|

In this preview from Part 2 of ‘A Practical Guide to Implementing Telco 2.0’, we outline the structural, cultural and strategic challenges of building new competences, and a service development process designed to overcome classic industry weaknesses in infrastructure businesses such as telcos and broadcasters. (October 2012, Executive Briefing Service, Transformation Stream). |

|

Non-members can subscribe here or for other enquiries, please email / call +44 (0) 207 247 5003.

To share this article easily, please click:Telco 2.0’s Chief Strategist, Chris Barraclough, will be exploring these issues further in the highly interactive Executive Brainstorm sessions at Digital Arabia in Dubai, 6-7 November, and Digital Asia in Singapore, 3-5 December. Please (including full contact details) if you’d like to register for these senior, invitation only brainstorms, or to pre-order your copy of the report of which this is an edited extract.

Back in 1999, John Hagel and Marc Singer wrote an article in the Harvard Business Review called Unbundling the Corporation, in which they argued that companies tended to be formed of three fundamentally different businesses – an infrastructure business, a product innovation business and a customer relationship business. Each of these businesses has different roles, economics, culture and competition. This is summarised in Figure 48.

|

Core Business |

|||

|

Infrastructure Management |

Product Innovation |

Customer Intimacy |

|

|

Role |

Build and manage facilities for high volume, repetitive operational tasks |

Conceive of attractive new products and services and commercialise them |

Identify, attract and build relationship with customers |

|

Economics |

High fixed costs make large volumes essential to achieve low unit costs; economies of SCALE is key |

Early market entry allows for a premium price and large market share; SPEED is key |

High costs of customer acquisition makes it imperative to gain large shares of wallet; economies of SCOPE is key |

|

Culture |

Cost focused; Stress on standardisation, predictability and efficiency |

Employee-centred; Coddling the creative stars |

Highly service-oriented; Customers come first |

|

Competition |

Battle for SCALE; rapid consolidation; a few big players dominate |

Battle for talent; Low barriers to entry; Many small players thrive |

Battle for SCOPE; rapid consolidation; a few big players dominate |

|

Example industries1. |

Oil and gas; Water; Electricity |

Management consulting; Law, FMCG |

Retailing, Financial services |

Source: Hagel and Singer, Harvard Business Review, 1999; 1. Added by STL Partners

Although Hagel and Singer argued that most companies have all three businesses in them, STL Partners would argue that most companies and, indeed, industries have a clear skew towards one of the three business types. We have shown where example industries fit in Figure 48.

CSPs have historically been heavily skewed towards being Infrastructure Management:

Although CSPs have aspired to product innovation and customer intimacy, this has not been borne out in their behaviour:

The irony for CSPs has been that while they have been Infrastructure Managers, historically they have derived most of their revenue from on-going services – voice and messaging – which would usually imply strong Customer Intimacy. The advent of data services has changed things dramatically. For while it has opened up a new revenue source – broadband connectivity – it has also opened the door to new competitors who themselves are providing voice, messaging and other services.

CSPs, therefore, find themselves less able to monetise their network investments via voice and messaging and, at the same time, find that data is not filling the resulting ‘revenue gap’ (see our recent report on the outlook in Europe for core mobile services). Some CSPs may ‘hunker down’ and accept that it makes sense to remain an infrastructure manager (a Happy Piper) although even this will require fundamental changes as revenues decline. Even these CSPS will need to dramatically enhance their neglected Customer Intimacy businesses if they are to protect their existing voice and messaging revenue stream. More ambitious CSPs – the Telco 2.0 Service Providers – need to also develop a Product Innovation business to grow new revenues. Alex Osterwalder and Yvres Pigneur outline this ‘unbundling’ of CSPs in their book, Business Model Generation (Wiley, 2010), although STL Partners would argue this is less about the unbundling of the three discrete businesses and more about the development of two new ones.

The development of new businesses within CSPs implies fundamental changes to the entire company because, as Hagel and Singer observed and we have already pointed out relating to different Telco 2.0 services in Part 1, each business has different skill requirements and processes, partners, culture and economics.

The Telco 2.0 Business Model Framework (outlined previously here) provides a simple, structured and complete view of a company’s business model and so enables us to cover the main implications of specific Telco 2.0 innovations. For example, if a CSP wishes to change its value proposition or its revenue model, the Telco 2.0 Business Model Framework is very useful in ensuring that all the implications of such a change within the organisation and outside it (with partners/stakeholders and customers) are considered in a systematic manner.

Let’s assume as a starting point that a new Telco 2.0 innovation concept has been identified as potentially interesting to your organisation – either via taking something that has already been done by others or by following the Customer Goal-Led Innovation Process (both outlined in Part 1 of the report).

Furthermore, let’s assume that the concept has not been fully evaluated. You may have tested the concept with some customers (if you have followed the Customer Goal-Led Innovation Process in full), but have not undertaken the detailed use case and business case development outlined in the STL Partners scouting service in Part 1.

Essentially, you have an attractive idea and want to either get it to market or reject it.

So let’s also assume that:

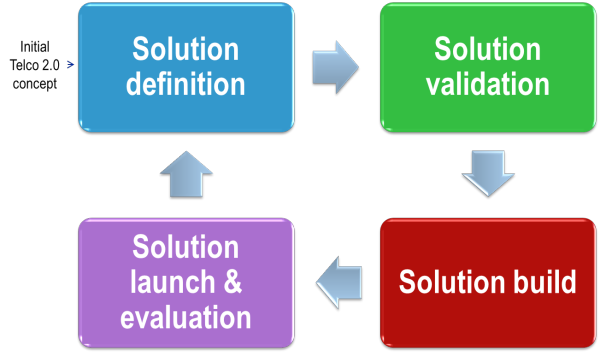

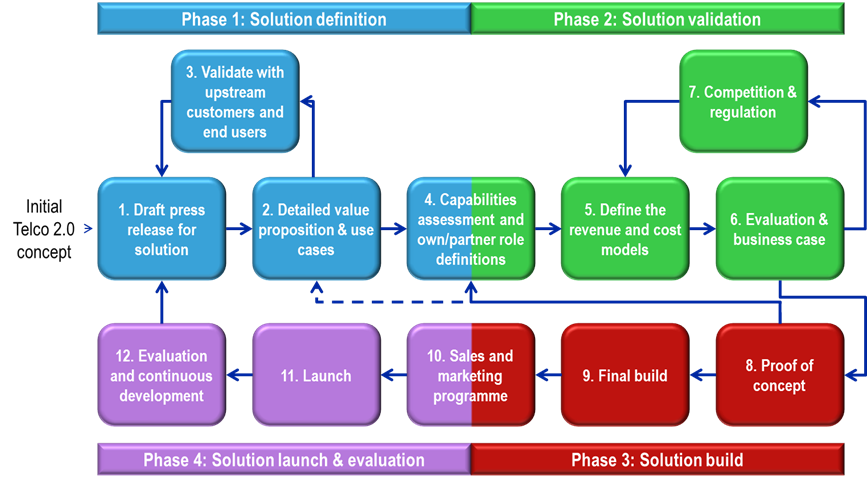

There are four phases to the Telco 2.0 Service Development Process:

We summarise the four phases in Figure 49 together with an outline of the twelve steps within the phases. There are a few important things to note about the process:

The process is most detailed in areas in which CSPs are generally weakest: the Solution definition and Solution validation phases. These two phases are critical to successful solutions as they provide the foundations for the build, test, marketing and sales phases that follow. We have not covered each step in these latter stages in the same detail but have, instead, sought to provide some guiding principles or ‘things to watch out for’.

Overview of Phases:

Detailed process steps:

Source: STL Partners/Telco 2.0

We'll be exploring these issues further in the highly interactive Executive Brainstorm sessions at Digital Arabia in Dubai, 6-7 November, and Digital Asia in Singapore, 3-5 December. Please (including full contact details) if you’d like to register for these senior, invitation only brainstorms, or to pre-order your copy of the report.