| Summary: smartphone apps, and in future HTML5 web apps, present new distribution opportunities for telco services including voice, messaging, and payments, as long as developers are motivated to use telco APIs. How should telcos approach the 'App Economy' to best defend existing revenues and develop new opportunities? (September 2011, Executive Briefing Service) |

|

Below is an extract from this 19 page Telco 2.0 Report that can be downloaded in full in PDF format by members of the Telco 2.0 Executive Briefing service here. Non-members Non-members can buy a Single User license for this report online here for £595 (+VAT), subscribe here or email / call +44 (0) 207 247 5003.

To share this article easily, please click:Many popular communications apps such as Facebook, Skype and iMessage bypass telcos’ core networks by going ‘over the top’ (NB embedded links are to our latest analyses).

Indeed, some operators we’ve spoken to appear to be privately contemplating that even if 2011 does not yet mark the end of telephony revenues, it is at least starting to look like the beginning of the end, and that the game now is to protect and milk the last of those revenues while working out how to build attractive new voice businesses based on IP. For example, as another part of this drive, 5 big operators are supporting RCSe (e=enhanced) and launching this autumn in an attempt to build more defensible value in personal communications.

Yet smartphone apps, and in future HTML5 web apps, also present new distribution opportunities for telco services including voice, messaging, and payments, providing app developer communities are motivated to use suitable APIs.

We will be exploring these major themes in totality in both in our Autumn/Fall 2011 Brainstorms and in our upcoming report on ‘Google, Apple, Facebook, Skype and Amazon – their business models and strategies for co-opetition’. In this analysis we outline how telcos should approach the ‘App Economy’ to best defend existing revenues and develop new opportunities.

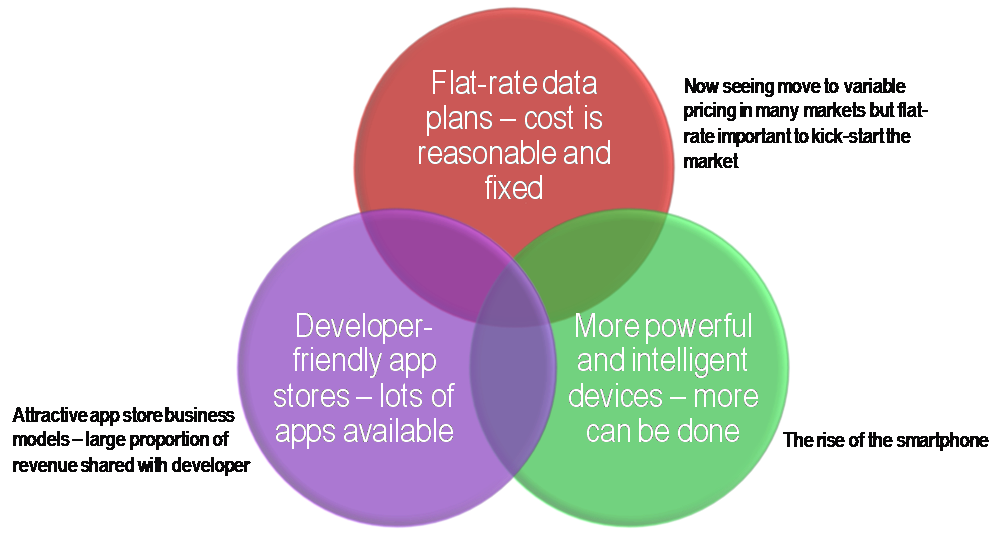

Operator mobile data revenues are enjoying strong growth in most markets. For example, AT&T posted mobile data revenues of $18.2 billion for 2010, up 29% year-on-year and an astonishing 323% on the $4.3 billion generated in 2006. The ‘app economy’, the provision of applications and content to mobile devices, is a key reason for this growth. The app economy has itself benefited from the confluence of three key drivers – the (probably temporary) shift to flat rate data plans, the development of more powerful devices with greater functionality, and the creation of appstores choc-full of tasty goodies (Figure 1).

Figure 1 - Three key drivers of the app economy

Source: STL Partners/Telco 2.0.

Operators have, therefore, both contributed to the app economy growth with their all-you-can eat pricing models (although there is now a move back to variable pricing in many markets) and benefited from it in their core business as users have consumed much larger amounts of data when accessing app stores and using applications.

So far, picking up these core service revenues from the app economy has been straightforward for operators. They have not been required to undertake any real technical implementation (they are a pipe) or, indeed, change their revenue models in a material way (the end user is still charged directly for data usage). This is in marked contrast to, for example, Apple which has benefited from iPhone sales significantly more than its competitors because it has built an end-to-end user experience. Apple has deployed its skills, partnerships and integration capabilities across the value chain – content owner, developer, app store, billing and payments and hardware all have to work in concert technically and commercially. Operators have not had to worry about these things – they derive value regardless of who provides the content or app store or hardware.

Some managers within operators, of course, don’t see it this way: for them, they are providing a ‘free’ ride to OTT players. This note is not the place to debate this issue – we cover it in other notes on, for example, net neutrality. However, it does seem that the next potential growth opportunity for operators – to make money beyond connectivity – requires operators to do more. To realise revenue growth from the app economy in their other core services (voice and messaging) or in their enabling services (advertising, payments, location, etc.) they will have to demonstrate at least some of the technical and commercial skills displayed by Apple.

The app economy should drive operator voice, messaging and enabler service revenues, but adding value to the app economy through network APIs has proved tough for operators.

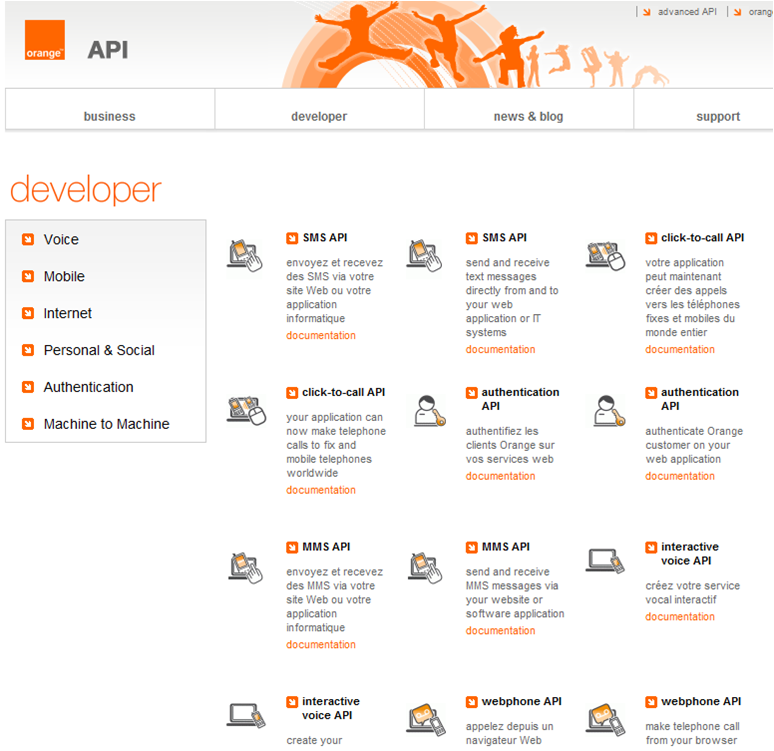

To date, most operators’ API developer programmes have enjoyed little success. Most have a suite of APIs available to developers – such as the 18 mobile APIs listed on Orange’s website in both English and French (Figure 2).

Figure 2 - Orange’s API website

Source: Orange

But usage of operator network APIs by developers has been almost universally low. We suggest the reasons for this are three-fold:

It has long been a Telco 2.0 theme that voice and messaging are, in an IP-based world, just another application - or even just a feature of an application.

If telcos want a piece of the future communications market, they need to find ways to for their communications services to participate in the apps economy, whether that participation is monetised by end-user revenues or other, merchant / developer revenues, and whether the services are telephony, VOIP, SMS, email, or any other form of digital communication. This report looks at the main strategies for participating in the mobile app economy.

To read the note in full, including additional analysis on......and the following charts...

...Members of the Telco 2.0 Executive Briefing Subscription Service can download the full 19 page report in PDF format here. Non-Members, please see here for how to subscribe or email / call +44 (0) 207 247 5003.

Organisations, people and products referenced: Amazon, Android, Apple, AT&T, BlueVia, Carlos Domingo, Facebook, Frog Design, Getjar, Google, GSMA, iMessage, iPhone, MBlox, Microsoft, Nokia, OneAPI, Orange, Paul Pugh, Peters Suh, RIM, Skype, Sybase, Telefonica, Whatsapp, Wholesale Application Comunity (WAC).

Technologies and industry terms referenced: advertising, APIs, app, app economy, appstores, developer, HTML5, in-app billing, IP, location, messaging, online, OTT, payments, RCSe, SIP client, smartphone, SMS, telephony, voice, VOIP.