|

| Digital Things 2.0: A summary of the findings of the Digital Things session at the New Digital Economics Executive Brainstorm, EMEA, held at the Wyndham Grand Hotel, London, on the 6th June 2013. The Brainstorm covered strategies, business models and platform requirements for the Internet of Things, and the critical relationship between this field and ‘Big Data’. |

|

Part of the New Digital Economics Executive Brainstorm series, the 20th Telco 2.0 event took place at the Wyndham Grand Hotel in London on the 5th and 6th of June, 2013. This report covers the Digital Things track on the second day.

Produced and facilitated by business innovation firm STL Partners, the event brought together 180 specially invited senior executives from across the communications, media, retail, banking and technology sectors, including representatives from:

- Alcatel Lucent, Amazon Web Services, Amdocs, Andorra Telecom, Arieso, Arkessa, BBC Worldwide, Booz & Company, BSkyB, BT, Buongiorno, Cerillion Technologies, Cisco, Connected Homes, Cordys, Deloitte, Deutsche Telekom, du, Ebay, E-Plus, Ericsson, Etisalat, European Commission, Everything Everywhere, Evrythng, GSMA, HP Enterprise Services, Huawei, IBM, IMImobile, MADE Holdings, Magyar Telecom, MasterCard, MEF, MetaSwitch, Minutrade, Mobily, NEC, Network Rail, Next World Capital, Nokia, Openet, Oracle, Orange Digital, Pachube.com, Placecast, Play, Polkomtel, Saatchi & Saatchi, SFR, SumUp Payments, Syniverse, Tekelec, Telefonica Digital, Tesco, Trend Micro, Turkcell, UnboundID, VeriSign, Verizon, Virgin Media, Visa, Western Union, Weve, World Economic Forum, ZangBeZang.

The Brainstorm used STL’s unique ‘Mindshare’, interactive format, including cutting-edge new research, case studies, use cases and a showcase of innovators, structured small group discussion on round-tables, panel debates and instant voting using on-site collaborative technology.

More information: Andrew Collinson, Research Director, STL Partners (www.stlpartners.com)

Email: . Phone: +44 (0) 207 247 5003.

DOWNLOAD REPORT

With thanks to our Sponsors:

Table of Contents:

- Introduction

- Executive Summary

- Session 1: Market Evolution towards Internet of Things – Part 1, Strategies

- Key themes

- Stimulus Speakers and Panellists

- Stimulus presentations

- Votes, discussion, and feedback

- Session 1, Part 2: Internet of Things Business Models

- Key themes

- Stimulus Speakers and Panellists

- Stimulus presentations

- Votes, discussions, and feedback

- Key takeaways

- Session 2: Internet of Things Platform Requirements

- Key themes

- Stimulus Speakers and Panellists

- Stimulus presentations

- Votes

- Key takeaways

- Session 4: Big Data - Exploiting the New Oil for the New Economy

- Key themes

- Stimulus Speakers and Panellists

- Stimulus presentations

- Key takeaways

- About STL Partners

Table of Figures:

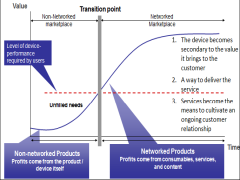

- Figure 1: Value migrates to solutions and data

- Figure 2: Key questions around Internet of Things business models

- Figure 3: Dramatic growth in numbers of devices

- Figure 4: The Internet of Things feedback loop

- Figure 5: Xively architecture for connected objects and developers

- Figure 6: What can you not find as a connected thing?

- Figure 7: M2M value is migrating towards data and solutions

- Figure 8: Outline of Deutsche Telekom’s M2M strategy

- Figure 9: An example M2M customer: A cargo monitoring solution

- Figure 10: How SigFox hopes to enable a range of new businesses

- Figure 11: Use cases for the Internet of Things

- Figure 12: Delegate vote on the Internet of Things opportunity

- Figure 13: What business models are most applicable to the Internet of Things?

- Figure 14: Where should privacy controls be focused?

- Figure 15: Do the Internet of Things and M2M need the same platform?

- Figure 16: Design principles for an M2M-specific network

- Figure 17: Internet of Things projects raising money through Kickstarter

- Figure 18: How telcos can support Internet of Things innovators

- Figure 19: S-curves of Internet growth Is the Internet of Everything next?

- Figure 20: How connectivity can add value to a car

- Figure 21: The elements of an Internet of Everything platform

- Figure 22: What are the most critical missing gaps in the Internet of Things?

- Figure 23: What roles will telcos play in the Internet of Things in three years time?

- Figure 24: Which type of organisation needs Internet of Things rather than M2M?

- Figure 25: What enablers are needed for the Internet of Things?

- Figure 26: Who should run Internet of Things platforms?

- Figure 27: Top six strategic opportunities for telcos

- Figure 28: Trust is breaking down between big data stakeholders

- Figure 29: WEF principles for personal data

- Figure 30: Five telco opportunity areas for personal data

- Figure 31: When will most enterprises take the following steps?