| Summary: Our top-level review of SAP’s vision of how it will enable telcos to ‘operate at internet speed’ against Telco 2.0 principles and the six key opportunity areas identified in our strategy research report, ‘The Roadmap to New Telco 2.0 Business Models’. We also challenged SAP to build a Proof of Concept implementation of a complex multi-sided business model with a leading European mobile operator within one month. How did it go? (February 2012, Foundation 2.0) |

|

To share this article easily, please click:

SAP’s new vision for telcos - ‘operating at internet speed’ - aligns well with certain Telco 2.0 principles and is supported by an interesting new set of tools, processes and pledges. To be more precise ‘operating at internet speed’ means driving change fast enough to match internet disruptors such as Google, Apple and Facebook.

This sounds great (and would truly be a boon for operators) but we have heard this all before and from just about everybody. Vendors making this claim need to be prepared to prove it. The Telco 2.0 team, together with a leading European Mobile Operator and a team of configuration experts from SAP, got together to build a Proof of Concept implementation of a complex multi-sided business challenge.

The results were impressive and within a period of a month:

The exercise convinced the Telco 2.0 team that operating at internet speed is not beyond the grasp of mobile operators, but it requires both a change in working practices and approach to partnering with key vendors. The barrier is organisational.

Based upon the success of the exercise, we will shortly be launching "The Telco 2.0 Challenge" to the wider Telecommunications Industry, and we’re now looking for more operators who’d like to set a new Telco 2.0 challenge. To find out more please email us at or visit SAP’s stand at the 2012 Mobile World Congress in Barcelona.

The Telco 2.0 team was recently invited by the leadership team at SAP’s Telecommunications Industry Group to review its vision of the evolution of Telco business models and the capabilities required to support this vision.

SAP is a world leader in enterprise application software with a turnover in 2010 of €12.5bn serving in excess of 170,000 customers in over 120 countries, including over 1,000 telco customers. SAP software has long been present in telecom operators’ finance and supply chain departments. Recent acquisitions such as Highdeal (real-time rating), Sybase (database, device management and mobile payments) and Business Objects (customer insight) together with in-house product developments such as In-Memory Computing and Cloud Computing position SAP to serve more and more of telco computing needs.

At the heart of SAP’s vision for telecoms operators is that they should be able to operate with more dynamism and flexibility. SAP aims to support telcos both internally and externally: internally SAP enables marketing, product and pricing teams to deliver a customized experience and quickly rollout and test new services; externally SAP enables enterprise customers and 3rd parties to integrate communications services and telco data services into their own.

Much of the SAP vision is aligned to key aspects of Telco 2.0 thinking. In this report we map the key aspects of the SAP vision to the Telco 2.0 future growth areas for telcos. SAP also has many years experience of working with many other industries and therefore is well positioned to assist cross-industry collaboration which of course is essential to successful two-sided business models.

This report examines the SAP vision in the context of two-sided business models, and specifically against the Six Telco 2.0 Opportunity Types identified in our recent research report The Roadmap to Telco 2.0 Business Models. It examines the tools and pledges made by SAP to support business model innovation and implantation. Finally, it examines some of the specific features within the SAP software and their applicability to telcos.

This report has kindly been sponsored by SAP and is freely available. SAP provided input to questions asked by STL Partners’ analysts and were given the opportunity to comment on working drafts. Research, analysis, and the writing and editing of the report itself were carried out independently by STL Partners. The views and conclusions contained herein are those of STL Partners.

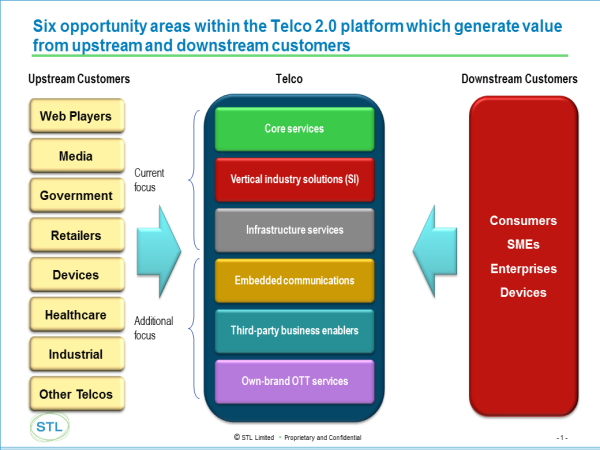

The most recent of these research reports, ‘The Roadmap to Telco 2.0 Business Models’ – describes the transformational path the telecoms industry needs to take to carve out a more valuable role in the evolving ‘digital economy’, and outlines six key opportunity areas in which telcos can create new value. We have used this framework to analyse SAP’s vision at a top level.

These opportunity areas sit themselves within the context of Telco 2.0’s ‘two-sided’ telecoms business model concept, in which telcos remodel their businesses to serve both traditional ‘downstream’ customers (individual and business end-users consuming traditional telco services) and ‘upstream’ customers, or ‘merchants’ who instead use telco assets in new ways to achieve business goals such as improving business processes or services. This concept and the accompanying opportunities are described in depth in The $125Bn ‘Two-Sided’ Telecoms Market Opportunity report (see also page 14).

The six opportunity areas are in summary:

a) Core Services

b) Vertical Industry Solutions

c) Infrastructure Services

d) Embedded Communications

e) Third party business enablers

f) Own-brand ‘Over-The-Top’ (OTT) services

The Roadmap also outlines a number of generic principles for success, which at a top level may be summarised as:

Dynamism and Flexibility lies at the heart of SAP’s vision for the Telco of the future. This future telco is a different organization from the one most of us is familiar with today. The Telco2.0 team took away four strands from this vision:

Ultimately, in SAP’s vision, this becomes a continuous process rather than a one-off sequence.

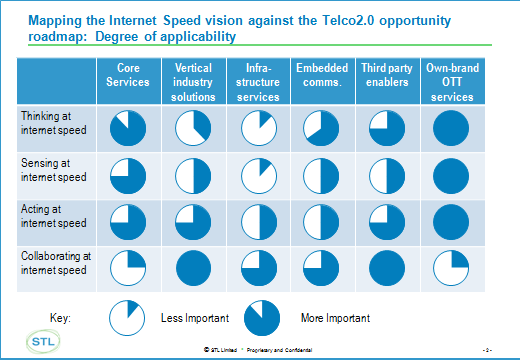

All the Telco 2.0 opportunity growth areas require a step change in the organizations’ ability to adapt and change. Indeed, this is one of the underlying strategic imperatives for change in the digital economy. There is a however a certain degree of applicability for each strand to each growth opportunity as the diagram below highlights.

For instance, the relatively asset intensive infrastructure services are slower moving than own-brand services. Similarly core services require less collaboration than with vertical industry solution and third party enablers.

However, in some instances, high speed sensing, thinking and acting may be required in these asset intensive services. For example, mobile offloading (an infrastructure service) requires real-time sensing and acting in it’s operation.

Equally, for some telcos, collaborating in OTT services may require more dynamism as some partners will need sensing information in near real-time...

To access the rest of this 17 page Telco 2.0 Report in full including...

...and the following report figures...

...members of the Telco 2.0 Executive Briefing service can download it in full PDF format here.

Additionally, to give an introduction to the principles of Telco 2.0 and digital business model innovation, we now offer for download a small selection of free Telco 2.0 Briefing reports (including this one) and a growing collection of what we think are the best 3rd party 'white papers'. To access these reports you will need to become a Foundation 2.0 member. To do this, use the promotional code FOUNDATION2 in the box provided on the sign-up page here. Your Foundation 2.0 member details will allow you to access the reports shown here only, and once registered, you will be able to download the report here.

We'll also be discussing digital business model innovation at the Silicon Valley (27-28 March) and London (12-13 June) Executive Brainstorms.

To access reports from the full Telco 2.0 Executive Briefing service, or to submit whitepapers for review for inclusion in this service, please email or call +44 (0) 207 247 5003.