Members of the Telco 2.0 Subscrioption Service and Future Networks Stream can download a more comprehensive version of this report in PDF format here. Please email or call +44 (0) 207 247 5003 to contact Telco 2.0 or STL Partners for more details.

To share this article easily, please click:STL Partners’ New Digital Economics Executive Brainstorm & Developer Forum EMEA took place from 11-13 May in London. The event brought together 250 execs from across the telecoms, media and technology sectors to take part in 6 co-located interactive events: the Telco 2.0, Digital Entertainment 2.0, Mobile Apps 2.0, M2M 2.0 and Personal Data 2.0 Executive Brainstorms, and an evening AppCircus developer forum.

Building on output from the last Telco 2.0 events and new analysis from the Telco 2.0 Initiative – including the new strategy report ‘The Roadmap to New Telco 2.0 Business Models’ - the Telco 2.0 Executive Brainstorm explored latest thinking and practice in growing the value of telecoms in the evolving digital economy.

This document gives an overview of the output from the Mobile Broadband Economics session of the Telco 2.0 stream.

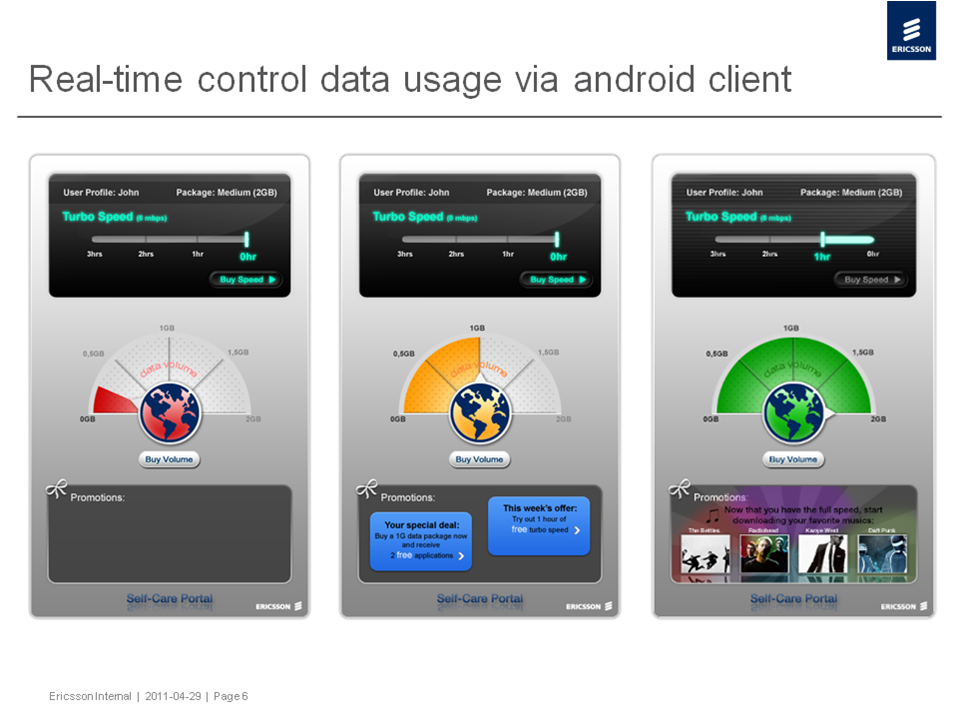

A key theme of the presentations in this session was putting users in more control of their mobile broadband service, by helping them to both understand what data they have used in an interactive environment, and giving them the option to choose to buy additional data capabilities on-demand when they need and can use it.

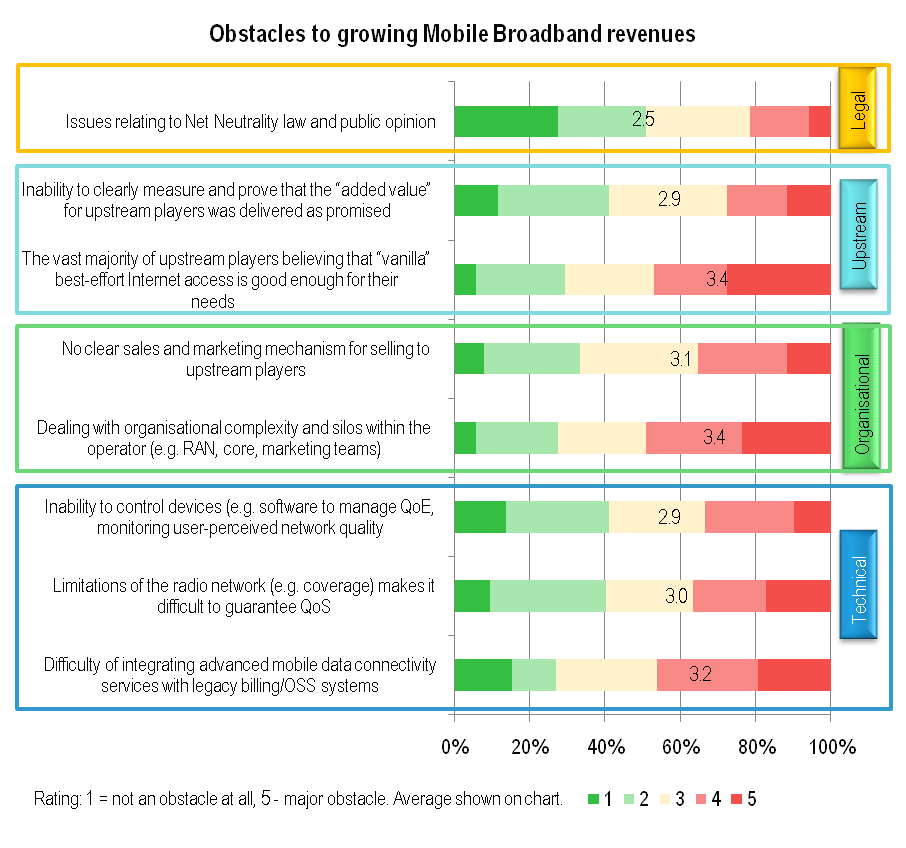

Delegates perceptions that key obstacles to building revenue were internal industry issues, and key cost issues involve better collaboration rather than technology (specifically, LTE) were both refreshing and surprising.

Ericsson presented a mobile Broadband Data ‘Fuel gauge’ app to show how users could be better informed of their usage and be interactively offered pricing and service offers.

Figure 1 – Ericsson’s Mobile Broadband ‘Fuel Gauge’

Source: Ericsson, 13th Telco 2.0 Executive Brainstorm, London, May 2011

Deutsche Telekom showed its new ‘self-care’ customer app, complete with WiFi finder, Facebook integration, and ad-funding options, and how they are changing from a focus on complex tariffs to essentially Small/Medium/Large options, with tiers of speed, caps, WiFi access, and varying levels of added-on bundled services.

While we admired the apparent simplicity of the UI design of many of the elements of the services shown, we retain doubts on the proposed use of RCS and various other operator-only “enablers”, and will be further examining the pros and cons of RCS in future analysis.

In addition to Ericsson’s concept of dynamic pricing, making offers to customers at times of most need and suitability, Openwave showed numerous innovative new approaches to charging by application, time/day, user group and event (e.g. ‘Movie Pass’), segmentation of plans by user type, and how to use data plan sales to sell other services.

Figure 2 – Innovative Mobile Broadband Offers

Delegates voted on the obstacles to mobile broadband revenues and the impact of various measures on the control of costs.

Figure 3 – Obstacles to growing Mobile Broadband Revenues

Source: Delegate Vote, 13th Telco 2.0 Executive Brainstorm, London, May 2011

Our take on these results is that:

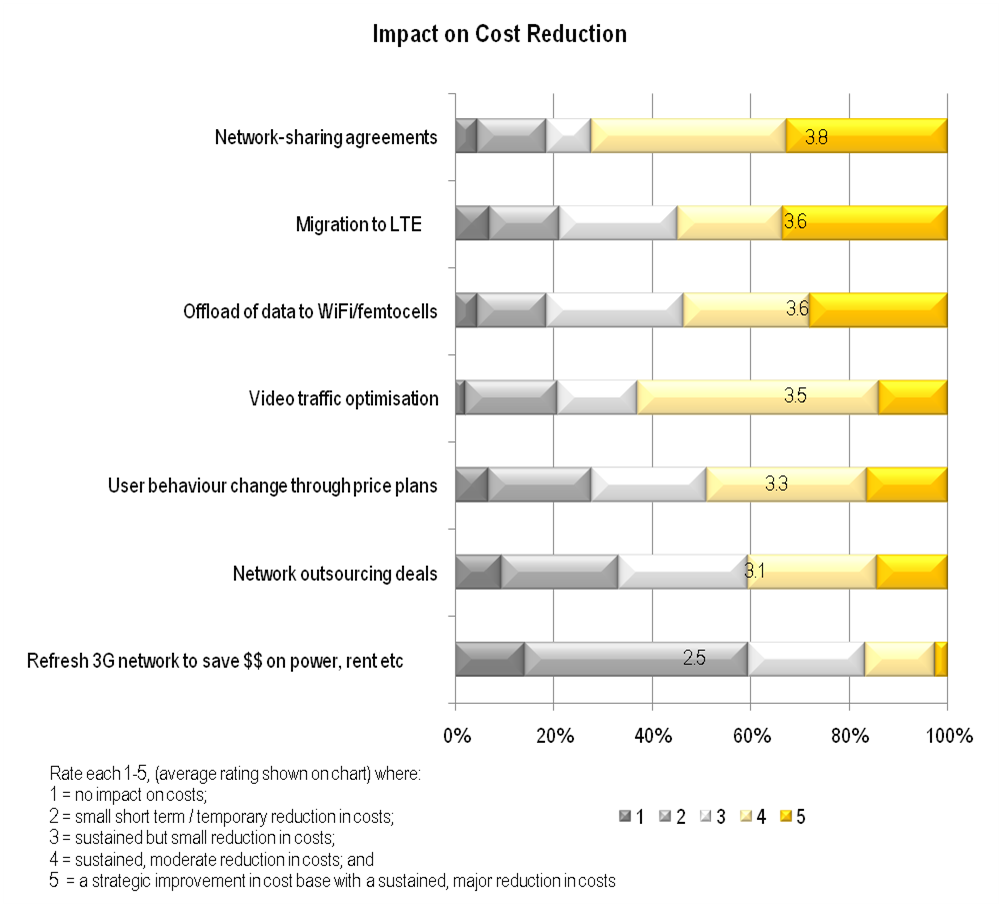

Figure 4 – Impact of Mobile Broadband Cost Reduction Strategies

Our take on these results is that the approaches fall into three groups:

It is interesting that network sharing deals were seen as a more strategic solution to long term cost issues than migration to LTE, although there is logic to this at the current stage of market development with the capital investments and longer time required to build out LTE networks. Similarly, data offload is currently an important cost management strategy.

We found it particularly interesting that network sharing (collaboration) deals are seen as significantly more effective than network outsourcing deals, and will be exploring this further in future analysis.