| Summary: ‘Telco 2.0’ has evolved considerably since we put forward the original concept for telcos’ future success in 2006. Here we dispel ten myths and misunderstandings that have also evolved that can misdirect strategy. (August 2012, Executive Briefing Service, Transformation Stream.) |

|

Below is an extract from this 24 page Telco 2.0 report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service and the Telco 2.0 Transformation stream here. Non-members can subscribe here and for this and other enquiries, please email / call +44 (0) 207 247 5003.

We are about to publish a new strategy report 'A Practical Guide to Implementing Telco 2.0' and will be previewing findings at the invitation only Executive Brainstorms in Dubai (November 5-7, 2012), Singapore (3-5 December, 2012), Silicon Valley (19-20 March 2013), and London (23-24 April, 2013). Email or call +44 (0) 207 243 5003 to order the report or find out more.

To share this article easily, please click:

As an organisation devoted to driving innovation, Telco 2.0’s thinking has continually evolved. Today, most of our work is focused on how to implement new business models, and helping industry players develop strategies and activities to address new threats and opportunities presented by adjacent players.

We have also learned that as the thinking has evolved it has spawned some myths and misconceptions. (NB. This is not an attempt to stifle insightful criticism or debate, as intelligent challenges and critiques are essential to the development of sound strategy and well informed decision making, and we welcome such challenges.)

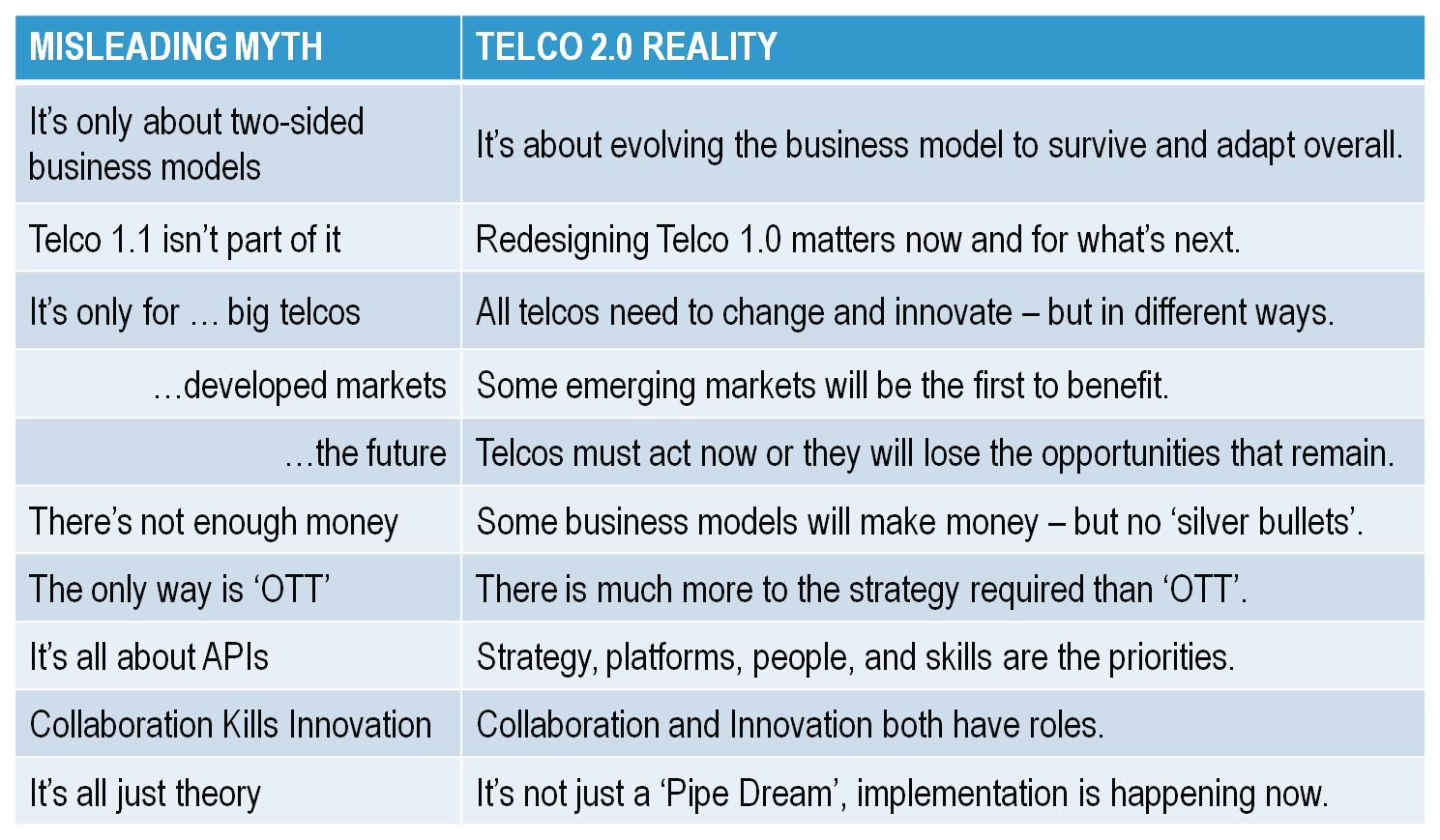

What matters about these myths is that they can inject a misleading or distracting idea capable of derailing balanced strategic consideration. The propagandists’ favourite weapons of ‘fear, uncertainty and doubt’ can easily and accidentally be triggered in this way. To counter this, here in summary are our ‘Telco 2.0 realities’ to what we’ve found to be the most prevalent and injurious misconceptions of Telco 2.0.

Figure 1 – Telco 2.0: Misleading Myths Vs. Realities

Source: STL Partners / Telco 2.0

When we first started the Telco 2.0 Initiative in 2006, the decline of the traditional telecoms industry business model based on voice and messaging seemed a long way off to most. ‘Broadband’ and ‘mobile data’ were still relatively immature propositions with great prospects for growing the industry further. ‘Smartphone’ was barely even a word, let alone a global phenomenon, and ‘tablets’ were what you took for a headache.

Most of our initial concepts have stood the tests of time and hindsight well. We drove for radical change in how the telecoms industry looked at:

Subsequently, we looked at:

Our next action on the overall Telco 2.0 strategy agenda will to be to publish a new report: ‘A Practical Guide to Implementing Telco 2.0’. We will also presenting key findings at the Digital Arabia (Dubai, 5-7 November 2012) and Digital Asia (Singapore, 3-5 December 2012) Executive Brainstorms.

We are also launching two new services:

To find out more about these or apply for an invitation to the Brainstorms, please email or call +44 (0) 207 247 5003. Additionally, we’ll be publishing major new research into Strategies in Voice and Messaging, ‘Telco Strategies in the Cloud’, and the impact and opportunities of combining personal data and digital and mobile commerce.

The rest of this report outlines the myths and their antidote realities in more depth (first two sections previewed below).

The concept of the two-sided telecoms business model has certainly had an impact on the industry, as can be seen for example in the illustrations below from Vodafone and Telefonica investor presentations.

Figure 2 – The impact of the Telco 2.0 Two-Sided Telecoms Business Model

Source: STL Partners / Telco 2.0

While we’re pleased to see the idea of the two-sided business model propagated, there is a degree to which the idea has been a victim of its own success. It appears that some people now think that the two ideas of ‘Telco 2.0’ and ‘Two-Sided Telco Business Models’ are one and the same, and that the two-sided model is the totality of Telco 2.0.

This is not correct. While we still use the concept of the two-sided telco business model as a tool to explain how operators need to consider how they add value to consumer and enterprises and show that revenues can flow from multiple sources, ‘Telco 2.0’ is much more than this and includes:

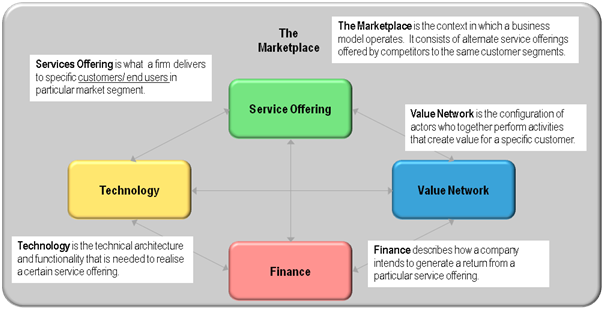

STL Partners believes that business model innovation equates to business transformation. Innovation can occur or be originated in many different ways and that each of these can have a knock-on effect through an organisation and beyond it to other organisations and industries. Our analytical framework for business model innovation covers 5 domains (see Figure 3).

Figure 3 – Analytical framework for business model innovation

Source: Source: Faber et al; Designing business models for mobile ICT services, 2001; adapted and developed by STL Partners

Figure 4 – Existing service revenues in the UK market

To illustrate the challenges facing the existing business model, Chris Barraclough, MD and Chief Strategist, Telco 2.0 / STL Partners, presented the above example analysis of voice and data revenues from the UK market at the EMEA Brainstorm in June 2012 as a preview of analysis we are conducting across the main markets in Europe. Two-thirds of the delegates supported this analysis, with over half saying they thought this was ‘about right’ - although just under a third thought it too pessimistic. Whatever the eventual outcome in the market, there is little doubt that the existing business model is under increasing pressure across many regions and for many operators.

There is a natural temptation when presented with forecasts like this for executives to just seek out the nearest red pen and start to cut their way to profits. While a degree of cost reduction is clearly required, this cannot be the sole strategy or commoditisation and a total lack of flexibility is the only possible outcome.

It is obviously important to extend the life of the core business model, and telcos have long been adept at lobbying the regulator as a primary strategy. Further to this, both continuing to re-price data and bundle in new services are also proven strategies. But this really cannot change the game enough and telcos need to fundamentally improve the interactions they have with their customers to retain any relevance as consumer-facing entities.

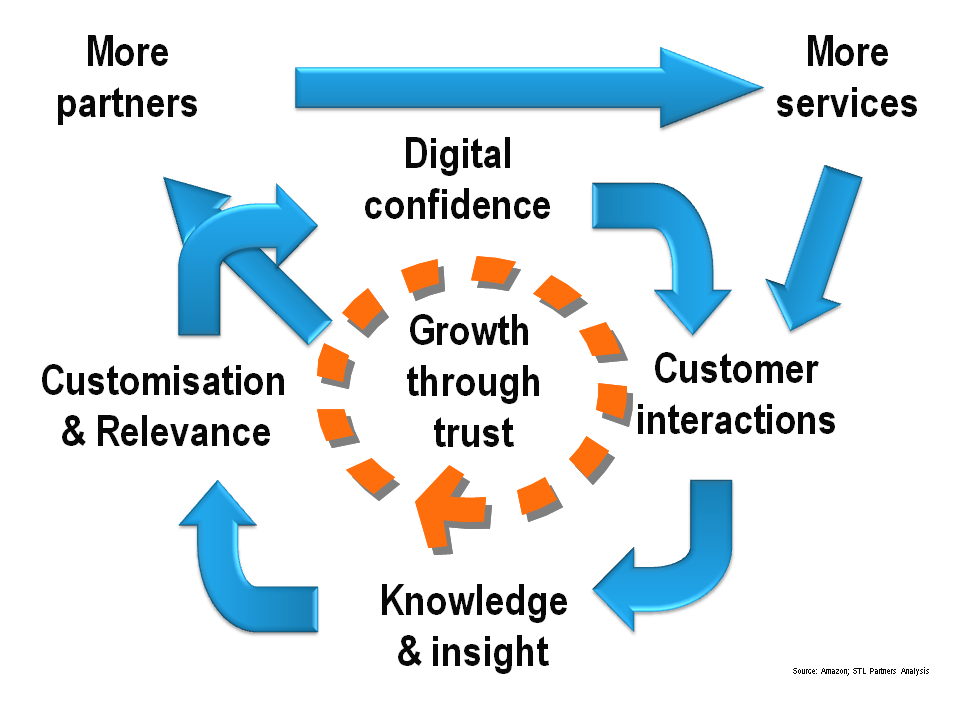

We have looked at many ways in which telcos can learn how to improve their customers’ experience from the leading web and physical retailers, with Amazon as a particular case in point. This is critical both to telcos existing business and to their prospects for building new businesses. Better service / product experience design and delivery, and the use of customer data to drive personalisation and intelligence in their experiences, are key opportunities to improve customer interactions for telcos, as shown in Figure 5 – The ‘Telco 2.0 Flywheel’.

Figure 5 – The ‘Telco 2.0 Flywheel’

Source: STL Partners / Telco 2.0

And quality is not the only issue: the quantity of customer interactions matters too, and for many telcos the quantity is now declining. For customers it is a simple equation: experience = relevance, so if your customers start using you less, you become less relevant. Telcos need to find new ways to interact with customers.

To read the note in full, including the following sections detailing support for the analysis...

...and the following figures...

...Members of the Telco 2.0 Executive Briefing Subscription Service and the Telco 2.0 Transformation stream can download the full 24 page report in PDF format here. Non-Members, please subscribe here. For this or other enquiries, please email / call +44 (0) 207 247 5003.

Companies and Technologies Featured: ISIS, E5, Oscar, 4T Sverige, Vodafone, Telenor, Telefonica, Singtel, O2, Priority Moments, Top-Up Surprises.