| A summary of the six Telco 2.0 opportunities to transform telco's business models for success in an IP-based, post PSTN world: Core Services, Vertical Solutions, Infrastructure Services, Embedded Communications, 3rd Party Enablers, and Own Brand OTT Services. It includes an extract from the Roadmap to New Telco 2.0 Business Models, updates on latest developments, and feedback from over 500 senior TMT industry execs. (July 2011, Executive Briefing Service, Transformation Stream). |

|

Below is an extract from this 50 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service and the Telco 2.0 Transformation Stream here. Non-members can buy a Single User license for this report online here for £795 (+VAT) or subscribe here. For multiple user licenses, package deals to buy this report and the Roadmap report together, or to find out about interactive strategy workshops on this topic, please email or call +44 (0) 207 247 5003.

To share this article easily, please click:The Telco 2.0 Strategy Report ’The Roadmap to New Telco 2.0 Business Models’ published in April 2011 examines ways in which operators can extend and solidify their roles in the future ecosystem, making themselves a cornerstone of a new structure. This Executive Briefing contains extracts from the full Strategy Report, and updates and validates it with feedback from recent Telco 2.0 and New Digital Economics Executive Brainstorms in EMEA and the Americas.

For the past four years, STL Partners has been using an iconic diagram (see Figure 1, below) to illustrate our views about the role of ‘two-sided’ business models in the telecoms industry. It highlights the critical role of a telecom operator in enabling interactions between its traditional end-user (“downstream”) customers and a variety of new “upstream” parties, such as application developers and media companies. In 2007, we also introduced the concept of “distribution” of Telcos’ core services through these upstream channels, with the addition of a range of value-added B2B services based around the inherent capabilities of the network and service platform.

This concept of two-sided business models originally introduced in the Telco 2.0 Strategy Report The $125Bn ‘Two-Sided’ Telecoms Market Opportunity has to a degree become synonymous with Telco 2.0, and has been widely embraced by the industry. We have now decided it is time to update our definition of “Telco 2.0” to reflect both business model evolution and fundamental changes in the telecoms industry structure itself. While these trends are indeed driving adoption of multi-sided business models, we have also observed that that are redefining the landscape for ‘traditional’ one-sided telecom model as well.

Figure 1: The high-level Telco 2.0 Business Model diagram

Source: STL Partners / Telco 2.0

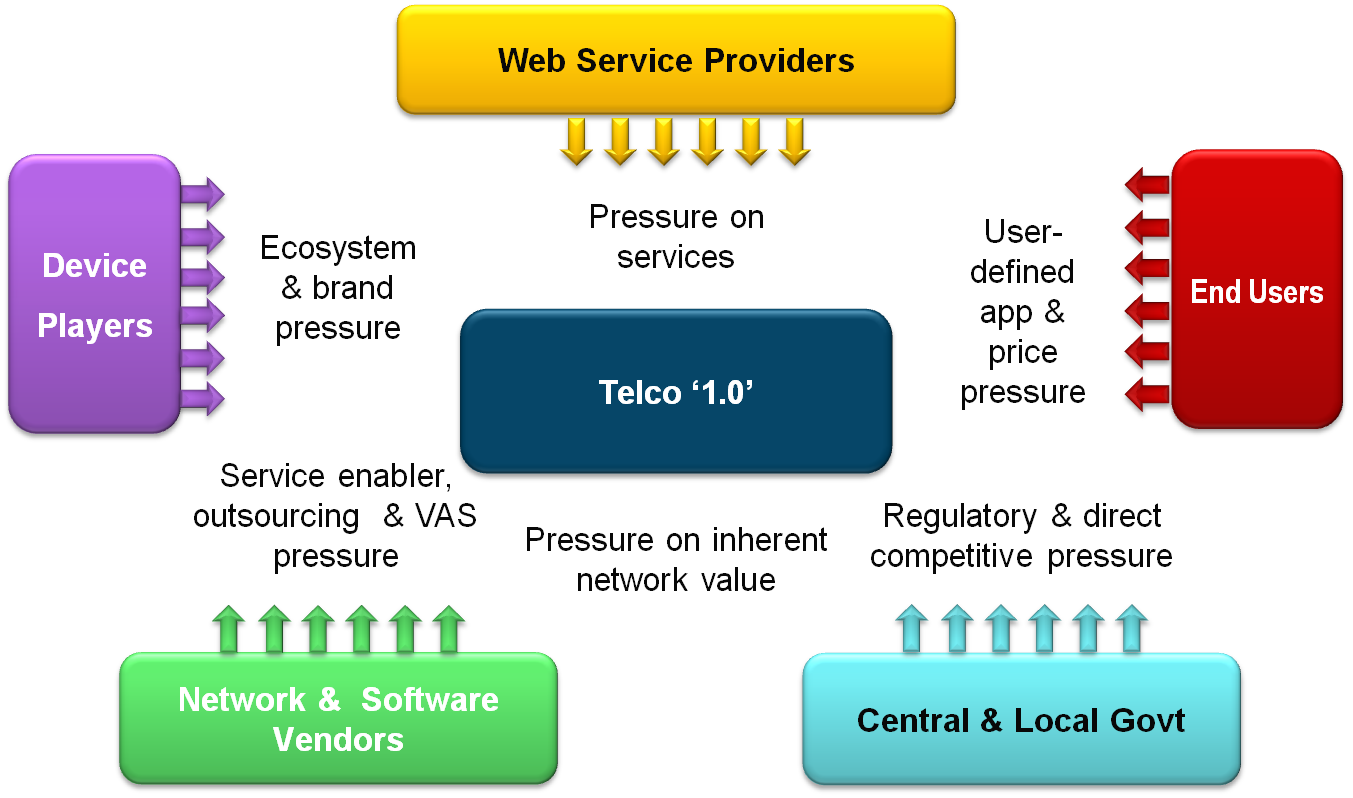

In particular, it is critical to understand the increasing pressure on Telcos’ traditional markets and value propositions, on all sides - not just by Internet/media companies (so-called “over-the-top” players), but also by third-party infrastructure operators and wholesalers, network and device vendors, governments, and even end-users themselves. In addition, there have been delays and organisational complexities in exploiting the true potential of some “upstream” opportunities.

Newcomers such as Apple have developed their own communications/content ecosystems, regulators have pushed for structural separation, Governments have funded wholesale networks and application developers have cherry-picked lucrative domains such as social networking. Network equipment vendors are helping operators convert capex to opex – but in the process are themselves capturing more industry value through outsourcing. End-users have developed work-arounds to reduce their expenditure on telco services (e.g. “missed calls”).

Figure 2 - Telcos squeezed from all sides

Source: Telco 2.0, The Roadmap to New Telco 2.0 Business Models

Taken together, the impact of these trends has led Telco 2.0 to expand its framework to embrace and refine its target market domains for telcos, especially in terms of innovation around advanced new “retail” services. We feel that it is becoming even more difficult for operators to navigate through this minefield – and if they are to succeed, they will need to develop and sell more appropriate, integrated and well-designed offerings. While defensive moves have their place, there is also an urgent need to innovate – but with well-focused efforts and resources.

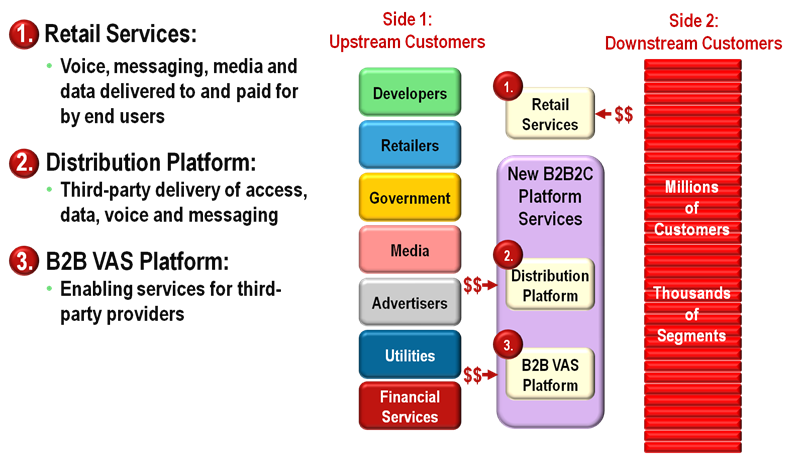

Originally, we spoke of three business model elements for telcos: Improved retail telecoms services; ‘Distribution’ of core telecom products and services through alternate upstream channels; and delivery to upstream customers of value-added enablers. (In the past, we did not explicitly address wholesale telco-telco services, as they were essentially “internal machinery” of the day-to-day retail business).

Figure 3 – The three opportunity areas in the original Telco 2.0 business model

Source: Telco 2.0, The $125Bn ‘Two-Sided’ Telecoms Market Opportunity

A long-term, strategic framework for is needed for telcos, both in fixed and mobile sectors. While the industry has strong cash flows, it needs to redefine its own space, exploit its strengths, and seek out areas of revenue growth and strong differentiation. Telcos also need to look for sources of their own profit in areas such as managed services, rather than just exploiting the cost savings offered by vendors and outsourcers.

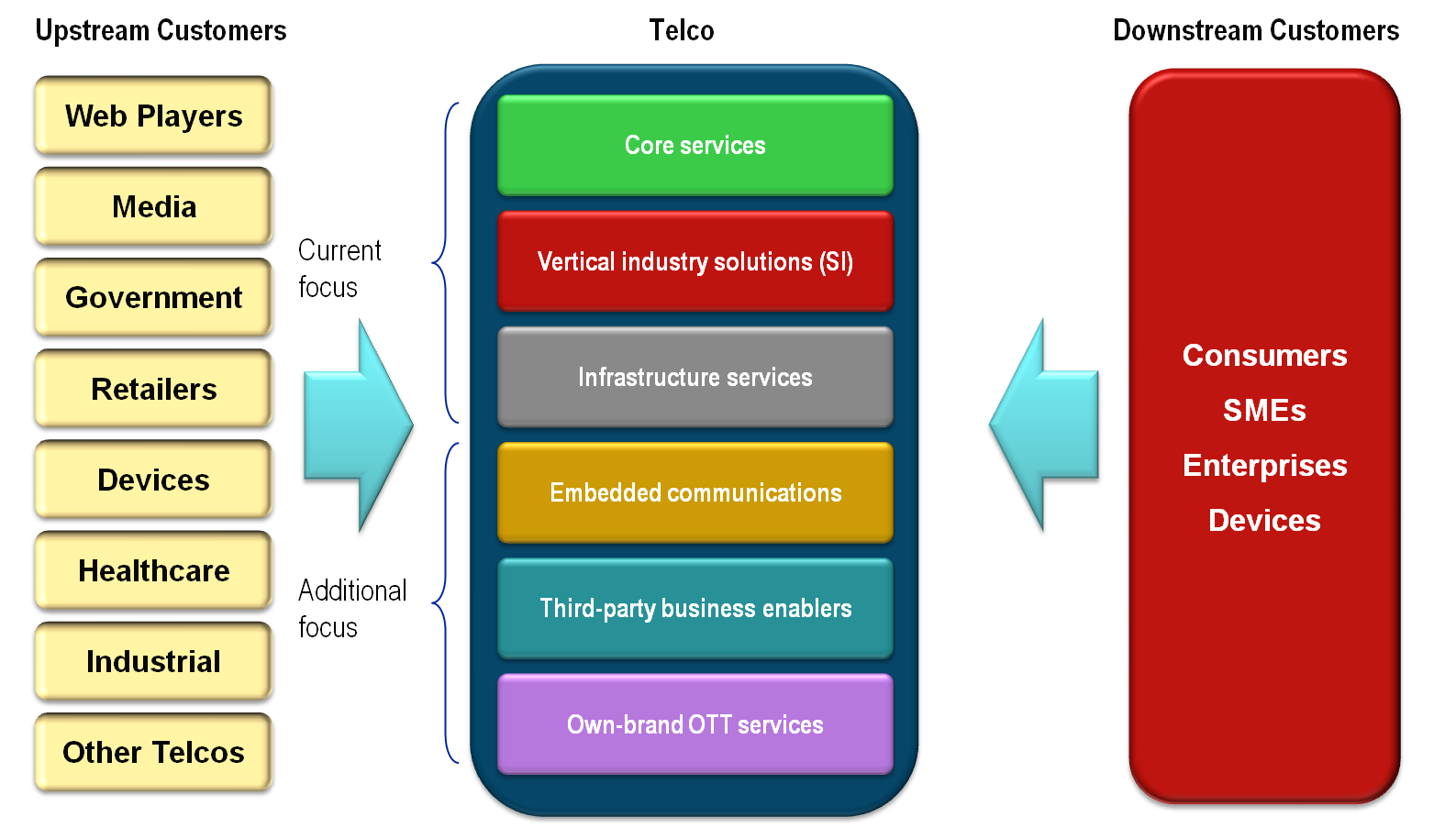

Figure 4 – The New Telco 2.0 Industry Framework

Source: Telco 2.0, The Roadmap to New Telco 2.0 Business Models

Our new framework is an evolution of the old, incorporating the two-sided model, and defining six opportunity types, comprising three existing types previously defined by Telco 2.0:

and extending it in three main directions:

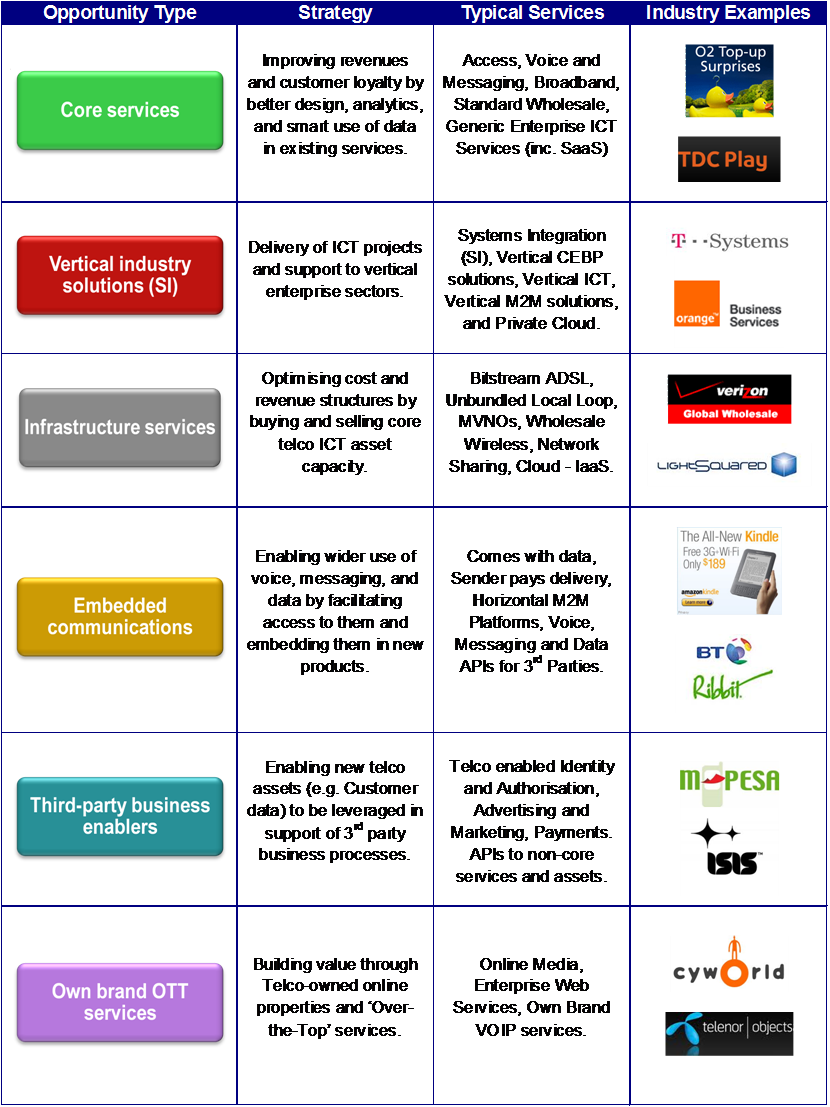

We have grouped the opportunities into six types shown in the following diagram and discussed further in the rest of this report.

Figure 5 – the Six Telco 2.0 Opportunity Types

Source: Telco 2.0, The Roadmap to New Telco 2.0 Business Models

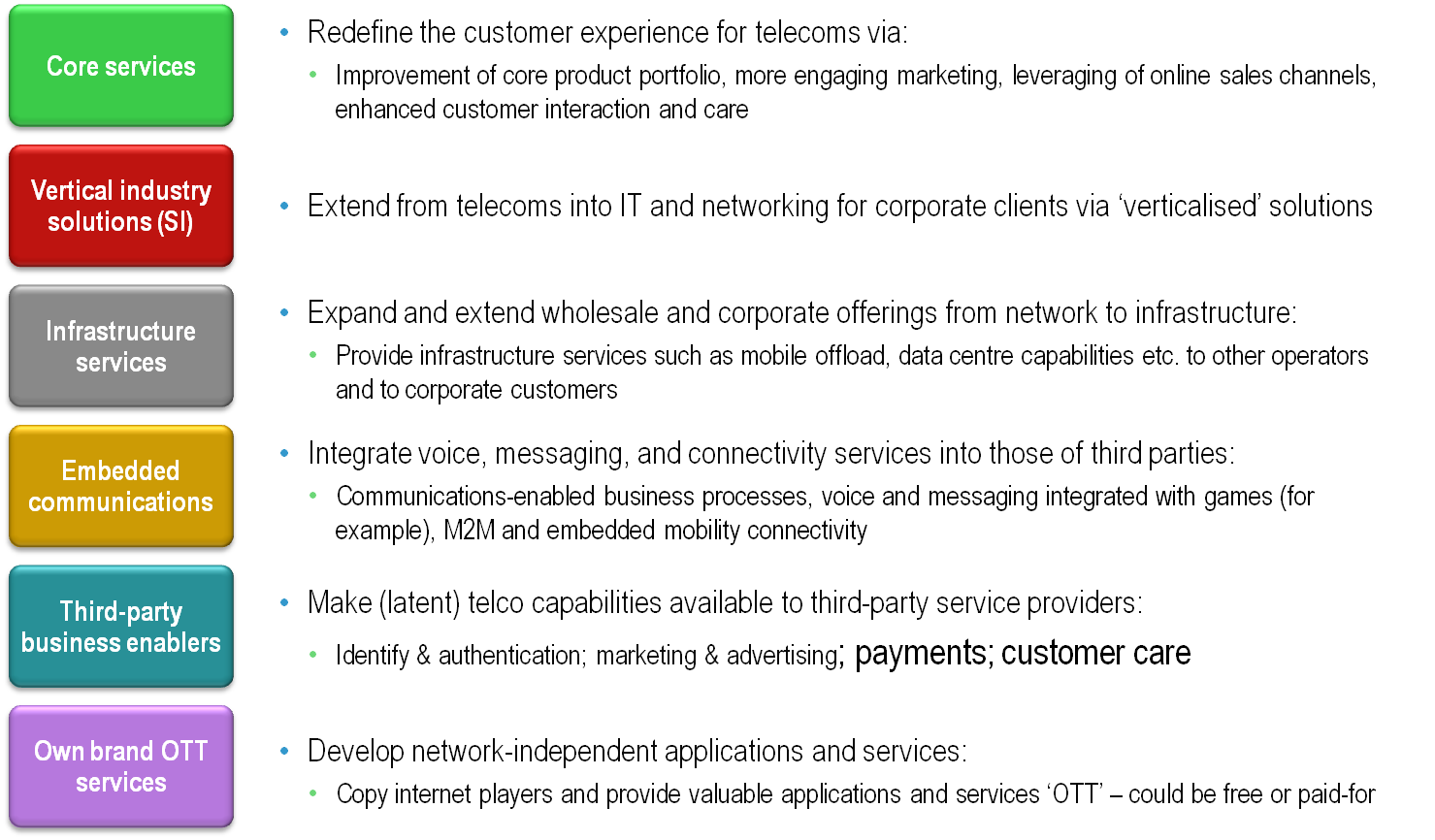

1. Core services (previously Retail Services), which encompasses transformational structural and strategic improvements to existing mainstream “Telco 1.0” offerings such as subscriptions, telephony and broadband access. These will remain at the core of telco revenues irrespective of other shifts, enhanced by the smart and targeted delivery of improved offers, manifesting in benefits via revenue addition, up-sell, and customer satisfaction. Our research identifies a portfolio of approaches here, such as:

In parallel with the revenue drivers, operators are also focusing on cost savings, throughout network operations and other areas such as retail channel costs and commissions, device subsidies and so forth.

2. Vertical industry solutions have been developed by fixed operators over the last decade and now starting to be demanded by customers for mobile solutions too. They comprise telephony services (voice and data) being integrated with IT with the operator acting in a systems integrator role to provide a complete solution. These solutions are tailored and packaged for specific vertical industries – transport, logistics, banking, government, manufacturing, utilities, etc. Companies such as BT (with BT Global Services), Orange (with Business Services) and Deutsche Telekom (with T-Systems) are examples of companies that have moved aggressively into this area.

3. A separated and richer tier of Infrastructure services, which includes telecom capacity “bulk” wholesale, as well as more granular “distribution” two-sided business models and aspects of hosting/cloud services. Some of these offerings have been around for a long time – bitstream ADSL, unbundled local loop sales and so forth. Others (data MVNOs, wholesale wireless networks) are relatively new. At the same time, operators are cutting new deals with each other for network sharing, backhaul provision, national roaming and so forth. We are splitting the new services out in this category, as a reflection of their impact on the cost side of operators’ business models, and new regulatory regimes (such as open access) that are redefining industry structure in many markets.

4. Embedded communications (previously Distribution Platform) – essentially the delivery to consumers of basic telecom services, primarily voice telephony, SMS and broadband data access, through new routes such as application-embedded functions or devices which “come with data” pre-provisioned.

5. Third-party Enablers (previously B2B VAS Platform) – the provision of extra capabilities derived from the operator's ’platform’ rather than just network transport. This includes functions such as billing-on-behalf, location, authentication and call-control, provided as basic building blocks to developers and businesses, or abstracted to more complex and full-featured enablers (for example, a location-enabled appointment reminder service). Another class of third-party enablers originates in the huge customer databases that Telcos maintain – in theory, it should be possible to monetise these through advertising or provision of aggregated data to 3rd parties – subject to privacy constraints.

6. Own-brand OTT services. Many operators are starting to exploit the scale of the wider Internet or smartphone universe, by offering content, communications and connectivity services outside the perimeter of their own access subscriber base. With a target market of 1-2bn people, it is (in theory) much easier to lower per-unit production costs for new offerings and gain “viral” adoption. It avoids the politics and bureaucracy of partnerships and industry-wide consortia – and potentially has the ‘pot-of-gold’ of creating huge value from minimal capital investment. On the downside, the execution risks are significant – as is the potential for self-cannibalisation of existing services.

Figure 6 – The Six Opportunity Areas – Strategy, Typical Services and Examples

Source: Telco 2.0, The Six Opportunity Types Executive Briefing

To read the report in full, including the following contents.........Members of the Telco 2.0 Executive Briefing Subscription Service and the Telco 2.0 Transformation Stream can download the full 50 page report in PDF format here. Non-Members, please see here for how to subscribe, here to buy a single user license for £795 (+VAT), or for multi-user licenses and any other enquiries please email or call +44 (0) 207 247 5003.

Organisations and products referenced: 3UK, Alcatel-Lucent, Amazon, Amazon Kindle, Android, Apple, AT&T, BlackBerry, BT, BT Global Services, Carphone Warehouse, Cisco, Clearwire, Deutsche Telekom, Equant, Facebook, FCC, Gamesload, Google, Harbinger/SkyTerra network, iPad, iPhone, Jajah, KDDI, LightSquared, LinkedIn, Microsoft, Musicload, O2, Ofcom, Openzone, Optism, Orange, ProgrammableWeb, Qualcomm, Revoo, Scout24 family, Skype, smartphones, SMS, Softwareload, Telefonica, T-Mobile, UQ, Verizon, Videoparty, Vodafone, W3C, Xiam, YouTube.

Technologies and industry terms referenced: 3G, 4G, ADSL, API, appstore, authentication, B2B VAS platform, backhaul, billing-on-behalf, bitstream ADSL, broadband data access, Bulk wholesale, cable, cloud, Comes with data, Core services, CRM, data centres, Embedded Communications, femtocells, fibre, freemium, GSM, healthcare, Identity, Infrastructure services, location, LTE, M2M, managed services, messaging, MiFi, MVNO, MVNOs, Net Neutrality, NGA, NGN, own-brand OTT, Own-brand OTT, pipe, platforms, QoS, R&D, Retail, Sender pays, SIM, slice and dice, smart grids, Third-party business enablers, two-sided, unbundled local loop, Vertical industry solutions, voice telephony, VoIP, wholesale wireless networks, WiFi, WiMAX.