This article:

We'll also be analysing and discussing the Mobile Internet Ecosystem, and Mobile Apps 2.0, in more depth at our upcoming Executive Brainstorms (Palo Alto - April 5-7, and London - May 11-13 2011).

Steve Ballmer. Microsoft CEO "Warming up the shoulders" (Image Source: GSMA)

Steve Ballmer. Microsoft CEO "Warming up the shoulders" (Image Source: GSMA)From the start of his keynote address, Steve Ballmer prowled the Congress stage like a boxer, barking out his lines and making extraordinary gestures. His characteristic body-language always makes it look as if some poor souls in the Microsoft PR department have tried to teach the ex-Harvard football coach the new-fangled ways of modern media communications, but unfortunately the end result sometimes resembles a rather comic and aggressive interpretive dance routine. Indeed, this peculiar vision ultimately created the impression of an epic American fable being acted out in front of the audience's eyes - that of the former great attempting a last shot at glory, aided by his trusty sparring partner - Nokia's CEO Stephen Elop.

Elop and Ballmer at the Weigh-In (Image Source: Dagensit.no)

An important dramatic ingredient in the appeal of the fighter's fable is that the audience should not know at the outset whether the quest for glory will succeed. Will the hero fail in a plucky yet desperate bid? The Microsoft/Nokia alliance certainly holds this appeal. Many we spoke to said that the best they can hope for is to stave off inevitable decline for a couple more years.

But is this right? It can be all too easy for industry watchers to take a cynical line. What, after all, has the critical writer / analyst to lose? In the event that your critique was wrong, no one will remember in two years time and you can join in the cheering.

To us at Telco 2.0, the outcome is far from a certainty, and looking past Ballmer's fighting body language and occasional carpet salesman's manner, we see some strong positives in Microsoft's strategy - but also some currently unanswered risks. But on balance, and despite the tsunami of negative media / blogosphere reaction (and indeed, our own sadness at the devastating blow delivered to the European software industry), we are cautiously positive about the recent Microsoft/Nokia announcement - at least in the longer term.

'Who's the Daddy?' (Image Source: CBC.CA)

'Who's the Daddy?' (Image Source: CBC.CA)

Improving software / hardware integration is a never ending arms-race in development, and in this area Microsoft has great strength. The on-stage demonstration of the hugely accelerated smartphone experience using prototype Microsoft software was convincing, and the argument that they are increasingly developing their mobile and pc software platforms to enable easier cross-over of applications also made sense - though of course the proof will be in the delivery.

There is also little doubt that the market, and particularly telecoms operators, want to see strong third and fourth smartphone ecosystems to allow better balance against the power of Apple, and the fear of Google changing tack on Android and releasing less of the value it currently shares. Indeed, Ballmer went to some lengths to say that Microsoft wants to share some of the 'value on the table' with operators, and his talk was heavy with references to partnership opportunities. But can they be trusted? Microsoft has not always been overfriendly to operators in the past, and their monopolist's reputation and Ballmer's high testosterone personality may make it a little more intuitively difficult to imagine wanting to work with them, or to believe that they won't at some point revert to their previous predatory behaviours.

Moreover, and as Andrew Orlowski beautifully captures in his recent post Nokia's 15-year tango to avoid Microsoft, Microsoft are not always great at sharing the bounty with the developer communities in the ways that are needed to create the vibrant 'ecosystem' needed for smartphone success.

Nonetheless, Microsoft has deep pockets, wide distribution, and a 'high corporate IQ' - not to mention the aggressive and competitive instincts that so Ballmer so clearly manifests. And the Nokia deal is a fillip to their ambitions, both from a PR standpoint and from the huge potential channel to market it opens to them.

Indeed, in the one moment that he became tight-lipped in his own presentation, Google's normally inscrutable Chairman Eric Schmidt showed clear disappointment that Google had missed out on Nokia: the Nokia deal was a big one from Google's perspective.

"Definitely not happy..." (Image Source: CNET)

"Definitely not happy..." (Image Source: CNET)

Ballmer was less convincing when he took a few cheap shots at his competitors: "some other operating systems don't do this so well". Which ones, why, and why are Microsoft better? There are only really 3 main alternatives today after all - Blackberry, Apple and Android. In these circumstances anonymous jibes are counterproductive and unnecessarily disrespectful - was he afraid to be sued?

It's also a sad truth that there is no point in doing a demonstration that doesn't work. So why, oh why, do the Captains of Industry keep on doing it? For future reference for all career-minded folk: it doesn't matter if it's not your fault and the mobile network connectivity that fails you, even if you are at the biggest convention of mobile folks on the planet - it just looks bad. Fudge it with a fixed line or show us a video: just don't let the technology get the better of your experience.

Preparing for 'the body splash?' (Image Source: Telegraph.co.uk)

Preparing for 'the body splash?' (Image Source: Telegraph.co.uk)The great change in consumer behaviour in mobile communications in the last few years has been the massive uptake and enthusiasm for Apps. Apple started it, and Android uses an almost identical user interface and graphical presentation. So why, just when consumers are 'getting it', are Microsoft choosing a very different approach, using 'hubs' and 'smart design'?

(Image Sources: Apple, Samsung Galaxy S i9000 Android phone, Microsoft [HTC Phone], respectively.)

For sure, many reviewers are saying Windows Mobile 7 is much better than previous mobile Windows versions, and there's an obvious argument for Microsoft to appear to be different - to create a clearly differentiated platform that habitually locks people in to the new ecosystem. However, to gain loyalty, Microsoft needs to win people over in the first place, and it's not as if they are leading the field - they are trying to catch it. So why make it intuitively difficult for consumers to see that this does the same thing?

Perhaps consumers will just 'get it' with Window Mobile 7, or perhaps Microsoft will quickly change this aspect of their approach, or come up with a killer 'anti-app' marketing campaign. At this point though, it looks like a bad-old Microsoft trait - telling consumers what they want rather than giving them what they are telling the market in their hundreds of millions that they like. Whatever the case, how much time do they have to catch up?

In theory, the match between Microsoft's software skills, Nokia's market reach and mobile know-how, and their mutual needs to improve their positions in the smartphone market, make the partnership look perfect sense on paper. In practice though, there are plenty of obstacles, not least the power of the current leaders, Apple and Android, and the as yet unknown response of the ultimate decider - consumer choice.

Additionally, Blackberry has a strong long-term hold on enterprise and youth segments in certain markets, and a powerful business model with some interesting advantages for telcos in our view (see RIM: how does the BlackBerry fit with Telco 2.0 strategies?).

Microsoft also has a strong hold on, and comprehension of, the key enterprise market in terms of PC O/S, and might be expected to succeed there more naturally given their assets and experience than in the more unruly, open and volatile consumer mobile space. They should also ultimately be able to offer an excellent mobile migration path for the many habitual MS Office users globally. Nonetheless, it's hard to see Blackberry's hold on enterprise through its highly integrated services being eroded at a high pace even by the might of Microsoft, but it's also hard to see Blackberry leaping from there into Apple and Android's mass-market heartland. Microsoft, it seems, will have little choice but to take on both consumer and enterprise challenges.

In addition to the market challenges, there are massive cultural, technical and operational challenges to integrate the strengths of the US software and Nordic hardware giants. There's an argument to say they have to do it, but this is an argument that has failed in other collaborative ventures, and Microsoft's track record in other collaborative smartphone ventures is not great.

Even if it does work, will it work in time and in sufficient volume? It must be expected that despite the inevitably frantic urgings of the senior teams on both sides of the deal, any realistic and fully integrated collaboration will take at least a year or two to bear the first truly sweet fruit.

Additionally, there are likely to be further share declines before then - to misappropriate a phrase: 'a couple of years is a long time in the smartphone market' - it can be easy to forget that Android was nowhere two years ago in the OS charts. (NB: For an excellent overview of the dynamics of the Smartphone Ecosystem, please see this short video presentation from Telco 2.0 partners Bain at our recent 'Best Practice Live! virtual event - you'll need to register and login to watch it - only available to end March 2011.)

Our most optimistic (and speculative) view is that they could achieve success as measured by an equivalent share of the profit pool to one of the two big players - with the caveat it might take 5-6 years and a couple of iterations of the development cycle.

Less bullish would be to think that they should be able to secure the place of the 3rd place mobile ecosystem, catching and passing Blackberry, at least in market share if not in value. There are also a few other mobile O/S wannabes on the block, such as Samsung Bada which is doing better than Windows at present, so it's no shoe-in by any means.

But let's be clear here: these views aren't based on a mammoth spreadsheet multivariate model of the O/S market, scenario planned and gamed out to the Nth degree. This is the collective 'hunch' of our analyst team, based on many years of industry experience and a very busy time in Barcelona.

Fundamentally, this hunch boils down to the view that the vast power of the money, skills, stamina, vested interests, and collective survival instincts of these two giants will ultimately overcome the significant technical, market and cultural challenges they face. Moreover, surviving without triumphing is a trait that Microsoft seems to have perfected over the last few years. It may not advance their position but it does keep them in the game, and while that may sound like damnation with faint praise, there are many more players that have not managed such a feat in this high-stakes game. The great move of computing to mobile is simply too big a step-change in the market for Microsoft to miss out on, and as many times as they have already fallen short they will not stop trying, especially with the belligerent Ballmer at the helm.

Microsoft Share Price, Feb 2011 (Source: Yahoo! Finance)

The future is less certain for Nokia, the former champion of intuitive mobile user interface design before it was eclipsed by Apple, which also faces major challenges from low-cost competition from the Far-East in featurephones. But at least Nokia is prepared to try something radical to stop its decline in the smartphone market and get off the 'fiery platform'.

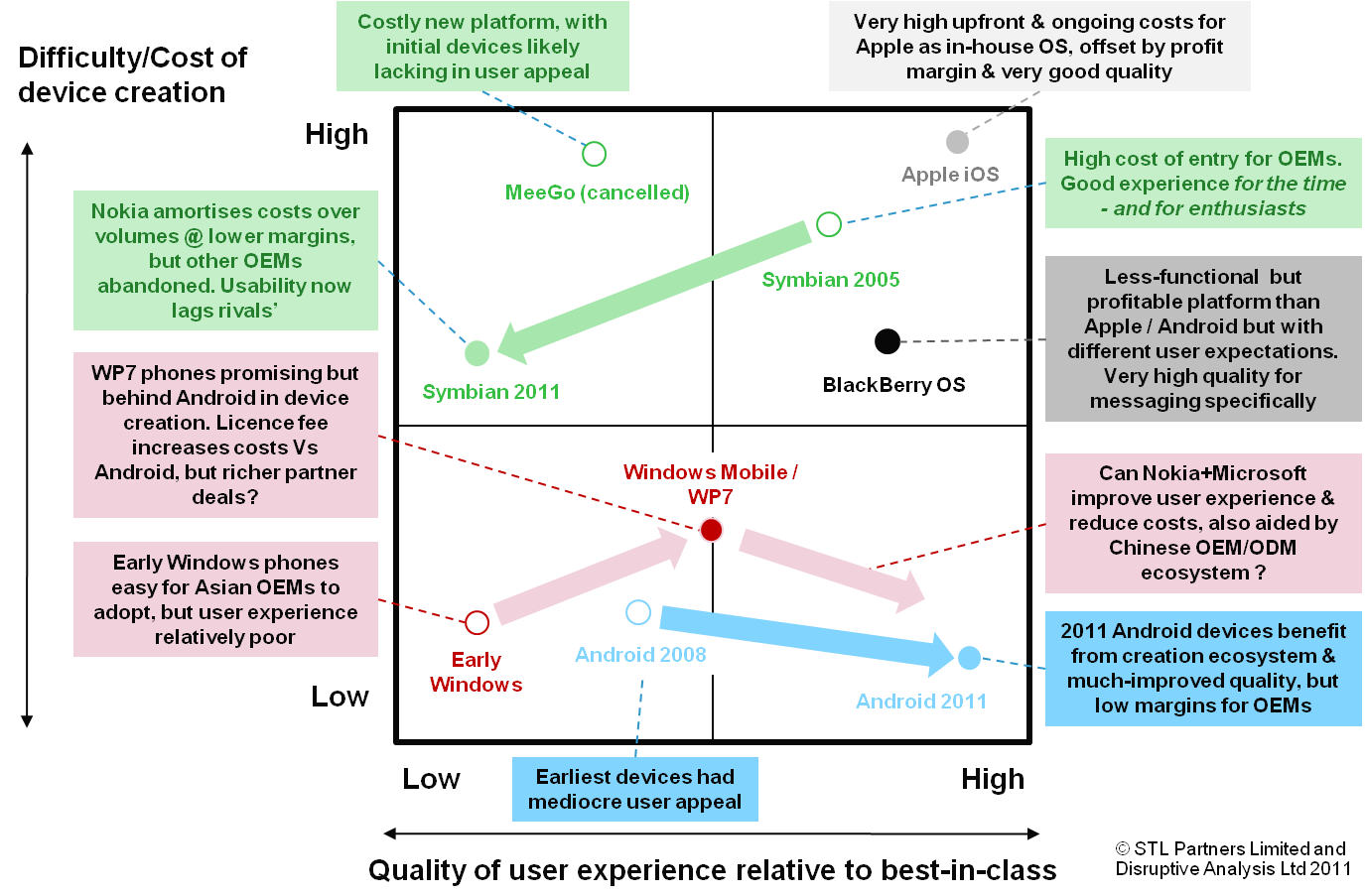

As we understand it, it was just too risky to keep trying to turn Symbian or Meego into a cheaper platform for Nokia and others to develop smartphones with a truly smart user experience. The following schematic, constructed together with Telco 2.0 Associate Dean Bubley at Disruptive Analysis, summarises the dynamics of the mobile O/S market, using axes that compare the relative cost and ease of creating new handsets with the various mobile O/S platforms, versus the perceived quality of user experience.

In the choice of what to do next, we believe that Microsoft won out over Android of the choices on the bottom right-hand quadrant of the chart because Nokia were more uncertain of Google's intentions in the value chain. There was no doubt also an intensive behind-the-scenes bidding war of which more of the story will eventually emerge.

Finally, putting this transition in perspective of Nokia's history, changing their smartphone O/S strategy is less of a quantum jump than their seminal move from tyre-maker to phone-maker. So perhaps the current generation of Nordic innovators can take heart from their ancestors' success story, and get to grips with the challenge of working with Microsoft.

There is a strategic appeal to encouraging the growth of a new major smartphone platform to rival the market strength and deep pockets of Apple and Android.

Windows Mobile 7 certainly seems like the best shot that Microsoft has taken for a while, even if it's early days in the market. And who yet knows, perhaps their design and marketing will appeal to later-adopting smartphone segments and start the next round of topsy-turvy market share exchanges?

Yet it's too early for most telcos to bring themselves to totally embrace the burly US software giant, and earlier still for the Nokia/Microsoft alliance. But for most operators, they are options that must be investigated, and for many, carefully exploited. There are still many questions to be answered in the market by the new OS, and so most telcos are likely to approach the new proposition with a degree of cautious optimism.

For Microsoft and Nokia, speed in bringing something great to the market is the key, and there are plenty of challenges ahead for them to achieve that - it is likely to prove a massive struggle.

For us, the appeal of the 'returning champions' fable is still strong. It's hard to be sure that the old champs will ultimately make it a triumphant return, but it's also irresistible to watch and speculate. Our deeper instincts, contrarian and reactionary though they may seem, suggest they might just pull it off in the long-term. We certainly aren't writing them off just yet.

NB. We'll also be analysing and discussing the Mobile Internet Ecosystem, and Mobile Apps 2.0, in more depth at our upcoming Executive Brainstorms (Palo Alto - April 5-7, London - May 11-13, and Singapore - 22-23 June 2011).

(NB Steve Ballmer might be pleased to know that Telco 2.0's ageing iPhone was not up to the task of taking good photos of him on stage, so we had to raid the internet to find illustrations of his body talk. We hereby thank the sources of these images, including the GSMA press office.)