|

Summary: Albeit pioneering, Telefonica’s Digital business unit as was lacked focus and combined too many clashing cultures and incompatible businesses. Our latest analysis sees the change as ‘the end of the beginning’ for Telefonica’s Telco 2.0 services, and summarises lessons for all players implementing strategic transformation. (March 2014, Executive Briefing Service, Transformation Stream.) |

|

Below is an extract from this 23 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service and the Telco 2.0 Transformation stream here. Non-members can find out about the service and how to subscribe here. For other enquiries, please email / call +44 (0) 207 247 5003.

Telefonica is one of the companies that we have analysed in depth in the Telco 2.0 Transformation Index research. In this report, we analyse Telefonica’s recent announcement that it is restructuring its Digital Business unit. We’ll also be exploring strategies for transformation at the OnFuture EMEA 2014 Brainstorm, June 11-12, London.

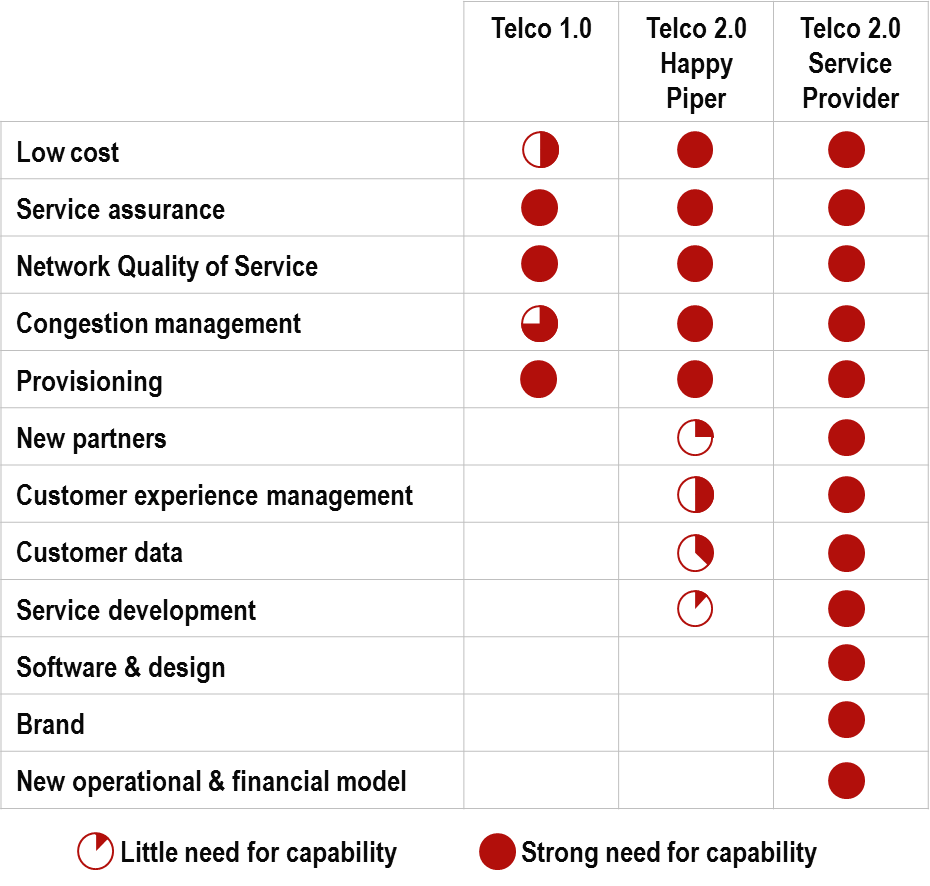

We have defined Telco 2.0 and, specifically, Telco 2.0 Happy Piper and Telco 2.0 Service Provider strategies in other reports so will not focus on the implications of each on service offerings and customer segments here. It is, however, important to understand the implications each strategy has on the organisation in terms of capability requirements and, by definition, on organisation design – structure, processes, skills and so forth.

As Figure 1 shows, the old Telco 1.0 world required CSPs to focus on infrastructure-oriented capabilities – cost, service assurance, provisioning, network quality of service, and congestion management.

For a Telco 2.0 Happy Piper, these capabilities are even more important:

Telco 2.0 Happy Pipers also need to expand their addressable market in order to thrive – into Infrastructure Services, M2M, Embedded Connectivity and, in some cases, into Enterprise ICT including bespoke vertical industry solutions. For sure this requires some new Service Development capabilities but, perhaps more importantly, also new partnerships – both in terms of service development and delivery – and a greater focus on Customer Experience Management and ‘Customer data/Big data’ in order to deliver valuable solutions to demanding enterprise customers.

For a Telco 2.0 Service Provider, the range of new capabilities required is even greater:

Source: STL Partners/Telco 2.0

STL Partners analysis suggests that the majority of CSPs (and certainly all the tier 1 and 2 players) have at least some aspirations as a Telco 2.0 Service Provider. Several, such as AT&T, Deutsche Telekom Orange, SingTel, Telefonica and Telenor, have been public with their ‘digital services’ aspirations.

But even more circumspect players such as Verizon and Vodafone which have to date largely focused on core telecommunications services have aspirations to move beyond this. Verizon, for example, is participating in the ISIS joint venture on payments, albeit something of a slow burn at present. Vodafone has also pushed into payments in developing markets via its successes with mPesa in Kenya and is (perhaps a slightly reluctant) partner in the WEVE JV in the UK on digital commerce.

Further back in their Telco 2.0 development owing to the attractiveness of their markets from a Telco 1.0 perspective are the players in the rapidly developing Middle Eastern and Asian markets such as Axiata, Etisalat, Mobily, Ooredoo, and Zain. These players too aspire to achieve more than Happy Piper status and are already pushing into advertising, content and payments for consumers and M2M and Cloud for enterprises.

It is clear that there is no consensus among management about how to implement Telco 2.0 services. This is not surprising given how new it is for telecoms operators to develop and deliver new services – innovation is not something associated with telcos. Everyone is learning how to take their first tentative steps into the wonderful but worrisome world of innovation – like toddlers stepping into the shallow beach waters of the ocean.

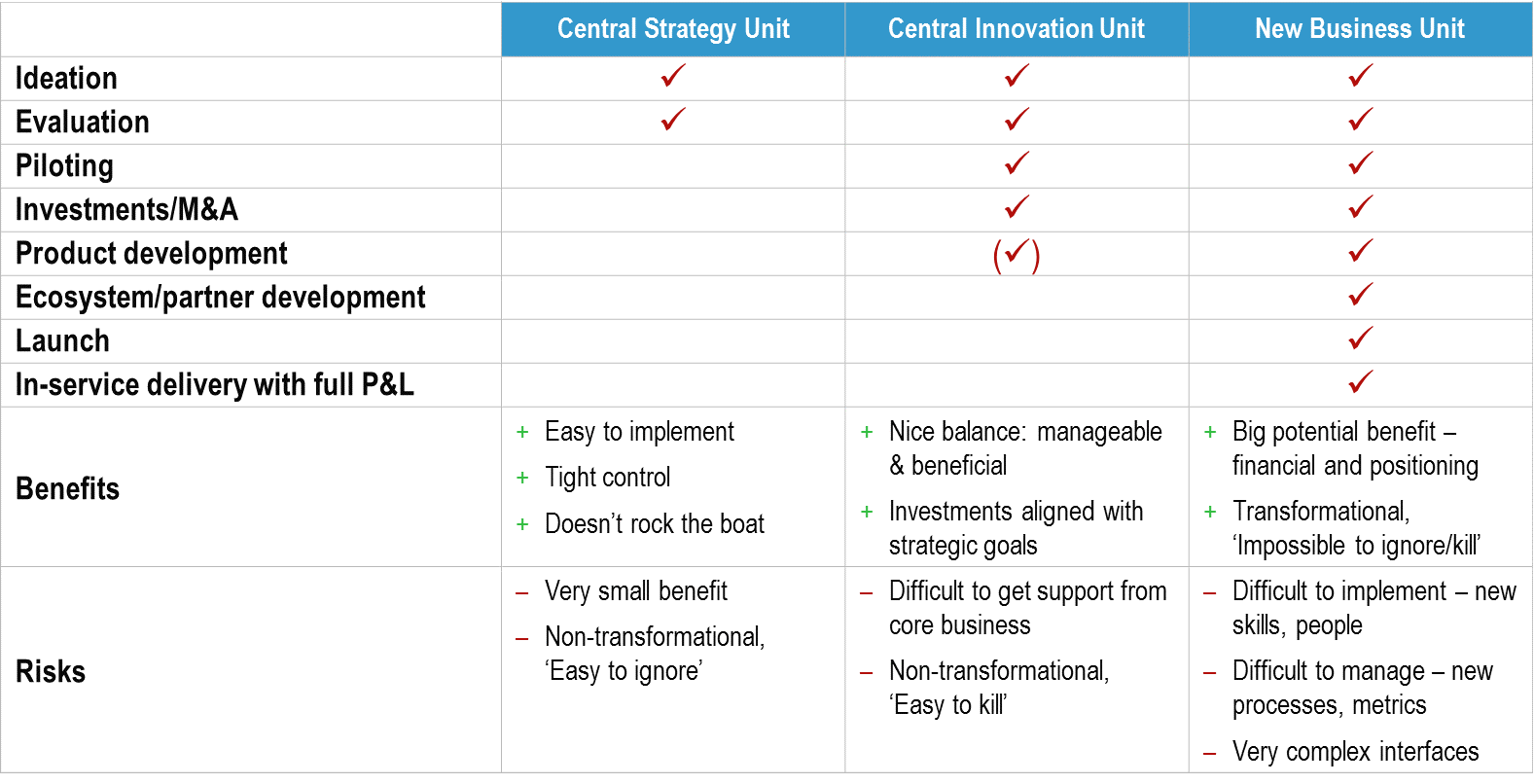

There is no tried and tested formula for setting up an organisation that delivers innovation but there is consensus (among STL Partners’ contacts at least) that a different organisation structure is needed to the one that manages the core infrastructure business. Most also agree that the new skills, partnerships, operational and financial model associated with Telco 2.0 innovation needs to be ring-fenced and protected from its mature Telco 1.0 counterpart.

The degree of separation between the old and new is the key area of debate. We lay out the broad options in Figure 2.

Fig 2 Organisation design models for Telco 2.0 Service Innovation

Source: STL Partners/Telco 2.0

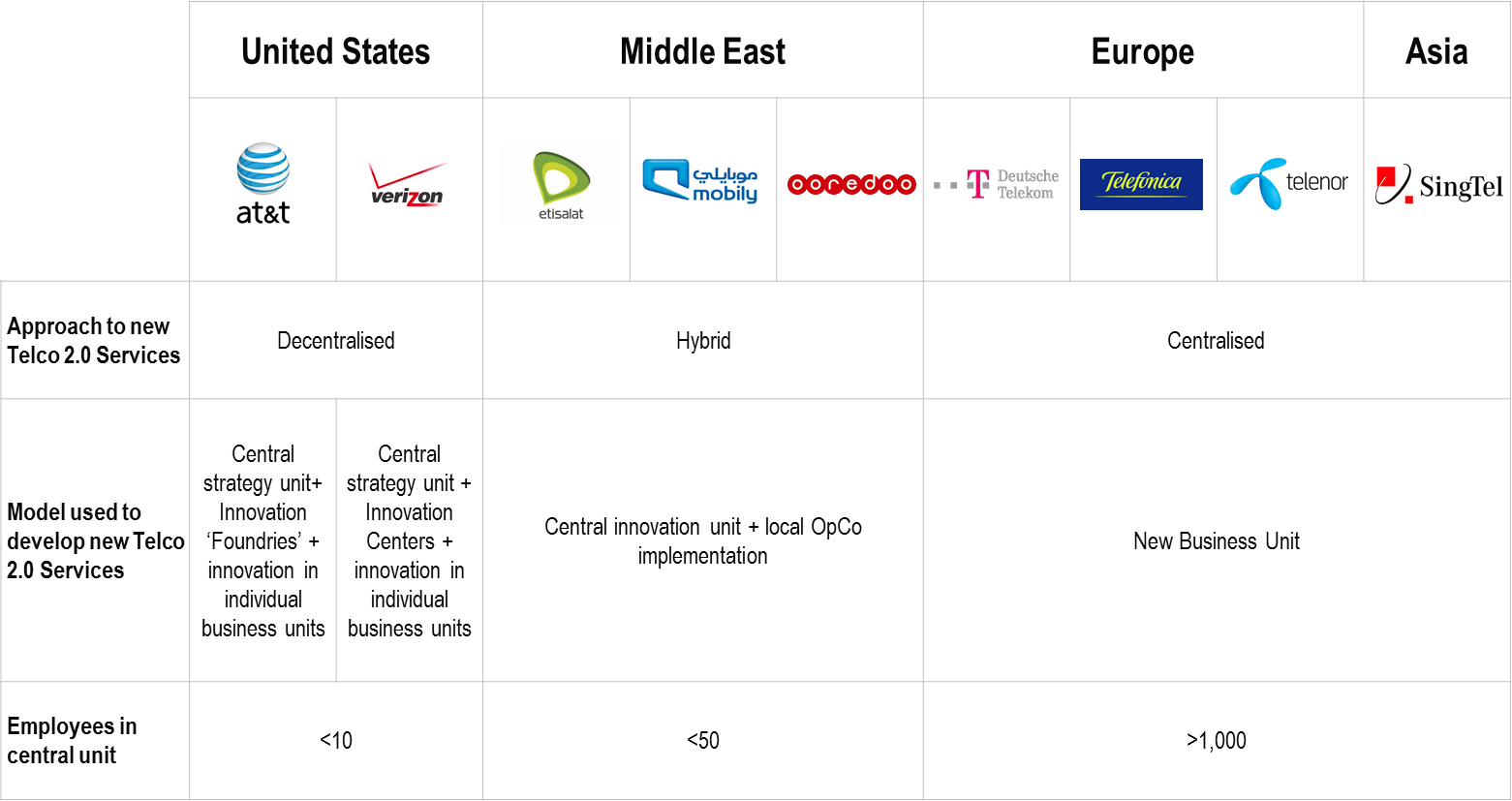

For some, a central independent strategy unit that identifies potential innovations and undertakes an initial evaluation is a sufficient degree of separation. AT&T and Verizon in the US have gone down this route – see Figure 3.

Fig 3 Organisation design approaches of 9 CSPs across 4 regions

Source: STL Partners/Telco 2.0

In this model, ideas that are deemed promising are handed over the operating units to develop and deliver where, frankly, many are ignored or wallow in what one executive described to us as ‘Telco goo’ – the slow processes associated with the 20-year investment cycles of an infrastructure business.

Players such as Etisalat, Mobily and Ooredoo that are taking their first steps into Telco 2.0 services, but harbouring great aspirations, have gone a step further than this and set up Central Innovation Units. In additional to innovation ideation and evaluation, these units typically undertake piloting, investment and, in some cases, some modest product development. This approach is a sensible ‘first step’ into innovation and echoes the earlier attempts by many multi-national European players in the early 2000’s that had central group marketing functions that undertook proposition development for several countries. The benefit is that the company can focus most resources on growth in existing Telco 1.0 services and Telco 2.0 solutions do not become a major distraction. The downside is that Telco 2.0 services are seen as small and distant are always far less important than voice, messaging and connectivity services or devices ranges that can make a big impact in the next 3-6 months.

Finally, the most ambitious Telco 2.0 Service Providers – Deutsche Telekom, SingTel, Telenor, Telefonica and others – have developed separate New Business Units The Telco 2.0 New Business Unit is given end-to-end responsibility for Telco 2.0 services. The units find, develop, launch and manage new digital services and have full P&L responsibility.

STL Partners has long been a fan of this approach. Innovation is given room to develop and grow under the guidance of senior management. It has a high profile within the organisation but different targets, processes, people and partnerships to the core business which, left unchecked, would intentionally or unintentionally kill the new ‘rival’ off.

Many of the leading telecoms players have, therefore, done the right thing with the development of their digital units. So why have they struggled so much with culture clashes between the core telecoms business and the new digital innovations? The answer lies in the way the units have been set up – their scope and role, the people that reside within them, and the processes and metrics that are used to develop and deliver services. This is covered in the next section of this report.

To read the note in full, including the following additional analysis...

...and the following additional figures...

...Members of the Telco 2.0 Executive Briefing Subscription Service and the Telco 2.0 Transformation stream can download the full 23 page report in PDF format here. Non-Members, please subscribe here. For other enquiries, please email / call +44 (0) 207 247 5003.

Technologies and industry terms referenced include: Telefonica, AT&T, Ooredoo, Singtel, Verizon, strategy, business model, Telco 2.0, OTT, competition, transformation, Index, telecom.