Summary: The success of the iPad2 has been seen by some as a sign of a paradigm shift in computing. With their theoretical appeal as a new portable medium for online video consumption could tablets have a significant impact on communications networks and economics? Here is Telco 2.0’s market outlook.

|

Below is an extract from this 18 page Telco 2.0 Analyst Note that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service using the links below. 'Growing the Mobile Internet' and 'Fostering Vibrant Ecosystems: Lessons from Apple' are also key session themes at our upcoming 'New Digital Economics' Brainstorms (Palo Alto, 4-7 April and London, 11-13 May). Please use the links or email [email protected] or call +44 (0) 207 247 5003 to find out more. |

The mobile device industry is currently awash with tablets. Catalysed by the iPad’s meteoric rise to prominence in 2010, the market has since been saturated with a broad range of similar devices such as Samsung’s Galaxy Tab. In early 2011, trade shows at CES in Las Vegas, and Mobile World Congress in Barcelona both saw the launch of countless Android-powered tablets, as well as others featuring RIM’s and HP’s own operating systems.

With the subsequent huge success and publicity of the iPad 2 launch (see iPad2: how Apple plans to dominate the ‘post PC era’), many in the technology industry are convinced that we are witnessing a new paradigm shift in computing. While the majority of debate has concerned itself with apps, content-publisher business models and the possible advent of the “post-PC era”, it is also worth stepping back and looking at the network-side implications of these new devices.

Some observers are expecting the advent of mobile-connected tablets to continue the assault on 3G and 4G network capacity, taking over where smartphones and laptops left off. Observing that tablets’ large screens are ideal for heavy-duty web and video consumption, there are certainly some doom-sayers predicting the imminent collapse of networks already suffering from congestion. For example, in July 2010, OpenWave’s CEO claimed that “There is no doubt that the iPad will be part of the data overload story when the wireless industry looks back in a few years time” . Even the FCC has used the potential tablet data threat in its efforts to gain additional spectrum rights for mobile broadband , saying “With the iPad pointing to even greater demand for mobile broadband on the horizon, we must ensure that network congestion doesn’t choke off a service that consumers clearly find so appealing or frustrate mobile broadband’s ability to keep us competitive in the global broadband economy.”

Other observers are more cautious. There are still some dissenters regarding the overall tablet story – will they really oust the netbook and laptop as the main mobile computing platforms? And even if they are game-changers, will they predominantly be used while connected to cellular networks, rather than WiFi?

While Telco 2.0 feels that tablets are indeed important in the medium term, we are concerned that 2011 may see the hype bubble pricked a bit, as the world’s gadget-enthusiast segment gets saturated before the mass-market really grasps what to do with a touchscreen device that isn’t pocketable. The rhetoric about the imminent death of the PC seems to fit poorly with data points such as Apple’s own rising laptop sales, paralleling the iPad’s growth.

Telco 2.0 has talked about the mobile broadband “capacity crunch” and the challenging economics of 3G/4G networks on numerous occasions over the past few years. We have considered the role of offload, traffic management, two-sided approaches to “slicing and dicing” network capacity in both fixed and mobile domains, and the need for sensible pricing plans for mobile data. We have watched the explosion of smartphones and the typical data volumes grow to 100’s of megabytes per month per user – even 1GB+ for certain devices such as high-end Android phones.

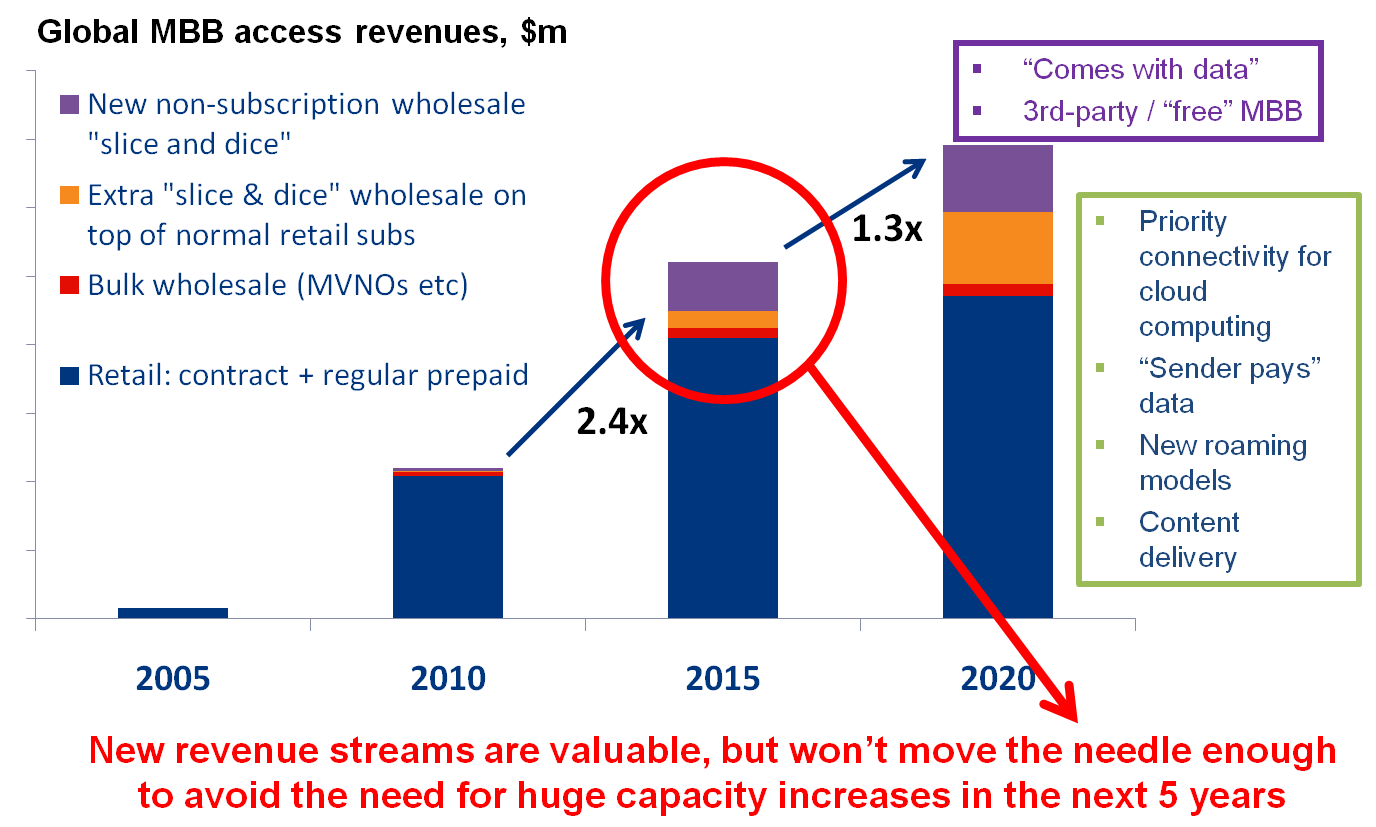

In 2010, we identified a variety of new mobile broadband business models involving new device categories, evolution of the wholesaling/MVNO concept, and “priority connectivity” for certain applications, plus new non-subscription revenues from sponsored or third-party paid wireless data sessions in Mobile, Fixed and Wholesale Broadband Business Models. While all these are attractive, we also identified likely pricing pressure on mobile data plans – despite some offerings such as 3G dongle modem tariffs already being positioned often at too-low rates.

The net conclusion is that mobile capacity will need massive enhancement anyway – likely through a combination of both a move to more-efficient networks (HSPA+ and LTE, especially), and ways of moving to smaller cells and offload (WiFi and femtocells) – adding capacity by “densifying” the networks. All this is pretty much “baked in”, irrespective of the growth of additional new device categories.

Figure 1: Mobile networks need much more capacity, despite new revenue models

Source: Telco 2.0 EMEA Brainstorm, April 2010

The last two years have seen increasing concern – and in some cases panic – among mobile operators about the effects of exploding data traffic on their networks. The emergence of tablets is adding to the sense of worry. Although some of the existing problems can be attributed to the extra signalling load, in other cases congestion is indeed being driven by sheer volumes of traffic, especially in “busy hours” or “busy cells”. For example, 4-10pm in regions with a lot of mobile laptop dongles tends to be a peak period. A growing shift to video traffic, driven by web TV streaming sites, social networks and adult content, has arisen as a particular point of concern. Various analyses have put video at 50-70% of total mobile data traffic already, consumed both on smartphones but also especially laptops with larger screens and batteries. Again, tablets are looked at as potential accelerators of this trend – with the vision of iPads being used to watch live TV via cellular networks while users are “out and about” a stereotypical fear.

Some operators have already tried to head off the problem with phones, with for example T-Mobile UK suggesting to its smartphone users that "If you want to download, stream and watch video clips, save that stuff for your home broadband." as part of its fair-use policy. However, many recognise that much of the problem has been brought by operators on themselves – especially through the mis-selling and mis-pricing of laptop data plans as being direct substitutes for home DSL and cable broadband, which clearly cannot have the same restrictions on video.

Tablets are potentially something of a quandary for operators – as a new category, there is no pre-existing expectation about exactly how data plans should be priced and managed – and few clear points on how much traffic they might be expected to generate. But conversely, if tablets are to be truly mobilised products rather than just WiFi-centric nomadic ones, they need to be usable without arbitrary restrictions or off-putting contract pricing.

(A quick note on signalling traffic: at the moment, it seems unlikely that tablets are going to major generators of load in this regard. Unlike smartphones, they are not “always-on”, running background tasks over the cellular network, or creating massive problems at the radio level through “fast dormancy” for power control. Irrespective of the precise applications used, they are likely to be similar to laptops/dongles, being online for lengthier sessions rather than ultra-frequent “pings” of servers.)

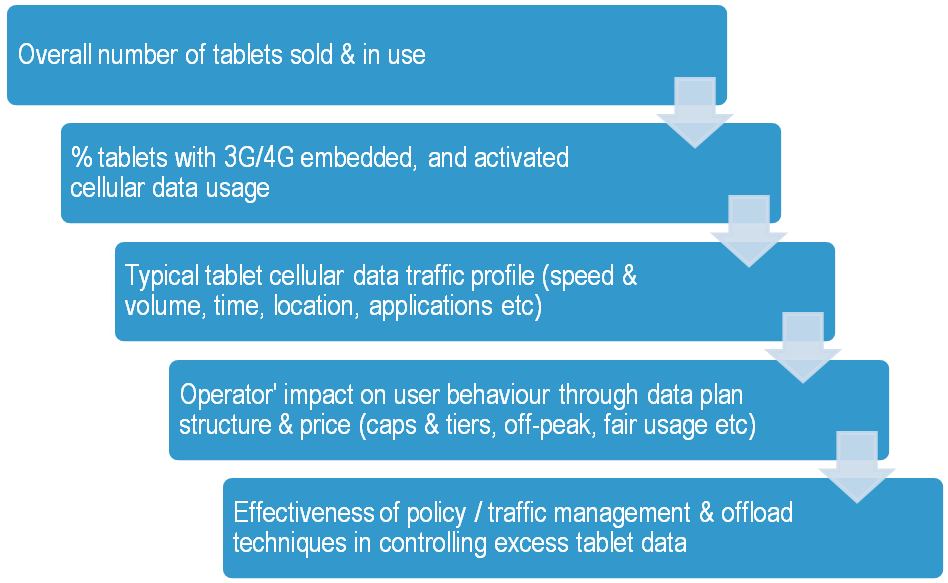

To work out whether or not tablets are a genuine source of concern for operators, Telco 2.0 has developed a simple analytical framework, bringing together sales volumes, operators’ role, traffic demands, data plans and the means for mitigation of network congestion. The following sections discuss each of these in turn.

Figure 2: Assessing tablets’ impact on mobile data networks

Source: Telco 2.0

Telco 2.0 does not itself forecast shipments of specific computing product categories. However, we are in agreement that the overall tablet sector will grow strongly through 2011 and beyond, although we are slightly more bearish than some observers who proclaim “the death of the PC”, asserting that tablets will inevitably become the main portable computing format. Our view is that tablets will (largely) complement smartphones and notebooks, rather than massively substituting for either – although the smaller netbook PC format is more threatened. Research firm Disruptive Analysis has noted that typical tablet battery capacity – a proxy for processing or display, capability and therefore ability to “do stuff” - is mid-way between the two other device categories, reflecting a distinct role and market-space for tablets.

Figure 3: Device battery power diversity suggests different use cases for tablets, smartphones & laptops rather than outright substitution

Source: Telco 2.0, Disruptive Analysis

Depending on the exact definition of “tablet” (itself an imprecise term), around 17-20m devices shipped in 2010, of which about 15-16m were Apple iPads. Android-powered devices started making significant in-roads in Q4, gaining perhaps a 20% market share.

...Members of the Telco 2.0TM Executive Briefing Subscription Service can access and download a PDF of the full report here. Non-Members, please see here for how to subscribe. Alternatively, please email [email protected] or call +44 (0) 207 247 5003 for further details. 'Growing the Mobile Internet' and 'Lessons from Apple: Fostering vibrant content ecosystems' are also featured at our AMERICAS and EMEA Executive Brainstorms and Best Practice Live! virtual events.