| Summary: At the Digital Asia Executive Brainstorm in Singapore, December 2012, we saw that all economies in SE Asia are now innovating rapidly in digital commerce, entertainment and public sector services, and in mobile in particular. There are both unique opportunities and transferable lessons, and a key theme is that companies need to transform even faster to take advantage of the opportunities and prosper. (December 2012) |

|

Below is a preview of the Executive Summary of the detailed report from Digital Asia 2012. The full report is available to download below in PDF format to event participants and members of the Telco 2.0 Executive Briefing service. Non-members can subscribe here. To find out more and for all other enquiries, please email / call +44 (0) 207 247 5003. We'll also be discussing our findings at future brainstorms.

Digital Asia took place on 3-5 December, 2012, at the Capella Resort Hotel, Singapore.

Part of the New Digital Economics Executive Brainstorm & Innovation Series, it built on output from recent events in San Francisco, Singapore, London, New York and new market research and analysis, and focused on new business models and growth opportunities in digital commerce, content and the cloud in South East Asia.

Produced and facilitated by business innovation firm STL Partners, the event brought together 80 specially-invited senior executives from across the communications, media, retail, banking and technology sectors, including: (ART+DATA) Institute; AEIS; Aircel Ltd; Amdocs; American Express; Brightcove; CEA; Comviva; Crystal Interactive; CSG International; DBS; Ericsson; Experian; Eyelevel Interactive; Frog Asia; Global Voice | TM Global; Globe Telecom; Google; Infocomm Development Authority; Ithos Digital; Jana; MasterCard; McCann Group; Minutrade; Ogilvy; Openet; Peppers & Rogers Group; PLDT Group; Singapore-MIT Alliance; SingTel; Sony Music; Standard Chartered Bank; StarHub Ltd; STL Partners/Telco 2.0; Telcentris; Telenor Group; Telkom Indonesia: True Corporation; Turner; Unilever Asia; Universal Music Group; Verifone; XL Axiata.

The Brainstorm used STL’s unique ‘Mindshare’ interactive format, including cutting-edge new research, case studies, use cases and a showcase of innovators, structured small group discussion on round-tables, panel debates and instant voting using on-site collaborative technology.

This note summarises the key themes emerging from the Brainstorm.

For further information, please contact Andrew Collinson, COO & Research Director, STL Partners, .

We’d like to thank our sponsors:

At the Digital Asia Executive Brainstorm in Singapore, December 2012, we saw that all economies in SE Asia are now innovating rapidly in digital commerce, entertainment and public sector services, and in mobile in particular. There are both unique opportunities and transferable lessons, and a key theme is that companies need to transform even faster to take advantage of the opportunities and prosper.

This summary (and the document in full) follows the structure of the brainstorm, covering:

The Brainstorm focused on the SE Asian economies of Indonesia, Thailand, Malaysia and The Philippines, which we characterise as 'SE Asian Digital Supernovas' - fast developing with massive and broadly youthful populations (242m, 69m, 28m and 95m respectively, totalling 434m).

The Brainstorm also explored innovative examples and case studies from India, China and Singapore, and lessons from Europe and other parts of the world.

As overall regional context, Google's MD SE Asia, Julian Persaud said 'The Mobile Internet is going to Asia'. For example, 3 of the top 4 countries for global app downloads on Google Play (after the US) are Asian: Japan, Korea, and India.

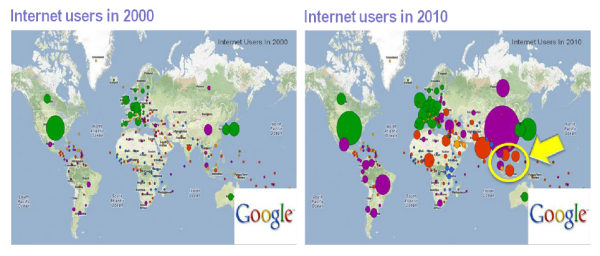

Overall internet access has grown massively in the region as shown in Google's charts below, and the past two years have seen significant further mobile uptake.

There is business optimism in SE Asia compared to European telecoms markets in both current business outlook and the field of new business opportunities. For example:

(Notes. 1. The question was How many years do telcos have left to create or retain key control points in the digital economy? 2. The option ‘5 years or more’ was weighted at 5 years only for simplicity to calculate these averages, so a ‘true’ average is likely to be somewhat higher for ‘transportation of bits and bytes’ in particular.)

In these large highly price-sensitive markets, despite the lower penetration of smartphones, services that provide additional benefits to users for no direct cost or small incremental costs can grow rapidly. Hence WiFi, OTT communications services (where practical and allowed), and social networks like Facebook are extremely popular.

High churn to better value packages, multi-SIM usage and SIM boxing (a means of re-routing calls to avoid termination rates that delivers cheaper calls to customers but defrauds operators and government tax collectors) also play to this appeal.

In terms of core services, this means that innovations that provide ‘thinly sliced’ services which give limited access for minimal additional spend (e.g. ‘Facebook only data packages’) are highly attractive to many customers. Relative consumer openness to sharing their data also creates opportunities for innovative brand or merchant-funded propositions.

There can be a temptation for service providers to import the latest great idea to a new market from somewhere else they’ve seen it work.

While it is smart to learn from other markets, it is not necessarily the case that a solution that works in one market will work in another. In commerce, for example, the problem in SE Asia is not an incumbent banking system that could be improved but the relative lack of efficient and trusted cashless finance solutions in the wider economy. In economies like Indonesia, where mobile penetration is substantially higher than banking, mobile commerce has a serious opportunity to create useful ‘leapfrog’ solutions and innovations.

Whereas many operators in Europe and North America are facing significant ARPU declines, the relatively low ARPUs that exist in most SE Asian markets may paradoxically represent an opportunity. Where ARPUs are low (and customer volumes high), it takes only a small increase in ARPUs to “move the needle”. This could potentially see operators in the region taking far greater interest (and senior management attention) in business opportunities overlooked by their peers in Europe, North Asia and North America.

In terms of digital content, there are opportunities for monetisation in SE Asia, but a successful approach is therefore likely to be different than in Europe and North America.

And overall, global goliaths like Google and Apple are less prevalent in SE Asia, creating a little more space for local and regional players - for the time being at least.

These many factors mean that there are regional and local opportunities to create new services employing new business models. But the windows to take these opportunities are always temporary, time is passing, and players in the region need to avoid the mistakes of the West and move swiftly to new business models.

Singtel’s new digital unit is undoubtedly a step in the right direction for the regional giant, but it is clear there is much to do to release the creativity and dynamism of an innovative new business while getting what is needed from the existing telecoms business.

As one participant said, ‘we need to act like we aren’t a telco, but we have a very good friend that is’.

Summarising the brainstorm output, the key areas for improving mobile data take-up were:

The focus of this section of the brainstorm was to generate ways to accelerate the take-up of mobile data, and the bulk of the input received was how to make the ‘Telco 1.0’ propositions more attractive.

The exchange of personal data for data, and brand-funded packages were ideas that went beyond enhanced pricing packages, and it would be interesting to examine these ideas in further depth, and useful to examine whether business model innovation is possible around others of the concepts.

There appeared to be little doubt of the realities of the opportunities based on 'big data':

There were still a relatively high number of votes that saw personal data as a long-term opportunity rather than immediately. Perhaps this is unsurprising given the relatively optimistic current view of the health of the current telco business model in SE Asia.

Success in Digital Commerce (which includes payments, loyalty, direct marketing, and customer research – see Figure 33) requires large scale and reach, and it is a complicated and multi-faceted area. In most cases, this is not achievable by one player. In the end, a few ‘ecosystems’, each involving several parties, will dominate. Market wide changes typically take around 10 years to come to maturity, so it is a long game requiring deep pockets and determination.

Although the commerce is a ubiquitous need, consumers in different digital commerce markets need very different things. This means that propositions from one market are usually quite hard to import to another, and that propositions that are likely to achieve traction solve specific, unmet customer needs.

While the idea of telcos making super-profits from digital commerce has thankfully been abandoned, there is now a realistic sense that telcos can benefit from participating in digital commerce. Some of those benefits are indirect but substantial, like reducing churn. For others, when sufficient scale can be achieved through suitable platforms, new revenues at least become a realistic possibility, and given time and skill, may be realised.

Many digital commerce propositions are in the earliest stages of formation, and many lessons are no doubt yet to be learned. It is clear that as well as having scale and a proposition of sufficient distinguishing value, a good customer experience is vital. What makes this ‘good’ depends of course on the market – but most things need to be better (more effective, safe, useful or enjoyable), quicker or cheaper, to win over an existing working choice.

Jana aggregates anonymous data from 3.48 billion mobile consumers, including their mobile numbers, and provides high performance research, acquisition and loyalty services to third parties including Unilever, Gillette and Microsoft in emerging markets. Its early results are impressive. The questions are whether telcos in other markets should join or can learn from this approach, and whether Jana will effectively remove the opportunity of telcos to do this for themselves or on regional and local platforms.

The Chinese market is huge and in many ways different from most others in the globe. Concepts of ownership, relationships between brands, retailers and consumers, and the economies of labour are very different, and combine to create opportunities for very innovative services. The extremity of some of the concepts this breeds is stimulating, and it is possible that some of these ideas can also stimulate new ideas in other markets, as economic conditions and digital proliferation dissolve further traditional boundaries.

We titled the conclusion of the section of our 2011 Digital Asia event report ‘Someone’s got to pay, somehow’, and while ad-funded is still the most favoured option for digital content in 2012, it was notable that for music in particular, ownership was seen as a viable option by some (see Figure 6).

It was argued by some participants that this is true for music because repeat consumption is much more prevalent than it is for video. It was also argued by some that ‘lifestyle’ consumer brands such as Coke were more suited to deliver music than telcos, but this was not met with widespread agreement. The success of subscription / streaming models in other markets also prompted this as a potential option.

There was also a high degree of agreement that user engagement in the production and consumption of music was a major theme in Asia. The popularity of Karaoke and other types of participation may lead to interesting new modes and models in Asia, but it is still early days for this as a widespread digital phenomenon.

Finally, as for commerce, there are widely different needs and cultures in the different nations of SE Asia, and many different models will emerge, evolve and ultimately succeed. This is likely to happen at a faster rate than in the past, and the current situation is chaotic and makes firm predictions extremely difficult. What is clear though is that the region will see a great deal of innovation as artists, entertainment companies and brands seek new ways to satisfy people’s demand for music.

Building digital platform businesses is complex, and presents significant strategic and cultural challenges to telecoms operators. Singtel, like Telefonica and Telenor in Europe, has created a standalone digital services unit, but there is still much work to do for it to succeed.

Digital platforms are also typically long term endeavours by nature. They take significant investment and time to reach scale in the markets they operate in. They may also require cross-market collaboration to achieve the reach needed, and this is another reason that profiting from platforms is a ‘long game’.

These examples, and others like the UK’s newly formed Weve M-Commerce platform (a collaborative venture between Telefonica O2, Vodafone and Everything Everywhere) show that telcos are starting to take the prospect of creating ‘Telco 2.0’ digital platforms seriously. It remains to be seen if the platforms businesses will get the time, independence, investment and support they will need to be successful, and there are bound to be many further developments in the future. At least Singtel, among others, has made a start.

At the final session of the brainstorm, we asked participants to articulate key messages to take forward.

The key themes were: