also a major digital transformation that is destroying traditional value and moving it 'disruptively' to new areas and geographies. For the incumbent industry players we call the near-term results of this disruption 'The Digital Hunger Gap' – the widening deficit between past and projected revenues. This is our analysis of the top-level findings of the 2013 Silicon Valley Executive Brainstorm. (March 2013, Executive Briefing Service, Transformation Stream.) |

|

The note below summarises some of the key themes emerging from the Brainstorm, and is an extract from a 20 page Telco 2.0 Briefing Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service and the Telco 2.0 Transformation Stream here. We'll also be discussing the impact of the 'hunger gap' on telecoms and other industries at our Executive Brainstorms on London (5-6 June) and Dubai (12-13 Nov). Non-members can find out more about subscriptions here or find out more about this and/or the Brainstorm by emailing or calling +44 (0) 207 247 5003.

The Silicon Valley Brainstorm took place on 19-20 March 2013, at the Intercontinental Hotel, San Francisco.

Part of the New Digital Economics Executive Brainstorm & Innovation Series, it built on output from previous events in Singapore, Dubai, London and New York, and new market research and analysis, and focused on new business models and growth opportunities in digital commerce, content and the Internet of Things.

In the next 10 years, many industries face the ‘Great Compression’ in which, in addition to the pressures of ongoing global economic uncertainty, there is also a major digital transformation that is destroying traditional value and moving it ‘disruptively’ to new areas and geographies, albeit at diminished levels.

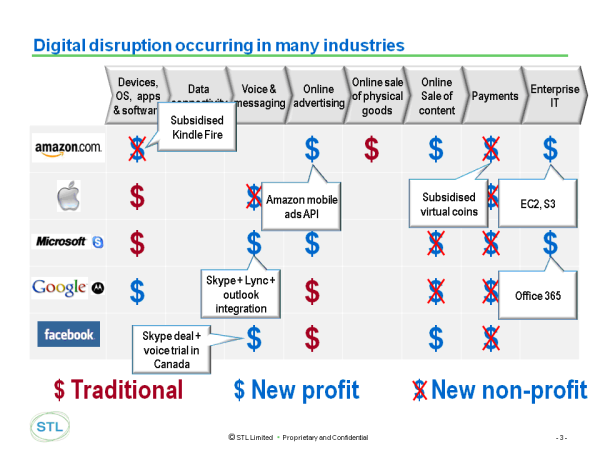

In previous analyses (e.g. Dealing with the 'Disruptors': Google, Apple, Facebook, Microsoft/Skype and Amazon) we have shown how key technology players in particular compete with different objectives in different parts of the digital value chain. Figure 1 below shows via crossed dollar signs (‘New Non-Profit’) the areas in which companies are competing without the primary intention of driving profits, which means that traditional competitors in those areas can expect ‘disruptive’ competition from new business models.

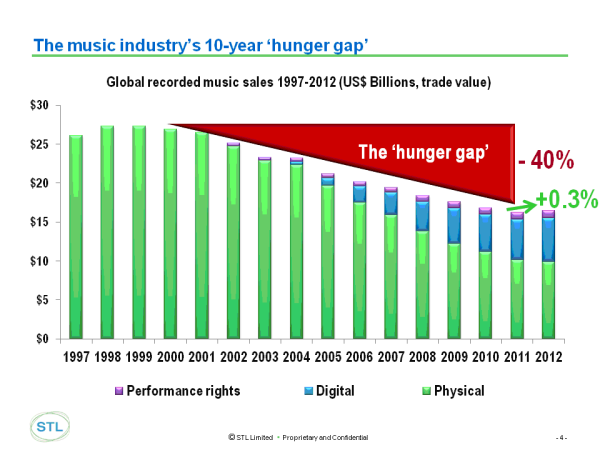

For the incumbent industry players we call the near-term results of this disruption ‘The Digital Hunger Gap’ – the widening deficit between past and projected revenues. Chris Barraclough, Chief Strategist STL Partners presented the classic Music Industry case study of the ‘Hunger Gap’ effects of digital disruption.

In a vote, 95% of participants agreed that something similar would happen in other industries.

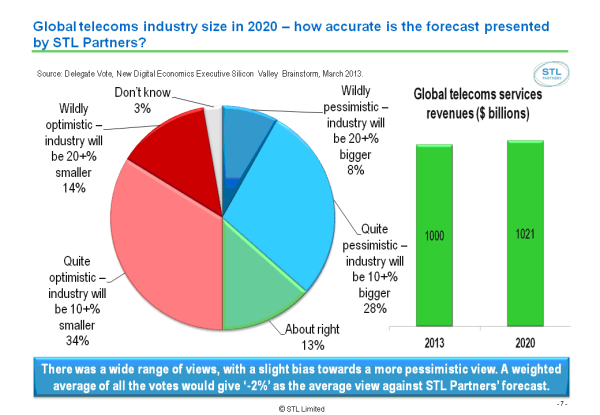

Chris then presented our initial analysis of the ‘Hunger Gap’ for telcos (to be published in full shortly), and asked the participants where they thought the telco industry would be relative to its 2012 position in 2020.

As can be seen, participants' views were widely spread, with a slight bias towards a more pessimistic outlook than that presented of a recovery to 2012 levels.

Chris argued that as the ‘hunger gap’ widens, and before new revenues are developed, there will be massive consolidation and cost-reduction among incumbent players, and opportunities for innovation in services, but the chances of success in the latter are very low and require a portfolio approach and either deep pockets, exceptional insight, or considerable good fortune.

Richard Kramer, Managing Partner of Arete Research, also presented a deflationary outlook for all but the leading consumer technology players in the handset and tablet arena.

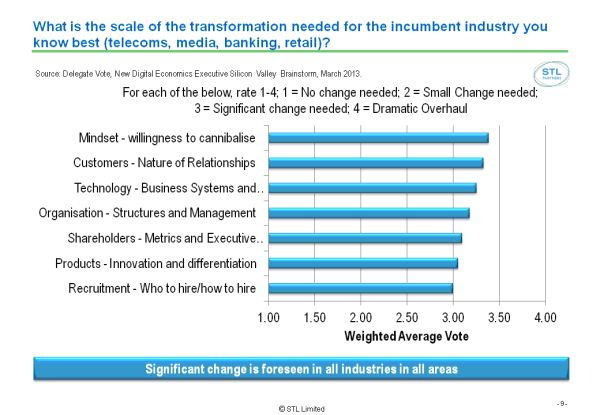

Participants then voted on which areas needed the most significant changes in their business – and existing managements' ‘mindset’ was voted as the top priority.

It is also notable that all categories averaged 3.0 or over – or needing ‘Significant Change’. This points to a significant transformation across all industries.

To read the note in full, including the following sections detailing additional analysis...

...and the following figures...

...Members of the Telco 2.0 Executive Briefing Subscription Service and the Telco 2.0 Transformation Stream can download the full 20 page report in PDF format here. Non-Members, please subscribe here. For this or other enquiries, please email / call +44 (0) 207 247 5003.

Produced and facilitated by business innovation firm STL Partners, the 2013 Silicon Valley Brainstorm brought together 150 specially-invited senior executives from across the communications, media, retail, banking and technology sectors, including:

The Brainstorm used STL's unique ‘Mindshare’ interactive format, including cutting-edge new research, case studies, use cases and a showcase of innovators, structured small group discussion on round-tables, panel debates and instant voting using on-site collaborative technology.

We’d like to thank the sponsors of the Brainstorm: