This is a summary of the key out-takes from the 10th Telco 2.0 Americas Executive Brainstorm (incorporating Digital Entertainment 2.0) held in Santa Monica, Los Angeles, October 28-29, 2010.

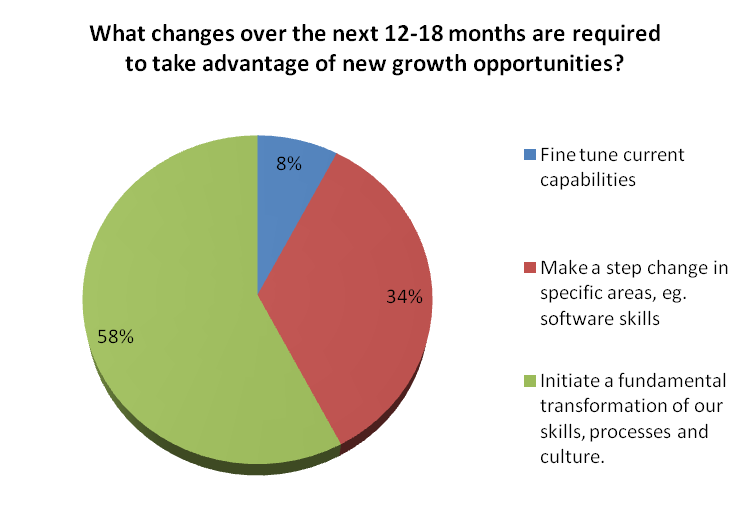

One hundred and twenty senior strategy execs from across the North American telecoms, media and technology sectors participated in the event. 92% of participants agreed it is time to make either a step change in key functions (34%) or initiate a fundamental transformation (58%) in the next 12-18 months.

[NB There's more on Customer Data at our AMERICAS, EMEA and APAC Executive Brainstorms and Best Practice Live! virtual events, and the ‘Roadmap to New Telco 2.0 Telecoms Business Models’ report will be published in February 2011.]

This summary covers:-

Telco 2.0 would like to thank the event sponsors without whom this would not have been possible: Platinum - Cisco, Ericsson; Gold - Connectiva, Credit Suisse, Intel, Oracle and Ubiqisys; Silver - Aricent, Blyk and Globecast; and Bronze - Huawei and Juniper.

A full PDF copy of this 16 page report can be downloaded here.Telcos urgently need to find new $multi-billion sources of growth to stave off mounting industry pressures on core revenues. For although US investors are bullish on many incumbent telco stocks in the near-term (according to Credit Suisse), they are primarily investing for dividend yield rather than capital growth.

Operators, therefore face a timing challenge: at some point in the next 12-24 months they must move beyond harvesting and show greater commitment to ‘sowing and growing’ new revenues from new propositions made available to the wider ‘digital economy’. As well as determining when to make such a move, operator management must also determine how to achieve new growth. Most executives polled at the Telco 2.0 event felt that substantive changes at operators need to happen now if the industry is to achieve a successful outcome.

Figure 1 - Giving an unambiguous signal of the urgency of change 92% of delegates said a step change or fundamental transformation is needed in Next 12-18 Months

Source: Telco 2.0 Americas’ Brainstorm Delegate Vote, October 2010

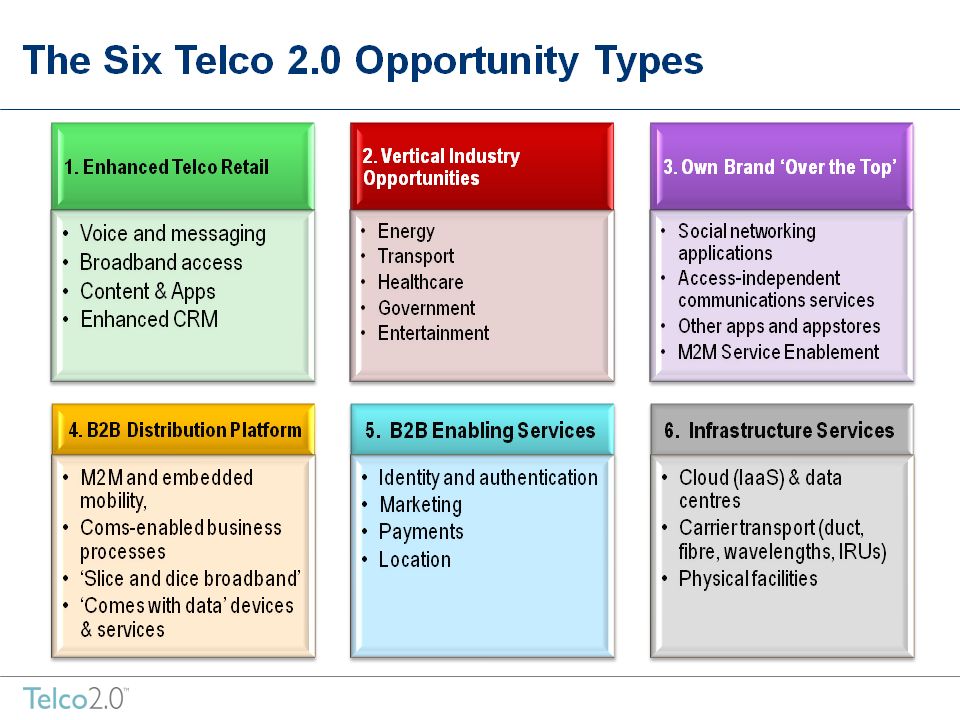

In terms of strategic priorities, delegates supported all six Telco 2.0 opportunity types previewed from the upcoming ‘Roadmap to New Telco 2.0 Business Models’ Strategy Report.

Figure 2 - Delegates supported all six Telco 2.0 Opportunity Types

In contrast to what is actually done today, delegates:

A key take out of this session was that telcos are not currently set up to develop the innovation necessary to take advantage of these opportunities and that they must find new ways of doing this through collaboration and partnerships, especially higher up the service delivery pyramid (as explained by AT&T).

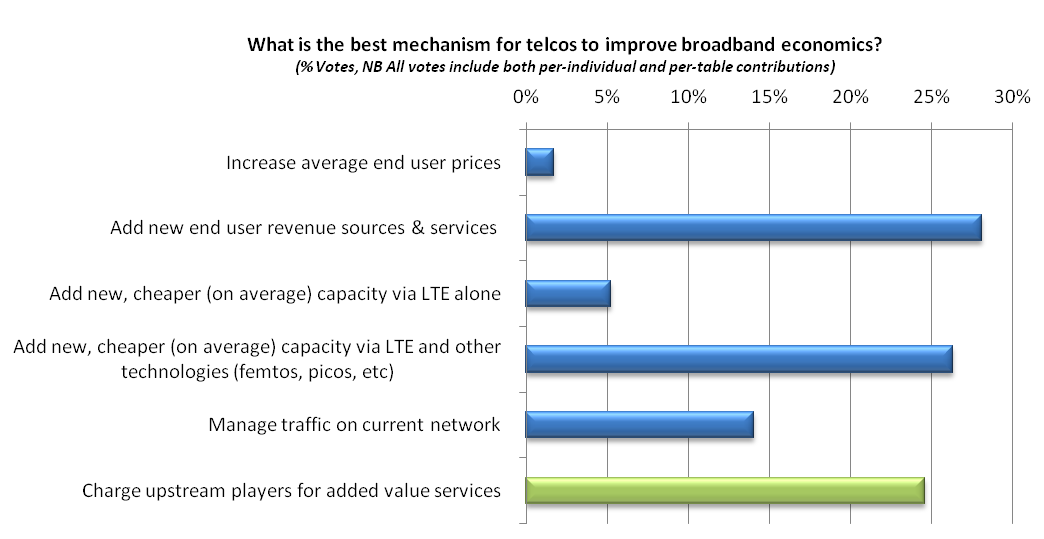

As we’ve previously documented, Broadband economics have been increasingly distorted by imbalances between usage, pricing, and costs, especially through unlimited data plans on which a minority of higher using customers are being subsidised by the majority of lower users. Additionally, increasing political tribalism in the Net Neutrality debate in the US, which threatens to polarise views around the traditional Democrat/Republican divide, is distracting policy-makers’ attention from the core issues of enabling a competitive and fair market, and delivering services to as broad a market as possible.

Figure 3 – Delegates saw charging ‘Upstream’ Customers as valid as Cost Reduction and New End-User Revenues as a mechanism to improve Broadband Economics

Source: Telco 2.0 Americas’ Brainstorm Delegate Vote, October 2010

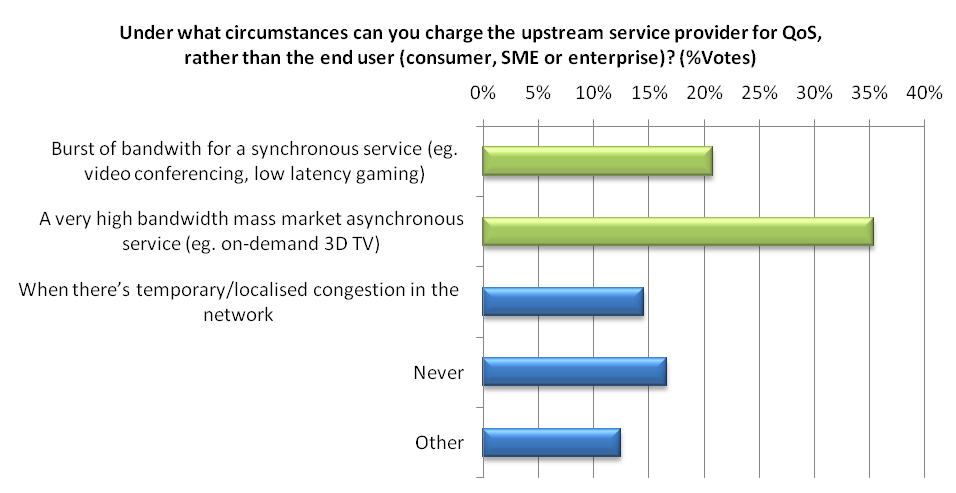

Figure 4 – Very High Bandwidth TV and Synchronous Services (e.g. Videoconferencing) emerged as the clearest contenders for Upstream Charging

Source: Telco 2.0 Americas’ Brainstorm Delegate Vote, October 2010

It was perhaps not surprising that so few of a telecoms industry dominated audience thought that two-sided business models involving upstream charging should never be allowed. Of more interest was that we learned privately that some incidents of upstream charging already take place. We will be developing exploring a High Bandwidth TV charging ‘Use Case’ at the EMEA Brainstorm next week in London.

US Telcos also face potentially disruptive new entrants and market plays including:

Questions remain around all these approaches, for example the interference issue with femtos, whether the US unconnected are interested in being connected, whether Lightsquared can make the satellite L band pay when so many others have failed – but the key point for US telcos is to understand that disrupters are coming into their core business and they must be aware of that as they attempt to move into new business areas.

Telco 2.0’s approach to these issues is outlined in New Mobile, Fixed and Wholesale Business Models, and ‘Net Neutrality 2.0: Don’t Block the Pipe, Lubricate the Market’, and we will be publishing more analysis in coming months on Net Neutrality and future broadband economics.

Oracle argued that no one has the resources to build every app and cited Telecom Italia’s strategy as an example of how to use 3rd party long tail apps to subsidise short tail, telco-controlled apps. According to this model, the same SDP is used to support the telco’s own offerings and the 3rd party app developer programme.

Telcos should also track what’s working in the market and bring successes in-house. The key point made in the session was that working through both internal and external app development environments makes sense strategically, technically and practically.

There is a $44Bn telco opportunity in Cloud Services by 2014 according to Cisco, supported by the evidence of 30%+ enterprise IT cost savings and productivity gains that resulted from Cisco’s own comprehensive internal adoption of cloud services. Ribbit, AT&T, and Salesforce.com supported the viability of cloud services, and that concerns over trust and privacy (of which more below) are gradually being allayed.

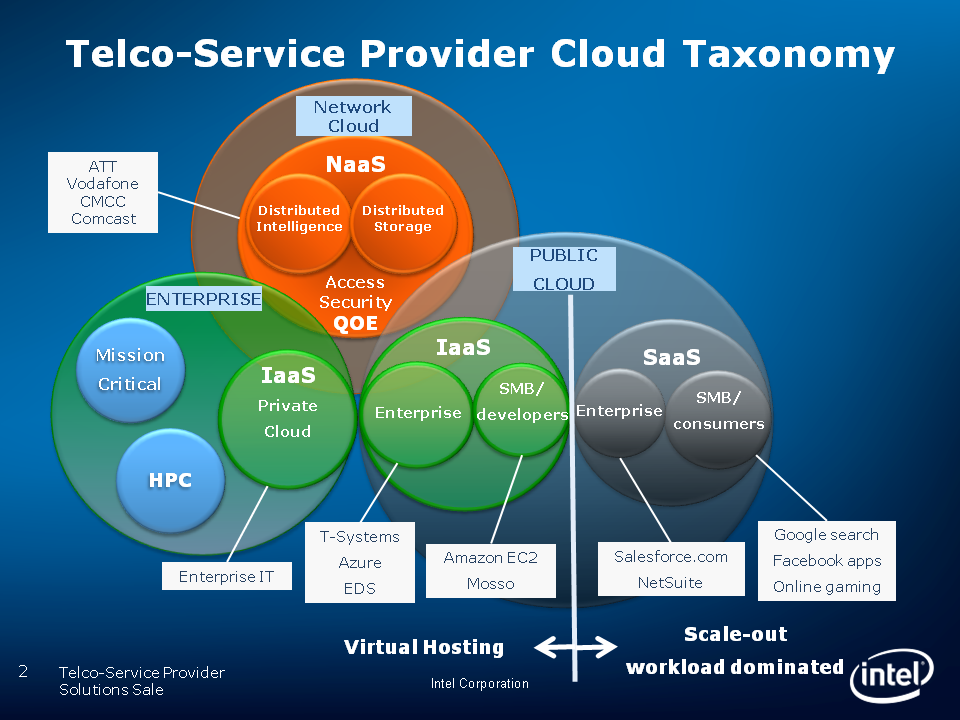

Intel argued that Network as a Service (NaaS) is emerging as a cloud opportunity alongside Enterprise and Public Clouds, and that by combining NaaS with the telco influence over devices and device computing power, telcos can be a major player in a new ‘Pervasive Computing’ environment.

Figure 5 – Intel’s Cloud / XaaS Taxonomy

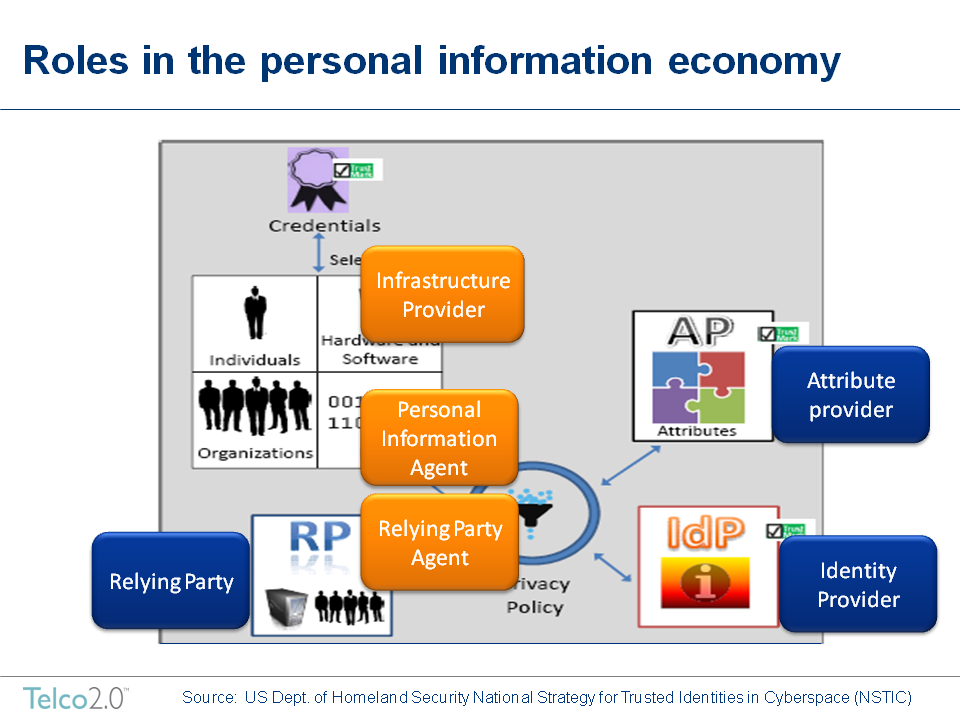

As described in Customer Data 2.0: Telcos Must Vie for a slice of the $Multi-Billion ‘PIE’ and Can Telcos Unlock the Value of their Consumer Data?, a recurring theme of Telco 2.0 that customer data is a potential source of value to telcos, and a key enabler of the ‘Personal Information Economy’ based on the value of processing and sharing this data.

A key development evident from the Americas Brainstorm is that the theory is moving increasingly rapidly to practice, and the new ‘Personal Information Economy’, is fast becoming a reality. In particular, the structure of the industry is becoming clearer, including the emergence of ‘trust networks’ and the importance of putting customers in charge of their own data, although the business models and money flows are less clear.

Figure 6 – Roles in the 'PIE'

Other significant industry developments include:

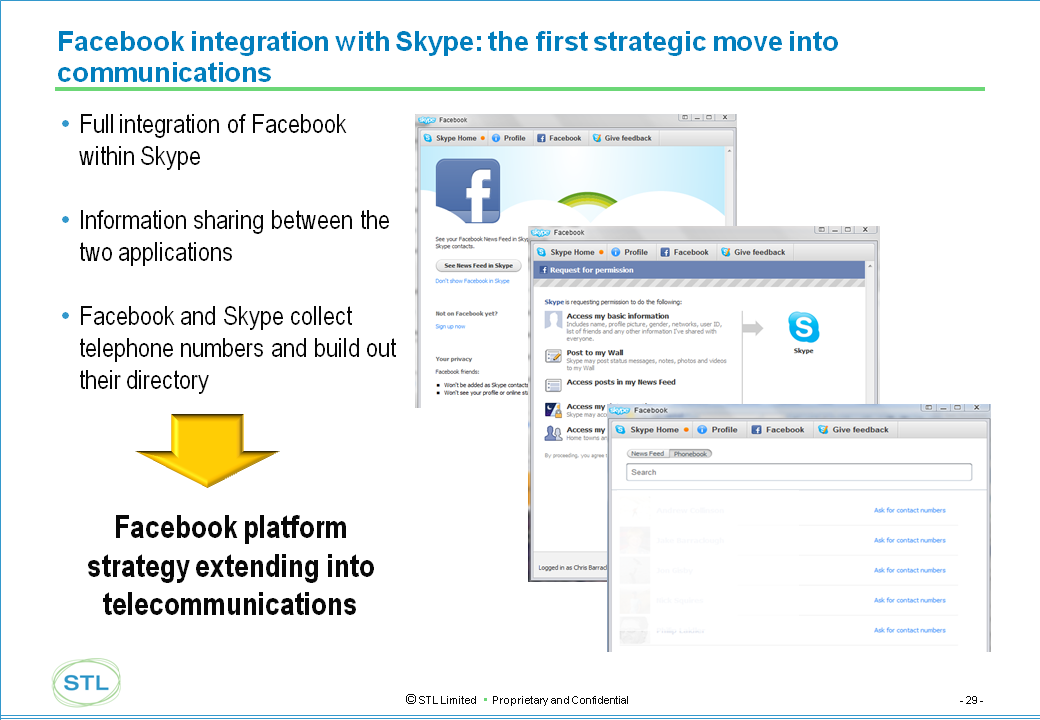

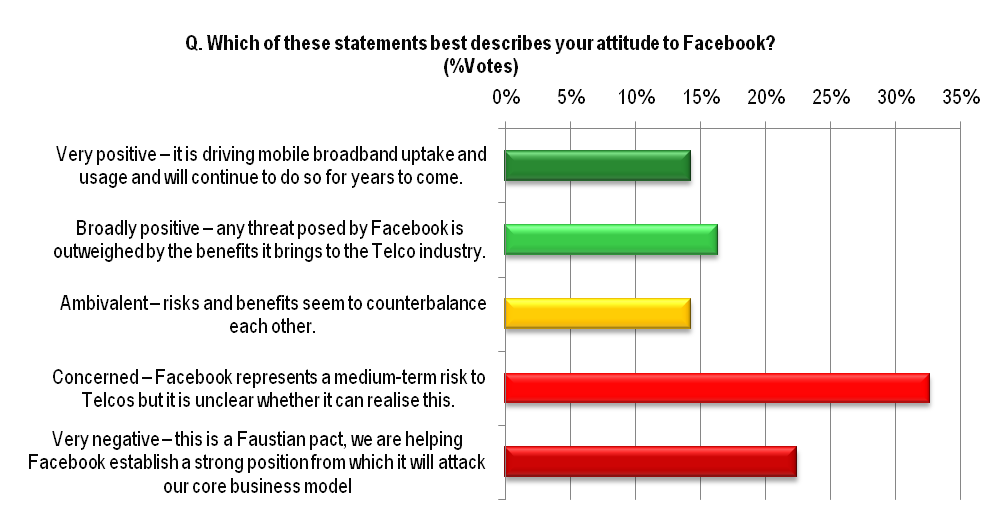

Telco 2.0 previewed its analysis of Facebook’s business model and strategy which shows that Facebook will need to expand into communications to achieve growth required of them by investors, and hence poses a threat to core telco voice and messaging revenues. The resulting debate showed a lack of clarity on telcos response as yet, despite growing telecoms industry concerns.

Figure 7 – Facebook’s First Communications Play

Source: Telco 2.0 Americas’ Brainstorm Delegate Vote, October 2010

Apple’s power in the telecoms market is increasingly well understood if not managed, and the following session showed that there is equally widespread fear in the Entertainment Industry of Apple dominating online video in the way it has music.

Telco 2.0 offered three industry scenarios for the state of the video market, suggesting in the worst case, the loss to the entertainment industry from physical sales could be as high as $8.4bn. At the same time, with the growth of online video (Netflix streaming services for example now account for 20% of total US internet traffic, twice the amount as YouTube), the majority of delegates at the event voted that cutting or ‘fraying’ the cord (using broadband to access premium content) could exceed 10% of US households over the next five years. Both would have catastrophic effects on incumbent players in the market.

The opportunity for Telcos (in supporting Hollywood) is not only in providing more bandwidth, but introducing tiered data plans to better reflect the economics of delivery (See Broadband above). In addition to this there is the opportunity to provide cloud services such as digital lockers to the end-consumer as well as content distribution, identity management and payment services to upstream content providers.

Comscore – who track online consumer usage and behaviour - presented data which showed that online video distributers were leaving significant advertising dollars on the table by not selling enough advertising inventory. Comparing the average amount of ad content to video, Comscore said that Online’s rate was 8% compared to 15% on TV, simply because the advertising wasn’t there.

IconMobile – a WPP interactive agency - claimed instead that advertising was itself changing and that new media would need to be supported by new models. In particular, the development of services that support product sales were highlighted, e.g. a mobile app game that comes with a toothbrush to encourage kids to brush their teeth.

Ericsson previewed consumer research and ‘proof of concept’ tests that suggest that the desire for interactivity between screens is on the increase with people wanting to use both smartphones and tablets to control as well as experience online video.

Figure 10 – The Ideal Multi-Screen Experience combines multi-format access, choice and control of viewing

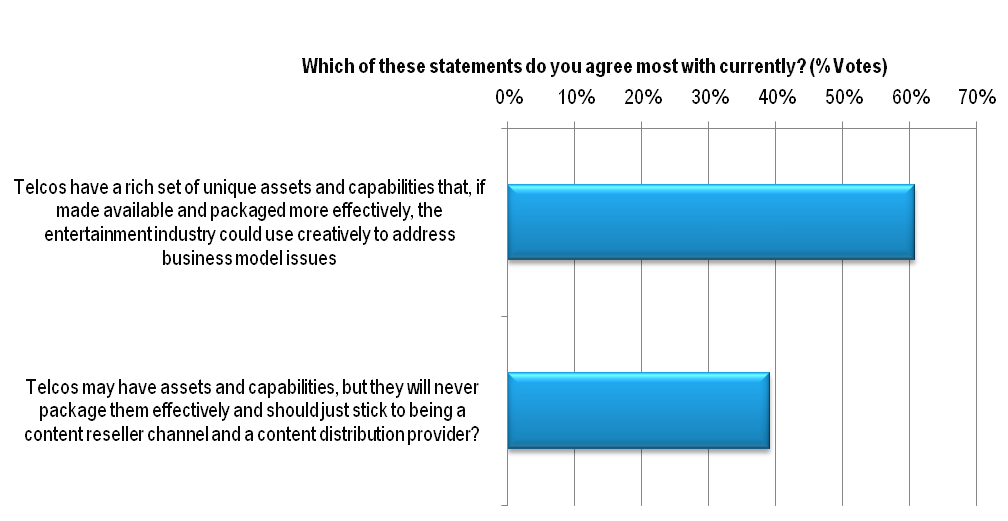

Figure 11 - While the majority of delegates were positive on the Digital Entertainment 2.0 opportunity, a significant minority held reservations about telcos’ ability to deliver.

Source: Telco 2.0 Americas’ Brainstorm Delegate Vote, October 2010

Telco 2.0 will be continuing to examine these issues in our ongoing research at telco2research.com, and at our events, now scheduled as follows: